If you’ve been working for New York State or a local municipality since before the 2010s, you’re probably sitting on a gold mine without even realizing it. Most people just call it "the pension." But in the world of Albany bureaucracy, it's New York state tier 4 retirement. It is, quite honestly, the "holy grail" of public service benefits.

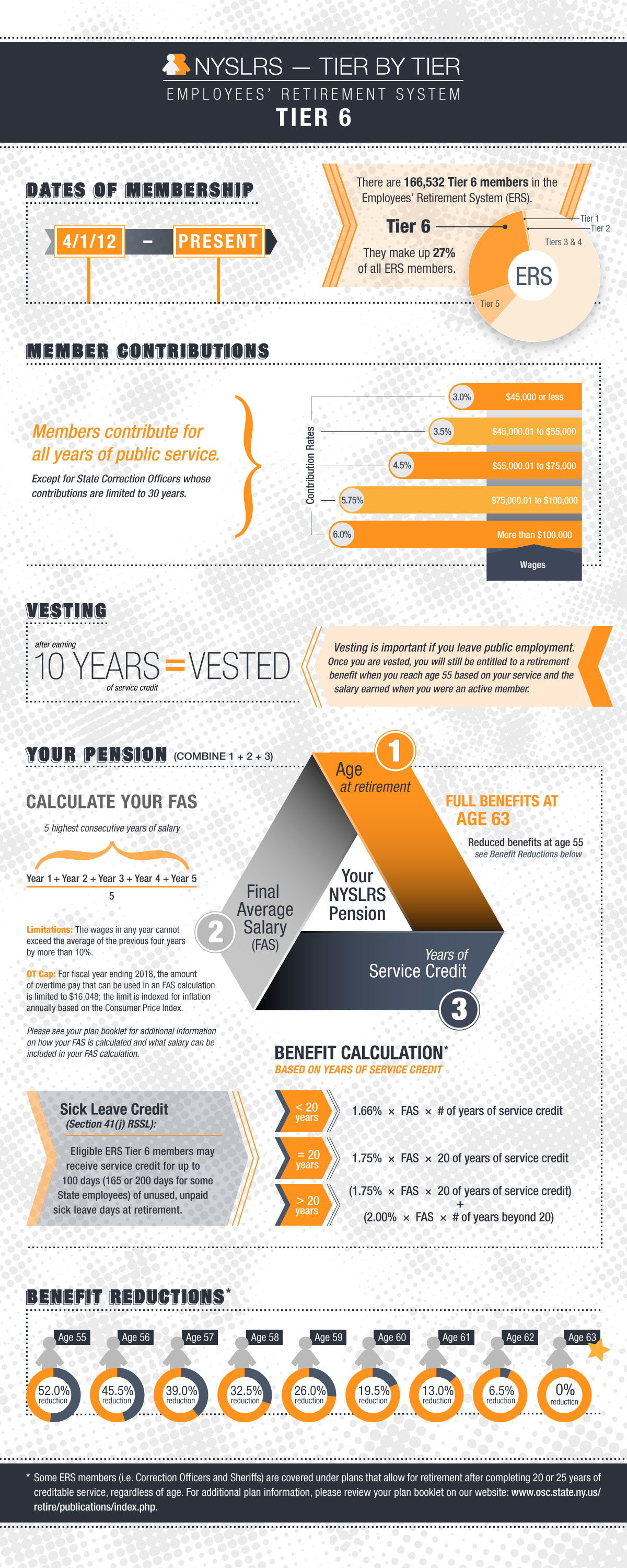

Think about it. While Tier 6 workers are stuck paying into the system for their entire careers, Tier 4 members generally stopped paying a dime toward their pension years ago.

It's a massive wealth gap in the public sector.

The magic of the 10-year mark

Let’s talk about the biggest perk of being Tier 4. Contributions. For most members in this tier—specifically those who joined between September 1, 1983, and December 31, 2009—there was a simple rule: you pay 3% of your salary.

But here is the kicker. You only pay that 3% until you hit 10 years of service or 10 years of membership. After that? You’re done. You get a "raise" because those deductions just stop. Compare that to Tier 6, where some people are losing 6% of every paycheck forever. It's a huge deal.

How the math actually works

Your pension isn't a random number. It's a formula. And for Tier 4, that formula is incredibly generous if you put in the time. Basically, the system looks at your Final Average Salary (FAS).

