You’ve refreshed the page three times today. Still nothing. That "Processing" message on the Department of Taxation and Finance website is starting to feel like a personal insult. Honestly, waiting for a NY state tax refund status update is a special kind of torture, especially when you have bills breathing down your neck or a big purchase planned.

Most people think it’s a black hole. It isn't. But the logic Albany uses to send out your cash isn't always what you'd expect.

Why your refund is stuck in limbo

Basically, New York is obsessed with fraud. Can you blame them? Every year, scammers try to divert millions in tax credits into offshore accounts using stolen Social Security numbers. Because of this, the state has cranked up their "Identity Verification" filters.

If you claimed the Earned Income Credit or the Empire State Child Credit, don't expect a lightning-fast turnaround. By law, the state (and the IRS) often holds these returns longer to verify every single digit. It’s annoying. It’s slow. But it’s the reality of filing in 2026.

If you filed a paper return, I have bad news. You’re looking at a wait time of 6 to 8 weeks, minimum. Sometimes it stretches to 12 if the processing center in Albany is buried under a mountain of envelopes. E-filers usually see movement in about 2 to 3 weeks, but even that isn't a guarantee.

NY state tax refund status: The "Check Your Refund" tool

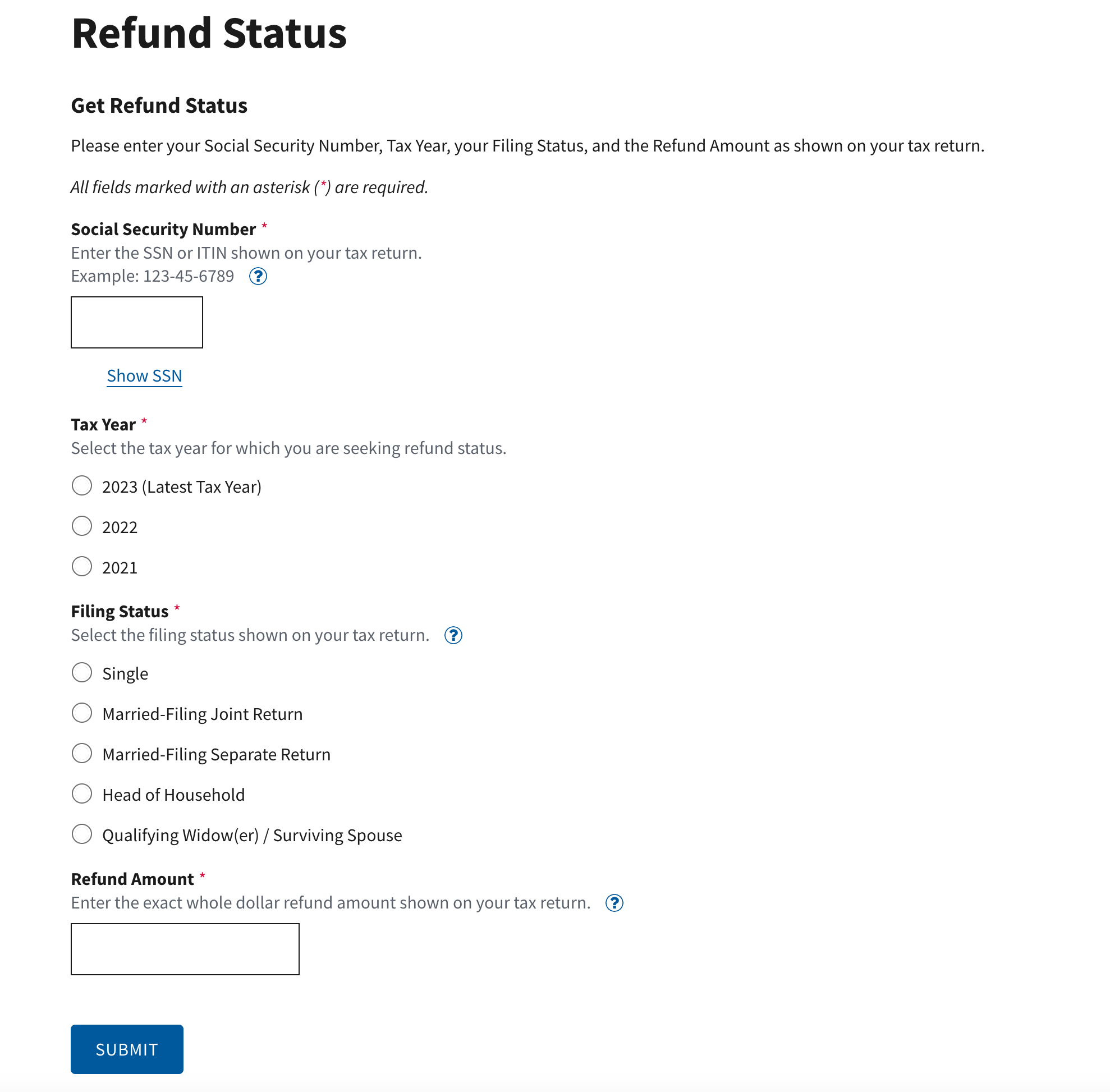

You probably already know the URL, but are you using it right? To get an actual answer from the Check Your Refund Status tool, you need three very specific things:

🔗 Read more: Palmer Equipment Co Inc: Why This Local Powerhouse Still Matters in the Modern Market

- The tax year (obviously).

- Your Social Security Number.

- The exact amount of the refund you requested.

That last part is where people trip up. If you enter $1,200 but your actual return says $1,200.50, the system might give you an error or tell you it can't find your record. Look at your Form IT-201. Find the line that says "Refund." Enter that number exactly.

The system updates overnight. Checking it at 10:00 AM and again at 2:00 PM is just going to stress you out for no reason. It won't change until the next day.

Deciphering the status messages

The state loves vague language. Here is what those status bars actually mean in plain English:

- Received: They have it. A computer has acknowledged the file exists. It hasn't been looked at by a human or a deep-level audit program yet.

- Processing: This is the longest phase. Your return is being compared against your W-2s, 1099s, and previous years' data.

- Further Review: Don't panic, but this usually means a human needs to look at something. Maybe your signature was wonky, or your employer hasn't sent their copy of your wage info yet.

