You're looking at your paycheck or a receipt at a Raleigh boutique and wondering where that extra chunk of change went. It happens. Taxes in North Carolina have undergone a massive facelift over the last decade, moving from a progressive system—where the rich paid a higher percentage—to a flat tax that's basically aiming for the floor.

The current tax percent in north carolina for individual income is 4.5%.

Simple, right? Not really. While that 4.5% figure for 2024 is what you’ll see on the Department of Revenue (NCDOR) website, it’s just one piece of a much larger, sometimes frustrating puzzle. If you’re living in Charlotte, your "tax experience" is wildly different than if you're tucked away in the Blue Ridge Mountains of Watauga County. It's about more than just that flat income rate.

The Flat Tax Evolution: Where We Are Now

North Carolina is currently in the middle of a scheduled "race to the bottom" regarding income tax. Back in 2013, the state had brackets that topped out at over 7%. It was a different world. Then the General Assembly decided to simplify. They landed on a flat tax model that has been ticking down annually.

For the 2024 tax year, the rate is 4.5%. If you're planning ahead for 2025, expect it to drop to 4.25%. The ultimate goal, as outlined in recent legislative sessions, is to eventually hit 3.99% or lower, depending on whether certain "triggers" in the state's general fund are met.

It's a bold move. Proponents like the John Locke Foundation argue this makes the state a magnet for businesses and high-net-worth individuals moving from high-tax states like New York or California. Critics, including the North Carolina Justice Center, worry that the flat rate shifts the burden onto lower-income families who feel the bite of sales tax more sharply. Honestly, both sides have a point. When you move to a flat tax, the guy cleaning the stadium and the guy owning the team pay the same percentage of their taxable income. That’s the definition of "flat," but the impact on their grocery budget isn't equal.

Standard Deductions are the Real Hero

Most people ignore the standard deduction, but it's the reason many low-income North Carolinians actually pay a 0% effective tax percent in north carolina. For 2024, if you’re married and filing jointly, the first $25,500 you earn is essentially invisible to the state. Single filers get $12,750.

If you earn $30,000 as a single person, you aren't paying 4.5% on all thirty grand. You’re paying it on the $17,250 left over after the deduction. That brings your "effective" rate way down. It’s a nuance that gets lost in the headlines about "flat taxes."

👉 See also: Why Toys R Us is Actually Making a Massive Comeback Right Now

The Sales Tax Trap: It’s Not Just 4.75%

Here is where it gets messy. If you go to the NCDOR website, it says the state sales tax is 4.75%. You might think, "Hey, that's lower than most states!"

You’d be wrong.

Almost every single county in North Carolina adds its own "local" tax on top of that state rate. In most places, like Wake, Durham, or Mecklenburg, you’re actually looking at a total of 6.75% to 7.25%.

Take Durham County. They have a 2% local tax plus a 0.5% transit tax. Suddenly, you’re paying 7.25% at the register. Meanwhile, a few counties might stay at the 6.75% floor. If you’re buying a $40,000 truck, that 0.5% difference is $200. It pays to know where you're shopping.

- Groceries: North Carolina is a bit of an outlier here. While "unprepared food" (your raw ingredients) is exempt from the 4.75% state tax, it is still subject to a 2% uniform local tax. So yes, you are taxed on your bread and milk, just at a lower rate.

- Dining Out: If you buy a burger at a restaurant, it's "prepared food." That means the full state rate plus the full local rate applies. In some cities, there's even an additional 1% "Prepared Food and Beverage" tax to fund convention centers or stadiums.