In 2026, this is still calculated using your three highest consecutive years of earnings. There are some caps—you can't usually have one year spike more than 10% over the average of the previous two—but it’s still a solid base.

- If you have less than 20 years: You get 1.66% of your FAS for every year.

- If you have between 20 and 30 years: The multiplier jumps to 2% per year.

- If you hit 30 years: You get 60% of your salary for life.

- Beyond 30 years: They add another 1.5% for every extra year.

So, if you retire with 32 years of service, you’re looking at 63% of your best three-year average. Every single year. For the rest of your life.

Can you leave early?

This is where people get tripped up. The "normal" retirement age for Tier 4 is 62. If you wait until 62, you get your full benefit regardless of how many years you worked (as long as you’re vested with 5 years).

But New York has this famous "30-year rule." If you have 30 years of service credit, you can retire as early as age 55 with zero penalties.

What if you have 20 years and want to bail at 55? You can, but it’s gonna cost you. The state will permanently slash your monthly check by about 27%. That’s a massive haircut. Honestly, unless you have a high-paying second career lined up or a very comfortable lifestyle, taking that hit is usually a bad move.

The COLA Factor

New York's pension system has a Cost-of-Living Adjustment (COLA). It’s not a full inflation match—don't get your hopes up—but it helps.

For the 2025-2026 period, the COLA was set at 1.2%. It only applies to the first $18,000 of your pension, and you have to meet certain age requirements (usually age 62 and retired for five years, or age 55 and retired for ten). It's a small check, maybe an extra $18 or $20 a month, but over twenty years of retirement, those small bumps stack up.

The "Secret" 55/25 Plan

There’s a bit of a weird wrinkle called the 55/25 program. Some members, particularly in New York City or specific titles, opted into plans that allowed them to retire at 55 with only 25 years of service.

✨ Don't miss: What’s Actually Going on at 2150 S Canalport Ave Chicago IL 60608

The catch? They usually had to pay an extra percentage of their salary (often 1.85% or more) for their entire career. If you’re in this plan, you didn't get the "stop paying after 10 years" perk. You traded that cash for the ability to leave earlier. You've got to check your specific member profile on Retirement Online to see if you're in one of these "special" plans.

What about sick leave?

Don't burn all those sick days if you don't have to. Most New York state tier 4 retirement members can trade in unused sick leave for extra service credit.

Usually, you can get credit for up to 165 days (or 200 for some state employees). This doesn't increase your Final Average Salary, but it does add to your total years of service. If you're at 29.5 years and you've got six months of sick time saved up, that could be the bridge that gets you to the 30-year mark and a penalty-free retirement.

Real talk: The Tier 6 Envy

There is a lot of talk in the legislature lately about "fixing" Tier 6 because the gap between Tier 4 and Tier 6 is so wide. As of early 2026, bills like S7825 have been floated to try and make the newer tiers look more like Tier 4. Why? Because the state is having a hard time hiring.

When a Tier 4 nurse and a Tier 6 nurse sit next to each other, the Tier 4 nurse is taking home more money every week and retiring years earlier with a bigger check. It’s a major point of friction in unions like NYSUT and PEF.

👉 See also: Are There Going To Be Stimulus Checks: The Truth About The 2,000 Dollar Payout

Actionable Steps for Tier 4 Members

- Log into Retirement Online: This is the NYSLRS portal. Do not guess your years of service. The system will tell you exactly how much credit you have down to the decimal point.

- Check your "Death Benefit" beneficiary: People forget this. If you haven't looked at this since you were hired in 1995, your ex-spouse or a deceased relative might still be listed. Fix it.

- Run a Projection: Use the calculator to see the difference between retiring at 60 versus 62. Sometimes those two extra years add $500 or more to your monthly check for the rest of your life.

- Verify your military service: If you served in the military, you might be able to buy back up to three years of service credit. For Tier 4, this is almost always worth the cost because it can push you into that 2% multiplier bracket or help you hit the 30-year milestone early.

- Look at your 457(b): The pension is great, but it’s only one leg of the stool. In 2026, the IRS limit for the New York State Deferred Compensation Plan is $24,500 (plus catch-up contributions if you're over 50). Maximizing this now will make your "pension life" much more luxurious.

Tier 4 is a relic of a time when the state was more generous with its benefits. If you're in it, you're in a great spot, but you still need to know the rules to make sure you aren't leaving money on the table when you finally hand in those keys.