Waking up and checking your portfolio today feels a bit like watching a slow-motion car crash that everyone saw coming, yet nobody quite knows how to dodge. If you’re looking at oil stock price today, you’re seeing a market that’s basically wrestling with two giant, angry bears: a massive global supply surplus and a geopolitical landscape that changes every time a headline hits the wire.

Honestly, it's a weird time for energy.

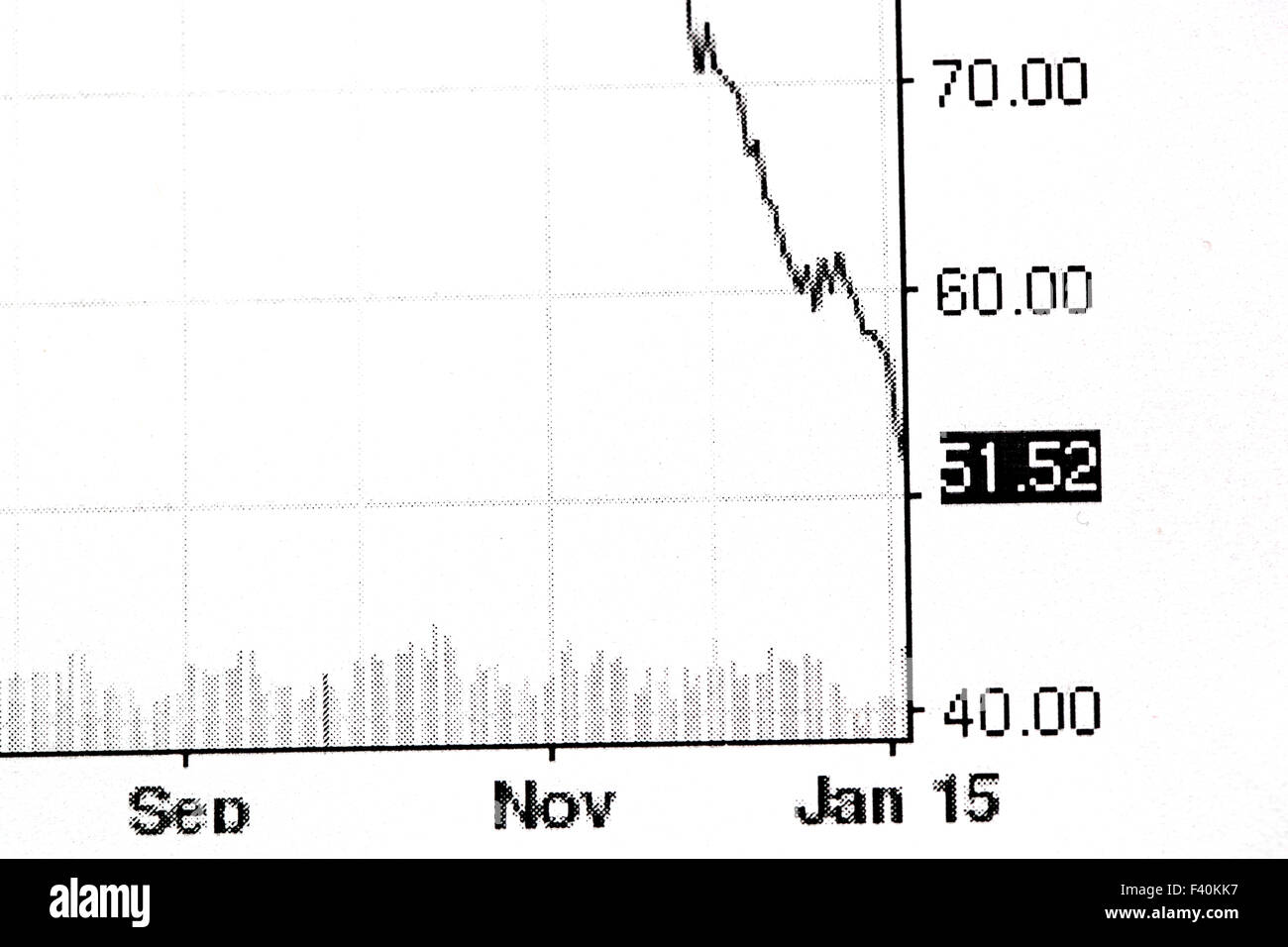

We are officially in the "Great Surplus" of 2026. For months, analysts like those at the EIA and Fitch Ratings have been shouting from the rooftops that we’d have more oil than we knew what to do with. And here we are. WTI crude futures are hovering right around $59.44 per barrel, while Brent is sitting at roughly $64.13.

But if you think it's just a straight line down, you haven't been paying attention to the chaos in the Middle East or the sudden "Venezuela shock."

