You’re sitting there, scrolling, and you see it. That blur of red and white numbers spinning so fast they basically look like a solid line. It’s the US national debt. It just hit $38.43 trillion in January 2026. Honestly, that number is so big it doesn't even feel like real money anymore. It’s Monopoly money for giants.

A national debt clock app is one of those things you download, look at for three minutes in a cold sweat, and then hide in a folder on your phone next to your banking apps. But here’s the thing: most people don't actually know where those numbers come from or why they never seem to match between different apps.

💡 You might also like: Is TikTok China Owned: What Most People Get Wrong

Where do these apps actually get their data?

Most people think there’s a guy at the Treasury Department with a massive remote control updating a global scoreboard. Not quite.

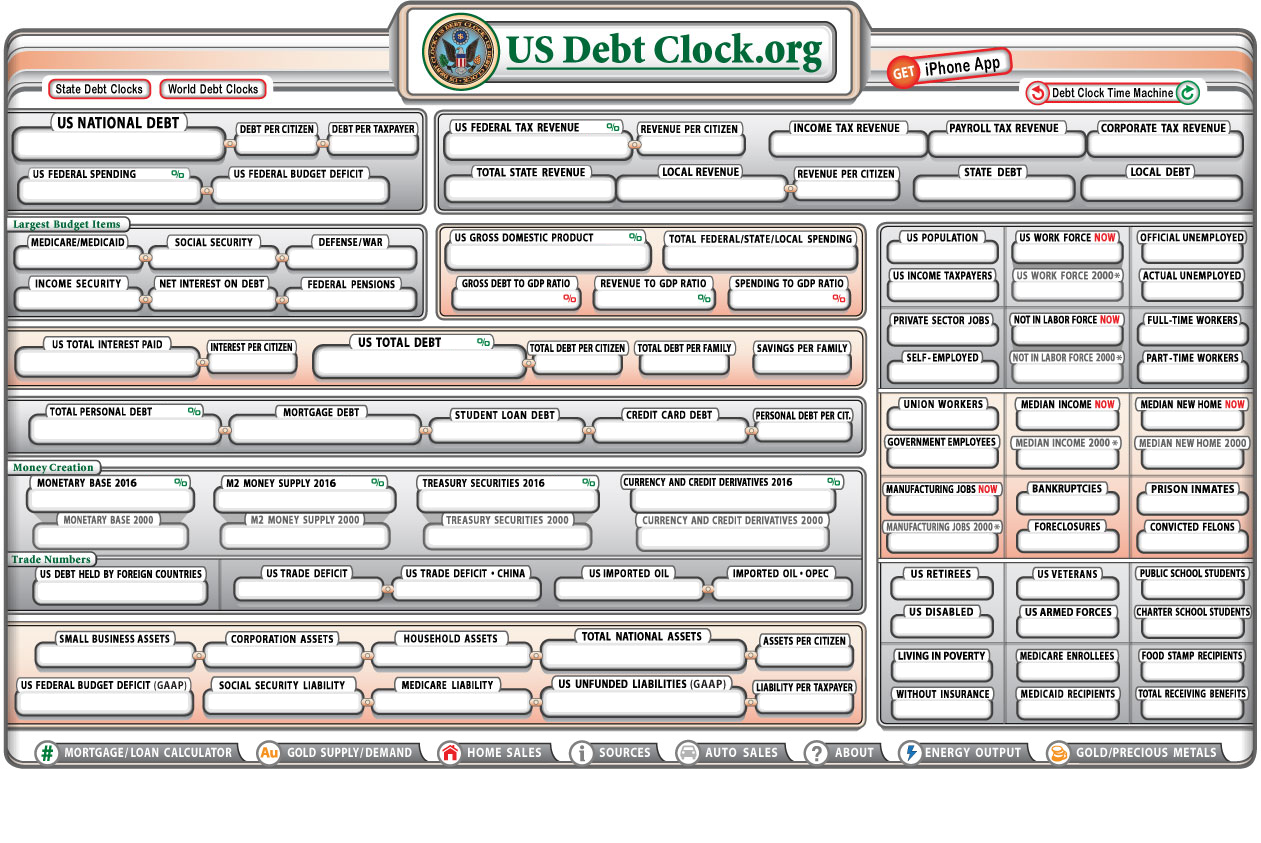

Almost every reputable national debt clock app—from "US Debt Now" to "US Debt Clock .org"—pulls its "official" data from the US Treasury's Fiscal Service. They specifically use a dataset called "Debt to the Penny." The Treasury updates this every business day.