Property Taxes: The Silent Budget Killer

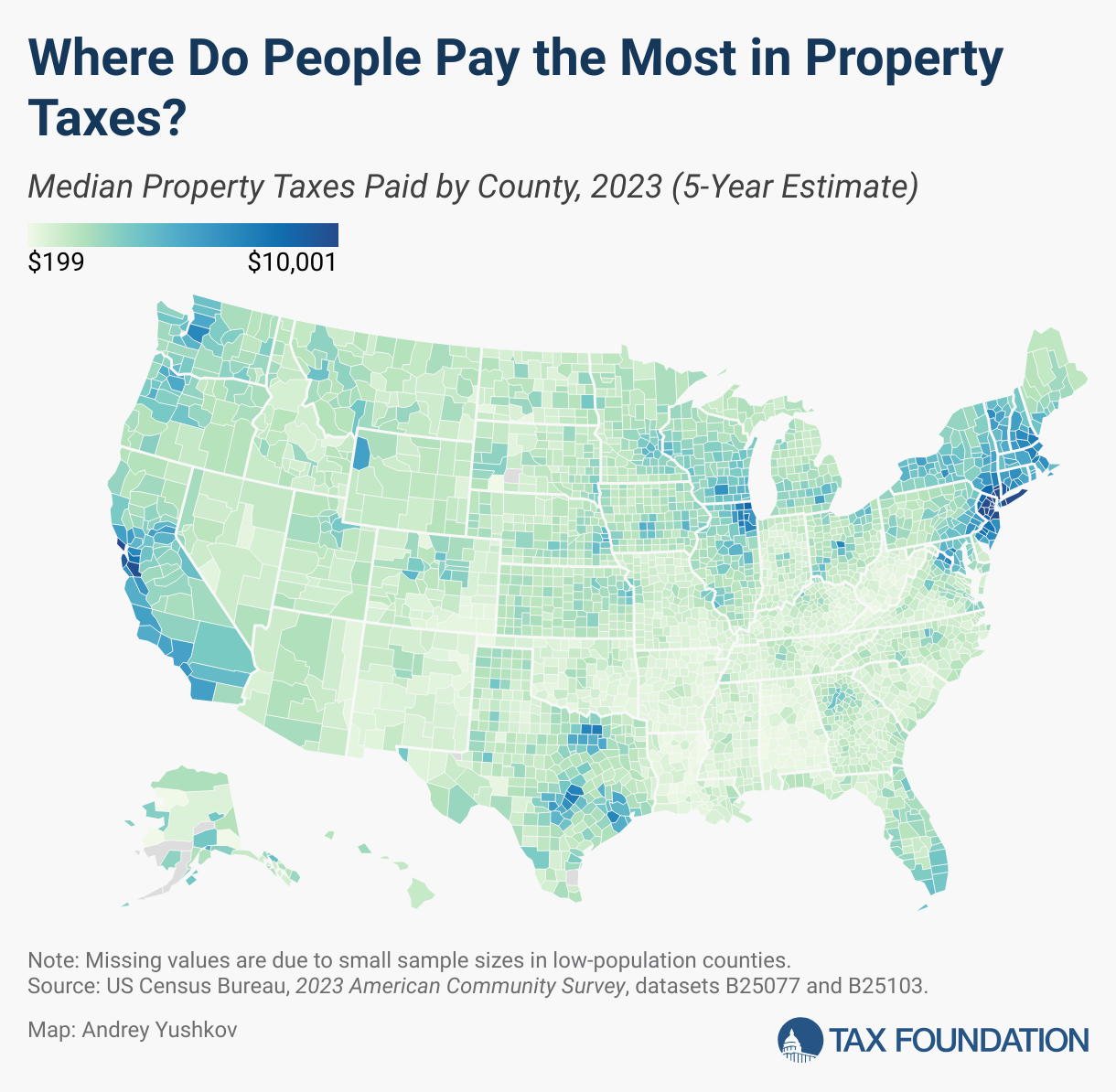

In North Carolina, the state doesn't collect property tax. The counties and cities do. This is why your tax percent in north carolina feels so different if you live in a rural area versus a booming metro.

Property is taxed per $100 of assessed value.

Let's look at the disparity. In a place like Orange County (home to Chapel Hill), the combined county and city tax rates can be quite high, often exceeding $1.30 per $100 of value. On a $500,000 home, that’s over $6,500 a year. Go a few counties over to a more rural area, and that rate might be half.

✨ Don't miss: Price of Tesla Stock Today: Why Everyone is Watching January 28

The tricky part? Reappraisals. North Carolina law requires counties to revalue property at least every eight years, though many do it every four. If you live in an area where property values are skyrocketing—hello, Asheville and Wilmington—your tax bill can jump 30% in a single year even if the "rate" stays the same. The rate is just a multiplier. The "value" is the target.

Corporate Tax: The Zero Percent Goal

If you own a business, North Carolina is basically trying to be your best friend. The state's corporate income tax is currently 2.5%. That is the lowest in the United States among states that actually have one.

But wait, there's more. The state is on a legal path to phase this tax out entirely. By 2030, the corporate income tax percent in north carolina is scheduled to be 0%.

This is a massive pillar of the "Carolina Comeback" strategy. It’s why Apple and Google are scouting the Research Triangle. However, businesses still have to deal with the Franchise Tax. This is a tax on the net worth of the company. It’s been a point of contention for years because businesses have to pay it even if they don't make a profit. It’s basically a "tax for the privilege of existing" in the state.

Gas, Sin, and Other "Hidden" Percentages

We can't talk about the tax percent in north carolina without mentioning the stuff you buy at the pump or the ABC store.

