Honestly, it feels like finding a twenty-dollar bill in an old pair of jeans, but on a massive, state-wide scale. Right now, the Oklahoma State Treasurer is sitting on a mountain of cash—over $1.4 billion in assets, to be exact. That isn't the state's money. It's yours. Or your neighbor’s. Or maybe it belongs to that great-aunt who lived in Tulsa back in the '80s and never told anyone about her utility deposit refunds.

Most people think "unclaimed property" means abandoned houses or overgrown lots. That's a total misconception. In the world of state finance, oklahoma state unclaimed property is almost always about the "paper" trail of your life that somehow got cold.

The $1.4 Billion Question: What Is This Stuff?

Basically, when a business loses track of you, they can't just keep your money. If a bank account sits untouched for three years, or a paycheck goes uncashed, the law says that company has to hand the funds over to the State Treasurer for safekeeping.

The variety of what’s sitting in the vault at 4841 N. Sewell Ave in Oklahoma City is kind of wild. We're talking about:

- Uncashed payroll checks (that one Friday you were sick and forgot to swing by the office).

- Mineral interests and oil royalty payments—huge in Oklahoma, obviously.

- Old utility deposits from an apartment you left ten years ago.

- Forgotten savings accounts or CDs.

- The actual physical contents of safe deposit boxes, like jewelry or rare coins.

State Treasurer Todd Russ has been pretty vocal about the fact that about 1 in 7 Oklahomans has something waiting for them. It’s not always a life-changing windfall. Sometimes it’s a $15 rebate from a cell phone provider. But sometimes? It’s a five-figure insurance payout that someone's grandmother meant to leave to her grandkids but the paperwork got lost in a move.

Why Oklahoma State Unclaimed Property Still Matters in 2026

You might think you’re too organized to lose money. But life happens. People move, companies merge, and mail gets sent to old addresses. In 2025 and heading into 2026, the state has been processing hundreds of millions of dollars in returns.

The reason it matters right now is that the system has become way more digital. Back in the day, you had to scour the "legal notices" section of the newspaper—those tiny, eye-straining lists of names—to see if you were owed anything. Now, the yourmoney.ok.gov portal makes it almost too easy.

How to Search Without Getting Scammed

Here is the thing you've got to remember: Searching for your money is 100% free. There are "finders" or "locators" who will mail you official-looking letters offering to help you recover your funds for a "small" fee of 10% or 20%. Don't do it. There is absolutely no reason to pay a private company to do a search that takes you thirty seconds on the official state website.

The Search Process

- Go to the official portal at yourmoney.ok.gov.

- Type in your last name. If you have a common name like Smith or Miller, add your first name to narrow it down.

- Check for variations. Did you go by "Chris" or "Christopher"? Did your mother use her maiden name on that one account?

- Don't just search for yourself. Search for your parents, your late grandparents, or even your small business.

If you find a match, the site will let you "claim" it right there. You'll usually need to provide some basic proof—like a scan of your ID or a document showing you once lived at the address associated with the money.

🔗 Read more: Why far limitation of funds is the real reason your project is stalling

What Happens Behind the Scenes

When you file a claim for oklahoma state unclaimed property, it doesn't just trigger an automatic robot to mail you a check. A real person—an auditor—has to verify that you are who you say you are.

According to the Treasurer's office, you should usually allow about 90 days for an auditor to be assigned to your claim, especially if it's a more complex one involving an estate or a safe deposit box. If it's a simple uncashed check under $1,000, it might move a lot faster.

Wait.

The state actually holds this money in perpetuity. That means there is no "expiration date." If your great-grandfather had a forgotten bank account in 1950, and the state took custody of it in 1955, his heirs can still claim it in 2026. The state doesn't "absorb" the money into the general budget to spend on roads—at least, not the principal. It stays in a trust fund, waiting.

The "Mineral Interests" Factor

Oklahoma is unique because of the sheer volume of mineral interests. If you inherited land or "rights" from a relative, there might be royalty checks sitting in the unclaimed property fund.

Oil and gas companies are required to report these funds annually. If they can’t find the owner of a specific "well" or "unit," that money goes to the state. We've seen cases where families discovered thousands of dollars in accumulated royalties they never knew existed because the original deed was in a name they didn't recognize or a trust that hadn't been updated.

