Money is weird. Especially in Kabul. If you’re trying to figure out the value of one dollar in afghani, you aren’t just looking at a number on a screen; you’re looking at one of the most confusing economic anomalies of the last few years.

Back in late 2021, everyone—and I mean everyone from the World Bank to the guy selling saffron in the bazaar—thought the Afghani (AFN) was going to zero. It didn't happen. Instead, we’ve seen a currency that held its ground while much bigger economies watched theirs crumble. It’s a wild story.

To get the basics out of the way, as of early 2026, the rate for one dollar in afghani typically hovers in that 65 to 75 AFN range. But don't bet your life on that specific number. It changes. Fast. You check your phone, it’s 68. You walk to a money changer at Sarai Shahzada, and suddenly it's 70. Why? Because in Afghanistan, the "official" rate and the street rate are distant cousins who don't always talk to each other.

✨ Don't miss: Exactly how many hours is 9-2 and why the math often feels wrong

The Reality of One Dollar in Afghani Right Now

The value of the Afghani is propped up by things that wouldn't work in a normal economy. Think about it. The country is largely cut off from the global banking system. SWIFT is a memory. Most of the central bank's foreign reserves are sitting in a vault in Switzerland or frozen in New York.

So, how is it that one dollar in afghani isn't 500 to 1?

Control. Absolute, rigid control.

The Da Afghanistan Bank (DAB) isn't playing by the usual rules of the IMF. They’ve banned the use of foreign currency for local transactions. If you're in Kandahar and you want to buy a sack of flour, you use AFN. You get caught using Pakistani Rupees or US Dollars? You’re going to have a very bad day. This forced demand keeps the currency's head above water.

What your dollar actually buys

Inflation is a monster, but it's a monster that’s been somewhat leashed by the currency's stability. In the markets of Kabul, one dollar in afghani (roughly 70 AFN) can still get you a few loaves of fresh naan or a decent amount of seasonal vegetables. It’s not much, but compared to the hyperinflation seen in places like Lebanon or Turkey, it’s a miracle of sorts.

Actually, it’s more of a manufactured miracle.

The UN flies in literal planes full of cash—physical US dollars—for humanitarian aid. This is the "secret sauce." These dollars get auctioned off by the central bank to keep the AFN from plummeting. It’s a strange cycle where international aid essentially subsidizes the exchange rate.

Why the Exchange Rate is Often Misunderstood

People see a stable exchange rate and think "Oh, the economy must be doing great."

Nope.

The stability of one dollar in afghani hides a lot of pain. We are looking at a "liquidity trap." There’s no credit. There are no big commercial loans. Businesses are terrified to move money because they don't know if they can get it back out. So, while the exchange rate looks "good" on a chart, the actual volume of trade is often depressing.

- The Sarai Shahzada Factor: This is the heart of the Afghan economy. It's a massive, multi-story building filled with money changers. It’s loud, it’s chaotic, and it’s more accurate than any Bloomberg terminal for local rates.

- The Hawala System: This is how money actually moves. It’s an informal trust-based network. You give a guy a dollar in London, and his brother gives your family the equivalent in Afghani in Jalalabad. No banks needed.

- The Ban on Online Trading: The current administration has cracked down on forex trading apps. They want to control every single unit of currency.

Basically, if you’re looking at a Google Finance chart for the AFN, you’re only seeing half the picture. The real price of one dollar in afghani is determined by how many physical greenbacks are sitting in the vaults of the money changers on any given Tuesday.

