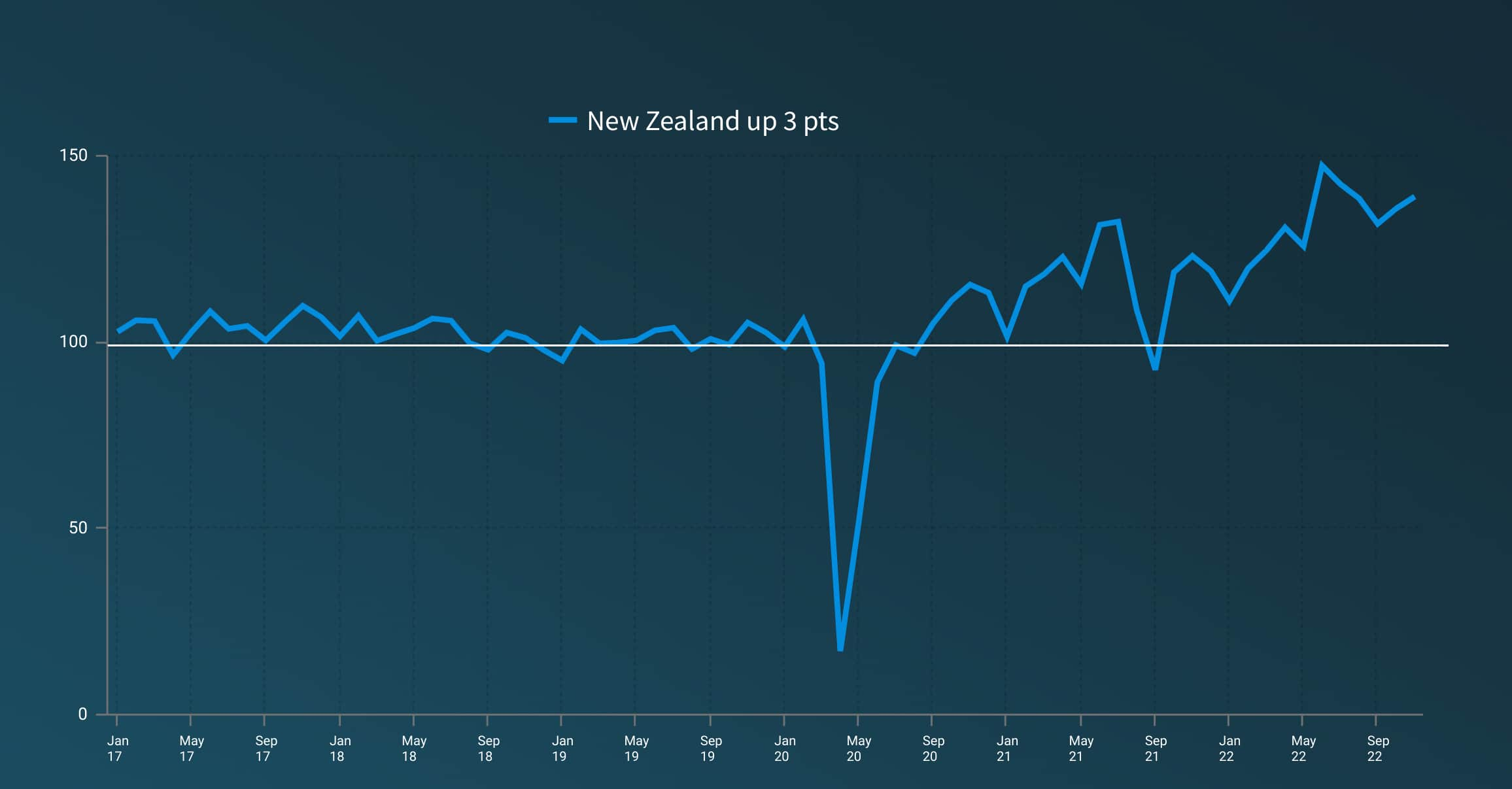

Honestly, if you’ve been scrolling through the headlines lately, you’d think the sky was falling for Kiwi businesses. Just last week, 61 shops announced they were closing doors in a single ten-day span. That's heavy. But then you look at the NZIER Quarterly Survey of Business Opinion (QSBO) and see business confidence hitting its highest peak since 2014.

