It's a weird time to be a billionaire in America. Honestly, it's a weird time to be anyone in America, but the math at the very top is getting truly dizzying. If you feel like the gap between your grocery bill and the net worth of the guys on the news is widening into a canyon, you're not imagining it.

The numbers are huge.

As of January 2026, the number of billionaires in the USA has climbed to 935. That is a massive jump from the 813 we saw just about a year ago. To put that in perspective, back in 1990, there were only 66 billionaires in the entire country. We’ve gone from a small club that could fit in a local diner to a population the size of a small town, except this town owns about $8.1 trillion.

Why the Number of Billionaires in the USA Is Skyrocketing

You’ve probably heard people blame "the economy" or "the market," but that’s sorta vague. The reality is more specific. The big driver right now? Artificial Intelligence.

It isn’t just a buzzword anymore. It’s a wealth engine.

🔗 Read more: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

Look at someone like Elon Musk. He’s currently sitting at the top of the heap with a net worth hovering around $726 billion. That’s not just from selling cars. It’s his stake in SpaceX and the merger of X and xAI into a massive AI holding company. Then you’ve got Larry Page and Sergey Brin at Google. They’ve seen their fortunes surge because Google’s AI integration finally started printing money in a way investors actually trust.

The AI Wealth Effect

- Jensen Huang (Nvidia): Basically the architect of the AI boom. His wealth went from under $5 billion in 2020 to over $160 billion by early 2026.

- Larry Ellison (Oracle): He's been around forever, but Oracle’s pivot to AI cloud infrastructure pushed him past $245 billion.

- The "Centi-Billionaire" Surge: We now have 15 people in the US worth more than $100 billion each. Their wealth grew by 33% in 2025 alone, which is double what the S&P 500 did.