- Approved: The best word in the English language. This means they’ve done the math, and they agree with you.

- Issued/Sent: The money is on its way. If you chose direct deposit, give it 3 to 5 business days. If you're waiting for a check, check your mailbox in about 10 days.

Surprising reasons for a delay

Did you move recently? If your address on the return doesn't match the one the DMV has or the one from your last filing, New York might flag it for identity verification. They’ll send a letter (Form DTF-948) asking you to prove you are who you say you are.

Another big one: Offset Programs.

New York is very good at debt collection. If you owe back taxes, student loans to a state university, or even certain types of child support, the state will snatch your refund before you ever see it. You’ll get a letter later explaining where the money went, but the online status tool might just show a "reduced" amount or a completed status that doesn't match your bank account.

When to actually pick up the phone

Calling the Department of Taxation and Finance is a test of patience. Their main refund line is 518-457-5149.

Honestly, don't even bother calling unless it has been more than 4 weeks since you e-filed. The agents have access to the same screen you do. If the website says "Processing," they will tell you "It's processing."

However, if the tool says a letter was sent and you haven't received it after two weeks, that's the time to call. Or, if you filed an amended return (Form IT-201-X), you have to call or check your online account, because the standard "Where's My Refund" tool often doesn't track amended filings accurately.

Actionable steps for a faster refund

If you haven't filed yet, or you're already stuck in the queue, here is what you can actually do to move things along:

- Create an Online Services Account: This is different from the "Check Your Refund" tool. A full account lets you see "Account Alerts." Sometimes the state will post a notice there weeks before it arrives in your physical mailbox.

- Respond to "Request for Information" letters immediately: If they ask for a copy of a W-2, don't mail it. Use the "Respond to Department Notice" link in your Online Services account to upload a photo of it. It cuts weeks off the wait time.

- Double-check your bank info: If you typo your routing number, the bank will reject the deposit. The state then has to wait for the money to bounce back, process it, and then print a physical check. This adds about 3 to 4 weeks to the ordeal.

New York’s system is old and heavily burdened, but it does work. Most delays are just the result of a "perfect storm" of high volume and fraud-prevention checks. Keep your paperwork handy, check the portal once a day, and stay on top of any mail from Albany.