It’s weird. It’s a total "tale of two cities" situation.

While some are folding, others are leaning into what experts are calling "anti-scale." Basically, they’re choosing to stay small on purpose to actually make more money. If you’re looking for new zealand small business news today, you’ll find that the old dream of the "Bach, Boat, and BMW" is being replaced by a much more high-tech, lean version of success.

The Real Story Behind the 2026 Confidence Spike

Most people think "business confidence" is just a vibe, but the data from January 2026 shows a net 39% of firms expect the economy to improve. That’s a massive jump from the 17% we saw back in September.

Why the sudden change?

👉 See also: To Whom It May Concern: Why This Old Phrase Still Works (And When It Doesn't)

It’s mostly because the Official Cash Rate (OCR) has finally settled. After the aggressive cuts through 2025, we’re looking at a stable period where the OCR is expected to hover between 2.00% and 3.50% for the next couple of years. This gives small business owners something they haven't had in a long time: predictability.

But don’t get too comfortable. The Inland Revenue (IRD) is also making noise today. They’ve sharpened their digital tools for 2026. If you’re a contractor or run a side hustle, they are moving much faster on penalties this year. The message is clear—the government wants the economy to grow, but they aren't going to be "chill" about tax compliance.

The Minimum Wage Shift

Minister Brooke van Velden just confirmed the adult minimum wage will rise by 2% to $23.95 starting April 1, 2026. It’s a moderate increase compared to previous years. The goal here is to stop "wage compression"—that annoying thing where your junior staff end up making almost as much as your experienced managers because the floor keeps rising so fast.

Why Staying Small is the New New Zealand Small Business News Today

For years, we’ve been told that New Zealand’s productivity problem is because our businesses are too tiny. We’re a nation of "micro-firms." But as of January 2026, that narrative is flipping.

✨ Don't miss: The Stock Market Since Trump: What Most People Get Wrong

AI is the great equaliser.

The government just launched the AI Advisory Pilot, which is offering co-funding of up to $15,000 for small businesses to get an AI plan in place. Minister Chris Penk is basically betting $765,000 that a two-person team using generative AI can be just as productive as a twenty-person firm.

If you can use a tool to handle your customer service, drafting, and data analysis, why would you take on the massive overhead of a big office and a huge payroll?

- Resilience: Small teams can pivot in a week. Big ones take a year.

- Global Reach: Digital services don't care that you're operating out of a garage in Hamilton.

- Specialisation: Successful Kiwi firms are stopping the "generalist" approach and dominating tiny niches worldwide.

What's Actually Happening with Interest Rates?

If you’re looking at your business loans today, January 17, 2026, the rates are still a bit of a sting but are stabilizing. For example, ASB’s business base rate is currently sitting around 10.97%.

🔗 Read more: Target Town Hall Live: What Really Happens Behind the Scenes

It’s not cheap.

However, the "MoneyHub" view is that shorter fixed terms—one or two years—are the way to go right now. Most economists believe the RBNZ is done with the heavy lifting for now, so locking in a five-year rate could be a massive mistake if things soften further by mid-2026.

Actionable Steps for Kiwi Business Owners

Forget the generic advice. Here is what you actually need to do based on the news hitting the wires this week:

- Apply for the AI Pilot: If you’re already an RBP customer, get your hand up for that $15,000 co-funding. The pilot starts late January 2026. It's literally free money to help you automate the boring stuff.

- Audit Your Margins Before April: With the $23.95 minimum wage coming in, you need to check your pricing now. Don't wait until June to realize your labor costs ate your profit.

- Clean Up Your IRD Filing: The IRD is using automated data matching more aggressively in 2026. If you have "untaxed income" from a side project, disclose it before the July 7 deadline.

- Short-Term Debt Only: If you're refinancing equipment or property, keep your terms short. The market expects a possible rate hike in the second half of 2026, so you want to be flexible when that happens.

- Focus on "Anti-Scale": Instead of asking "how do I hire more people?", ask "how do I increase my revenue per employee?" That is the only metric that matters for New Zealand's 2026 economy.

The landscape for new zealand small business news today isn't about surviving a recession anymore; it's about navigating a very high-tech, very lean recovery. The businesses that are closing are the ones stuck in 2019. The ones growing are the ones that realized being small is actually a superpower.