If you’ve lived in Ohio for a while, you know the drill. Every couple of years, the state decides to shuffle the deck on how much of your hard-earned money they actually keep. But right now, we’re in the middle of a massive shift. Basically, Ohio is ditching the old way of doing things and heading toward a "flat" future.

It’s a big deal. For decades, Ohio used what experts call a progressive tax system. You make more, you pay a higher percentage. Simple, right? Well, the state legislature decided that was too clunky. Now, we’re watching the state of ohio income tax brackets collapse into a much simpler—though controversial—single rate.

👉 See also: Co-ownership real estate: What most people get wrong about buying a home with others

Honestly, if you’re looking at your 2026 paystub and wondering why the math looks different, it’s because the tiers are officially gone for almost everyone.

The 2026 Reality: One Rate to Rule Them All

We’ve finally arrived. Starting January 1, 2026, Ohio has transitioned to a flat tax system. If you earn more than $26,050, your non-business income is taxed at a single rate: 2.75%.

That’s it. No more jumping from 2.75% to 3.125% or higher just because you got a promotion or a nice holiday bonus. If you’re under that $26,050 threshold, you still owe $0. You're essentially "in the clear" as far as the state is concerned.

But for the rest of us? The math is pretty straightforward now. You take your Ohio taxable income, subtract the $26,050 "base," and multiply what's left by 0.0275. Then you add a small base fee of $332. It's way less of a headache than the old multi-step calculations we used to do back in 2023 or 2024.

Wait, What Happened to 2025?

If you’re doing your "last year" taxes (the ones due in April 2026), you’re actually looking at a transitional phase. For the 2025 tax year, Ohio kept a three-bracket system. It was sorta like a "test run" for the flat tax.

- If you made $26,050 or less: 0%

- If you made between $26,051 and $100,000: 2.75% (plus a $342 base fee)

- If you made over $100,000: 3.125% (plus a $2,394.32 base fee)

You can see the trend. They were slowly squishing the top rate down to meet the middle one.

The "LLC Loophole" and Business Income

Now, don't get confused. Everything I just mentioned applies to "non-business" income—your W-2 wages, your interest, that kind of stuff. Business income is a different animal.

If you own a small business or work as a freelancer, you probably already know about the Business Income Deduction (BID). This hasn't gone away. You can still deduct the first $250,000 of business income entirely. Zero tax. Anything above that $250,000 is still taxed at a flat 3%.

✨ Don't miss: Energy Development Corporation Stock: Why You Can't Buy it on the PSE Anymore

Interestingly, this means high-earning business owners actually pay a higher rate (3%) on their excess profits than a regular W-2 employee pays on their salary (2.75%). It's a weird quirk of the new system that most people don't realize until they're sitting in their CPA's office.

Credits and Exemptions: The Catch

Nothing in life is free, and a lower tax rate usually comes with a "gotcha" tucked in the fine print. To pay for these cuts, the state tightened the screws on who gets to claim certain credits.

For the 2026 tax year, if your Modified Adjusted Gross Income (MAGI) is over $500,000, you can basically say goodbye to personal exemptions. You can't claim yourself, your spouse, or your kids to lower your bill. You also lose the joint filing credit.

The state is basically saying: "We gave you a lower rate, so you don't need these extra discounts anymore."

New Wins for Educators and Parents

It’s not all take-away, though. There are a few bright spots if you know where to look.

- Ohio Educator Expense Deduction: If you're a K-12 teacher, you can now deduct up to $300 for those classroom supplies you’re inevitably buying with your own money.

- Home School Expense Credit: This one got a nice upgrade. It used to be $250 per return. Now? It’s $250 per student. If you’re homeschooling three kids, that’s a $750 credit right there.

- Pregnancy Resource Centers: There’s a new deduction for contributions made to qualifying centers, capped at $750 per individual or $1,500 for couples.

Why This Change is Stirring Up Drama

Not everyone is throwing a party over the flat tax. Organizations like Policy Matters Ohio have been pretty vocal about the "equity" problem.

The logic is simple: a flat tax helps wealthy people way more than it helps the working class. If you're a millionaire in Shaker Heights, a drop from 3.5% to 2.75% is a massive windfall—we're talking thousands of dollars. But if you're a barista in Columbus making $30,000, you were already in a low bracket. Your "tax cut" might barely buy you a couple of pizzas.

