You’ve seen the headlines. New York City is "unlivable" or the "tax capital of the world." People love to complain about the cost of a bagel, but the real mystery—the thing that actually keeps folks up at night—is the NYC effective tax rate.

Most people look at their paystub, see a bunch of deductions, and assume they’re losing half their check to the government. It’s not quite that simple. Honestly, if you’re trying to figure out what you actually pay versus what the law says you should pay, you’re diving into a maze of city, state, and federal rules that even seasoned CPAs find a bit dizzying.

The Big Difference Between Statutory and Effective Rates

Statutory rates are the "scare" numbers. You see 10.9% for New York State or nearly 3.9% for NYC and you panic. But nobody actually pays that on every dollar. Your NYC effective tax rate is the percentage of your total income that actually disappears after you account for the standard deduction, credits, and the fact that we use a progressive tax system.

✨ Don't miss: Walmart Stock Price Now: What Most People Get Wrong

Think of it like a bucket system. The first few thousand dollars you earn are taxed at a tiny rate. Only the dollars at the very top of your "bucket" get hit with those scary high percentages. For the 2026 tax year, single filers in NYC see a city-level tax starting at roughly 3.078% for the lowest bracket, climbing up to 3.876% for taxable income over $50,000.

But wait. There’s a twist.

Recent legislative shifts, like the ones enacted in the 2025-2026 fiscal plan signed by Governor Kathy Hochul, have actually nudged some of these middle-income rates down slightly. We’re talking about a 0.1% reduction for 2026. It sounds like pennies—and in the grand scheme of a Manhattan rent payment, it kinda is—but it impacts your final effective number.

Why Your Neighbor Pays Less (The Property Tax Trap)

