Netflix doesn't usually do "surprises" when it comes to the calendar. If you were looking for the netflix earnings date october 2025, it landed exactly when the seasoned pros expected: Tuesday, October 21. But while the date was predictable, the numbers inside that Q3 report were anything but boring.

Wall Street was ready for a victory lap. Instead, they got hit with a $619 million bill from Brazil that nobody saw coming.

Honestly, it’s kinda wild how one legal ruling in South America can ripple through a global giant's balance sheet. Netflix is a massive machine. It has over 300 million subscribers now. Yet, even with that scale, a sudden tax expense can still knock the wind out of an earnings call.

What Actually Happened on October 21?

When the clock hit 1:01 p.m. Pacific Time on that Tuesday, the shareholder letter dropped. Most people go straight for the "subs" number. But remember, Netflix told us back in early 2025 that they were going to stop focusing on quarterly member counts. They want us looking at the money now.

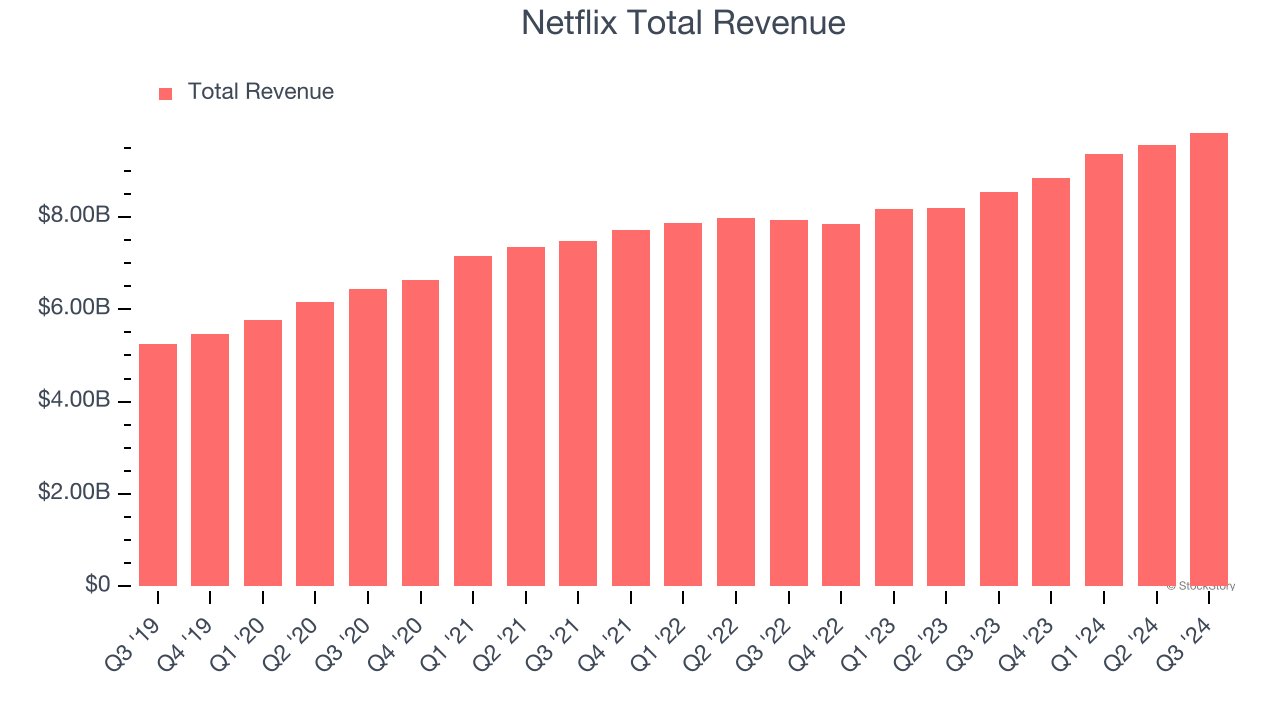

Revenue looked great. They pulled in $11.51 billion. That’s a 17% jump from the year before. Basically, the strategy of cracking down on password sharing and pushing people toward the ad-supported tier is working like a charm.

🔗 Read more: Shangri-La Asia Interim Report 2024 PDF: What Most People Get Wrong

But then there was the EPS (earnings per share).

Analysts were expecting something in the range of $6.90 to $7.00. Netflix reported **$5.87**. That’s a massive miss. The reason? That Brazilian tax dispute. A Supreme Court ruling in Brazil essentially expanded what counts as taxable transactions, and Netflix had to cough up for three years' worth of backdated expenses all at once.

The Ad-Tier is the Real Story

Forget the tax glitch for a second. If you look at the actual business, the netflix earnings date october 2025 confirmed that the "Ad-supported" era is officially in full swing.

By May 2024, they had 40 million monthly active users on the ad plan. By the time this October report rolled around, that number had exploded to 94 million. That is a staggering growth rate. In markets where the ad tier exists, nearly 40% of all new signups are choosing the cheaper, ad-heavy version.

💡 You might also like: Private Credit News Today: Why the Golden Age is Getting a Reality Check

- Engagement: People are watching about 63 minutes a day on average.

- Content Slate: "Squid Game" Season 3 and "Wednesday" Season 2 were the heavy hitters mentioned in the report.

- Live Events: This was the quarter where the Canelo vs. Crawford fight proved Netflix could handle massive live sports audiences.

Investors were initially spooked by the tax hit, and the stock actually dropped about 10% the following day. It closed around $90 (after a mid-year split or correction, depending on which chart you're looking at). But the smart money noticed that without that one-time Brazil charge, the operating margin would have been 33%—shattering their own guidance of 31.5%.

Why October 2025 Felt Different

Usually, these calls are a bit of a snooze-fest unless there’s a big subscriber loss. This time, the vibe was about "monetization over membership."

Co-CEO Greg Peters basically said 2025 was the year the ads business had to "step up to the plate." They’ve been building their own internal ad-tech platform all year to stop relying so much on third parties. That means they get to keep more of the profit.

It’s a pivot. Netflix isn't just a library of movies anymore; it's a massive advertising billboard that happens to play Stranger Things in between the commercials.

📖 Related: Syrian Dinar to Dollar: Why Everyone Gets the Name (and the Rate) Wrong

Actionable Insights for Investors and Fans

If you're tracking the aftermath of the netflix earnings date october 2025, here is what you actually need to know for the months ahead:

Watch the Q4 Forecast: Management warned that spending would be higher in the final months of 2025. They are pouring money into live events (like the Christmas NFL games) and huge original releases. This means margins might look a bit thinner in the next report, which is scheduled for January 20, 2026.

The "Brazil Effect" is Over: This was a one-time adjustment. It doesn't change the long-term profitability of the company. Most analysts, like those at TD Cowen and Goldman Sachs, actually kept their "Buy" ratings even after the price dip, seeing it as a temporary discount on a strong company.

Content is Getting More Expensive: Netflix is moving into the "Big Event" phase. To keep those 94 million ad-tier users happy, they need content that can't be missed. That’s why you’re seeing more live sports and massive sequels.

If you're a subscriber, expect more "bundles" and maybe another slight price hike on the Premium (no-ad) plan. They want to make that ad-tier look as attractive as possible because, ironically, they make more money from you when you watch commercials than when you pay for the top-tier subscription.

The October 2025 report proved that while Netflix can still get tripped up by international legalities, its core engine—trading password-sharing "freeloaders" for ad-watching "customers"—is running at maximum efficiency. Keep an eye on the January 2026 report to see if the holiday NFL games actually moved the needle on ad revenue.