So, you’re looking into the ANCHOR program. Maybe you heard a neighbor talking about a check hitting their mailbox, or perhaps you’re just tired of New Jersey’s property taxes eating your entire paycheck. It happens.

NJ is expensive. We all know it.

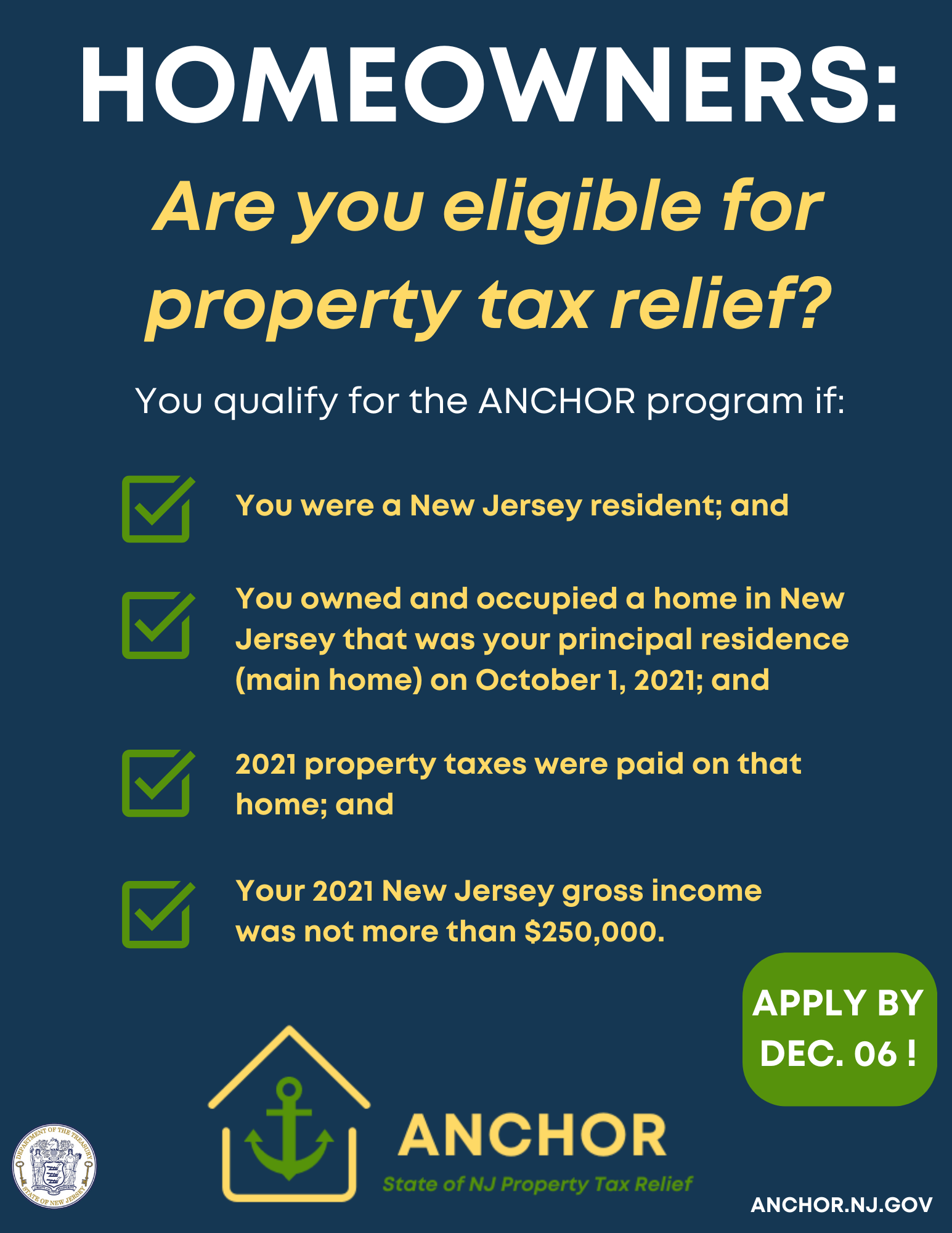

The Affordable New Jersey Communities for Homeowners and Renters—yeah, that’s why we just call it ANCHOR—is basically the state's way of saying, "Sorry about the tax bill, here’s some of it back." But the rules? They change. Often. If you're looking at old 2021 or 2022 data, you’re going to get confused. Honestly, the biggest mistake people make is thinking they don't qualify because they don't "own" a traditional house.

Here is the deal for the 2026 cycle, which is primarily looking at your life as it stood back in 2024.

The Basic Math of nj anchor program eligibility

It isn't just for people with a white picket fence in Cherry Hill.

If you lived in NJ on October 1, 2024, and that place was your "principal residence," you’re already halfway there. But "principal residence" is tax-speak. It means the place you actually live most of the time. You can’t claim this for your shore house in Wildwood if you spend most of your year in a condo in Hoboken.

Income is the next hurdle.

For homeowners, the ceiling is pretty high. If your 2024 gross income was $250,000 or less, you're in. If you made $250,001? Sorry. The state is very literal about that one dollar.

Renters have a lower bar but it's still generous. You need to have made $150,000 or less.

What if you’re a senior?

Everything changes when you hit 65. Well, the money changes.

If you were 65 or older by December 31, 2024, the state adds a "senior bonus." It’s usually an extra $250. This is where people get tripped up with the new PAS-1 form. In the past, you filed separate things for different programs. Now, the state basically mashed the ANCHOR program, the Senior Freeze, and the new Stay NJ program into one big application.

💡 You might also like: Why the 2013 Moore Oklahoma Tornado Changed Everything We Knew About Survival

It's simpler, kinda. But it means you have to be more careful with the details.