The Weird History of the "New" Afghani

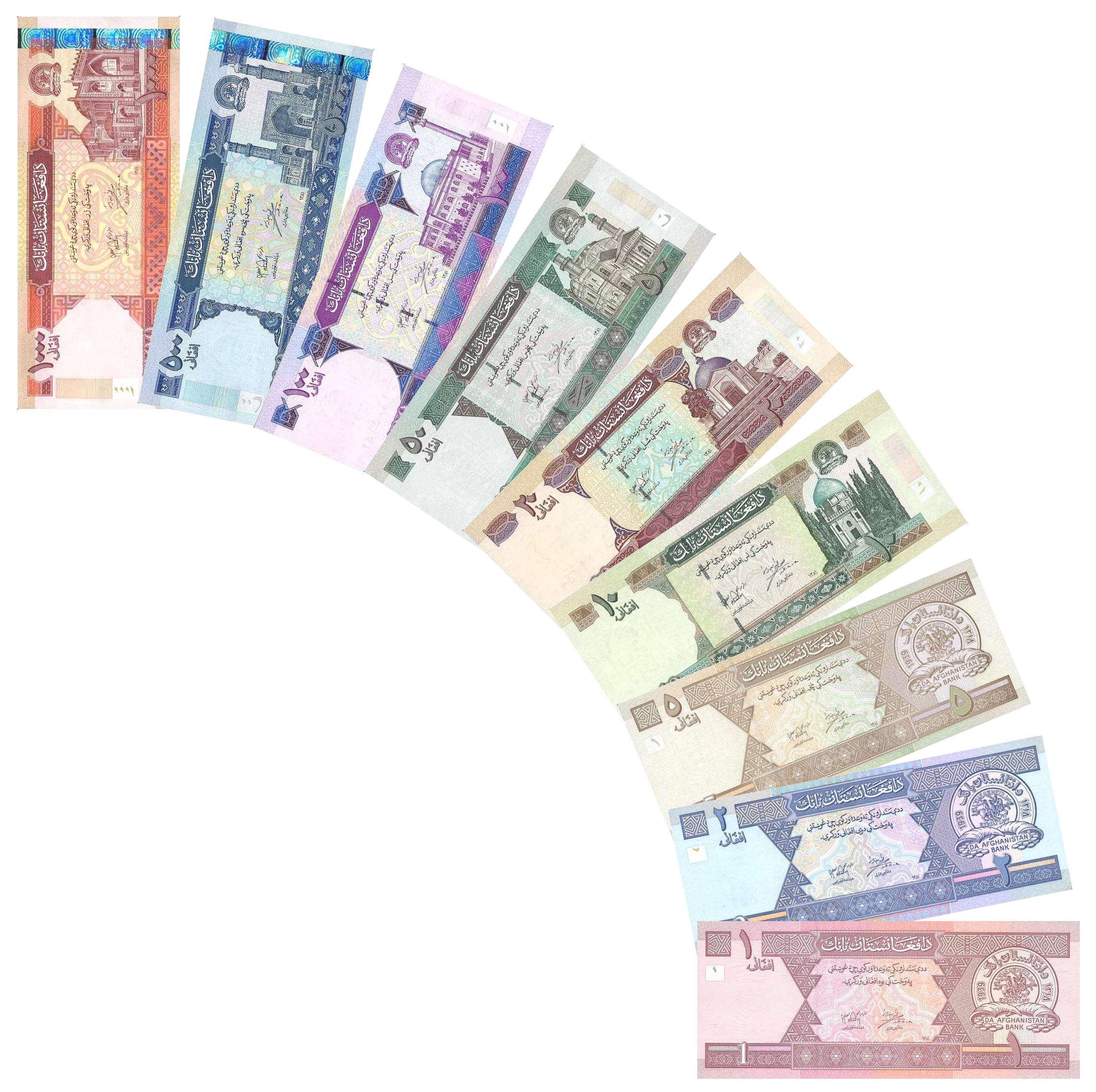

Remember the old notes? The ones with all the zeros? In 2002, the country lopped off three zeros to create the currency we see today. It was a symbol of a new era.

Today, that same paper currency is literally wearing out. Because the current government isn't recognized internationally, they had a nightmare of a time getting new banknotes printed. For a while, the bills in circulation were so old and taped-up they looked like they’d been through a blender. Eventually, some new shipments arrived via contracts signed with European printers before the 2021 shift, but the physical supply of cash remains a bottleneck.

