You've probably seen the ticker NAK popping up on your feed more than a few times over the last decade. Honestly, it’s the stock that simply refuses to go away. Northern Dynasty Minerals Ltd stock is basically the "final boss" of speculative mining plays. One day it’s a penny stock darling poised to unlock the world’s largest undeveloped copper and gold deposit, and the next, it’s a political football getting kicked around by federal agencies in D.C.

If you’re looking for a boring, stable dividend payer, you’re in the wrong place. This is high-stakes gambling disguised as resource development.

As of early 2026, the drama around the Pebble Project in Alaska has reached a fever pitch. We aren't just talking about rocks in the ground anymore; we are talking about a massive legal and political tug-of-war that involves the EPA, the U.S. Army Corps of Engineers, and the highest levels of the American government.

The Pebble Project: Why People Care

The math behind Northern Dynasty is actually kind of staggering. They are sitting on the Pebble deposit in Southwest Alaska. We're talking about a resource that contains roughly 57 billion pounds of copper, 71 million ounces of gold, and 3.4 billion pounds of molybdenum.

In a world obsessed with Electric Vehicles (EVs) and "green" infrastructure, copper is basically the new oil. You can't have a modern power grid or a Tesla without it. This is why the Northern Dynasty Minerals Ltd stock gets so much attention from people who aren't even typical "mining investors." The sheer scale of the asset makes it look like a lottery ticket that’s already been printed—it’s just waiting for a signature to be cashed.

💡 You might also like: Missouri Paycheck Tax Calculator: What Most People Get Wrong

But there is a catch. A huge one.

The mine is located near Bristol Bay, home to the world’s most productive sockeye salmon fishery. This has turned the project into an environmental lightning rod. You have commercial fishermen, Indigenous groups, and environmentalists on one side, and mining advocates and "critical mineral" hawks on the other. It’s a mess.

The 2026 Legal Landscape: A New Hope?

For years, the EPA used what’s known as a "Section 404(c) veto" to block the project, claiming it would cause "unacceptable adverse effects" on the salmon habitat. Northern Dynasty spent years in court calling this an "illegal veto."

Recently, the tide has started to shift in the courtrooms. In late 2025 and moving into 2026, the company—backed by groups like the National Mining Association and the U.S. Chamber of Commerce—filed heavy-hitting summary judgment briefs. Their argument is basically that the EPA overstepped its bounds by issuing a "pre-emptive" veto without properly considering the economic costs or the actual science of the updated mine plan.

📖 Related: Why Amazon Stock is Down Today: What Most People Get Wrong

- The Trump Administration's Role: With a more "pro-extraction" tilt in the current federal administration, the EPA has recently proposed new rules to limit state and tribal power to block these kinds of energy projects.

- The Court Case: Northern Dynasty Minerals, et al. v. EPA is the one to watch. If a judge vacates that EPA veto, the stock could potentially see the kind of "moon mission" move that NAK fans have been dreaming about for twenty years.

- The Army Corps Factor: Even if the EPA moves out of the way, the U.S. Army Corps of Engineers still has to approve the actual discharge permits. They denied them back in 2020, but that decision is also being fought in the appeals process.

Checking the Financial Vitals

Let's get real for a second. Northern Dynasty Minerals Ltd stock is what we call a "pre-revenue" company. That’s a fancy way of saying they don't actually make any money. They just spend it.

The company’s balance sheet is a tightrope walk. According to recent filings from January 2026, they have roughly CA$45 million in cash. That sounds like a lot until you realize they are burning millions every quarter on lawyers, lobbyists, and environmental studies.

They did manage to snag a royalty agreement that brings in occasional $12 million payments, which has helped keep the lights on without completely diluting the shareholders into oblivion. But the "going concern" warning from auditors is a permanent fixture here. If they don't get a permitting win soon, they’ll have to go back to the well and issue more shares, which usually hurts the stock price in the short term.

What Most People Get Wrong About NAK

A lot of retail investors think this is a "binary" play: either the mine opens and the stock goes to $20, or it doesn't and it goes to zero. It’s actually more nuanced than that.

👉 See also: Stock Market Today Hours: Why Timing Your Trade Is Harder Than You Think

The real value might not be in Northern Dynasty actually building the mine. They are a small company. They don't have the $10 billion required to build a world-class mine in the Alaskan wilderness. The "end game" for NAK has always been to get the permits and then sell the whole thing to a major player like Rio Tinto or BHP.

If you're holding Northern Dynasty Minerals Ltd stock, you aren't betting on a mining company; you're betting on a legal victory that makes the project "de-risked" enough for a big fish to buy it.

Current Market Sentiment

- Analyst View: H.C. Wainwright recently reiterated a "Buy" rating with a target of $2.50.

