Honestly, if you’ve spent any time trying to send money to Lagos or pay for an international subscription from Abuja lately, you know the Nigerian currency exchange rate is basically a moving target. It’s exhausting. You check one app, it says 1,420 Naira to the dollar. You walk down to a local mall or call a guy who "knows a guy," and suddenly the price is something else entirely.

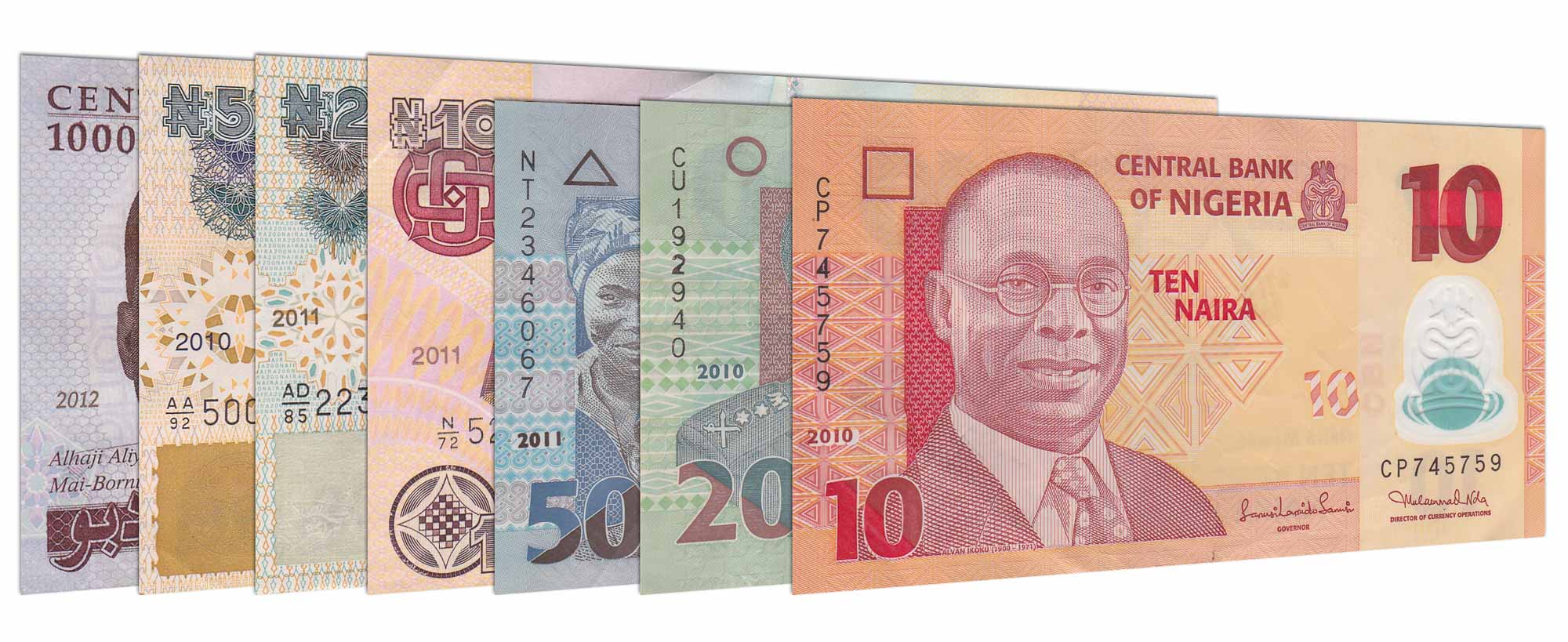

The reality of the Naira in 2026 is a story of two worlds trying to become one. On one hand, you have the official window—the Nigerian Foreign Exchange Market (NFEM)—and on the other, the street markets that have historically dictated the price of a loaf of bread or a gallon of petrol.

As of January 16, 2026, the official rate has been hovering around 1,420.04 Naira per US Dollar. That sounds high if you remember the days of 450, but compared to the chaos of early 2024 when we saw spikes toward 1,600, there’s a weird sense of stability settling in.

The Great Unification: Nigerian Currency Exchange Rate Under the Microscope

Most people get the Naira wrong because they think it's still 2023. Back then, the gap between the official rate and the black market (parallel market) was a canyon. You could literally make a fortune just by having access to official dollars and selling them on the street.

That "arbitrage" is mostly dead now.

The Central Bank of Nigeria (CBN), led by Olayemi Cardoso, has spent the last two years forcing these rates together. They adopted a "willing buyer, willing seller" model. It’s exactly what it sounds like. The bank doesn't just pick a number out of thin air anymore; they let the market fight it out.