The motor fuels tax is currently 40.4 cents per gallon (as of 2024). This rate isn't random; it's calculated based on a formula that accounts for population changes and the energy component of the Consumer Price Index. It's one of the highest in the Southeast. If you're driving a gas-guzzler, you're paying a lot more into the Highway Fund than someone in South Carolina.

Then there's the "sin tax." North Carolina is a "control state" for liquor. That means the state has a monopoly on the sale of spirituous liquor. The tax on liquor is 30%, but by the time you add the various markups and local board fees, the "effective" tax rate on a bottle of bourbon is significantly higher than the 4.75% sales tax you see on a t-shirt.

🔗 Read more: GA 30084 from Georgia Ports Authority: The Truth Behind the Zip Code

What Most People Get Wrong

The biggest misconception is that North Carolina is a "high tax" or "low tax" state. It's actually a "moderate tax" state that is aggressively trying to become a "low tax" state.

People often compare NC to Florida or Tennessee because those states have 0% income tax. While that sounds great, those states have to get their money from somewhere. Florida has higher property taxes in many areas, and Tennessee has some of the highest sales tax rates in the country (often nearly 10%).

North Carolina takes a more balanced approach. We have a moderate income tax, a moderate sales tax, and moderate property taxes. It's less of a shock to the system, but it also means there's no way to completely "dodge" the tax man by changing your spending habits.

Nuances for Retirees

If you're moving here to retire, pay attention. North Carolina does not tax Social Security benefits. That’s a huge win. However, it does tax other forms of retirement income—like 401(k) distributions or private pensions—at that same 4.5% flat rate.

Military retirees used to have a hard time here, but a few years ago, the state finally passed a law (the 2021 budget) that exempts military retirement pay from state income tax for those who served at least 20 years or retired due to medically unfit reasons. It was a long-overdue change that kept veterans from fleeing to neighboring states.

Real World Example: The "Triangle" Resident

Let's say you live in Raleigh (Wake County). You earn $80,000.

- Income Tax: After your $12,750 standard deduction, you pay 4.5% on $67,250. That’s roughly $3,026.

- Sales Tax: You spend $20,000 on taxable goods. At Raleigh's 7.25% rate, that’s $1,450.

- Property Tax: You own a $400,000 house. Wake County’s rate is roughly 0.5% and Raleigh’s is about 0.4%. Total rate is 0.9%. You pay $3,600.

- Vehicle Tax: NC charges an annual "ad valorem" tax on your car's value when you renew your tags. On a $30,000 car, that might be another $250.

Your total state and local tax burden is somewhere around $8,326. That’s an effective rate of about 10.4% of your total gross income. Seeing it broken down like that usually makes people realize that the "4.5%" headline is only a fraction of the story.

Actionable Steps for Navigating NC Taxes

Don't just write a check and grumble. There are ways to navigate this system more effectively.

- Audit Your Residency: If you spend part of the year in another state, track your days. North Carolina considers you a resident if you spend more than 183 days here. Being a "part-year" resident requires filing Form D-400 Schedule PN, which can be a headache but might save you money if your other state has a lower rate.

- Appeal Your Property Value: When your county sends that revaluation notice, don't just toss it. If you can prove that similar houses in your neighborhood sold for less than your "new" value, you can file an appeal. Most people don't bother, but the ones who do often see a 5-10% reduction in their tax bill.

- Time Your Big Purchases: Since the income tax rate is dropping every year, pushing income into the next year or pulling deductions into the current year can save you a few basis points. More importantly, if you’re buying a car or a boat, check the sales tax rates in neighboring counties. You generally pay the tax based on where you register the vehicle, not where you buy it, so this is harder for cars, but for other big-ticket items, location matters.

- Contribute to a 529 Plan: North Carolina doesn't give you a state tax deduction for 529 contributions anymore (they killed that in 2014), but the earnings still grow tax-free. If you're looking for state-specific tax breaks, you’re mostly looking at the standard deduction or business-related credits for things like historic preservation.

- Check the "Tax-Free Weekend" Status: North Carolina repealed its annual sales tax holiday years ago. Don't wait for August to buy school supplies thinking you'll save the 7%. It’s not coming back anytime soon.

Understanding the tax percent in north carolina requires looking past the 4.5% sticker price. It's a combination of a shrinking income tax, a stable but localized sales tax, and property taxes that are highly dependent on your zip code. Staying informed on the legislative "triggers" is the only way to know if that 4.5% will actually hit the 3.99% target by 2027.