If you look at the U.S. Treasury’s official "Debt to the Penny" tracker right now, it feels like watching a fast-forwarded movie of a train wreck. The numbers just spin. Honestly, seeing national debt each year climb higher and higher is enough to make anyone want to shove their head in the sand. But here is the thing: everyone talks about the "cliff" we are supposedly falling off, yet the ground keeps staying under our feet. Why?

It isn't just about a big, scary number. It is about what that money is doing.

The federal government basically runs on a massive credit card that never gets canceled. Since the early 1900s, and especially after we went off the gold standard in the 70s, the "limit" has become more of a suggestion. We are currently sitting at over $34 trillion. That sounds fake. It is so large our brains can’t actually process it. But if you want to understand where we are going, you have to look at how we got here, year by fiscal year.

The Massive Surge in National Debt Each Year

Historically, the U.S. only really ramped up borrowing for two things: wars and depressions. After World War II, the debt-to-GDP ratio was huge—over 100%—but then we spent decades bringing that ratio down. We didn't necessarily pay off the debt; we just grew the economy so fast that the debt became a smaller piece of the pie.

Then came the 1980s.

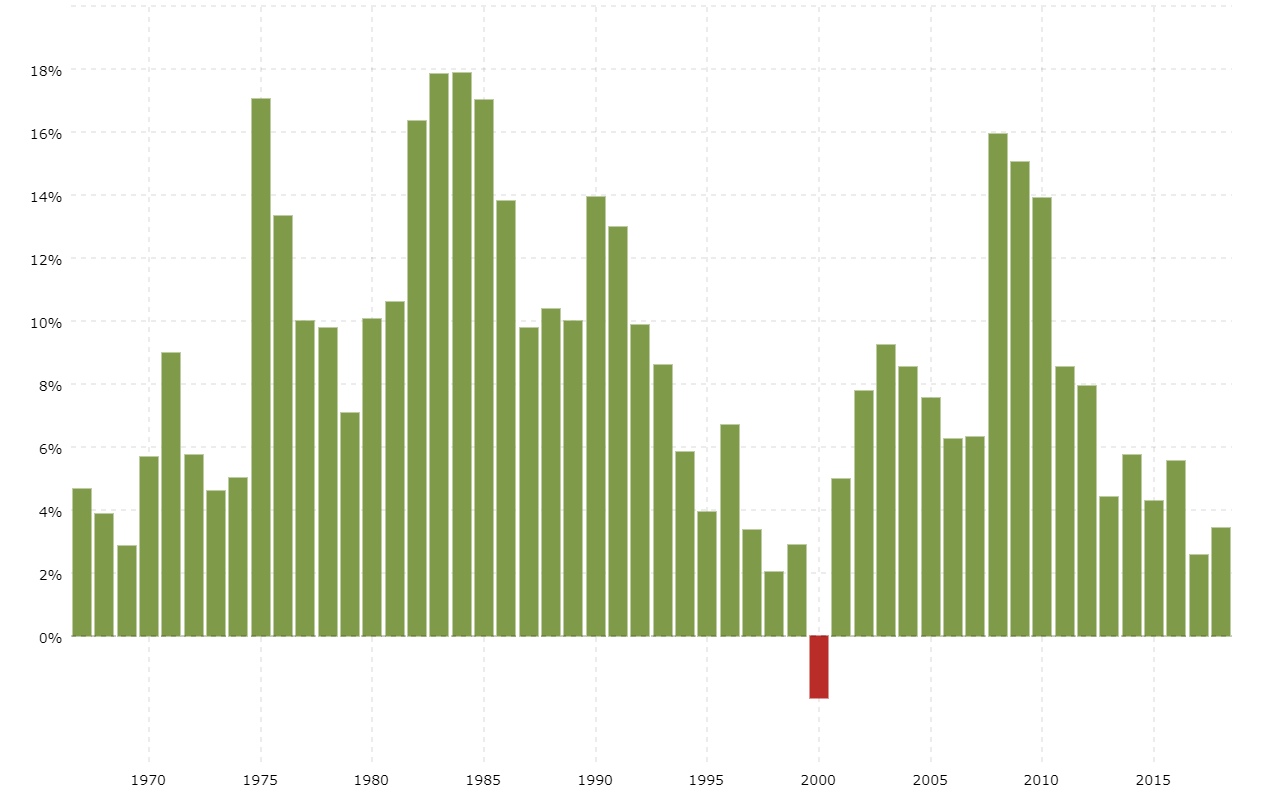

Under the Reagan administration, we saw a massive shift. Tax cuts combined with increased military spending meant the national debt each year started to balloon during peacetime. It was a new strategy. By the time the 90s rolled around, there was a brief, almost miraculous moment where we actually had a budget surplus under Clinton. People thought we might actually pay the whole thing off. Imagine that.

