Honestly, the numbers coming out of Santa Clara right now are getting a bit ridiculous. If you’ve been watching NVDA stock latest news and projections October 2025, you probably noticed the massive headline: NVIDIA just became the first company ever to cross a $5 trillion market cap.

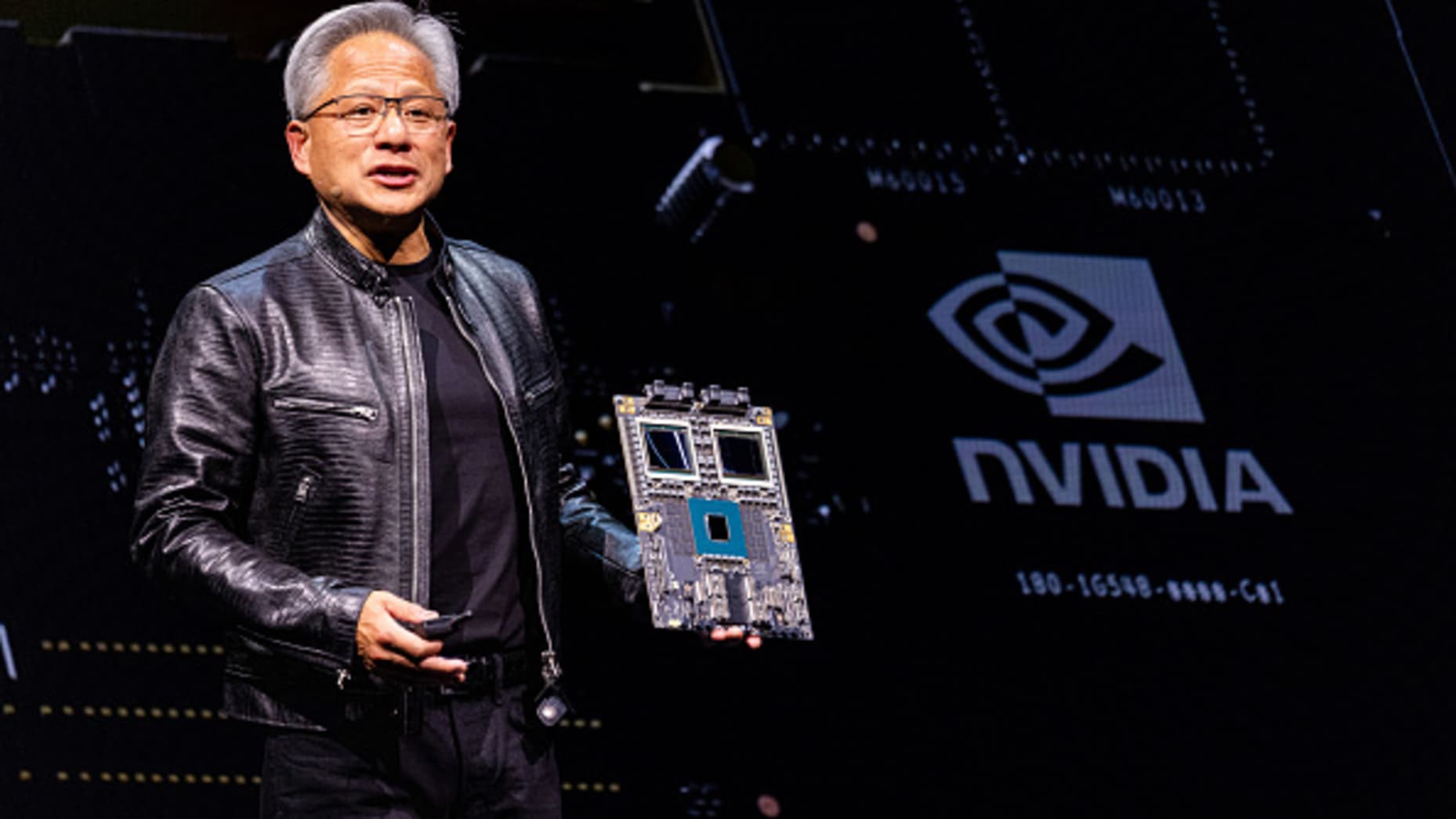

It feels like just yesterday people were arguing about whether it could even hit $3 trillion. Now, Jensen Huang is presiding over a literal empire of silicon. But if you think this is just another "AI bubble" story, you're kinda missing the nuance of what happened in late 2025.

The stock didn't just drift higher on vibes. It was a violent, fundamental shift.

The Blackwell Explosion and Why October Changed Everything

By the time October 2025 rolled around, the "Blackwell" architecture wasn't just a roadmap item anymore. It became the primary revenue driver. For months, everyone was worried about supply chain bottlenecks and whether Coherent or TSMC could keep up.

Guess what? They did.