Homeowners: The Nitty Gritty

Being a homeowner for ANCHOR purposes isn't just about having a deed. You had to have paid property taxes on that home for 2024.

If you live in a multi-unit property, it gets weird. If you own a four-unit building and live in one of the units, you can apply. If it’s five units? You’re likely out of luck. The state views that as a commercial business, not a residence.

Condos and Co-ops? You’re treated like a homeowner.

Mobile homes? Usually, the state treats you like a renter because you’re likely paying "site fees" rather than traditional property taxes.

One thing that genuinely surprises people is the PILOT (Payment in Lieu of Taxes) situation. Historically, if your building had a PILOT agreement, you couldn't get the rebate. The rules have loosened up lately, especially for renters, but for homeowners, if you aren't paying traditional property taxes to the municipality, you need to check your specific tax status before getting your hopes up.

Renters: You Aren't Left Out

There is a persistent myth that ANCHOR is only for people who pay a mortgage. Total lie.

If you wrote a rent check in 2024, you likely qualify for at least $450. If you’re a senior renter, that jumps to $700.

There are "buts," though.

- Your name must be on the lease.

- The property you rent must be subject to local property taxes.

- You can't be living in tax-exempt housing (like some on-campus college dorms or certain non-profit housing).

Think about that middle one for a second. Most apartments in NJ pay property taxes—your landlord just folds that cost into your rent. That’s why the state gives you the rebate; you’re technically the one "paying" the tax through your rent. If you live in a place owned by the county or a religious organization that doesn't pay taxes to the town, the state won't give you a "rebate" for a tax that was never paid.

The 2026 Shift: Stay NJ and PAS-1

The landscape changed significantly heading into 2026. Governor Murphy’s administration pushed through the "Stay NJ" program, which is aimed squarely at seniors.

📖 Related: Ethics in the News: What Most People Get Wrong

What does this have to do with nj anchor program eligibility?

Everything.

Because the state now uses the PAS-1 form to determine eligibility for all three major relief programs at once, the data you provide for ANCHOR is now being used to calculate if you get that massive 50% property tax credit (up to $6,500) from Stay NJ.

If you are a senior homeowner making under $500,000, you are eligible for Stay NJ. But to get it, you have to go through the ANCHOR eligibility process first. They are linked like a chain.

Why your 2024 Taxes matter now

The state is looking at Tax Year 2024. This means your Line 29 on the NJ-1040 is the "magic number."

If you haven't filed your 2024 state taxes, or if you filed them incorrectly, your ANCHOR application is going to get flagged. The Division of Taxation cross-references these things. If your ANCHOR application says you made $140,000 but your tax return says $160,000, you’re going to be waiting a long time for that check while a manual auditor looks at your file.

Common Roadblocks and Scams

Honestly, the ID.me thing is the biggest headache right now.

To prevent fraud, New Jersey started requiring identity verification through ID.me for new applicants or those who didn't receive an "auto-file" confirmation letter. It’s a pain. You have to take a selfie, upload your license, and sometimes wait on a video call with a "trusted referee."

If you get a text message saying "Click here to claim your NJ ANCHOR rebate," delete it. Immediately.

The state will never text you about your rebate. They communicate through those blue or green mailers, or through the official .gov website. If you're unsure, just go to the NJ Division of Taxation website directly. Don't trust a random link from a "Property Tax Assistant" on Facebook.

👉 See also: When is the Next Hurricane Coming 2024: What Most People Get Wrong

The "Auto-File" Mystery

Some of you might have received a letter in the mail saying "You don't need to do anything."

This happens if you filed last year and the state already has your bank info and address. They basically assume nothing has changed and file for you. It sounds great, but it's a trap if you moved or changed banks. If that money goes to a closed account or an old address, it can take six months to get it rerouted.

If you got that letter but your life changed in 2025, you must go in and manually update your info before the deadline.

Real Examples of Eligibility

Let's look at how this actually plays out for different people.

Example A: The "Young" Professional

Sarah is 30, lives in a rented apartment in Morristown, and made $85,000 in 2024. Her name is on the lease. She is eligible for a $450 renter benefit.

Example B: The Married Seniors

Bob and Linda are 70. They own a home in Toms River. Their combined income in 2024 was $140,000. They are eligible for the $1,500 homeowner benefit plus the $250 senior bonus, totaling $1,750. Because they also meet the Stay NJ requirements, their PAS-1 application will also trigger that separate credit.

Example C: The High Earner

Mark owns a home in Princeton and made $300,000 in 2024. He is ineligible for ANCHOR because his income exceeds $250,000. However, if he is over 65, he might still qualify for Stay NJ because that program has a higher $500,000 income cap.

What You Should Do Right Now

Check your mail for the PAS-1 form or the ANCHOR confirmation letter. If you didn't get one, don't panic, but don't wait either.

- Find your 2024 NJ-1040. You need the exact gross income from Line 29.

- Locate your ID and PIN. If you're a homeowner and filed before, you likely have an ID and PIN from a previous mailer. If not, there’s an online lookup tool on the taxation website.

- Verify your bank info. If you want the money faster, direct deposit is the only way. Paper checks are notoriously slow and prone to getting lost.

- Mind the October Deadline. Every year, the deadline is usually late October (often the 31st). If you miss it, the money is gone. There are no "late fees" you can pay to get it back; the window just shuts.

The system isn't perfect, and the phone lines at the Division of Taxation are usually jammed with a three-hour wait. But for $450 to $1,750, it’s worth the twenty minutes of paperwork. Just make sure you're using your 2024 data, or you're just wasting your time.