Ever stay up late watching the tickers crawl across the bottom of the screen? It's a weirdly addictive habit, especially when a titan like Nike is in the mix. If you're looking at the nike stock price after hours right now, you’re seeing more than just a flashing green or red number. You're seeing the "middle innings" of what CEO Elliott Hill calls a massive comeback story.

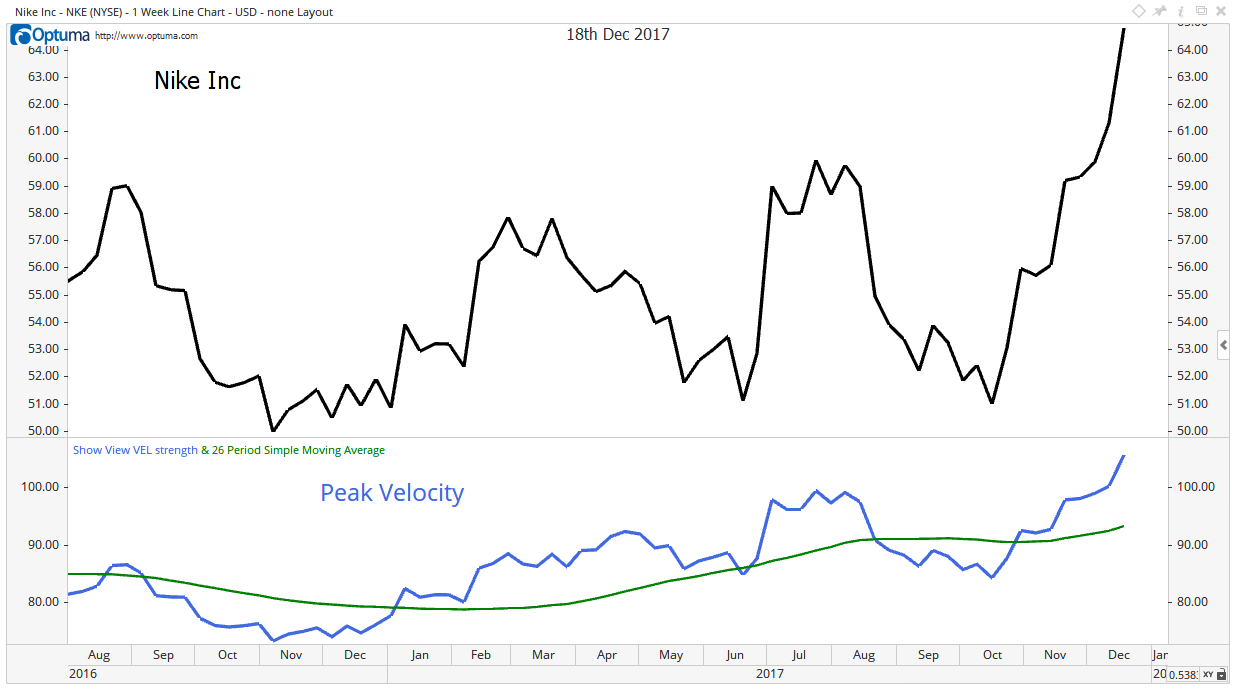

Right now, as of mid-January 2026, Nike is sitting in a fascinating, if somewhat uncomfortable, spot. The stock closed the most recent session around $64.39, showing a slight dip of about 0.31%. After-hours trading has been relatively quiet but steady, hovering near that $64.40 mark. It’s a far cry from the **$82.44** high we saw over the last 52 weeks, but it's also noticeably up from the $52.28 floor.

Honestly, the "after-hours" noise is usually just that—noise—unless there's a major catalyst. But for Nike, every tick matters because the market is still digesting the fiscal Q2 2026 earnings report that dropped just before the holidays.

The Reality Behind the Post-Market Fluctuation

When you check the nike stock price after hours, you’ve gotta remember that volume is thinner. Small trades can move the needle more than they would at 10:00 AM. Currently, the bid-ask spread is tight, reflecting a market that has mostly priced in the recent earnings beat.

Wait, did I say beat? Yeah, Nike actually surprised a lot of people.

They reported an EPS (Earnings Per Share) of $0.53, which blew past the analyst consensus of $0.37. Revenue came in at **$12.4 billion**, slightly ahead of the $12.2 billion expected. So why isn't the stock soaring to the moon? Well, it's complicated. While the top and bottom lines looked okay, the "guts" of the report showed a 300-basis-point drop in gross margin, landing at 40.6%.

