You’ve refreshed the page five times. The little spinning wheel on the New York State Department of Taxation and Finance website feels like it’s mocking you. Honestly, we’ve all been there, staring at a screen hoping for a "Sent" status but seeing nothing but "Processing." Waiting on your nys state tax return status can feel like shouting into a void, especially when you have bills piling up or plans for that money.

The truth is, New York’s system isn't a black box, but it definitely has its quirks. Most people think checking a refund is just about entering a Social Security number and waiting. It's actually a bit more nuanced. If you’re sitting there wondering why your neighbor got their check in ten days while you’re hitting week four, you aren't alone.

The Reality of the NYS State Tax Return Status Tool

Let’s talk about the "Check Your Refund" tool. It is the holy grail of information for New York taxpayers, but it only tells you what the system is allowed to share. You can find it directly on the official Tax.NY.gov website. To get in, you need three specific things: your Social Security number, the tax year (2025 or 2026, usually), and the exact whole-dollar amount of the refund you requested.

If you’re off by even one dollar, the system will kick you out. It’s brutal.

Why the status doesn't change for weeks

New York doesn't update the status for every tiny internal move. You might see "Received" for three weeks. This doesn't mean your return is sitting on a dusty desk in Albany. It means it hasn't hit the next major milestone—like "Approved" or "Sent." The state’s fraud filters are some of the most aggressive in the country. They’re looking for identity theft, which has skyrocketed in the last few years. If your return looks even slightly different from last year—maybe you moved or changed jobs—it might trigger a manual review.

Manual reviews are the "slow lane" of the tax world. A real human has to look at your documents. That can add weeks to the timeline.

Breaking Down the Processing Timelines

So, how long is "too long"? Generally, New York State says most e-filed returns take about two to four weeks. If you mailed a paper return, Godspeed. You’re looking at six to eight weeks, minimum.

- E-filed with Direct Deposit: The gold standard. Usually hits your bank account the fastest.

- E-filed with a Paper Check: Adds a week for the mail to actually move.

- Paper Filing: Expect a long wait as someone has to manually input your data into the system.

One weird detail: if you filed an amended return, the online tool won't help you. It simply doesn't track them. You have to call the automated line at 518-457-5149 to get any info on those.

Common Hang-ups That Kill Your Speed

Sometimes it’s not the state’s fault; it’s a tiny error that snowballs. Math errors are the biggest culprit. If you claimed a credit you weren't eligible for—like the Empire State Child Credit or the Earned Income Credit—the system pauses. It doesn't just reject the return; it tries to fix it for you, which takes forever.

Another big one? Mismatched info. If your name on your return doesn't perfectly match what the Social Security Administration has (maybe you got married and haven't updated your name everywhere), the fraud filters will flag it.

✨ Don't miss: JNJ Stock Price Today Per Share: Why the Blue Chip Giant is Moving

The Dreaded "Request for Information" Letter

If your nys state tax return status says something about a letter being sent, do not ignore it. This usually means Form DTF-948 or DTF-948-O. They might want to see your W-2s again or proof that you actually live in the state.

Pro tip: Use the "Respond to Department Notice" application in your Online Services account. It’s way faster than mailing back physical copies. You just take a photo of your documents and upload them. It cuts the wait time significantly because it bypasses the mailroom.

When to Actually Call a Human

Calling the New York Tax Department is an Olympic sport. If you call on a Monday morning in March, you will be on hold for hours. The main refund status line (518-457-5149) is 24/7 and automated. It’s great for a quick check.

But if you need a person because your refund has been stuck for over 90 days, call 518-457-5181.

Be ready. Have your return in front of you. The agents are actually pretty helpful once you get them on the phone, but they can't make the money appear any faster if it's still in "Review." They can only tell you if there’s a specific problem you need to solve.

Offsets: Where Did My Money Go?

This is the part nobody likes to talk about. You check your nys state tax return status, it says "Sent," but the amount in your bank account is $500 short. What gives?

New York participates in the Treasury Offset Program. If you owe back taxes, child support, or even certain debts to other state agencies (like a SUNY school tuition balance), they can snatch that money before it ever hits your pocket. You’ll get a notice in the mail (eventually) explaining the "offset," but it’s often a shock when it happens.

