Navigating the healthcare system in the Land of Enchantment can feel like trying to find a specific trail in the Gila Wilderness without a map. It's confusing. Honestly, with the recent shift to Turquoise Care, many people are staring at their computer screens wondering if they still qualify or if the rules just did a 180 on them.

You’ve probably heard whispers about new work requirements or income caps changing for 2026. Some of it is true; some of it is just noise. If you're looking for the bottom line on new mexico medicaid eligibility, you aren't just looking for a list of numbers. You're trying to figure out if your family can see a doctor without breaking the bank.

💡 You might also like: Finding a Normal Picture of a Labia: Why Reality Looks Different Than You Think

The Reality of Turquoise Care and Your Eligibility

First off, "Turquoise Care" is just the new fancy name for the Medicaid managed care program that kicked off in mid-2024 and is hitting its stride here in 2026. It didn't replace Medicaid; it just reorganized how you get your benefits through different insurance companies like Blue Cross Blue Shield or UnitedHealthcare.

But here is the kicker: eligibility still boils down to your "Category."

New Mexico is an expansion state. That’s good news. Basically, it means if you’re an adult between 19 and 64, you don’t necessarily need to have a disability or a child to get covered. You just need to fall under the income line.

The Income Numbers You Actually Need

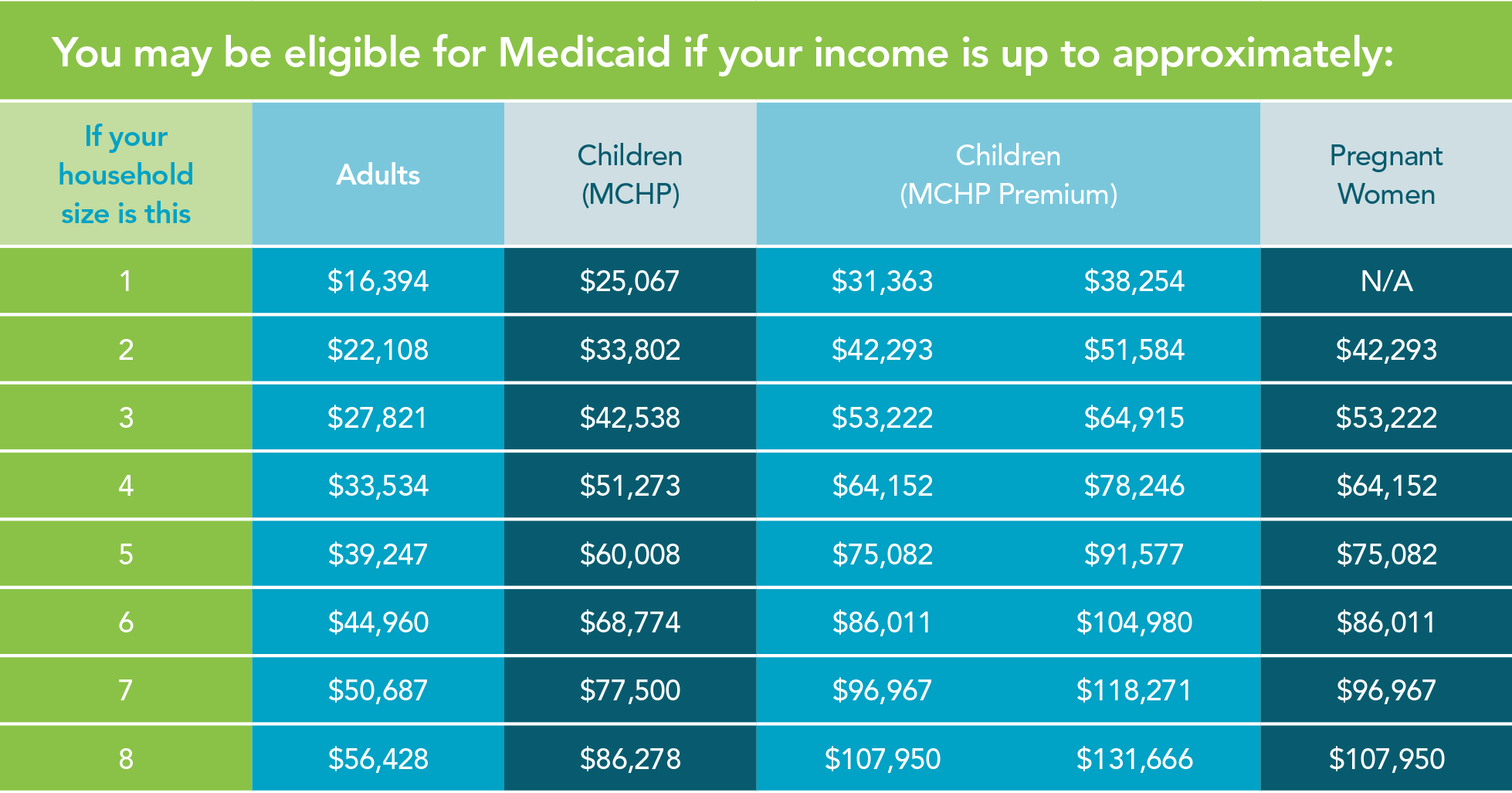

In 2026, the state uses the Federal Poverty Level (FPL) to decide who’s in and who’s out. Because of the way the math works, the "Adult" category (Category 100) generally covers you if your household income is at or below 133% of the FPL.