The Geopolitical Rollercoaster No One Asked For

Most people assume that when oil prices drop, oil stocks just follow them down into the basement. That’s the first thing people get wrong. Stocks like ExxonMobil (XOM) and Chevron (CVX) aren't just betting on the price of a barrel; they are betting on their ability to survive the volatility that comes from things like the detention of Nicolás Maduro or protests in Iran.

Just a few days ago, the market was bracing for a massive spike because of tensions in the Strait of Hormuz. Then, suddenly, the risk premium evaporated. One minute you've got traders panicking about a quarter of the world's seaborne oil being cut off, and the next, they’re selling off because the immediate threat of a U.S. strike has cooled down.

✨ Don't miss: Syrian Dinar to Dollar: Why Everyone Gets the Name (and the Rate) Wrong

It’s exhausting.

The reality for the oil stock price today is that the "fear factor" is losing its punch. We have so much spare capacity—mostly sitting in the hands of Saudi Arabia and the UAE—that even a legitimate disruption doesn't scare the market the way it did ten years ago. OPEC+ just met on January 4th and decided to keep their production pause in place through March. They are trying to be the "adults in the room," but even their caution can't hide the fact that the U.S., Brazil, and Guyana are pumping out record amounts of the stuff.

Why Some Oil Stocks are Actually Winning

You’d think a supply glut would be a death sentence for the sector.

Not quite.

Look at Valero Energy (VLO). While the guys pulling oil out of the ground are sweating, the refiners are often having a blast. Valero’s stock has seen a massive 45% return over the last year. Why? Because they buy the crude, which is getting cheaper, and turn it into gasoline and jet fuel, which still have decent demand.

🔗 Read more: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

The Split in the Sector

- Exploration & Production (E&P): These are the high-stakes gamblers. Think ConocoPhillips (COP) or Devon Energy (DVN). Their stock prices move almost in lockstep with the daily ticker. If WTI drops another two bucks, they feel it in their bones.

- Refiners: These folks (like Marathon Petroleum) often thrive on the "crack spread"—the difference between the price of crude and the price of the finished product.

- Service Providers: Companies like Halliburton (HAL) and Baker Hughes (BKR) are the ones selling the shovels in a gold rush. Their stocks are currently resilient because even if prices are lower, the sheer volume of production in the U.S. means they stay busy.

The "China Factor" and the 2026 Forecast

If you want to understand where the oil stock price today is headed, you have to look at what's happening in Chinese ports. China has been on what analysts call a "war footing" with their stockpiling. They’ve tucked away nearly 1.4 billion barrels of oil. That’s three months of total cover if their imports were ever cut off.

This massive hoarding is one of the only things keeping a floor under the price right now.

Without China's strategic buying, we’d likely be looking at $40 oil instead of $60. The demand growth for 2026 is projected to be around 1.2 million barrels per day, which sounds like a lot, but it's being outpaced by a production increase of nearly 2 million barrels.

Basically, we're making it faster than we can burn it.

What You Should Actually Be Watching

If you're trying to trade these moves, stop looking at the daily fluctuations of Brent. Start looking at the OPEC+ compensation plans. Countries like Iraq and Kazakhstan have been "cheating" on their quotas for years. Now, they are being forced to make extra cuts through June 2026 to make up for it.

💡 You might also like: How Much Do Chick fil A Operators Make: What Most People Get Wrong

If they actually follow through, the supply might tighten enough to save some of those E&P stocks. If they keep cheating? Expect the downward slide to continue.

Actionable Steps for Navigating Oil Stocks Right Now

Forget the "buy and hold" mantra of the 1990s oil boom. This is a tactical market now.

First, check the dividend safety. In a low-price environment, companies with high debt loads will cut their dividends first. Stick to the "supermajors" like Exxon or Chevron if you want that quarterly check to actually show up. They have the balance sheets to weather a couple of years of $50 oil.

Second, look at the midstream. Companies like Enbridge (ENB) operate pipelines. They are basically toll booths. They don’t care as much if the oil is $100 or $50; they care how much is flowing through the pipes. In a surplus, the pipes are full.

Finally, don't ignore the "behind-the-meter" shift. One of the weirdest reasons U.S. production is staying so high despite lower prices is that data centers—the ones running all the AI tech—are demanding massive amounts of dedicated energy. Some oil and gas firms are pivoting to provide direct power to these centers, creating a new revenue stream that has nothing to do with the global spot price.

The bottom line? The oil stock price today reflects a world that is moving away from scarcity and into a period of awkward abundance. It's great for your gas tank, but it's a minefield for your brokerage account. Stay skeptical of the "geopolitical spikes"—they usually fade faster than a summer tan. Focus on the companies that can make money at $50 oil, because that's the neighborhood we're living in for the foreseeable future.

To wrap this up, your best move is to monitor the February 1st OPEC+ meeting. If they show signs of cracking or if the U.S. production numbers for January come in higher than 13.6 million barrels, it might be time to trim some exposure to the pure drillers. Keep an eye on the refining margins; that's where the real "hidden" profit is sitting this quarter.