You've been hitting the refresh button on your browser for three days straight. We’ve all been there. You filed your PA-40, saw that beautiful refund amount on the screen, and now you’re basically planning how to spend it. But the screen just says "Processing." It’s frustrating. Honestly, checking your pa state tax return status can feel like shouting into a void, but the Pennsylvania Department of Revenue actually has a pretty specific rhythm to how they handle your cash.

They aren't just sitting on your money for fun. The state is dealing with millions of returns, and lately, the security filters have become incredibly sensitive.

🔗 Read more: A Bank Account With Millions: Why Most People Are Doing It All Wrong

The myPATH Portal and the Waiting Game

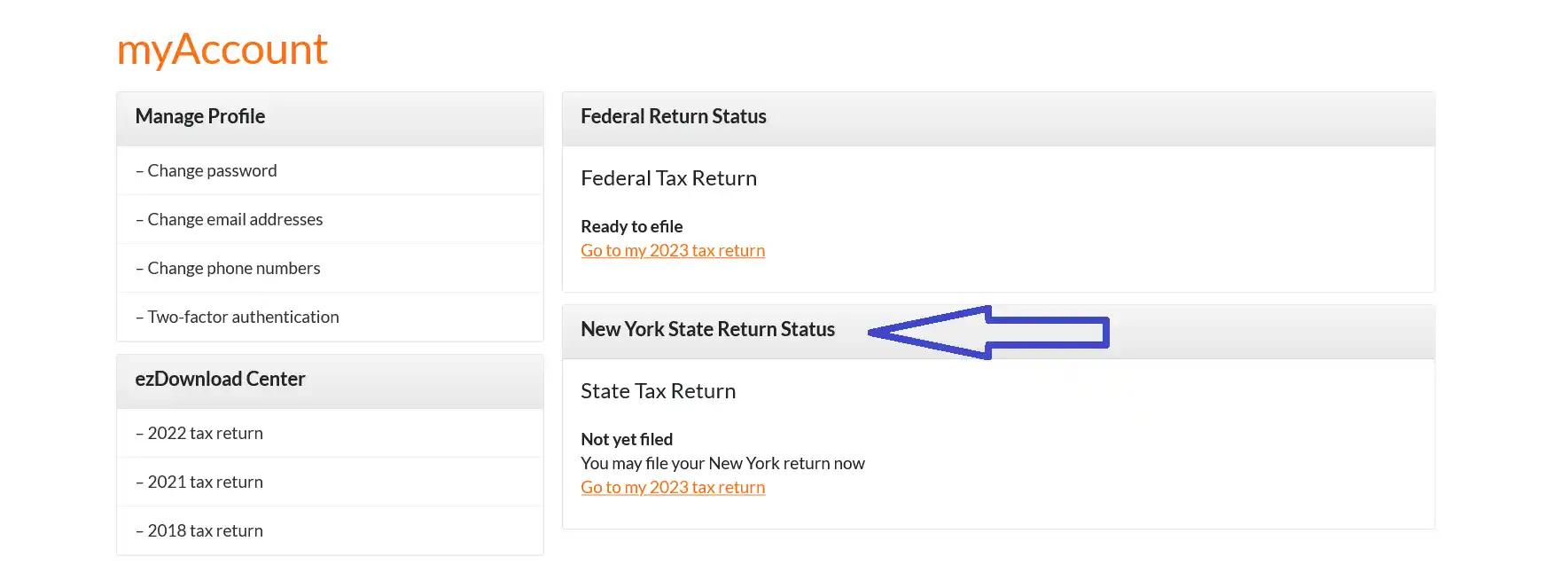

The absolute fastest way to see what's happening is through the myPATH portal. You don't even need an account to check the basics. Just look for the "Where's My Refund?" link. You’ll need two specific things: your Social Security number and the exact whole-dollar amount of the refund you’re expecting.

Don't round up. If your return says $452, don't type $450. The system will spit you out and tell you the information doesn't match, which usually triggers a minor heart attack for most people.

If you e-filed, give it at least 24 to 72 hours before you even bother checking. The digital handshake between your tax software and the state's servers isn't always instant. If you’re one of the brave souls who still uses paper and a stamp? You’re looking at a much longer wait. It can take 8 to 10 weeks just for a paper return to even show up as "received" in the system.

Why Does It Say "Routine Review"?

This is the phrase that kills the mood. You check your pa state tax return status and see a message about a "routine review." Most people assume this means an audit. It usually doesn't.

Pennsylvania, like many other states, has ramped up fraud detection because identity theft is rampant. A routine review often just means a human needs to look at a scan of your W-2 to make sure the numbers match what your employer reported. If you claimed a lot of business expenses or used multiple form types, the "review" flag is almost guaranteed.

It’s just the state making sure they aren't sending your money to a scammer in another country.

Breaking Down the Timeline

- E-filed Returns: Usually processed within 4 weeks. Once approved, the actual payment—either direct deposit or a paper check—takes another 3 to 4 weeks.

- Paper Returns: Expect 8 to 10 weeks just for entry, then the standard 4-week processing window.

- Amended Returns: These are the marathon runners of the tax world. They can take up to 16 weeks to process.

The Hidden Delays Nobody Mentions

Sometimes your pa state tax return status gets stuck because of something called an "offset." If you owe back taxes from three years ago, or if you have unpaid child support or certain court-ordered obligations, the state will snag that refund before it ever hits your bank account. They’ll send you a letter, but the letter usually arrives a week after you realize the money is missing.

Another weird one? The address mismatch. If you moved recently and didn't update your address with the Department of Revenue, but your tax return has your new home on it, the system might pause. It’s a red flag for fraud.

What to Do When the Screen Won't Change

If it’s been more than 10 weeks and you’re still seeing the same "Processing" message, it’s time to stop refreshing and start calling. You can reach the Customer Experience Center at 717-787-8201.

Pro tip: Call early. Like, 7:30 a.m. early. If you call at lunch, you’ll be on hold long enough to learn a new language.

There is also an automated line at 1-888-PA-TAXES (728-2937). It’s basically a robot reading the same status you see on the website, but sometimes the phone system updates a few hours before the web portal does.

🔗 Read more: EUR to ILS Exchange Rate: What Most People Get Wrong

Actionable Steps for Pennsylvania Taxpayers

Don't just wait in the dark. If you're stuck in limbo, here is exactly what you should do right now:

- Verify your numbers: Re-check your physical copy of your PA-40. Ensure the refund amount you are entering on myPATH is the state refund, not your federal one. It sounds silly, but people mix them up constantly.

- Check your mail: If the Department of Revenue needs more info, they will send a "Request for Information" letter. They rarely email you for privacy reasons. If you see a letter from Harrisburg, open it immediately.

- Upload documents via myPATH: If they do ask for a copy of a W-2 or a 1099, don't mail it. Use the "Respond to a Letter" feature on the myPATH homepage. It’s faster and much harder for them to lose.

- Contact the Taxpayers' Rights Advocate: If you are facing a genuine financial hardship and your refund is caught in a loop for months, this office is your last resort. They can intervene when the standard channels fail.

Getting your pa state tax return status updated is mostly a game of patience, but being proactive with documentation is the only way to speed up a flagged return. Check the portal once a week—every day is just going to stress you out.