🔗 Read more: 121 GBP to USD: Why Your Bank Is Probably Ripping You Off

A big chunk of that pain came from North American tariffs and the cost of cleaning up messy inventory. Investors aren't just looking at the price after the closing bell; they're looking at whether Nike can actually protect its profits while it tries to win back its "cool" factor.

Why Investors Are Watching the $64 Level

The current price action suggests a tug-of-war. On one side, you have the "Wait and See" crowd. They're worried about the 9% drop in Nike Direct revenues and the fact that digital sales are still struggling. On the other side, you've got the "Buy the Turnaround" group.

One of the most interesting things happening lately is the insider activity.

- CEO Elliott Hill recently bought over 16,000 shares.

- Tim Cook, who sits on the board, picked up 50,000 shares.

- Other directors like Robert Swan and Jorgen Vig Knudstorp also put their money where their mouths are.

When the big bosses are buying at $60-$65, it usually sets a "psychological floor" for the stock. If the nike stock price after hours dips below that, it often attracts buyers who think, "If it's good enough for Tim Cook, it's good enough for me."

The Wholesale Pivot

For a few years, Nike tried to cut out the middleman. They wanted to sell everything through their own apps and stores. It didn't work as well as they hoped. Now, they are crawling back to partners like Foot Locker and Dick's Sporting Goods.

💡 You might also like: Yangshan Deep Water Port: The Engineering Gamble That Keeps Global Shipping From Collapsing

In the latest quarter, wholesale revenue jumped 8%. In North America alone, it was up 9%. This shift is basically Nike admitting that they need help reaching the average runner or high school kid who just wants to try shoes on in a mall. It’s a "back to basics" move that the market is slowly starting to respect.

What to Watch Before the Next Opening Bell

If you're tracking the nike stock price after hours, keep your eyes on the broader macro environment. Tariffs are the big boogeyman right now. Nike’s CFO, Matthew Friend, has been pretty vocal about how product costs are rising because of these trade shifts.

The company is currently trying to "diversify the manufacturing footprint" away from China, but that’s like trying to turn a cruise ship in a bathtub. It takes time.

Analysts are all over the place on this one. You’ve got Barclays setting a target of $64, essentially saying "it's fairly valued right here." Then you have Bernstein and Goldman Sachs looking way up at $77 or $85.

The consensus seems to be a "Moderate Buy," but it’s a nervous buy. No one wants to be the last person holding the bag if the Q3 guidance—which predicted a low-single-digit revenue decline—turns out to be even worse than expected.

📖 Related: Why the Tractor Supply Company Survey Actually Matters for Your Next Visit

Actionable Insights for Your Next Move

Looking at a stock price after the market closes can be a bit like looking at a frozen frame of a movie. It doesn't tell the whole story, but it gives you a hint of the mood.

If you’re holding or thinking about jumping in, here’s how to handle the current volatility:

- Check the Volume: If the price is moving on low volume after hours, don't panic. It often corrects itself by the next morning's pre-market session.

- Monitor the "Floor": The $60 to $63 range has shown strong support recently. If it breaks below that, the "insider buying" narrative loses its teeth.

- Watch the Competition: Keep an eye on Deckers (HOKA) and On Holding. Part of Nike’s struggle is that these smaller brands are eating their lunch in the premium running category. If those stocks are up while Nike is flat, it’s a sign the "innovation gap" is still wide.

- Focus on the Dividend: Nike has increased its dividend for 24 straight years. With a yield around 2.55%, you're getting paid to wait for the turnaround to actually take hold.

The nike stock price after hours is ultimately a reflection of a brand in transition. It’s not the dominant, untouchable force it was in 2019, but it's also not a dying legacy brand. It's a company trying to find its rhythm again in a world where consumers have a lot of other options.

Watch the $64.50 level closely. If it can hold that through the week, the bulls might actually have a case for a slow climb back toward the $70s. For now, it’s a game of patience and watching the margins.

To stay ahead of the curve, you should set price alerts for the $62.00 and $68.00 levels. These represent the current "battleground" zones where institutional buyers and sellers tend to trigger larger moves. Additionally, keep a close eye on retail sales data for the footwear sector, as any broader industry weakness will likely hit Nike's after-hours valuation before the rest of the market reacts.