"Stability in currency, exchange rates, and growth of reserves is the foundation for public confidence." — Olayemi Cardoso, CBN Governor (Annual Bankers' Dinner, 2025).

But let's be real. Just because the rates are "unified" doesn't mean they're cheap.

📖 Related: Why the stock market cycle chart keeps catching investors off guard

Why the Rate Is Finally Stopping Its Freefall

If you look at the numbers from mid-January 2026, the Naira is actually showing a bit of muscle. External reserves hit roughly $45 billion by the end of 2025. That’s a huge deal. When the central bank has a big pile of dollars in the basement, it makes speculators nervous. They stop betting against the Naira because they know the CBN can step in and flood the market if things get too crazy.

There are three big reasons we aren't seeing 2,000 Naira to the dollar right now:

- Crude Oil Gains: Production has stabilized around 1.67 to 1.71 million barrels per day. More oil exported means more dollars coming into the treasury.

- Tight Money: The Monetary Policy Rate (MPR) is sitting high at 27%. It’s painful for people taking out car loans, but it keeps the currency from devaluing further by making Naira-denominated assets more attractive to big investors.

- The BDC Cleanup: The CBN basically nuked the old Bureau de Change system. They revoked thousands of licenses and forced the remaining ones to recapitalize—with some licenses now requiring a 2 billion Naira capital base. It's much harder for small-time "mallams" to manipulate local sentiment now.

What This Means for Your Pocket (The Real Impact)

Look, a "stable" exchange rate at 1,420 is still a tough pill to swallow for a country that imports almost everything. Inflation in early 2026 is around 14.45%. That's much better than the 30%+ we saw in 2024, but prices aren't exactly dropping.

When the Nigerian currency exchange rate stays flat, businesses can finally plan. Imagine being a manufacturer in Kano. If you don't know if the Dollar will be 1,400 or 1,800 next month, you can't price your goods. You just hike prices to be safe. Now that the rate has stayed in the 1,400–1,450 band for months, that "panic pricing" is starting to fade.

Surprising Winners in the New Economy

You’d think everyone loses when the currency is weak, but that’s not quite right.

Local farmers are actually finding a silver lining. Because imported food is so expensive, Nigerian-grown rice and poultry are becoming the default choice, not just the "cheap" choice. The International Finance Corporation (IFC) has even been pumping over $1 billion into local currency financing for sectors like agritech and housing because they see the Naira as finally being "fairly valued."

Expert Outlook: Where Is the Naira Heading?

Analysts at firms like Cordros and various economic summits in late 2025 suggest a "cautious optimism" for 2026. Some valuation models, specifically the Behavioural Equilibrium Exchange Rate (BEER), actually suggest the Naira is undervalued.

Basically, the math says the Naira should be stronger than it is, but "fear" is keeping it down. If the government keeps the non-oil exports growing—which saw a 20% rise recently—we could see the rate drift toward 1,350 by December.

However, risks remain. If global oil prices tank or if there’s a sudden surge in government spending, that stability could vanish overnight.

Actionable Steps for Navigating the Current Rate

If you're dealing with FX in Nigeria right now, don't just wing it.

- Use Official Channels: With the Electronic Foreign Exchange Matching System (EFEMS) now fully live, the "street" premium is often not worth the risk of counterfeit notes or scams.

- Hedge Your Costs: If you’re a business owner, look into forward contracts. The CBN has cleared most of the old "FX backlog" that caused so much drama in 2024, making these tools usable again.

- Monitor the MPC Meetings: The Monetary Policy Committee meets regularly (the 303rd meeting was just recently). Their decisions on interest rates almost always cause a 24-hour ripple in the exchange rate.

- Diversify into Exports: If you can earn in Dollars or Pounds while your costs are in Naira, you are winning this game. The 2026 economy is designed to reward producers, not just importers.

The days of the "hidden" exchange rate are mostly over. What you see on the CBN portal or reputable financial apps is increasingly the reality on the ground. It’s a high-price reality, sure, but at least the ground has stopped shaking.

Strategic Move: To stay ahead of sudden shifts, track the weekly "Balance of Payments" reports and the CBN's "Business Expectations Survey." These documents provide the earliest warnings of liquidity crunches before they hit the exchange rate. For those holding significant Naira, moving into high-yield Nigerian Treasury Bills (currently offering attractive returns due to the 27% MPR) can help offset the remaining inflationary pressure.