Ohio’s tax code used to be a messy mountain of brackets. Honestly, it was a headache. If you’ve lived in the Buckeye State for more than a few years, you probably remember when we had a half-dozen different tiers. But things just changed in a huge way.

Starting January 1, 2026, the what is the state income tax rate in ohio question has a much simpler answer: 2.75%.

Wait. It’s not quite that simple for everyone. While the state is officially moving to a flat tax system, there is a massive "zero percent" bracket that catches a lot of people. Basically, if you earn $26,050 or less in taxable income, you owe the state exactly zero dollars.

For every dollar you make over that $26,050 mark, you’ll be taxed at that flat 2.75% rate. This is a massive shift from 2025, where we still had a top rate of 3.125% for high earners. The state is essentially betting that a lower, simpler tax will keep people from fleeing to Florida or Texas.

💡 You might also like: F and W Media: What Really Happened to the Hobbyist Empire

The 2026 Transition: Goodbye Brackets

Most people think "flat tax" means everyone pays the same percentage of their total check. In Ohio, it’s more like a "floor."

If you make $50,000, you aren't paying 2.75% on the whole $50,000. You're paying nothing on the first $26,050. Then, you apply the 2.75% rate to the remaining $23,950. It’s a nuances that often gets lost in the headlines, but it makes a big difference in your actual take-home pay.

Last year (2025), the system was still tiered. You had:

- $0 to $26,050: 0%

- $26,051 to $100,000: 2.75%

- Over $100,000: 3.125%

By 2026, that top 3.125% tier is gone. Deleted. It’s all 2.75% now.

Why High Earners Might Actually Pay More

Here is the kicker. While the rate dropped, the state took away some "prizes" for the wealthy.

If you earn more than $500,000, you can no longer claim personal exemptions for yourself, your spouse, or your dependents. You also lose the joint filing credit. For a family making mid-six figures, the loss of these deductions might actually "cancel out" the savings they got from the lower tax rate.

It's a weird trade-off. The state simplified the math but tightened the belt on who gets to claim credits.

The Business Income "Loophole" (That’s Not a Loophole)

Ohio still treats business owners differently. If you own a "pass-through" entity—think S-corps, LLCs, or partnerships—you still get the Business Income Deduction.

👉 See also: Tunisian Dinar to USD Exchange Rate: What Most People Get Wrong

You can generally deduct the first $250,000 of business income entirely. Anything above that is taxed at a flat 3%. Yes, the business rate is actually slightly higher than the individual rate now, which is a bit of an irony compared to years past.

