If you’ve been watching the OnMobile Global stock price lately, you know it feels a bit like riding a wooden roller coaster in a thunderstorm. One day it's a "Hold," the next it's flirting with its 52-week low. Honestly, the numbers can be a headache. As of mid-January 2026, the stock has been hovering around the ₹56 to ₹57 range on the NSE, which is a far cry from the highs some of us were hoping for when they celebrated their 25th anniversary last year.

But here's the thing about OnMobile: it's a company in the middle of a massive identity crisis, and I mean that in the most profitable way possible.

They are pivoting. Hard.

For years, everyone knew them as the "caller tune" people. Now? They want to be the global powerhouse of mobile gaming. Whether the stock price reflects that transition yet is the big question every retail investor is asking.

Breaking Down the OnMobile Global Stock Price Movement

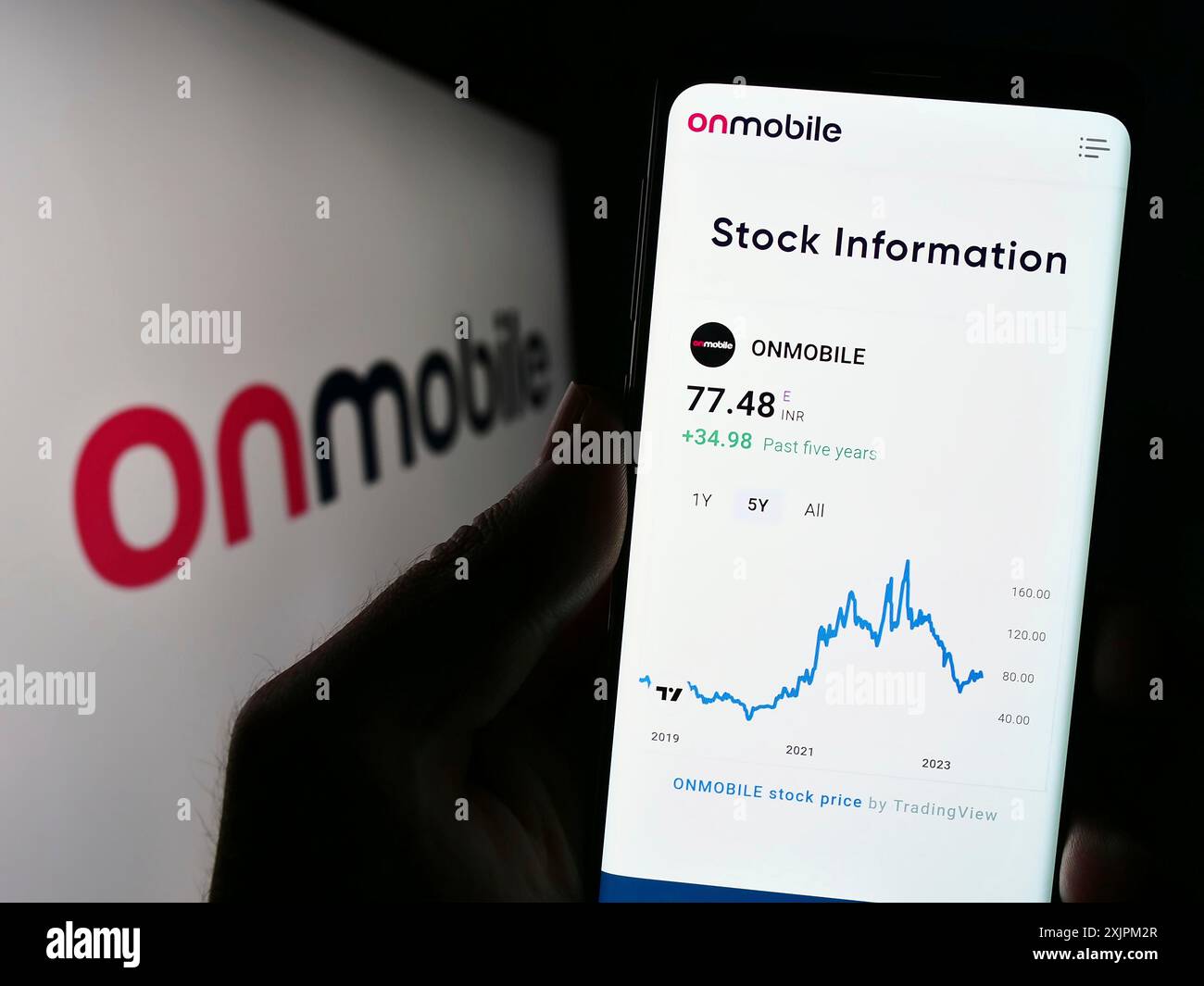

Look at the charts from 2025 and you'll see a lot of red. The stock basically took a 15% to 16% haircut over the last year. It hit a rough patch in April 2025, bottoming out around ₹41.07. If you bought then, congrats, you’re actually up! But for the long-term crowd, the three-year return of roughly -40% is a bitter pill to swallow.

Why the disconnect?

