Honestly, if you’d told an investor in 2021 that Nike would be sitting at roughly the same price as it was in 2018, they’d have laughed you out of the room. Back then, the "Swoosh" was unstoppable. Everything was going digital, the SNKRS app was a goldmine, and the stock was flirting with $170. Fast forward to January 2026, and the vibe is... different. Nike Inc stock price history has officially entered its "repair job" era.

As of late January 2026, the stock is hovering around $64. That’s a far cry from the triple-digit glory days. It’s been a wild, multi-decade ride from a $23 IPO in 1980 (which, after all the splits, is basically pennies) to a global behemoth that currently finds itself at a crossroads. To understand where we're going, we've gotta look at how we got here.

The Early Days: From Pennies to Powerhouse

Nike didn't start as the king of the mountain. When it went public on December 2, 1980, it was a scrappy challenger to Adidas. If you look at the split-adjusted Nike Inc stock price history, that initial price was about $0.18. Think about that. Every dollar invested then would be worth a small fortune today, even with the recent slump.

The 80s and 90s were essentially a massive sprint. The brand signed Michael Jordan, released the Air Max, and basically invented modern sneaker culture. This growth was so consistent that the company had to split the stock repeatedly just to keep it accessible to regular folks.

- January 1983: 2-for-1 split

- October 1990: 2-for-1 split

- October 1995: 2-for-1 split

- October 1996: 2-for-1 split

By the time the late 90s rolled around, Nike wasn't just a shoe company; it was a cultural proxy. If the economy was good and people were feeling sporty, Nike stock went up. Simple.

🔗 Read more: Is Today a Holiday for the Stock Market? What You Need to Know Before the Opening Bell

The Great Disruption: 2020 and the Digital Mirage

The pandemic was a weirdly "good" time for Nike stock—at least initially. While the world locked down, everyone decided they needed new leggings and high-end joggers. In 2020, sales in China tanked first, giving Nike an early warning. But then, something crazy happened. The stock price exploded.

By late 2021, NKE hit an all-time high of around $173. The narrative was perfect: Nike was cutting out the middleman (wholesalers like Foot Locker) and selling directly to you via their apps. Higher margins. More data. Total control. Wall Street loved it.

But here’s the thing—they might have leaned too hard into the "Direct-to-Consumer" (DTC) model. By 2024 and 2025, it became clear that while selling on your own app is great, you lose the "foot traffic" of people just wandering into a store. Suddenly, the shelves were full of stuff people didn't want, and the "hype" around shoes like the Dunk and Jordan 1 started to fade.

Why 2025 Was a Reality Check

If 2021 was the peak, 2025 was the valley. The company faced a "triple threat" that hammered the price down to the $50–$60 range.

💡 You might also like: Olin Corporation Stock Price: What Most People Get Wrong

- The Innovation Lag: Critics (and even some loyalists) started saying Nike's designs got stale. They relied too much on retro hits and not enough on the next "big thing" in performance running.

- The China Problem: Economic headwinds in China—historically Nike's fastest-growing market—saw sales plummet. In the quarter ending November 30, 2025, China revenue was down 13%.

- The Tariff Scares: Increased tariffs in North America took a "sledgehammer" to profitability, as the company puts it. Gross margins took a 330-basis-point hit late in the year.

Basically, the stock got "too cheap to ignore," according to some analysts, but it stayed cheap because the turnaround was taking forever.

The Elliott Hill Era: Can a Veteran Save the Swoosh?

In late 2025, Nike did what many legacy brands do when they're in trouble: they brought back a "lifer." Elliott Hill, a guy who started as an intern and spent 32 years at the company, took over as CEO. His "Win Now" strategy is basically an admission that the previous plan was a bit of a mess.

Hill is already making big moves. He’s re-hiring regional leaders, cutting out unnecessary corporate layers, and—this is the big one—re-embracing wholesale partners. You’re going to see Nike back in places like Amazon and more prominent in local running shops. They’re even getting back into the "cheap" shoe game to compete with brands like Hoka and On that have been eating their lunch.

| Metric (as of Jan 2026) | Value |

|---|---|

| Current Price | ~$64.38 |

| 52-Week High | $82.44 |

| 52-Week Low | $52.28 |

| Dividend Yield | 2.55% |

| Payout Ratio | ~94% |

That payout ratio is a bit of a red flag for some. It means Nike is sending almost all of its earnings back to shareholders as dividends. Great for income, but it leaves less cash to reinvent the lab.