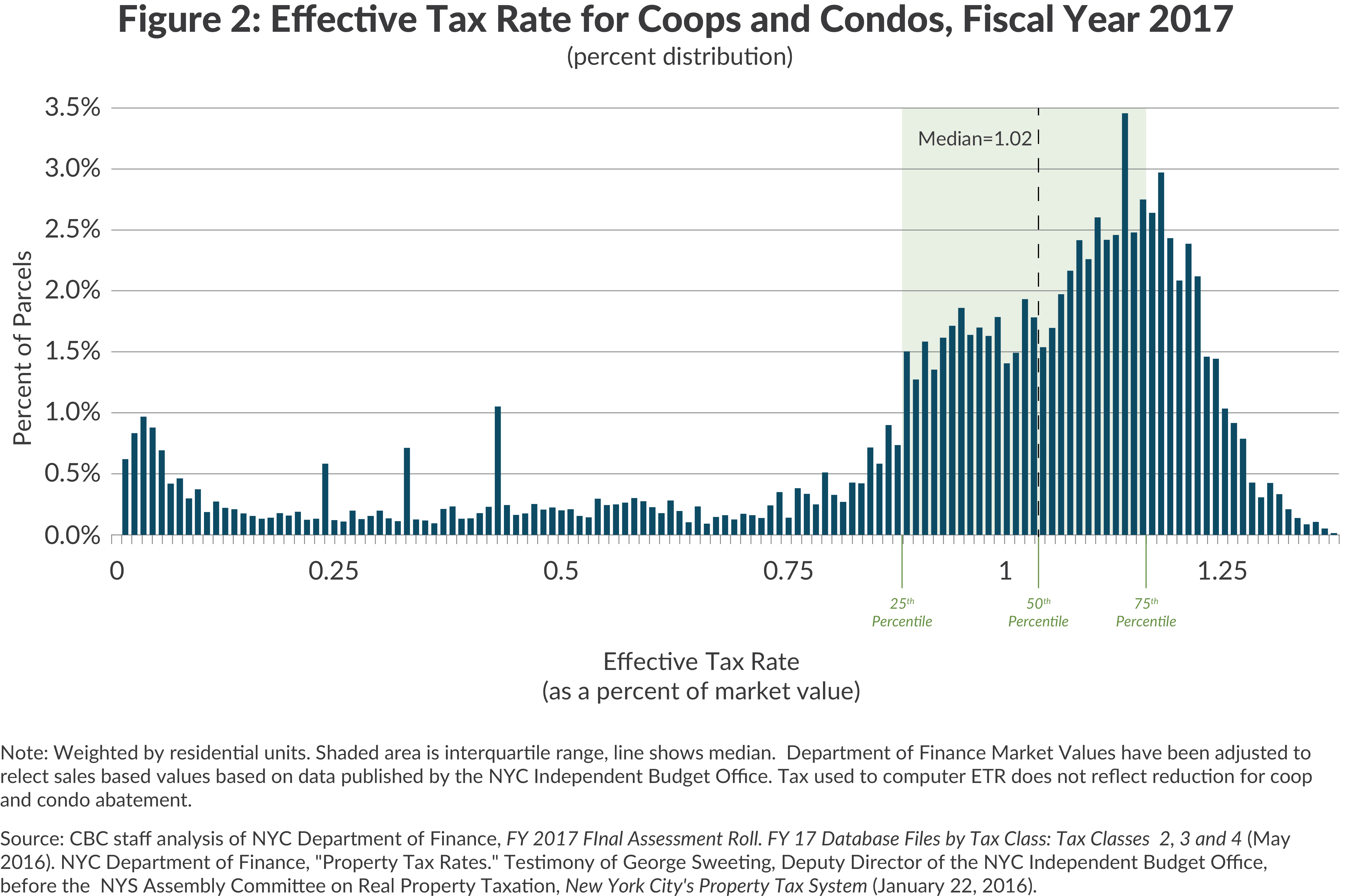

This is where things get truly weird. If you own a brownstone in Park Slope, your NYC effective tax rate for property might be significantly lower than someone owning a condo in a shiny new glass tower in Long Island City.

NYC property taxes are divided into "classes."

Class 1 (small homes) has a tax rate of about 19.843% for 2026.

Class 2 (condos and co-ops) sits around 12.439%.

You’d think the 19% number means home owners are getting crushed, right? Wrong. The city assesses small homes at a tiny fraction of their market value—often 6% or less. Then they cap how much that assessment can grow. Because of this, the "effective" property tax rate—what you pay as a percentage of what the house is actually worth—is often under 1%. Meanwhile, renters are indirectly paying a much higher effective rate because apartment buildings are taxed more aggressively, and landlords just bake that into the monthly rent.

It's a lopsided system. The Citizens Budget Commission (CBC) has been screaming about this for years. They point out that two people living in houses worth the exact same amount can pay wildly different tax bills just because one person’s neighborhood saw a faster spike in market value ten years ago.

The 2026 Middle-Class "Breather"

If you're making between $80,000 and $215,000, 2026 is looking... okay? Not great, but okay. The state is phasing in tax cuts for the bottom five brackets. For a single filer, that 6% bracket is seeing a tiny shave.

Also, keep an eye on the Metropolitan Commuter Transportation Mobility Tax (MCTMT). It’s that annoying "extra" tax for the MTA. Starting January 1, 2026, the threshold for self-employed people to even pay this tax jumped to $150,000. If you’re a freelancer making $100k, you just got a raise by default because you no longer owe that slice of your income to the subway system.

🔗 Read more: Check Stimulus Check Status: Why You Still Haven't Received Yours and How to Fix It

Real Talk: The Combined Burden

When you stack it all up, what is the actual NYC effective tax rate?

- Low Income ($30k - $50k): Between credits like the Earned Income Tax Credit and the Empire State Child Credit (which is $1,000 for kids under 3 in 2026), your effective rate might actually be negative or near zero.

- Middle Income ($100k - $150k): You’re likely looking at a total state and city effective rate of around 7% to 9%. Add federal taxes, and you're hitting the 22% to 25% range.

- High Earners ($1M+): This is where the 10.9% state surcharge kicks in. High earners in NYC often face a combined effective rate (including federal) that clears 40% easily.

Common Blunders to Avoid

Don't just look at the tax tables. Most people forget that NYC and New York State treat deductions differently than the IRS. For example, while the federal government capped SALT (State and Local Tax) deductions at $10,000, New York allows certain workarounds for business owners through the PTET (Pass-Through Entity Tax). If you’re an S-Corp owner and you aren't using this, you’re essentially lighting money on fire.

Another one? The "Part-Year Resident" mistake. If you moved to Florida in October but kept your apartment in Chelsea, the city might still consider you a resident for the whole year if you spent more than 183 days here. They will check your cell phone pings and credit card swipes. They’re good at it.

Actionable Steps for Your 2026 Taxes

Stop guessing. If you want to lower your actual NYC effective tax rate, you need to move beyond just filing a 1040.

📖 Related: Why the Stock Market Last 30 Days Graph Looks So Weird Right Now

- Verify your "Zone": The MCTMT rates changed specifically for different zones in the metropolitan area. If you work in the "Suburban" zone versus the "City" zone, your employer might be withholding the wrong amount.

- Max the New Credits: The 2026 budget increased the Empire State Child Credit. If you have a toddler, ensure you’re claiming the full $1,000 per child, which is a direct dollar-for-dollar reduction of your tax bill.

- Audit Your Property Assessment: If you're a homeowner, check your "Notice of Property Value" sent in January. If the city thinks your house is worth more than it is, you have a very short window to challenge it before the tax rate is applied.

- Freelancer Thresholds: If you’re self-employed, stop paying the MTA tax if your net earnings are under $150,000. Many automated payroll systems might not update this threshold immediately.

The reality of living in New York is that you pay for the privilege. But you shouldn't pay a cent more than the law requires just because the math is confusing. Understanding that your effective rate is almost always lower than the "headline" rate is the first step toward actually keeping more of your paycheck.