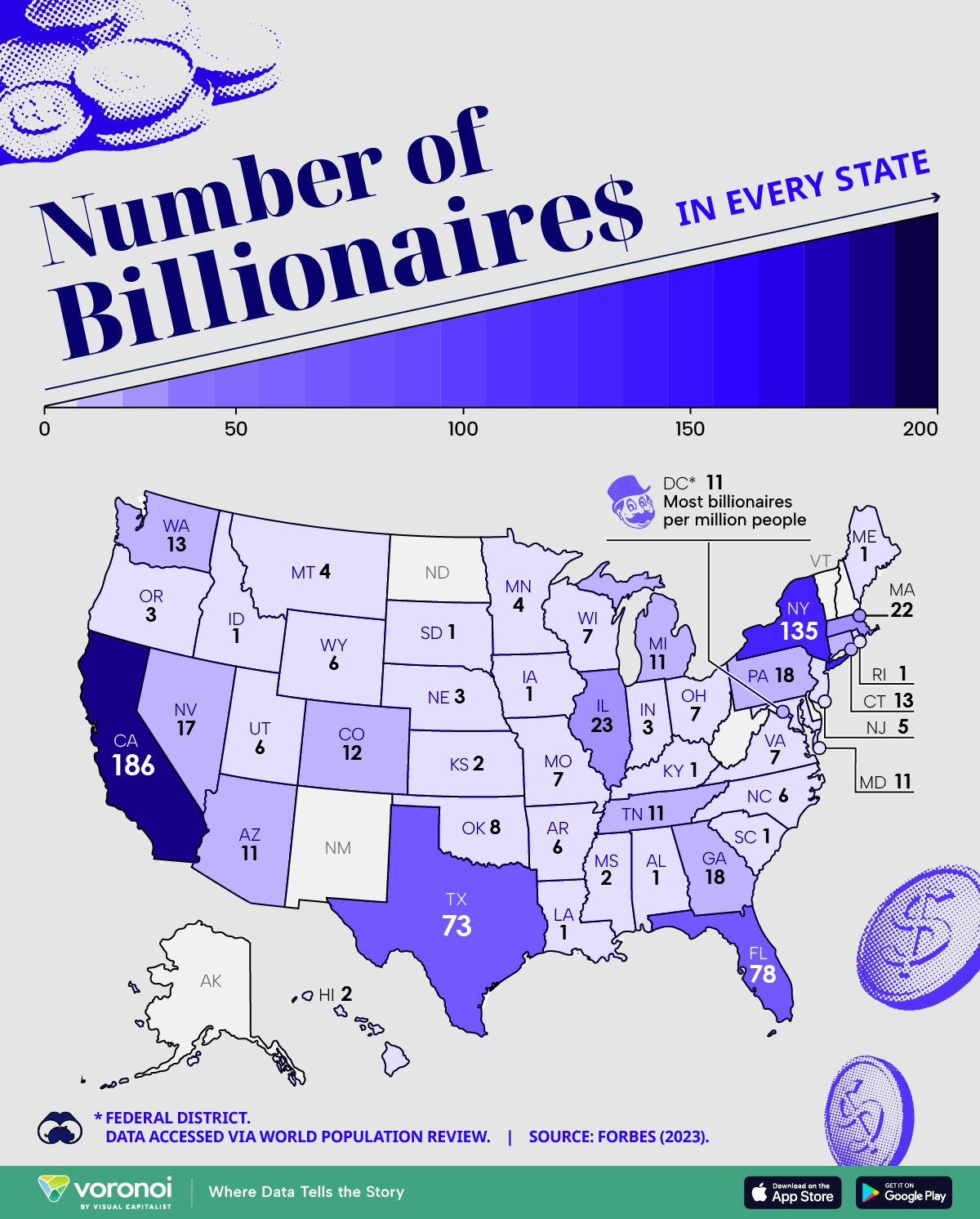

Where They Actually Live

Billionaires aren't spread out evenly. They tend to cluster. If you’re looking to spot one in the wild, your best bets are still the usual suspects, but the rankings are shifting a bit.

California is still the heavyweight champion. It’s home to about 28% of all billionaire wealth in the country. Silicon Valley remains the factory where these fortunes are minted. However, there’s a noticeable "Plan B" trend happening. Because of new tax proposals—like the California 2026 Billionaire Tax that aims to levy a 5% tax on extreme wealth—a lot of these folks are looking at the exit signs.

Texas and Florida are the big winners of this migration.

💡 You might also like: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

Low taxes.

Warmer weather.

Pro-business environments.

Austin and Miami are no longer "up-and-coming" hubs; they are established fortresses of private wealth. Dallas has seen its millionaire and billionaire population grow by nearly 85% over the last decade. It’s not just tech, either. It’s finance, real estate, and a lot of private equity.

The Reality of "Self-Made"

There is this myth that every billionaire started in a garage with nothing but a dream and a soldering iron. Kinda true for some, but the data tells a more nuanced story.

Roughly 70% of the current billionaire list is considered "self-made" in the sense that they founded the companies that made them rich. Think Jeff Bezos (Amazon) or Mark Zuckerberg (Meta). But the other 30%? That’s pure legacy. The Walton family (Walmart) and the Koch family are the standard-bearers here. They represent "old money" that isn't just sitting still—it's compounding.

📖 Related: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

It's also worth noting that "self-made" is a bit of a loose term. Most of these individuals started with access to elite education, venture capital, and social networks that the average person just doesn't have. It's easier to take a massive risk when you have a safety net made of gold.

What This Means for You

So, the number of billionaires in the USA is up. Why should you care?

Well, for one, it changes the political landscape. We are entering what some experts call "hyper-extraction." When wealth concentrates this heavily, it doesn't just stay in bank accounts. It buys influence. It buys media outlets. It buys policy. According to the Institute for Policy Studies, the top 12 billionaires in the US now have a combined net worth of $2.7 trillion. That’s more than the GDP of many developed nations.

On the flip side, this concentration of capital is what fuels the massive R&D budgets for things like carbon capture, life extension, and space travel. Whether you think that's a good trade-off depends on your worldview.

Actionable Insights for 2026

If you want to navigate an economy dominated by this kind of wealth concentration, you have to play by the rules they’ve created:

- Invest in Infrastructure, Not Just Trends: The billionaires aren't just betting on AI apps; they own the chips (Nvidia) and the data centers (Oracle/Microsoft). Look for the "picks and shovels" of any industry.

- Watch the Tax Migration: Follow the money. If billionaires are moving to Texas and Florida, those real estate markets and local service economies will likely remain resilient despite broader national fluctuations.

- Understand Equity: The biggest takeaway from the billionaire boom is that you don't get rich through a salary. You get rich through ownership. Whether it's stocks, a small business, or real estate, owning assets is the only way to keep pace with inflation and wealth gaps.

The number of billionaires in the USA is likely to hit 1,000 before the decade is out. The system is currently designed to accelerate wealth at the top through automation, tax efficiency, and market dominance. Understanding how these fortunes are built—and where they are moving—is the first step in protecting your own financial future in an increasingly lopsided economy.