📖 Related: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

What Most People Get Wrong About Nike Stock

A lot of folks look at the Nike Inc stock price history and think it’s a dying brand. It’s not. It’s a "repair job." The brand still owns a massive chunk of the global market.

One thing to watch? The dividends. Nike has increased its dividend for 25 consecutive years. Even when the stock price is bleeding, they’re still paying you to wait. It’s now officially a "Dividend Aristocrat" territory play.

Also, keep an eye on the "insider" moves. CEO Elliott Hill and board members like Apple’s Tim Cook have been buying up shares with their own money lately. When the people running the show start opening their own wallets, it usually means they think the bottom is in.

Actionable Insights for the "New" Nike Investor

If you're looking at Nike today, don't expect a moonshot. The 20% gains of the 90s are likely over for a bit. Instead, treat it like a value play.

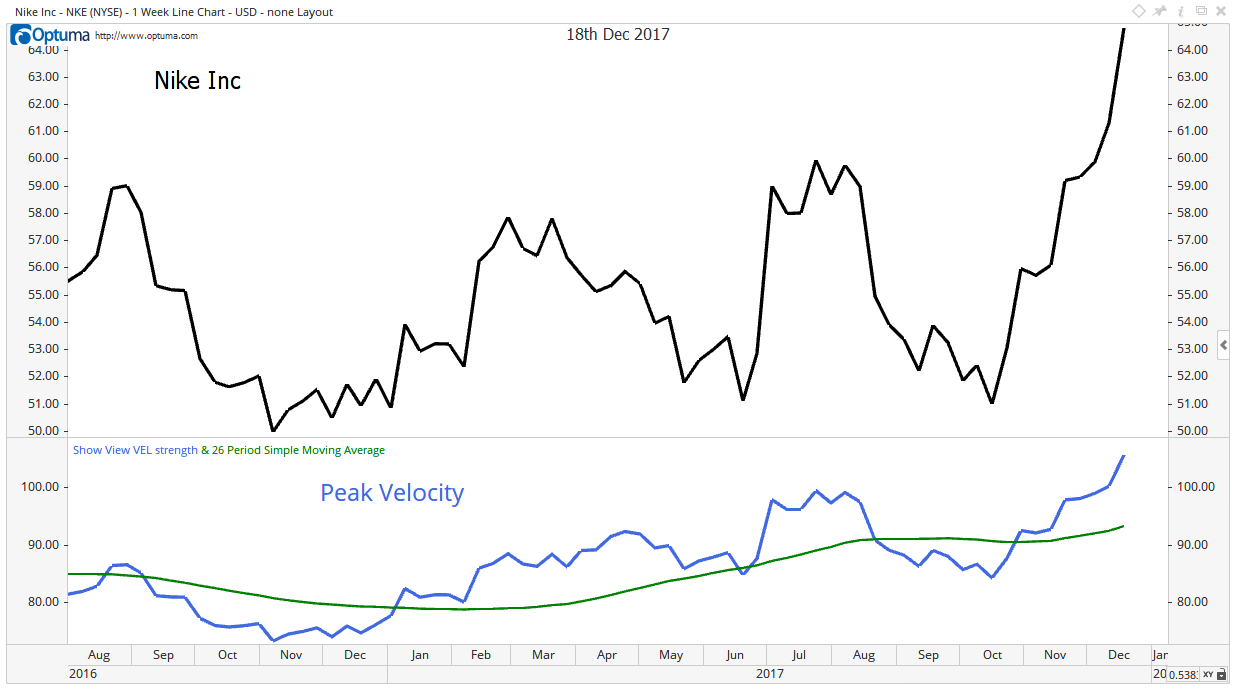

- Watch the $52 level: This has acted as a strong "floor" for the stock. If it dips back there, it’s historically been a decent entry point.

- Ignore the "Hype" for a second: Focus on the wholesale recovery. If Nike starts showing growth in their partners' stores again, that’s the signal that the "Win Now" strategy is working.

- Check the Margins: The real story isn't how many shoes they sell; it's the gross margin. If that starts climbing back toward 45% or 46%, the stock price will follow.

- Patience is mandatory: Turnarounds in retail usually take 18 to 24 months. We are currently about six months into the Hill era.

Nike isn't going anywhere, but the days of easy money are gone. It's a grind now. But then again, "Just Do It" was always about the grind, right?

Keep an eye on the next earnings report in late March. That will be the real test of whether the "Win Now" plan is just a slogan or a legitimate comeback. Focus on North American inventory levels; if those are down, the "bloat" is clearing out, and the Swoosh might finally start moving upward again.