You’ve probably seen the headlines lately. There’s a lot of chatter about the "new pension scheme" and how it’s basically taking over the conversation from the National Pension System (NPS) we've known for years. Honestly, the terminology alone is enough to give anyone a headache. Some people use these names interchangeably, but as of early 2026, there’s a massive distinction that could change how you retire.

It’s personal.

Most of us aren’t just looking for a tax break. We want to know that at 65, we aren't eating through our savings faster than we can replenish them. The recent introduction of the Unified Pension Scheme (UPS) has shifted the goalposts for millions, especially those in the government sector.

The Confusion Between the New Pension Scheme and National Pension Scheme

Let’s clear something up right away. Historically, people called the National Pension System the "New Pension Scheme" because it replaced the old fixed-pension world back in 2004. But today, when people search for the "new pension scheme," they are often actually looking for details on the Unified Pension Scheme (UPS), which was greenlit in August 2024 and officially kicked off its implementation phase for the 2025-26 fiscal year.

Basically, the National Pension Scheme is market-linked. You put money in, it grows (hopefully) with the stock and bond markets, and you take out whatever the pot holds at the end. The actual new kid on the block, the UPS, tries to bring back that old-school "guaranteed" feeling while keeping the contribution model of the NPS.

📖 Related: Converting 26 billion won to usd: Why that number keeps popping up in the news

It’s a hybrid. A middle ground.

If you're a central government employee, you’re likely standing at a crossroads. You’ve been told you can stick with the National Pension Scheme or jump ship to this new arrangement. It’s not a small choice. One path offers the potential for massive, market-driven wealth, while the other offers the quiet sleep-at-night security of a fixed check.

Why the National Pension Scheme Still Wins for Many

Don't count the NPS out just yet. While the UPS offers a "guaranteed" 50% of your last 12 months' average basic pay as pension, that guarantee comes with a trade-off. In the National Pension Scheme, you have control.

I’m talking about "Active Choice."

In the NPS, you can decide to put up to 75% of your money into equities. If you’re 25 or 30 years old, that kind of exposure to the Indian stock market over three decades can result in a corpus that dwarfs any "fixed" pension.

The 2026 Reality Check

As of January 2026, the PFRDA (the folks who run the NPS) have made things even more flexible. You can now stay invested until you’re 85. That’s a huge deal. It means if you don't need the money at 60, you can let it keep compounding.

Moreover, they’ve introduced the Systematic Unit Redemption (SUR). Think of it like a Systematic Withdrawal Plan in a mutual fund. Instead of being forced to buy a massive annuity that pays a measly 5% or 6% interest, you can slowly bleed your corpus while the rest stays invested in the market.

- Lump Sum: You can still pull out 60% of your total wealth tax-free.

- Annuity: Only 40% needs to go into a monthly pension (and for some, that's now been lowered to 20% if the corpus is smaller).

- Tax Breaks: You still get that extra ₹50,000 deduction under Section 80CCD(1B), which is over and above the usual 80C limit.

What's the Catch with the New Unified Pension Scheme?

The new pension scheme (UPS) isn't just free money. It requires a 10% contribution from the employee, just like the NPS. The government, however, has upped its game, contributing 18.5% to the fund (compared to the 14% they contribute in the NPS).

But here’s what most people miss: The UPS is currently a one-way street for most. The government has allowed a one-time switch in 2025-2026 for existing employees. If you choose the "guaranteed" route, you’re essentially handing over the "extra" returns the market might have generated in exchange for that 50% salary guarantee.

If the market does 12% annually for the next 20 years, an NPS subscriber might end up with a pension that is actually 80% of their last salary. The UPS subscriber? They’re stuck at 50%.

On the flip side, if the market crashes right when you retire—a nightmare scenario for many—the NPS subscriber is in trouble. The UPS subscriber doesn't care. Their check stays the same.