Common Misconceptions to Ignore

- "The IRS will tax me on the whole thing." Not necessarily. If it’s a return of your own money (like a utility deposit), it’s usually not taxable income. If it’s interest or a death benefit, that’s a different story.

- "It’s a scam if they ask for my Social Security number." This is tricky. While you should be wary of random emails, the official yourmoney.ok.gov site will eventually need your SSN to verify your identity. Just make sure you are on the actual

.govsite and not a copycat. - "My name isn't there, so I'm done." Names are added every single month. Companies have different reporting deadlines (most report by November 1st, but life insurance companies report by May 1st).

Actionable Steps to Take Right Now

Stop wondering and just look. It takes less time than scrolling through a social media feed.

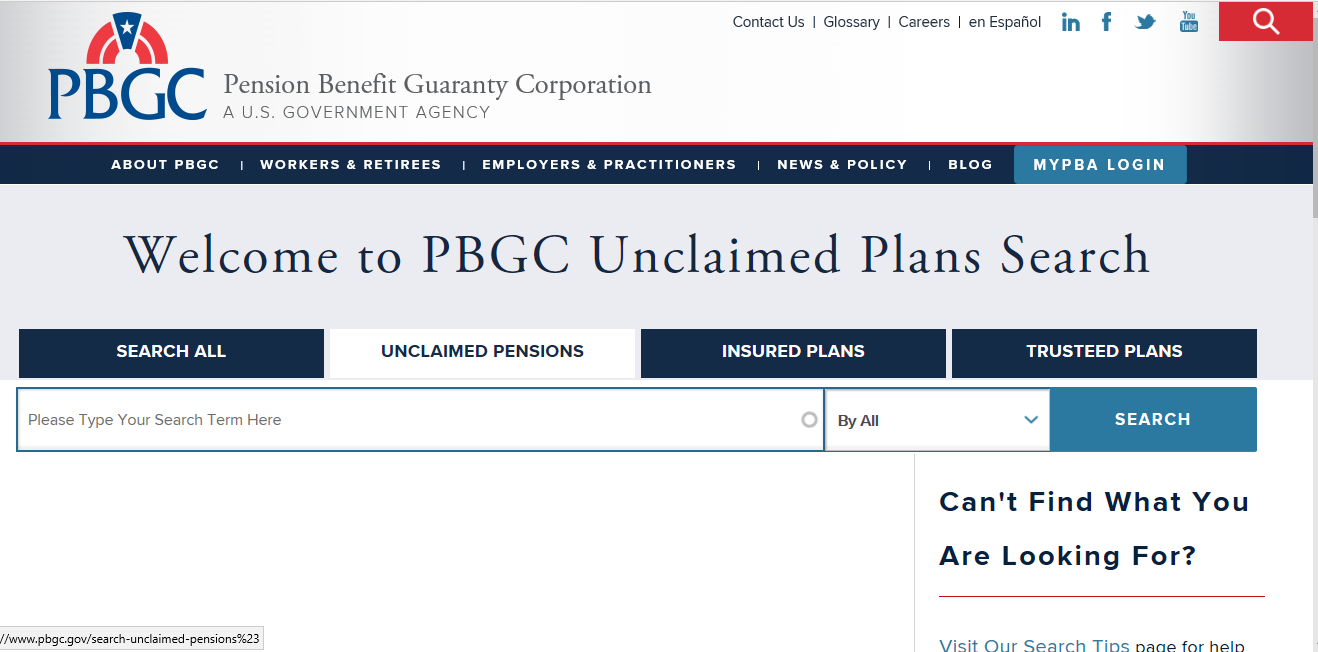

- Perform a multi-state search: If you’ve ever lived in Texas, Kansas, or anywhere else, use MissingMoney.com. It’s the national database endorsed by the National Association of Unclaimed Property Administrators (NAUPA).

- Check for deceased relatives: This is a big one. Search for parents or grandparents who have passed away. You may need a "Small Estate Affidavit" or probate documents to claim these, but the state provides the forms.

- Update your info: To prevent your current money from becoming "unclaimed," make sure you have a "move" checklist that includes updating your address with every bank, insurance company, and previous employer.

- Keep a log: If you file a claim, write down your claim number. You can check the status online without having to call and wait on hold.

The $1.4 billion currently held by the Oklahoma State Treasurer is essentially a giant "Lost and Found" box. It belongs to the people of Oklahoma, and the only way it gets back into the economy is if you take five minutes to go get it.