This scarcity of physical AFN notes actually keeps the value of one dollar in afghani lower than it might otherwise be. When there isn't enough local cash to go around, the cash that does exist becomes more "valuable."

It’s basic supply and demand, just applied in a very grim context.

A Comparative Look (Sort of)

If you compare the AFN to the Iranian Rial or the Pakistani Rupee, the Afghani looks like a rockstar. While the Rupee has slid down a mountain over the last two years, the Afghani has actually appreciated at times. It makes no sense until you realize that Pakistan and Iran are trying to participate in the global economy and are subject to its pressures. Afghanistan is essentially an island. An island with very strict guards.

How to Handle Currency if You're Dealing with Afghanistan

Honestly, if you're a freelancer or a small business owner trying to navigate this, it's a headache. You’ve got to be careful.

First, never trust a single source for the rate. Check the DAB website, but then ask someone on the ground what the "Hawala rate" is. They will never be the same. Usually, the informal rate gives you more AFN for your dollar, but the risk is higher.

Secondly, understand the "dollarization" problem. Even though it's banned, the economy still "thinks" in dollars. If the price of one dollar in afghani spikes, the price of cooking oil in the shop will go up ten minutes later. The merchants are hyper-aware of the exchange rate because they have to buy their stock from abroad—usually from Dubai or Pakistan—using hard currency.

Misconceptions to avoid

- "The currency is about to collapse." People have been saying this for four years. It hasn't happened yet because the central bank is willing to use every tool (and every whip) at its disposal to prevent it.

- "I can use my Visa card there." Forget it. The infrastructure is broken. It's a cash-only world.

- "The rate is the same everywhere." Rates in Herat (near Iran) might differ from rates in Kabul or Mazar-i-Sharif based on local demand and the flow of cross-border trade.

What the Future Holds for the Afghani

We have to be realistic. The current stability is brittle. It depends on the continued flow of UN cash shipments and the ability of the central bank to keep a lid on the black market. If the international community decides to stop the "humanitarian cash flights," the value of one dollar in afghani would likely crater overnight.

There’s also the issue of the frozen assets. There is roughly $7 billion sitting in the US. There’s a constant legal and political tug-of-war over this money. If that money is ever released back to the central bank, the AFN could become one of the most stable currencies in the region. If it stays frozen forever, the current "cracks" in the economy will eventually become canyons.

The nuances here are endless. You have a central bank that is surprisingly technocratic in its execution, staffed by people who were trained during the previous Republic, but overseen by an administration with a completely different ideology. It's a miracle the thing functions at all.

Actionable Steps for Tracking and Trading

If you need to move money or just stay informed about the value of one dollar in afghani, don't just set a Google Alert. You need to look deeper.

- Monitor the UN Relief Flights: These are often reported in Afghan news outlets like TOLOnews. When the cash arrives, the AFN usually gets a temporary boost because the central bank auctions those dollars to local traders.

- Watch the Border Trade: If Pakistan changes its transit trade rules (which happens a lot), it puts immediate pressure on the Afghani. Less trade means less demand for the currency.

- Use Trusted Channels: If you are sending money to family, stick to established Hawala networks that have a presence in major hubs like Dubai or Istanbul. They are the only ones with the "real" liquidity.

- Verify the Note Quality: If you are physically handling AFN, be wary of very old, damaged notes. Some vendors will refuse them or take them only at a discount, effectively changing your exchange rate.

Understanding the Afghani is about understanding a survival economy. It’s not about bull markets or bear markets. It’s about how a country manages to keep its lights on when the rest of the world has pulled the plug. The exchange rate is the pulse of that survival. It’s steady for now, but it’s a fast, shallow pulse that everyone is watching with bated breath.

Stay updated by checking the Da Afghanistan Bank's daily auction results. They publish how many millions of dollars they sell to keep the rate stable. It’s the most honest data point you’ll find in a very complicated financial landscape.