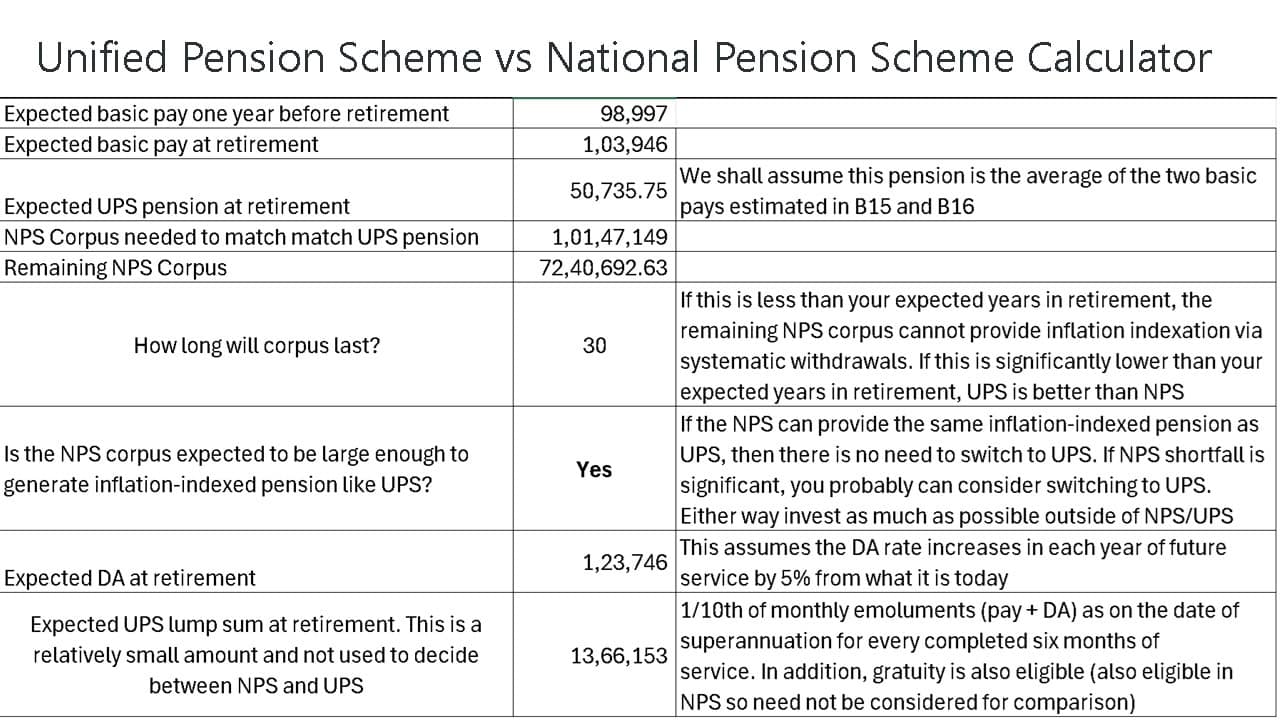

Comparing the Numbers: NPS vs. UPS

| Feature | National Pension Scheme (NPS) | Unified Pension Scheme (UPS) |

|---|---|---|

| Nature | Market-linked (Variable) | Fixed/Guaranteed (Predictable) |

| Pension Amount | Depends on corpus & annuity rates | 50% of last 12 months' avg basic pay |

| Risk | You carry the market risk | Government carries the market risk |

| Lump Sum | 60% of corpus at retirement | Separate lump sum (1/10th of pay per 6 months service) |

| Inflation Protection | No (unless you buy specific annuities) | Yes (linked to Dearness Relief) |

| Family Pension | Based on remaining annuity | 60% of retiree's pension |

The "Vatsalya" Factor: Pensions for Kids?

Something else that's actually new in the National Pension Scheme world is NPS Vatsalya.

It’s basically a pension account for minors. Parents can start a retirement fund for their kids when they are toddlers. By the time that kid turns 18, the account converts to a regular NPS Tier-I account. Because of the "power of compounding" (that old cliché that actually works), even a small monthly contribution of ₹1,000 can turn into a staggering amount by the time that child reaches 60.

Just this month, in January 2026, the rules were tweaked to allow parents to withdraw up to 25% for the kid's education after just three years. It’s becoming less of a "lock-box" and more of a flexible tool.

So, Which One Should You Actually Choose?

There is no "best" scheme. There is only the scheme that fits your blood pressure.

If you are 55 years old and the thought of the Sensex dropping 2,000 points makes you lose sleep, the new pension scheme (UPS) is probably your best friend. It offers dignity. It offers a minimum pension of ₹10,000 even for those with only 10 years of service. It’s safe.

But if you’re 28, working in tech or even in a government department, and you understand that India’s economy is likely to grow over the next few decades, the National Pension Scheme is hard to beat. The ability to choose your fund manager (like SBI, HDFC, or ICICI) and your asset mix (Equity vs. Corporate Bonds) gives you a level of wealth-building potential that a fixed pension just can't match.

The biggest mistake? Doing nothing.

Inflation in 2026 is still a reality. A ₹50,000 pension today might feel like a lot, but in twenty years, it might barely cover your electricity bill. The UPS handles this with Dearness Relief (DR), but the NPS handles this through growth.

📖 Related: How Much is Tesla Stock Worth: What Most People Get Wrong

Actionable Next Steps for Your Retirement

- Check your eligibility: If you're a private sector employee, the UPS isn't even an option for you. You are in the NPS camp, so focus on maximizing your equity allocation early.

- The One-Time Switch: Central government employees should look at their "Service Record." If you have 25+ years of service remaining, the math often favors NPS. If you have less than 10-15 years, the UPS guarantee is very attractive.

- Review your Tier-II account: Remember, NPS has a Tier-II account that acts like a savings account with no lock-in. If you want a place to park extra cash that isn't tied up until you're 60, use it.

- Tax Deadlines: We are in the middle of January. If you haven't exhausted your ₹50,000 extra deduction for the 2025-26 tax year, now is the time to dump that money into your NPS Tier-I account.

The landscape has changed. The days of "set it and forget it" are over. Whether you go with the market-heavy National Pension Scheme or the safety-first new pension scheme (UPS), ensure you’ve calculated your "real" requirement after adjusting for the 2026 cost of living. Your future self will thank you for being a bit of a nerd about this today.