The market is skeptical. It’s waiting for the "gaming surge" to actually show up in the bottom line. Right now, the OnMobile Global stock price is struggling with some technical gravity. It recently fell below its 200-day moving average (which is roughly ₹56.71), and traders generally see that as a "hey, watch out" signal.

Recent Performance at a Glance:

- Current Price (Jan 2026): ~₹56.36

- 52-Week High: ₹75.73

- 52-Week Low: ₹41.07

- Market Cap: Roughly ₹600 Crore (Small Cap territory)

It’s small. It’s volatile. And it’s currently a "Hold/Accumulate" candidate according to several analysts, including the latest updates from StockInvest.us as of January 9, 2026. Basically, the pros are saying: "Don't panic sell, but maybe don't bet the house on it just yet."

The Gaming Pivot: Growth vs. Reality

Bikram Singh Sherawat, the President and COO, has been pretty vocal about the future. He’s gone on record saying gaming will likely make up 50% of the company's revenue within the next year and a half. That’s a bold claim.

But the data sort of backs him up.

In Q2 of FY26 (the quarter ending September 2025), their mobile gaming revenue jumped 12% quarter-on-quarter. Their gaming subscriber base is now sitting at about 13.7 million people. That's not a small number. If they can keep that double-digit growth going, the OnMobile Global stock price might finally break out of its current slump.

The challenge is the "old" business. Their legacy services—the stuff that pays the bills right now—are facing headwinds. It's a classic case of a company trying to build a new engine while the plane is still flying. Sometimes the plane loses a little altitude during the swap.

What the Financials Are Actually Saying

If you dig into the Sep 2025 financials, the net profit margin was actually quite impressive at around 25% for the standalone entity, though the consolidated numbers are usually more conservative. They’ve got about ₹129 crore in cash.

That’s a healthy cushion.

They aren't drowning in debt either. Their debt-to-equity ratio is around 11.8%, which is nothing for a tech firm. Most of their "debt" is actually well-covered by their operating cash flow. So, the risk of the company going under is basically zero; the risk is just the stock "dead-ending" for a few more years.

👉 See also: Credit Card Interest Rates: What Most People Get Wrong About the 10% Cap

The Dividend Dilemma

Don’t buy this for the dividends. Period.

The dividend yield is currently 0%. They haven't cut a check to shareholders in about two years. They are reinvesting every spare rupee into their "Gamize" and "Challenges Arena" platforms. If you’re a dividend seeker, you’re in the wrong place. This is a pure turnaround play.

Technical Support and Resistance: Where to Watch

If you’re the type who stares at candles all day, you need to watch the ₹56.20 level. That’s the current support. If it breaks below that, we might be looking at the mid-40s again.

On the flip side, there is some heavy resistance at ₹58.28.

Until the stock can consistently close above ₹60, it's just going to keep bouncing around in this "no man's land" range. The MACD (Moving Average Convergence Divergence) is still flashing some sell signals on the 3-month chart, so the short-term trend is "bearish to neutral."

Misconceptions Most People Get Wrong

People think OnMobile is just an Indian company. It’s not. They are in 69 countries. They just partnered with Dialog Axiata in Sri Lanka and Vodafone in Qatar. They are a global B2B player that happens to be headquartered in Bangalore.

Another thing? People assume mobile gaming is just "apps."

OnMobile is focusing on "cloud gaming" and "gamification" for telcos. They aren't trying to build the next Call of Duty. They are building the platforms that telcos use to keep you engaged so you don't switch your SIM card. It’s a niche, but a very sticky one.

The Actionable Bottom Line for Investors

So, what do you actually do with this information?

- Watch the Q3 Results: The trading window closed on January 1, 2026, for the December quarter results. When those numbers drop in February, look specifically at the gaming revenue growth. If it's below 10%, the pivot is stalling.

- Set a Stop-Loss: If you’re trading this, a stop-loss around ₹53.70 makes sense. It protects you from a total breakdown if the market gets grumpy.

- Patience is Mandatory: This is not a "get rich quick" stock. The OnMobile Global stock price is tied to a multi-year transformation. If you don't believe in the mobile gaming future for telcos, stay away.

- Monitor FII Activity: Foreign Institutional Investors have been dipping their toes in and out. In September 2025, they increased their stake to 1.85%, but it dropped back toward 0.91% by December. When the "big money" starts staying put, that's your signal.

The company is 25 years old. It’s survived the 2G, 3G, and 4G eras. Now it’s trying to own the 5G gaming space. It’s a risky bet, sure, but at a ₹600 crore market cap, it’s a bet that doesn't need much to go right for the stock to double. Just don't expect it to happen by next Tuesday.

Check the NSE live feed for the most recent ticks, as the ₹56 range is currently being tested heavily by sellers. If it holds, the foundation for a 2026 recovery might finally be in place.

🔗 Read more: The Richest Country in the World 2025: Why It’s Not Who You Think

Next Steps: You should verify the exact date for the Q3 FY26 earnings call, usually announced on the OnMobile Investor Relations page in late January, to see if the gaming revenue target of $2 million monthly is being met.