But wait. If it only updates once a day, why is the app on your phone spinning in real-time?

It's an algorithm. Basically, the developers take the daily change—which has been averaging about $6.17 billion per day over the last year—and divide it down to the millisecond. The "spinning" you see is a mathematical projection. It’s an educated guess of what the debt is right now based on the pace of the previous 24 hours. It’s accurate in spirit, but if the government suddenly paid off a massive bond at 2:00 PM, your app wouldn't show it until the next day's Treasury dump.

👉 See also: Finding the Right Bose SoundLink Mini Charger Without Fried Circuits

Why your app might look different than your friend's

You’ve probably noticed that one app says $38.43 trillion and another says $30.81 trillion. No, one of them isn't "fake news." They’re just measuring different things.

- Gross National Debt: This is the big, scary $38 trillion number. It includes everything the government owes to outsiders plus what it owes to itself (like the Social Security Trust Fund).

- Debt Held by the Public: This is the $30.81 trillion figure. This is what we owe to individuals, corporations, and foreign governments. Economists usually care way more about this number because it’s the debt that actually affects interest rates and the "real" economy.

If your national debt clock app allows it, look for a toggle between these two. The "public" debt is the one that actually keeps the Fed up at night.

The Seymour Durst Legacy

We wouldn't even have these apps if it wasn't for a real estate guy named Seymour Durst. Back in 1989, he got so annoyed by the rising debt that he put up a physical clock near Times Square. He even sent out Christmas cards to Congressmen telling them exactly how much they owed.

✨ Don't miss: Why QQQQ Still Matters in High-Performance Computing

The first clock was a mechanical beast that had to be manually updated. When the debt dropped briefly in the late 90s, the clock actually started running backward. Then, when the debt hit $10 trillion in 2008, the clock ran out of digits. They had to jam a "1" in the spot where the dollar sign was.

Digital apps are just the modern version of Seymour’s public shaming tool. They’ve moved from a billboard in Manhattan to the pocket of every taxpayer.

What to look for in a debt tracking app

Don't just download the first thing that pops up. Some of these are just ad-farms. If you’re actually trying to track the fiscal health of the country in 2026, you want specific features.

- Debt per Citizen: This is the "ouch" factor. Currently, it’s about $112,966 per person. If the app doesn't break it down by household or person, it's just a big number without context.

- Debt-to-GDP Ratio: This is the real metric of "are we screwed?" In early 2026, we're hovering around 124%. For context, a ratio over 100% usually means a country is spending more than it’s producing.

- Interest Costs: This is the sleeper hit of scary stats. We are now spending about 30% of total federal spending just to maintain the debt we already have. That’s money not going to roads, schools, or the military.

How to use this info (without losing your mind)

It’s easy to get "doom-scrolly" with these apps. But use them as a tool. If you’re tracking the debt, watch the Daily Interest Rate feature. As interest rates on total marketable debt tick up (it was around 3.36% in late 2025), the speed of that clock is going to accelerate.

The real value of a national debt clock app isn't just watching the numbers fly by. It's using the "historical" tabs. Most good apps let you see the debt by President or by decade. Seeing how the debt spiked during the 2008 recession, the 2020 pandemic, and the current 2026 fiscal cycle provides perspective that a spinning number just can't.

If you want to get serious about tracking this, check out the US Treasury's Fiscal Data site directly or download a high-rated app like "National Debt - USA & World" which includes IMF data for comparison.

Actionable Next Steps:

- Check your app’s data source: Go to the "About" or "Info" section. If it doesn't mention the U.S. Treasury API or TreasuryDirect, delete it. It's probably using old or inaccurate projections.

- Look at the Interest Expense: Instead of the total debt, focus on the "Net Interest" figure. This is the immediate bill the taxpayer is paying. If that number is growing faster than the GDP, it’s a signal of long-term currency devaluation.

- Compare Global Debt: Download an app that shows the World Debt Clock. Seeing how the US stacks up against Japan (which has a much higher debt-to-GDP) or the Eurozone can help you understand if this is a "US problem" or a "global era of borrowing" problem.