Don't Forget the "Invisible" Local Taxes

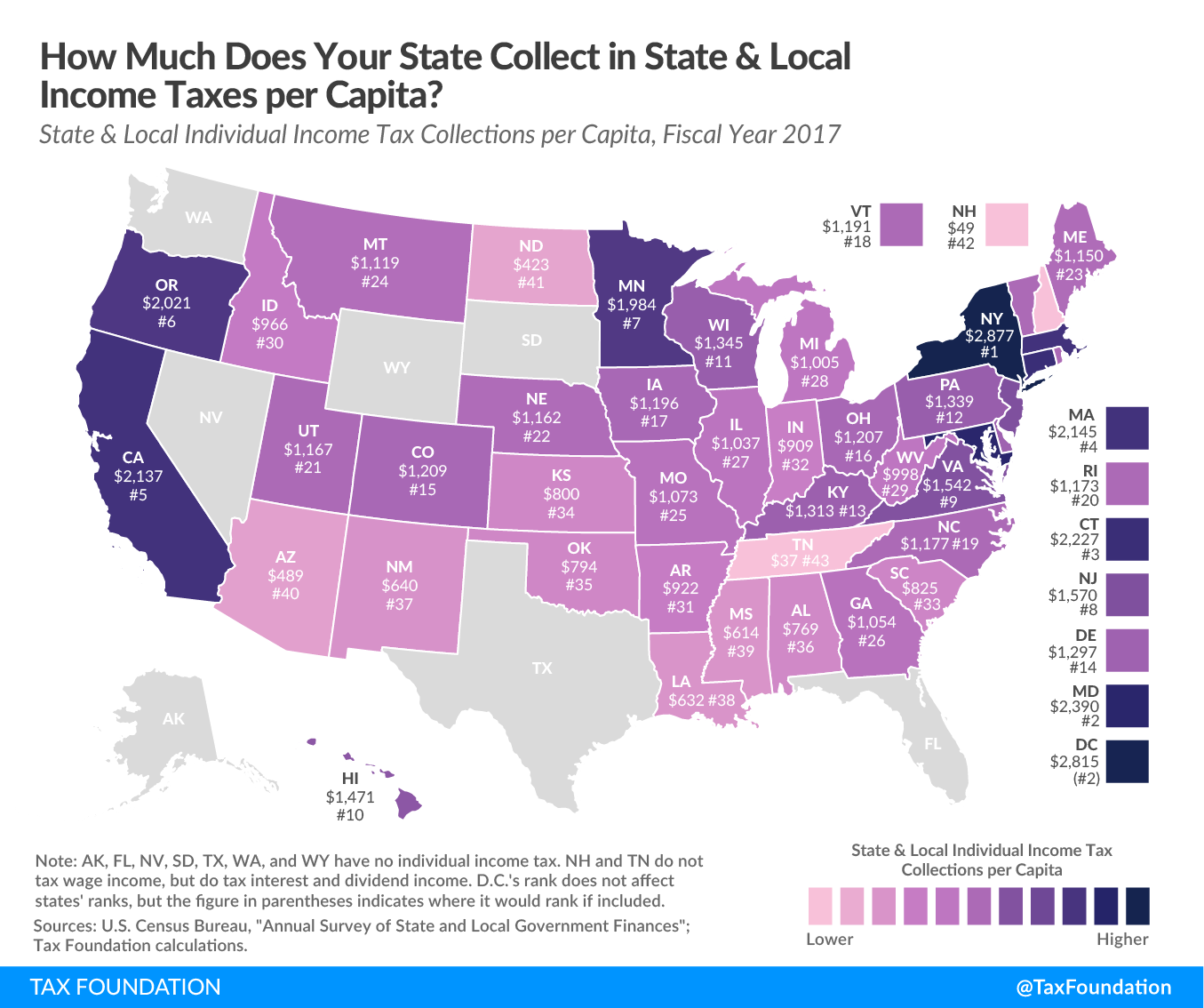

When people ask about the state income tax rate in ohio, they usually forget the local guys. Ohio is notorious for municipal taxes.

You might pay 2.75% to Columbus, but your city—say, Dayton, Cincinnati, or a tiny village in Medina County—might want another 1% to 3%. In fact, most Ohio cities have a municipal tax. If you work in one city but live in another, you might get a "credit" for taxes paid elsewhere, but you’ll often still owe a little "city tax" to your home base.

Then there are the school district taxes. Over 200 school districts in Ohio have their own separate income tax, usually ranging from 0.25% to 2%. You can find your specific rate by using the The Ohio Department of Taxation’s "The Finder" tool. It’s the only way to be sure you aren’t missing a hidden bill.

Reciprocity: The Border State Rules

Ohio has a "handshake agreement" with its neighbors. If you live in Indiana, Kentucky, West Virginia, Michigan, or Pennsylvania but work in Ohio, you don't pay Ohio state income tax on your wages.

You pay your home state instead. This is called reciprocity. It’s great for commuters in places like Toledo or Youngstown, but it only applies to wages. If you own a rental property in Ohio but live in Michigan, Ohio is still going to want their cut of that rent money.

Actionable Steps for Tax Season

- Check Your Withholding: Since the rate dropped to 2.75% for everyone over the threshold, you might be overpaying in your paycheck. Check with your HR department to see if your state withholding matches the new 2026 reality.

- Review Your Credits: If you make over $500,000, talk to a CPA. The loss of personal exemptions is a bigger deal than it looks on paper.

- Scan Your School District: Even if your state tax went down, a new school levy might have passed in your area. Use the "The Finder" tool mentioned above to check your address.

- Business Owners: Ensure you are still maximizing that $250,000 deduction before the 3% rate kicks in on the overage.

The move to a flat 2.75% makes Ohio much more competitive with states like Indiana (2.95%) and Kentucky (3.5%). While it’s not a "zero tax" state like Florida, the cost of living and the new lower rate make it an increasingly attractive spot for remote workers and growing families.