Then 2001 happened. Between the War on Terror, the 2008 financial crisis, and the massive tax cuts in 2017, the trajectory changed from a steady climb to a vertical launch.

Why the 2020s Changed Everything

When COVID-19 hit, the government didn't just borrow; it flooded the engine. In 2020 alone, the deficit—which is just the gap between what we spend and what we take in—hit $3.1 trillion. That is a single-year record.

When you add up the national debt each year since then, you see a pattern of "emergency" spending that never quite goes back to "normal." We are now in an era where trillion-dollar deficits are the baseline. Even the Congressional Budget Office (CBO) admits that the path we’re on is, in their words, "unsustainable." But "unsustainable" is a funny word in economics because things can stay unsustainable for a lot longer than you’d think.

Debt vs. GDP: The Only Metric That Actually Matters

If you have a $50,000 credit card debt and you make $20,000 a year, you are in big trouble. If you have $50,000 in debt but you make $500,000 a year, you’re doing fine. That is basically the relationship between the national debt each year and our Gross Domestic Product (GDP).

💡 You might also like: DC Housing Market Crash: What Most People Get Wrong

For a long time, economists like Kenneth Rogoff and Carmen Reinhart argued that once a country's debt-to-GDP ratio hits 90%, economic growth slows to a crawl. It was a huge talking point for years. However, other researchers later found some errors in their original spreadsheets, and more importantly, the U.S. has blown past that 90% mark and kept on chugging. We are currently well over 120%.

So, why hasn't the economy collapsed?

- The Dollar is King: Because the U.S. Dollar is the world's reserve currency, everyone wants our debt. It’s seen as the safest asset on Earth.

- Internal Ownership: A huge chunk of the debt isn't owed to China or Japan. It’s owed to us. The Social Security Trust Fund, private pension funds, and individual investors holding Treasury bonds own a massive slice.

- Inflation Dynamics: In a weird, dark way, inflation actually helps the government. If the dollar is worth less, the "real" value of the debt they have to pay back also goes down.

The Interest Rate Trap

This is where things get dicey. For a decade, interest rates were basically zero. Borrowing was "free." The government could add trillions to the national debt each year and the interest payments stayed manageable.

That changed when the Fed started hiking rates to fight inflation.

Now, we are hitting a point where the interest payments alone are starting to cost more than our entire defense budget. Think about that. We are spending more on "rent" for the money we already spent than we are on the actual military. That’s a massive "crowding out" effect. Every dollar spent on interest is a dollar not spent on infrastructure, education, or healthcare.

Real-World Consequences for Your Wallet

You might think the national debt each year doesn't affect your daily life. It feels like a DC problem. But it's actually a "your grocery bill" problem.

- Purchasing Power: To keep up with debt, the government can essentially "print" more money (through the Fed and Treasury mechanisms). More money chasing the same amount of goods equals higher prices.

- Tax Pressure: Eventually, the bill comes due. Whether it's through higher income taxes or new consumption taxes, the money has to come from somewhere.

- Interest Rates: When the government borrows heavily, it competes with you for loans. This can keep mortgage rates and car loan rates higher for longer.

Common Misconceptions About the National Debt

Many people think China could "call in" our debt and ruin us tomorrow. Honestly? They can’t.

Treasury bonds have fixed maturity dates. China can't just demand the money back early. If they tried to dump all their bonds at once, it would hurt them as much as us because the value of their remaining holdings would crater. It’s a "mutual assured destruction" situation, but for wallets.

Another myth is that we can just "cut waste and fraud" to fix the national debt each year. While there is plenty of waste, the reality is that the "Big Three"—Social Security, Medicare, and Interest—make up the vast majority of spending. You can't fix the debt by cutting some art grants or foreign aid. You have to touch the stuff that people actually vote for.

Actionable Steps to Protect Your Finances

The national debt isn't going away. It is a structural reality of the modern American economy. Since you can't control what Congress does, you have to control your own exposure.

- Diversify Away from the Dollar: Don't put everything in a standard savings account. Consider assets that tend to hold value when the currency devalues, like real estate, diversified stocks, or even small allocations of gold or Bitcoin.

- Lock in Fixed Rates: If you are looking at debt yourself, stay away from variable rates. If the government’s debt struggle keeps interest rates volatile, you don't want your mortgage or credit card jumping up alongside it.

- Max Out Tax-Advantaged Accounts: Use 401(k)s and IRAs now. If tax rates go up in the future to pay for the national debt each year, you’ll want as much of your growth shielded as possible.

- Stay Informed on the "Debt Ceiling": These political standoffs often cause short-term market dips. Don't panic sell when the news starts screaming about a default. The U.S. has never actually defaulted, and the political theater usually ends in a last-minute deal.

The reality of the national debt each year is that it’s a slow-moving tide, not a sudden tidal wave. It changes the landscape of the economy over decades. By understanding the relationship between spending, interest, and GDP, you can position yourself to stay dry even as the water rises.