You probably think you know American Express. It’s that heavy piece of metal in your wallet, the one that gets you into airport lounges or saves your skin with travel insurance when a flight to Denver gets canceled. But the banking side? That’s different. Amex isn’t just for credit cards anymore. When you decide to open American Express checking account access, you aren’t just getting a place to park your cash. You're basically stepping into a hybrid world where your debit card acts a lot like a rewards card. It’s weird. It’s actually pretty cool if you're already in their ecosystem, but it definitely isn't for everyone.

Honestly, the biggest mistake people make is treating this like a standard Chase or Bank of America account. It’s not. There are no branches to walk into if you lose your PIN or need a cashier's check on the fly. This is a digital-first play that rewards loyalty more than it rewards traditional banking habits. If you’re a fan of the "Membership Rewards" points game, this is your playground. If you still carry around paper checks and want to talk to a teller named Linda every Tuesday, you're going to be disappointed.

The Reality of the Amex Rewards Checking Loop

Let’s get into the weeds. Most banks give you... well, nothing. Maybe a 0.01% interest rate that feels like a slap in the face. American Express flipped the script by offering a competitive Annual Percentage Yield (APY) that actually rivals some high-yield savings accounts. At the time of writing, they’ve consistently kept their rates high enough to make you notice, often sitting significantly higher than the national average.

But the real kicker is the points.

When you use your Amex Debit Card, you earn Membership Rewards (MR) points on eligible purchases. Specifically, you're looking at 1 point for every $2 spent. Is that going to make you a millionaire? No. But it’s a heck of a lot better than the zero points your current debit card is giving you. For people who are debt-averse and prefer using their own money rather than a credit line, this is a massive win. You get the psychology of debit with the perks of credit. It's a sweet spot.

👉 See also: Hobby Lobby Fairfax VA: What You Should Know Before Navigating the Aisles

However, there’s a catch. You can’t just walk in off the street and get this account in every scenario. Traditionally, Amex required you to have an existing Consumer Credit Card with them for at least three months. They want to know you. They want to see how you handle credit before they let you into the banking suite. It’s like a velvet rope for checking accounts.

Why You Might Hate It (And Why You’ll Love It)

If you’re a cash-heavy person, you’ll probably find this frustrating. You can’t just go to a branded ATM and deposit a wad of twenties. You’re relying on mobile check deposits and ACH transfers. For a digital nomad or a tech-savvy professional, that’s fine. For a small business owner dealing in cash? It's a nightmare.

Also, consider the "All-in-One" factor.