If you're a single person, that’s roughly around $1,600 to $1,700 a month, depending on the latest federal adjustments. If you're a family of four, you're looking at something closer to $3,400 or $3,500 a month.

Wait. There's a "5% disregard." This is a little-known rule where the state essentially ignores a small chunk of your income, effectively making the limit 138% of the FPL. It’s a tiny cushion that helps people who are right on the edge.

What Most People Get Wrong About Assets

I’ve had people tell me they can’t apply for Medicaid because they own a car or have a few thousand dollars in a savings account. For most New Mexicans applying under the "Expansion Adult" or "Parent" categories, there is no resource test. Read that again.

If you are 25 years old, working a part-time job, and you have $5,000 in the bank, the state doesn't care about that money for your eligibility. They only care about your monthly income.

The only time assets (like savings, stocks, or property that isn't your primary home) really come into play is if you are applying for:

- Long-term care (nursing homes).

- Aged, Blind, and Disabled (ABD) programs.

- Senior-specific waivers.

In those cases, the limit for a single person is usually around $2,000 in countable assets. But for the average person just trying to get health insurance? Your bank balance usually doesn't matter.

The 2026 Work Requirement "Ghost"

There is a lot of talk about the "One Big Beautiful Bill Act" and work requirements. Here is the deal: While federal discussions have pushed for work mandates (roughly 80 hours a month of work or school), these rules are often tied up in legal battles or scheduled for late 2026 and early 2027.

As of right now, most New Mexicans do not have to prove they are working to get Medicaid. However, the state is moving toward more frequent "eligibility reviews." Instead of once a year, some adults might see their status checked every six months starting in late 2026.

Keep your mail updated. If you move and don't tell the Human Services Department (HSD), they’ll send a renewal form to your old address, you won't see it, and you'll get dropped. It happens more than you’d think.

Families, Kids, and the "CHIP" Buffer

New Mexico is actually pretty generous when it comes to children. Even if you make too much for Medicaid, your kids probably still qualify for something.

Children under age 6 can live in households making up to 240% or even 300% of the FPL and still get coverage through the Children’s Health Insurance Program (CHIP). For a family of four, that could mean making over $90,000 a year and still getting the kids covered for very little cost.

Pregnancy is a Fast-Track

If you’re pregnant, the rules soften even more. Category 301 (Pregnancy Related Medicaid) allows for income up to 250% of the FPL. The state wants healthy babies, so they make it easier to get in the door. You don’t even need "medical proof" of pregnancy to start the application; a self-attestation is usually enough to get the ball rolling.

The Immigration Factor

This is a sensitive one. To get full Medicaid, you generally need to be a U.S. Citizen or an "eligible non-citizen" (like a Green Card holder who has been here for five years).

However, New Mexico has "Emergency Medical Services for Non-Citizens" (EMSNC). It covers life-threatening emergencies and labor/delivery for people who don't meet the citizenship requirements. Also, as of 2026, the state has been working on "Medicaid Forward," which aims to let more people buy into the system regardless of status, though that’s still rolling out in phases.

How to Actually Apply Without Losing Your Mind

You have three main paths.

- The YESNM Portal: This is the online way. It’s okay, but it can be glitchy.

- The Phone: 1-800-283-4465. Prepare to wait on hold. Bring a book.

- In-Person: Walking into an Income Support Division (ISD) office. This is actually the best way if your case is complicated (like if you’re self-employed).

A Pro-Tip for the Self-Employed: Don't just give them your gross income. Medicaid looks at your Modified Adjusted Gross Income (MAGI). This means you can deduct business expenses first. If you made $3,000 last month but spent $1,000 on supplies, your income for Medicaid is $2,000.

What to Do If You Get Denied

Don't panic. If your income is just a hair over the limit, your application is supposed to be automatically sent to BeWellnm, the state’s insurance marketplace.

In 2026, New Mexico has some of the best "premium assistance" in the country. Many people who "make too much" for Medicaid end up with a Turquoise Plan on the marketplace that costs $0 or maybe $20 a month because the state chips in to cover the difference.

🔗 Read more: Pictures of Ant Bites on Skin: What They Actually Look Like and How to Tell Them Apart

Actionable Steps to Take Today

- Check your "Budget Group": Medicaid counts the people you include on your tax return. If you live with a boyfriend/girlfriend but file taxes separately, their income usually doesn't count against you.

- Gather 30 days of pay stubs: If your income varies (like waitressing or construction), provide a full month to show the average.

- Update your address: Use the YESNM chat tool to make sure they have your current cell number and email. Digital notifications are way harder to lose than a paper envelope.

- Look for "Presumptive Eligibility": If you have an urgent medical need right now, many hospitals in Albuquerque, Las Cruces, and Santa Fe can grant you temporary Medicaid on the spot while your full application processes.

New Mexico Medicaid eligibility isn't a "one and done" thing. It’s a snapshot of your life right now. If your hours get cut tomorrow, you might be eligible by Wednesday. Stay on top of the paperwork, and don't assume a "no" today means a "no" forever.