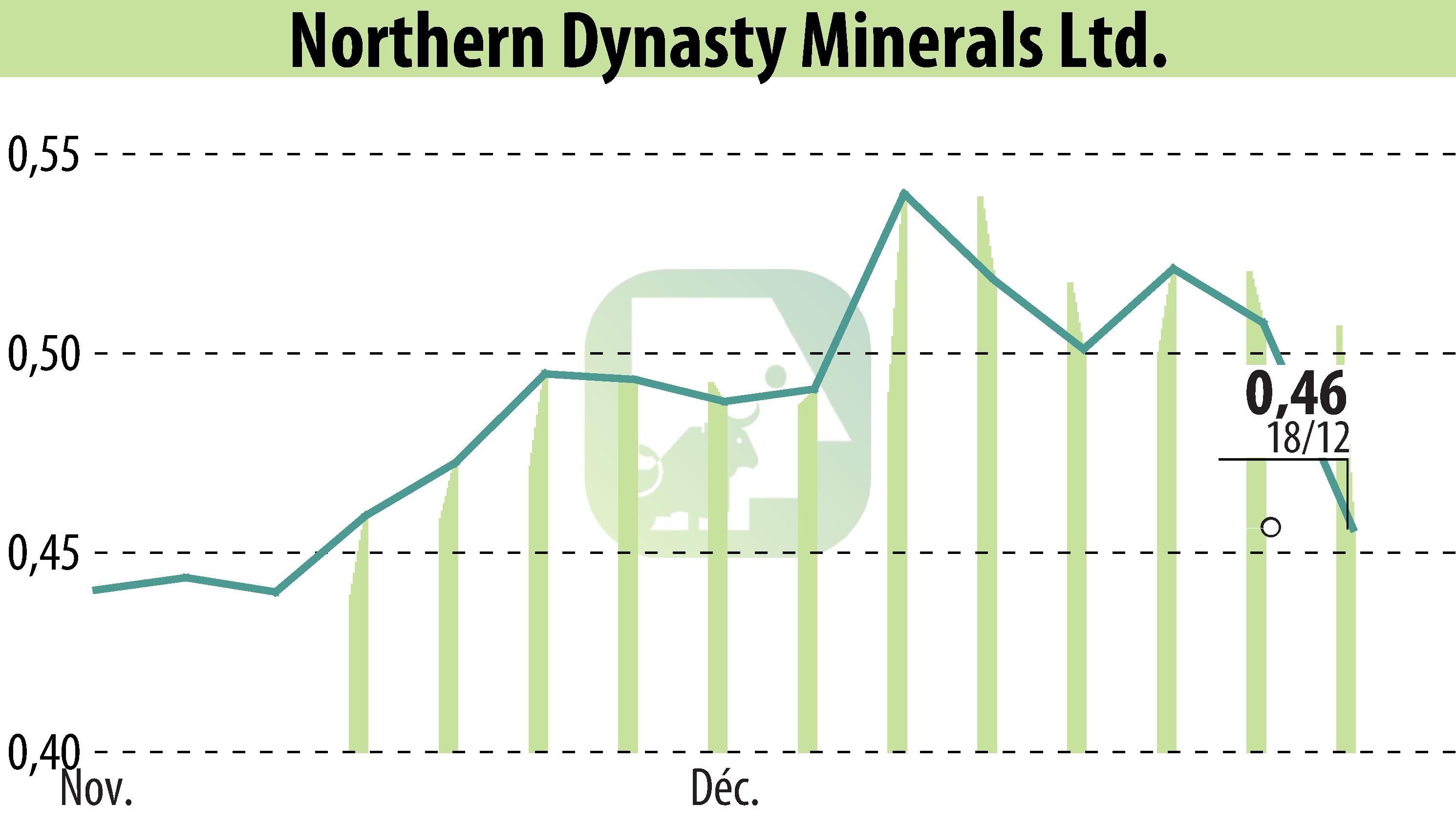

- Price Action: The stock has been swinging wildly between $1.90 and $2.30 in early 2026.

- Volatility: The implied volatility on NAK options is often over 100%. This is not for the faint of heart.

Actionable Insights for Investors

If you're thinking about jumping into Northern Dynasty Minerals Ltd stock, don't just "diamond hand" it because of a YouTube video. You need a strategy.

- Watch the Dockets, Not the News: The stock moves on legal filings. Follow the Northern Dynasty Minerals v. EPA case in the District of Alaska. When a judge rules on the "Summary Judgment" motions, the stock will move 30% in minutes.

- Copper Prices Matter: Even with permits, the project needs high copper prices to be economically viable. If copper is trading below $3.50/lb, the Pebble Project looks a lot less attractive to potential buyers.

- Position Sizing: Treat this like a speculative "alt-coin" or a long-shot option. Never put money into NAK that you actually need for rent. It is a high-reward, but very high-probability-of-loss play.

- Political Cycles: This stock is a barometer for U.S. environmental policy. If the political winds shift back toward heavy regulation, the "permitting window" could slam shut again for another decade.

Northern Dynasty is the ultimate test of patience. Some people have been holding this since the early 2000s, waiting for the "inevitable" approval. Whether 2026 is finally the year the legal logjam breaks or just another chapter in a never-ending saga remains to be seen, but one thing is certain: it won't be a quiet ride.

To stay ahead, keep a close eye on the EPA's proposed rule changes regarding the Clean Water Act. Those regulatory tweaks are the "secret sauce" that could finally bypass the local opposition that has stalled Pebble for so long. If those rules are finalized in the first half of 2026, the path to a permit becomes significantly flatter.

Next Steps for Your Portfolio:

- Check the latest SEC Form 6-K filings for Northern Dynasty to see their current cash burn rate and ensure they have at least 12 months of runway.

- Set price alerts at the $2.50 resistance level; a break above that on high volume usually signals that the "smart money" expects a legal win.

- Research the "Critical Minerals Act" updates in Congress, as federal subsidies for domestic copper could change the project's valuation overnight.