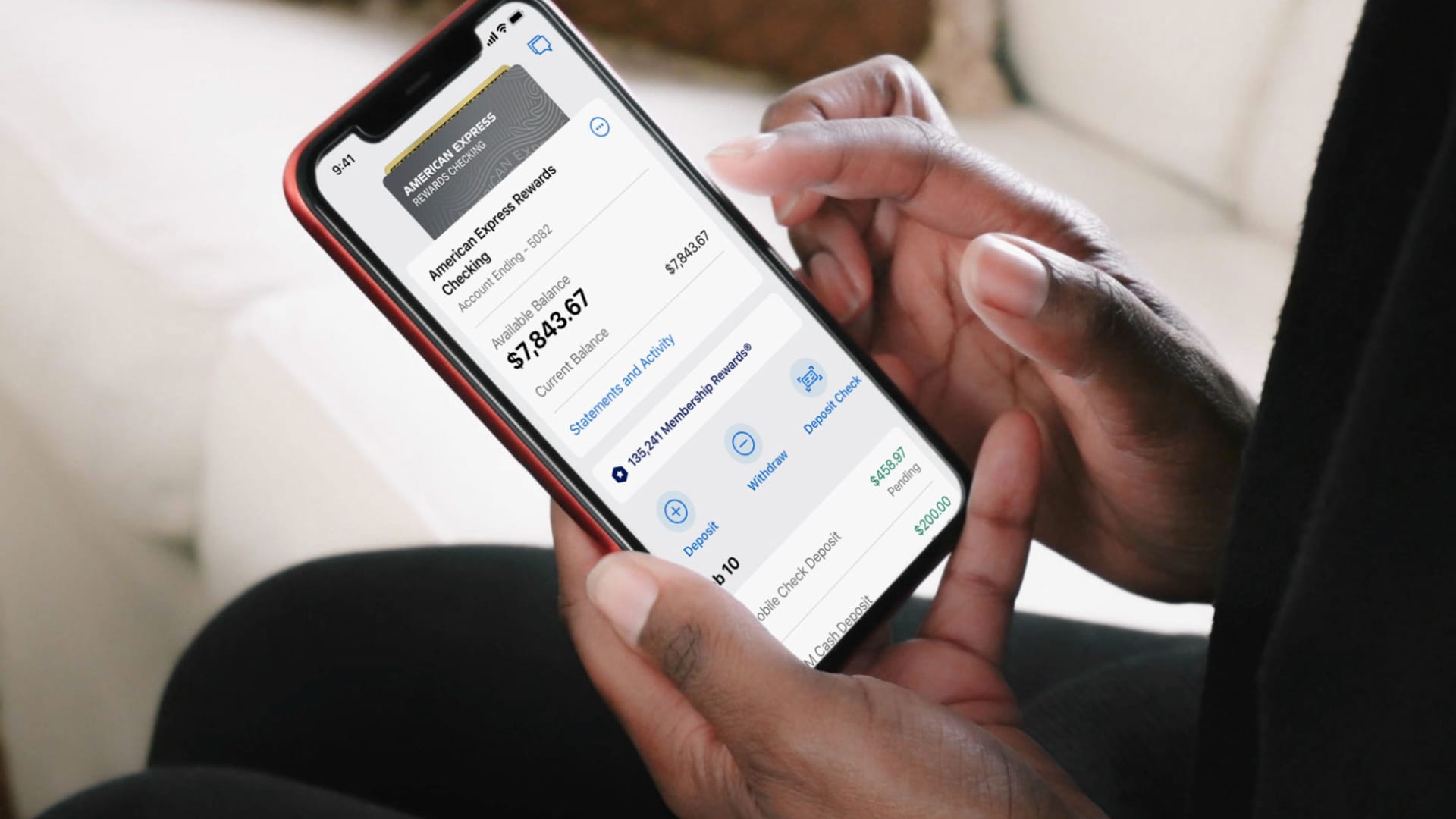

- App Integration: Your credit cards, savings, and checking all live in one app. It’s clean. The UI is actually intuitive, which is rare for a bank.

- Customer Service: You get the legendary Amex support. If something goes sideways, you aren't stuck in a phone tree for three hours.

- No Fees: We’re talking no monthly maintenance fees and no minimum balance requirements. This is huge. Most big banks want to charge you $12 a month just for the privilege of holding your money. Amex doesn't play that game.

The downside? No physical branches. None. If you need a medallion signature guarantee or a complicated wire transfer handled in person, you’re out of luck. You have to be comfortable doing everything through a screen. Some people love that. Some people find it terrifying.

The Impact of APY in a Shifting Market

We’ve seen interest rates dance around like crazy over the last few years. When you open American Express checking account perks, you’re locking into a system that generally stays ahead of the curve. While the "Big Three" banks are hoarding profits, Amex is using their checking account as a "loss leader" to keep you in their world. They want you to stay. They want you to keep that Platinum or Gold card in your pocket.

By offering a high APY on a checking account—not just savings—they allow your "walking around money" to actually grow. Most people keep their bills money in a zero-interest account. If you have $5,000 sitting in your checking account to cover rent and credit card bills, having that earn 1% or more throughout the month adds up. It’s free coffee money. It’s "found" money.

How to Actually Open the Account Without the Headache

Don't just rush the application. If you don't have an Amex credit card yet, stop. Go get one first. Use it for a few months. Build that history. Amex loves "tenure." They are more likely to approve your banking application and offer higher limits or better features if they see you’re a responsible cardholder.

- Check your eligibility: Log into your Amex portal. If the "Rewards Checking" option is there, you’re likely pre-approved.

- Fund it immediately: Don’t let the account sit at $0. Transfer $100 just to wake it up.

- Set up the Debit Card: It arrives in a sleek package. It looks like a credit card. Don't get them confused in your wallet!

- Connect it to your Savings: If you have an Amex High-Yield Savings Account (HYSA), the transfers are instantaneous. This is the secret sauce. You can move money from your "emergency fund" to your "buying groceries fund" in three taps.

People often ask about ATM access. Amex uses the MoneyPass network. There are over 37,000 of them. You can find them in 7-Elevens and pharmacies. If you use one of those, you don't pay a fee. If you go to a random ATM at a strip club or a high-end hotel, you’re going to get hit with a fee from the ATM owner, and Amex won't always reimburse that. Just be smart about where you pull out cash.

The Fine Print Nobody Reads

There are a few "gotchas." The rewards points you earn on debit are Membership Rewards points, but they are slightly limited compared to credit card points unless you have a "Premium" card. If you only have the checking account, your redemption options might be narrower—mostly for deposits back into your account or gift cards. But, if you also have a Gold or Platinum card, those points pool together.

This is where the magic happens. You can take those "debit points" and transfer them to Delta, Hilton, or British Airways. Suddenly, your grocery bill is helping you fly to London. That is the real reason to open American Express checking account access. It turns mundane spending into travel currency.

Think about it. Most people spend $2,000 to $4,000 a month on "stuff" via debit or credit. If you’re doing that on a standard bank debit card, you’re leaving thousands of points on the table every year. Over a decade, that's a free honeymoon or a business class upgrade. It’s about the long game.

Is It Safe?

Yes. It's FDIC insured. American Express National Bank is as solid as it gets. They’ve survived every financial crisis for the last century and a half. Your money isn't going anywhere. The digital security is also top-tier, with two-factor authentication that actually works and doesn't glitch out every time you update your phone's OS.

The Verdict on American Express Banking

If you’re a hater of big banks and want a local credit union feel, this isn't for you. It’s corporate. It’s sleek. It’s efficient. But if you’re already part of the Amex ecosystem, it’s almost a no-brainer. You're getting a high-interest rate on your liquid cash and earning points on things you’d buy anyway.

Stop letting your money sit in a stagnant account that charges you fees. The transition to digital banking is already over—we're living in it. You might as well get paid to participate.

Next Steps for Your Finances:

- Audit your current fees: Look at your last three bank statements. If you see "Monthly Maintenance Fee" or "Minimum Balance Fee," leave. Immediately.

- Check your Amex portal: See if the Rewards Checking offer is waiting for you.

- Consolidate: Moving your checking to the same platform as your credit cards simplifies your life. One login. One app. One less thing to worry about at 2:00 AM.

- Test the waters: You don't have to move your whole life over on day one. Open the account, put $500 in it, and use the debit card for a week. See if the interface fits your brain. If it doesn't, close it. No harm, no foul.