Moving Forward With Your Refund

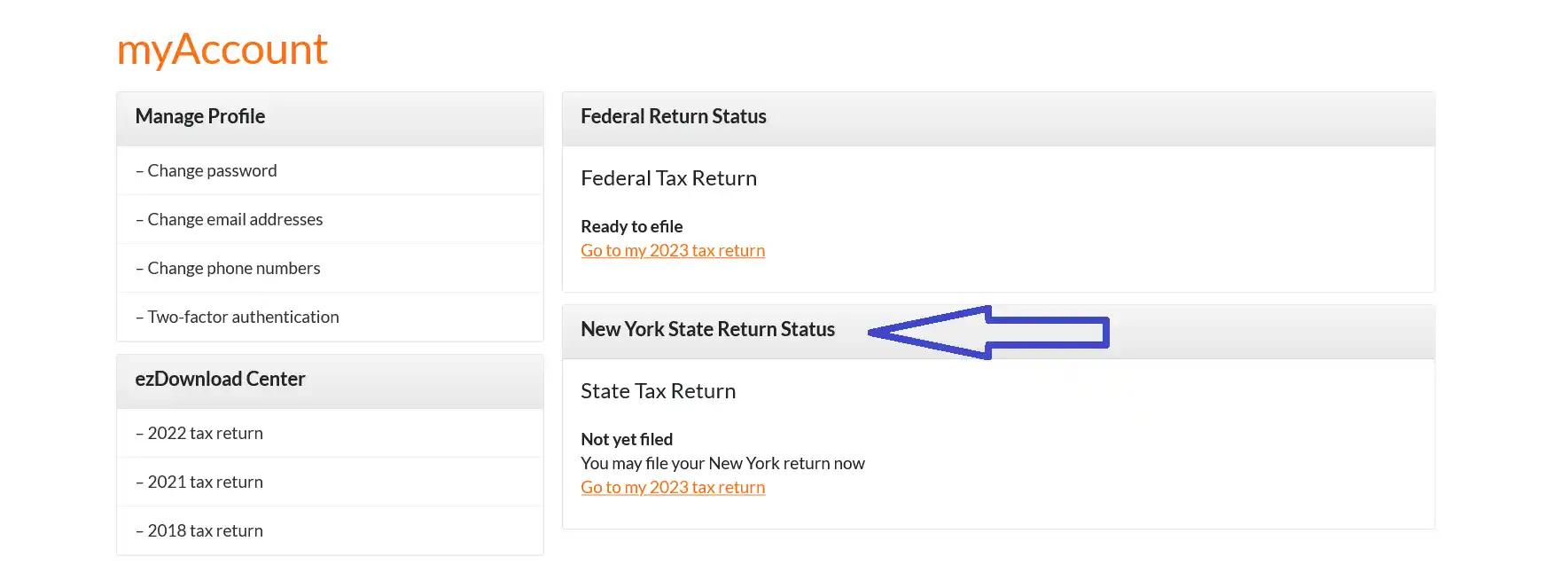

The best thing you can do right now is set up an Online Services account with the NYS Tax Department. It gives you much more detail than the basic "Where's My Refund" tool. You can see your filing history, respond to letters instantly, and even sign up for email alerts so you know exactly when the status changes.

Check your bank account info one last time. If you entered a wrong routing number, the bank will reject the deposit, and the state will eventually mail you a paper check. That mistake alone can add three weeks to the process.

Actionable Next Steps

- Verify your info: Go back to your copy of the return. Make sure the refund amount you're entering into the tool is the one on the "refund" line, not the "total tax" line.

- Create an account: Sign up for an NYS Online Services account today. It’s the only way to see if there are "hidden" issues like a request for information that hasn't arrived in your mailbox yet.

- Wait for the 21-day mark: If it’s been less than three weeks since you e-filed, the tax department likely won't even talk to you. Give the system time to breathe.

- Upload docs immediately: If you get a letter asking for proof of income or identity, use the online portal to submit it. Don't use the post office unless you absolutely have to.

The waiting game is the hardest part of tax season. Just remember that the system is designed to be slow to prevent fraud. It's annoying, but it's the reality of filing in a high-volume state like New York.