You’re sitting there, scrolling through Zillow, thinking you’ve got the Orange County housing market figured out. Most people do. They see a price tag in Irvine or a bungalow in Costa Mesa and assume that’s the end of the story.

Honestly, it’s not.

If you’re only looking at list prices, you’re basically flying blind. A real orange county property search isn’t just about finding a pretty kitchen. It’s about digging into the guts of the OC Clerk-Recorder’s database and understanding why that house in Huntington Beach is taxed at $4,000 while the one next door is hitting $18,000.

💡 You might also like: Why the Pickle Mess Jam NYT Connection is Breaking the Internet (and Your Taste Buds)

The Data Trap Most Buyers Fall Into

Searching for property here is weirdly addictive. You start looking at Dana Point and suddenly you're three hours deep into tax records for a mansion in Shady Canyon.

But here’s the kicker: the public-facing sites like Redfin are great for "vibes," but they’re often lagging when it comes to the nitty-gritty legalities. As of early 2026, the median home price in Orange County is hovering around $1.2 million. That’s a massive chunk of change. If you aren’t using the official Orange County Clerk-Recorder grantor-grantee index, you might miss liens, easements, or weird title issues that can kill a deal faster than a bad inspection.

People forget that OC is a patchwork.

Anaheim feels different from Newport Beach because the underlying "property DNA" is different. When you do a search, you’re looking for the Assessor’s Parcel Number (APN). That little string of numbers is the skeleton key. It tells you the exact boundaries and the "base year value."

Why Proposition 19 Still Messes With Everyone

You’ve probably heard of Prop 13—the "holy grail" of California real estate that keeps taxes low. But Prop 19, which really settled into the system over the last few years, changed the game for anyone inheriting property.

Kinda sucks, but if you inherit your parents’ house in Fullerton and don’t move in within a year, the tax bill is going to skyrocket to current market value. I’ve seen families get hit with $15,000 tax jumps because they thought the "old rate" just stayed with the house forever.

It doesn't.

How to Actually Search Like a Pro

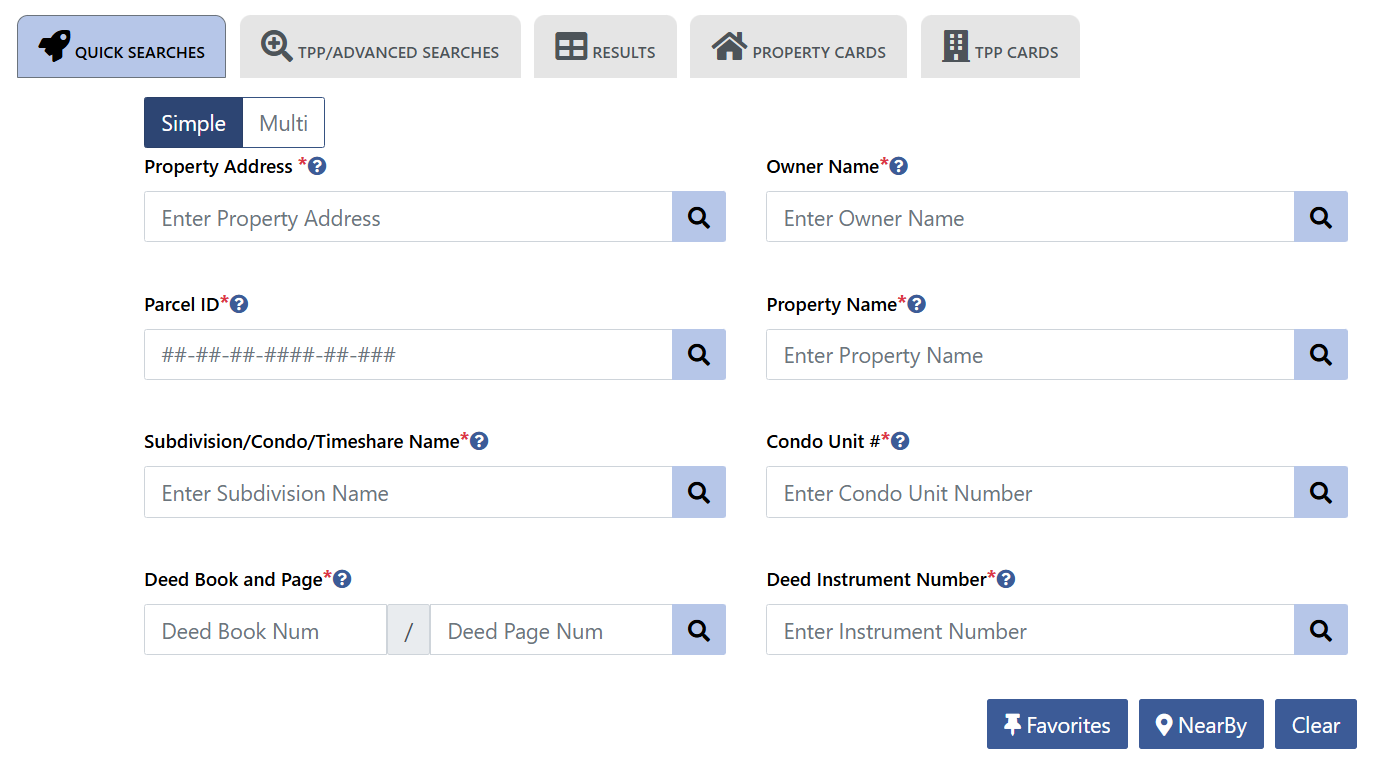

- The Assessor’s Portal: This is where you find the "Roll Value." If the house last sold in 1978, that taxable value is going to be tiny. Don't let it fool you. The second you buy it, that value resets to your purchase price.

- The Clerk-Recorder (RecorderWorks): You can search by name or document number. This is where you see if the seller actually has the right to sell the place or if there’s a messy divorce lien attached to the title.

- GIS Maps: Orange County has some of the best spatial data in the state. You can overlay flood zones (huge for places like Seal Beach) and seismic hazard maps.

The "Quiet" Neighborhoods No One Mentions

Everyone wants South County. Laguna Niguel and San Clemente are the darlings. But if you’re doing a savvy orange county property search, look at the fringes. Parts of North Tustin or the "flower streets" in Santa Ana have incredible historical value and lot sizes you just can’t find in the newer master-planned communities.

💡 You might also like: Outfits for Birthday Dinner: What People Actually Wear (And What to Skip)

Investing here is a long game.

The market is tight. Inventory in 2026 is still hovering at levels that make buyers want to scream. But if you know how to read a preliminary title report—which is basically the "background check" of the property—you’ll have a leg up on the 50 other people bidding on that condo in Mission Viejo.

Actionable Steps for Your Search

- Get the APN first. Never rely on just the street address. The APN is what the county uses for everything.

- Check for Mello-Roos. These are extra taxes often found in newer developments like Ladera Ranch or Irvine. They can add hundreds to your monthly payment and they don't always show up clearly on Zillow.

- Verify the Homeowner’s Exemption. It only saves you about $70 a year, but it’s a sign the property is owner-occupied, which matters for certain types of financing.

- Look at the "Transfer History." If a house has flipped three times in four years, there’s a reason. Use the Clerk-Recorder’s site to see if those were actual sales or just family transfers.

- Use the Tax Estimator. The Treasurer-Tax Collector’s website has a tool where you can plug in a potential purchase price to see what your actual bill will look like. Do this before you make an offer.

Stop just looking at the photos of the pool. Dive into the public records. The real story of a house is written in the county's ledger, not the agent's description.