Data center revenue for the quarter ending in late October hit a staggering $51.2 billion. That’s not a typo. To put that in perspective, that single segment grew 66% year-over-year. When we look at NVDA stock latest news and projections October 2025, the biggest takeaway is that the "Hopper to Blackwell" transition was much smoother than the bears predicted.

Wall Street was looking for any sign of a "digestion period"—that moment where big tech companies like Meta and Microsoft stop buying chips to actually figure out how to use them. We’re still waiting. Instead, these companies are doubling down.

💡 You might also like: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

What most people get wrong about the "Digestion" theory

The skeptics thought demand would crater once the initial LLM (Large Language Model) training was done. They forgot about inference. Basically, once you train a model, you have to run it. Every time someone asks an AI a question, it hits an NVIDIA chip.

As of October, inference demand has started to rival training demand. This is why the stock defied the "cyclical" gravity that usually kills semiconductor companies.

The Numbers That Matter Right Now

If you’re trying to value this thing, looking at the past is useless. The forward P/E ratio actually dropped recently. How? Because the earnings are growing faster than the share price.

- Quarterly Revenue (Q3 Fiscal 2026): $57.0 billion.

- Gross Margin: Hovering around 73.6%.

- Market Cap Milestone: $5 Trillion (Achieved late October).

Analysts like Brian Colello at Morningstar have been forced to hike their fair value estimates repeatedly. By October 30, the consensus "Strong Buy" was backed by 39 out of 41 major analysts. Only one lonely soul is still sitting on a "Sell" rating.

Competition and the "DeepSeek" Scare

We have to talk about the competition. Or the lack of it.

Earlier in the year, there was this brief panic when the DeepSeek R1 model came out of China. People thought it would prove that you could get "NVIDIA-level" results with way less compute. The stock actually dipped about 37% at one point during 2025 because of these fears and some tariff talk.

📖 Related: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

It was a head-fake.

The reality? Even if models get more efficient, the scale of the problems people are trying to solve is expanding. We're moving into "Agentic AI"—systems that don't just chat, but actually do work, navigate your computer, and manage supply chains. That takes more power, not less.

AMD’s MI325X is a respectable piece of hardware, but NVIDIA’s "moat" isn't the chip. It’s CUDA. It’s the software stack that millions of developers are already locked into. You don't just "switch" away from that over a weekend to save 10% on power costs.

Looking Toward 2026: The Rubin Platform

The NVDA stock latest news and projections October 2025 aren't just about what happened; they're about the "Rubin" platform. Jensen Huang announced that the successor to Blackwell, named after astronomer Vera Rubin, is already on an annual cadence.

The projections for 2026 are already starting to leak into the market:

- Revenue Forecasts: Analysts are pegging fiscal 2027 revenue at nearly $193 billion.

- Price Targets: The median one-year target is sitting around $264.

- Sovereign AI: This is the "sleeper" catalyst. Countries like Saudi Arabia, the UAE, and various European nations are building their own sovereign data centers. They don't want to rely on US-based clouds.

The Risks: What Could Actually Kill the Rally?

It’s not all sunshine and trillion-dollar bills. There are two major things that keep NVIDIA executives up at night, and they aren't named "AMD" or "Intel."

👉 See also: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

1. The China Export Ban

The Trump administration's tightening of export controls in early 2025 was a massive hurdle. NVIDIA had to stop selling the H20 chips it specifically designed for the Chinese market. That’s a huge chunk of potential revenue gone. While the rest of the world has made up for it so far, any further geopolitical friction is a direct threat to the stock's multiples.

2. Power Constraints

The world is literally running out of electricity to feed these chips. We're seeing NVIDIA partner with nuclear energy firms and specialized cooling companies just to ensure their customers can actually plug the Blackwell racks in. If the power grid can’t scale, the chip sales can't scale.

Actionable Insights for Investors

If you're holding or looking to buy, here is the ground reality as of late 2025:

- Don't wait for a 2023-style "moon mission." The law of large numbers is real. Moving a $5 trillion company is a lot harder than moving a $500 billion one. Expect more modest, 30-40% annual gains rather than 200%.

- Watch the margins. As long as gross margins stay above 70%, the "premium" valuation is justified. If that starts to dip toward 60%, it means price wars have finally started.

- Pay attention to Networking. NVIDIA isn't just a chip company anymore. Their Spectrum-X Ethernet and InfiniBand business is now a multi-billion dollar juggernaut. It's the "glue" that holds the data centers together.

The bottom line? October 2025 proved that NVIDIA is the landlord of the AI era. Everyone else is just paying rent.

Next Steps for You:

Check your portfolio's concentration. If NVIDIA makes up more than 15% of your holdings, you might want to look at "pick and shovel" plays like Corning (GLW) for fiber optics or Vertiv for data center cooling, which have been quietly outperforming the chips themselves as the infrastructure reaches its physical limits.