🔗 Read more: 15 Euros to US Dollars: Why the Exchange Rate Never Tells the Whole Story

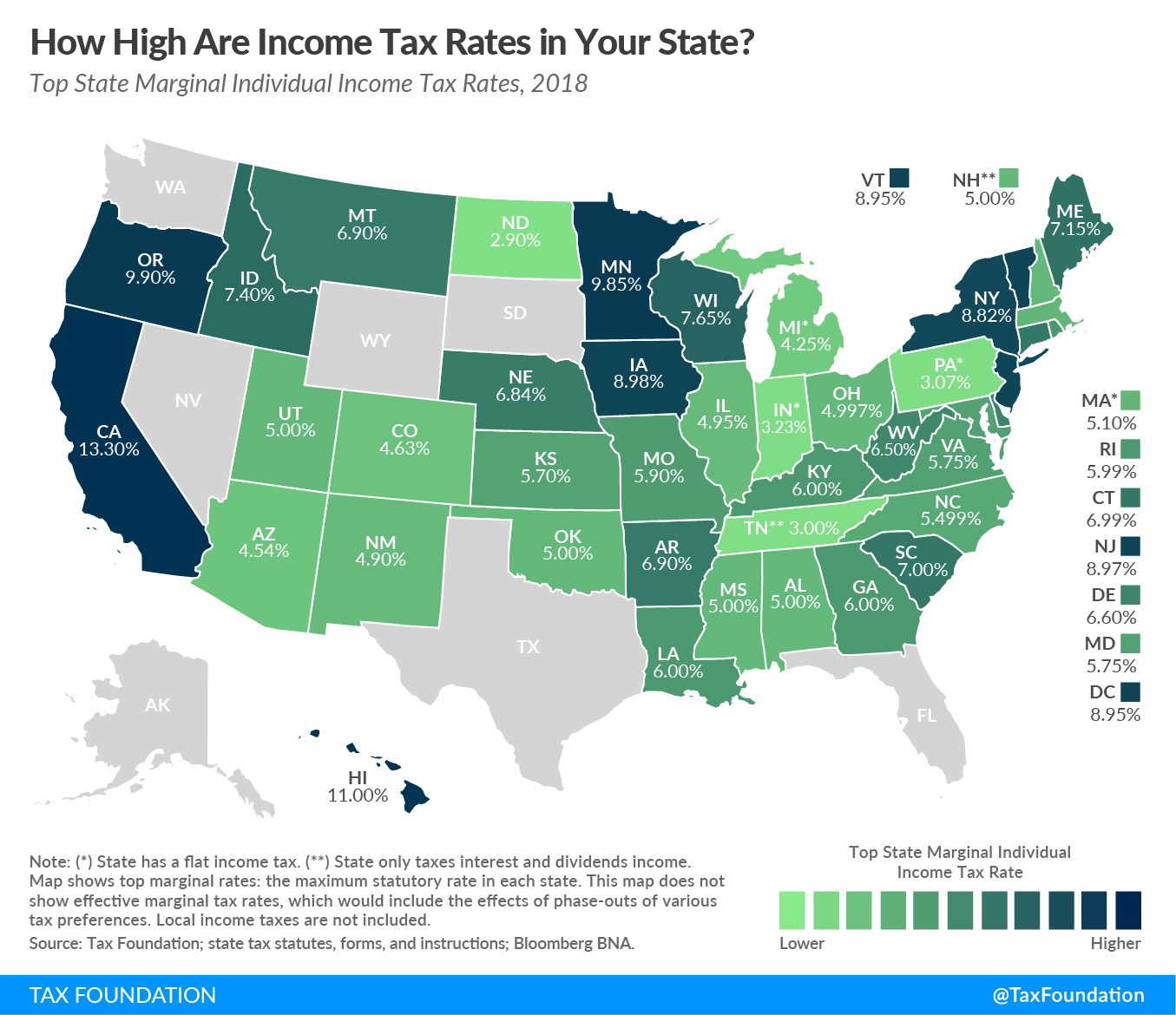

Supporters, including Governor Mike DeWine and many in the statehouse, argue this is about competition. They want Ohio to look more like Tennessee or Florida (well, tax-wise) to attract businesses. They believe a simple, low-rate state of ohio income tax brackets structure makes the Buckeye State a magnet for investment.

Practical Steps for Your 2026 Planning

You’ve got to be proactive here. Waiting until April to look at this is a recipe for a "fun" surprise from the Department of Taxation.

- Check Your Withholding: Since the rates changed on January 1, 2026, make sure your employer updated their tables. If they're still withholding at the 2025 rates, you might be overpaying (or underpaying) throughout the year.

- Re-evaluate Joint Filing: In the past, some couples in Ohio filed "Married Filing Separately" to stay in lower brackets. With a flat tax, that strategy is mostly dead. It’s almost always going to be simpler (and better) to file jointly now.

- Track Your Business Expenses: If you're nearing that $250,000 profit mark in your business, remember that every dollar over that is taxed at 3%, while your W-2 income is at 2.75%. It might be worth talking to a pro about how you're taking your draws.

- Keep Your Receipts: Especially for the new Home School and Educator credits. The OH|TAX eServices portal is getting stricter about documentation.

The transition to a flat tax is the biggest change to Ohio's fiscal identity in a generation. Whether you think it's a fair move or a handout to the rich, it's the reality we're living in. Take a look at your latest pay stub, run the numbers on the 2.75% rate, and make sure your 2026 budget reflects the new math.