Money is weird. Especially when you’re talking about trillions of dollars that technically don’t exist in a vault anywhere. If you’ve spent any time looking at a national debt chart by president, you’ve probably seen the same jagged line climbing toward the sky. It looks like a mountain range that never peaks. But here’s the thing: most of those viral charts you see on social media are kind of misleading.

They focus on "total debt" in raw dollars. That makes for a scary headline, but it’s a bit like comparing a $500 credit card bill for a college student to a $500 bill for Elon Musk. One is a crisis; the other is pocket change. To actually understand who "spent more," you have to look at debt as a percentage of the Gross Domestic Product (GDP). That’s how we measure what the country can actually afford.

💡 You might also like: Qatar and India Currency: What Most People Get Wrong About the Riyal-Rupee Link

Honestly, the history of American debt is a messy story of wars, tax cuts, and global pandemics. It isn't as simple as "this guy spent more than that guy."

Why the Raw Dollars on a National Debt Chart by President Lie to You

If you look at a standard bar graph, every president since the 1980s looks like a bigger spender than the one before. It's a ladder.

Ronald Reagan left office with about $2.7 trillion in debt. By the time Bill Clinton finished his two terms, it was up to $5.6 trillion. Fast forward to today, and we’re sitting at over $37 trillion in early 2026.

Does that mean Joe Biden or Donald Trump are "worse" at math than Reagan? Not necessarily. Inflation and the sheer size of the economy change the scale of the game every single year. A billion dollars in 1981 is roughly equivalent to over $3.4 billion today. If you don't adjust for that, the chart is basically useless for a fair comparison.

The Big Spenders and the Surprising Savers

Let’s get into the weeds. When you measure the percentage change or the debt-to-GDP ratio, the winners and losers change.

The Reagan and Bush Era (1981–1993)

Reagan is often called a fiscal conservative, but he actually oversaw one of the biggest debt explosions in history. He combined massive tax cuts with a huge buildup in military spending. During his eight years, the debt nearly tripled. It went from roughly 31% of GDP to about 49%.

His successor, George H.W. Bush, didn't have it any easier. He inherited a savings and loan crisis and a recession. By the time he left in 1993, the debt was climbing steadily.

The Clinton "Glitch" (1993–2001)

Bill Clinton is the only president in recent memory who actually saw the debt-to-GDP ratio go down significantly. It wasn't just him, of course—he had a tech boom and a Republican Congress that was obsessed with balanced budgets. By the end of his term, the U.S. was actually running a surplus. There was even talk back then about the national debt being completely paid off by 2010.

Obviously, that didn't happen.

The Post-9/11 Explosion (2001–2021)

George W. Bush took office just as the tech bubble burst and 9/11 happened. Between two wars in the Middle East, the 2001 tax cuts, and the 2008 financial crisis, the debt took off like a rocket.

Then came Barack Obama. He inherited the Great Recession, which meant tax revenues cratered while spending on the "safety net" and stimulus packages shot up. He added about $8.3 trillion in raw debt, though a lot of that was baked in before he even touched the Resolute Desk.

📖 Related: UK Pounds to Philippine Peso: Why the 80 PHP Mark Matters Right Now

The Modern Era: Trump, Biden, and the Pandemic

Donald Trump's term saw two distinct phases. Before 2020, the debt was growing due to the 2017 Tax Cuts and Jobs Act. Then COVID-19 hit. The government threw roughly $3.6 trillion at the problem in a single year to keep the economy from collapsing.

By the time Joe Biden took over in 2021, the momentum was hard to stop. Between the American Rescue Plan and rising interest rates, the numbers kept climbing. As of early 2026, the federal deficit for the fiscal year is already hovering around $600 billion just for the first quarter.

Who is Actually Responsible for the Bill?

It's tempting to point at the guy in the Oval Office and say, "That's your fault." But the President doesn't actually hold the checkbook—Congress does.

Most of the spending on a national debt chart by president is "mandatory." That’s stuff like Social Security and Medicare. No president can just "stop" that spending without a massive act of Congress that would likely be political suicide.

Then you have interest. As of 2026, interest payments are one of the fastest-growing parts of the federal budget. We're paying interest on money we borrowed decades ago. It's a snowball effect.

Critical Factors That Influence the Chart:

- Recessions: When people lose jobs, they pay fewer taxes. The government also spends more on unemployment. It's a double whammy for the debt.

- Wars: Conflict is incredibly expensive. The wars in Iraq and Afghanistan added trillions over two decades.

- Interest Rates: When the Fed raises rates to fight inflation, the cost of "servicing" our debt goes up.

- Demographics: As Baby Boomers retire, Social Security and Medicare costs naturally rise. This happens regardless of who is president.

The 2026 Reality Check

We’ve reached a point where the national debt is roughly 100% of our GDP. In simple terms, we owe as much as the entire country produces in a year.

🔗 Read more: What Does Commercial Mean? Why Everyone Gets the Definition Wrong

Is that a disaster? Some economists say yes, warning of a "debt trap" where we eventually can't even pay the interest. Others say that as long as the U.S. dollar remains the world’s reserve currency, we can carry a much higher load than other countries.

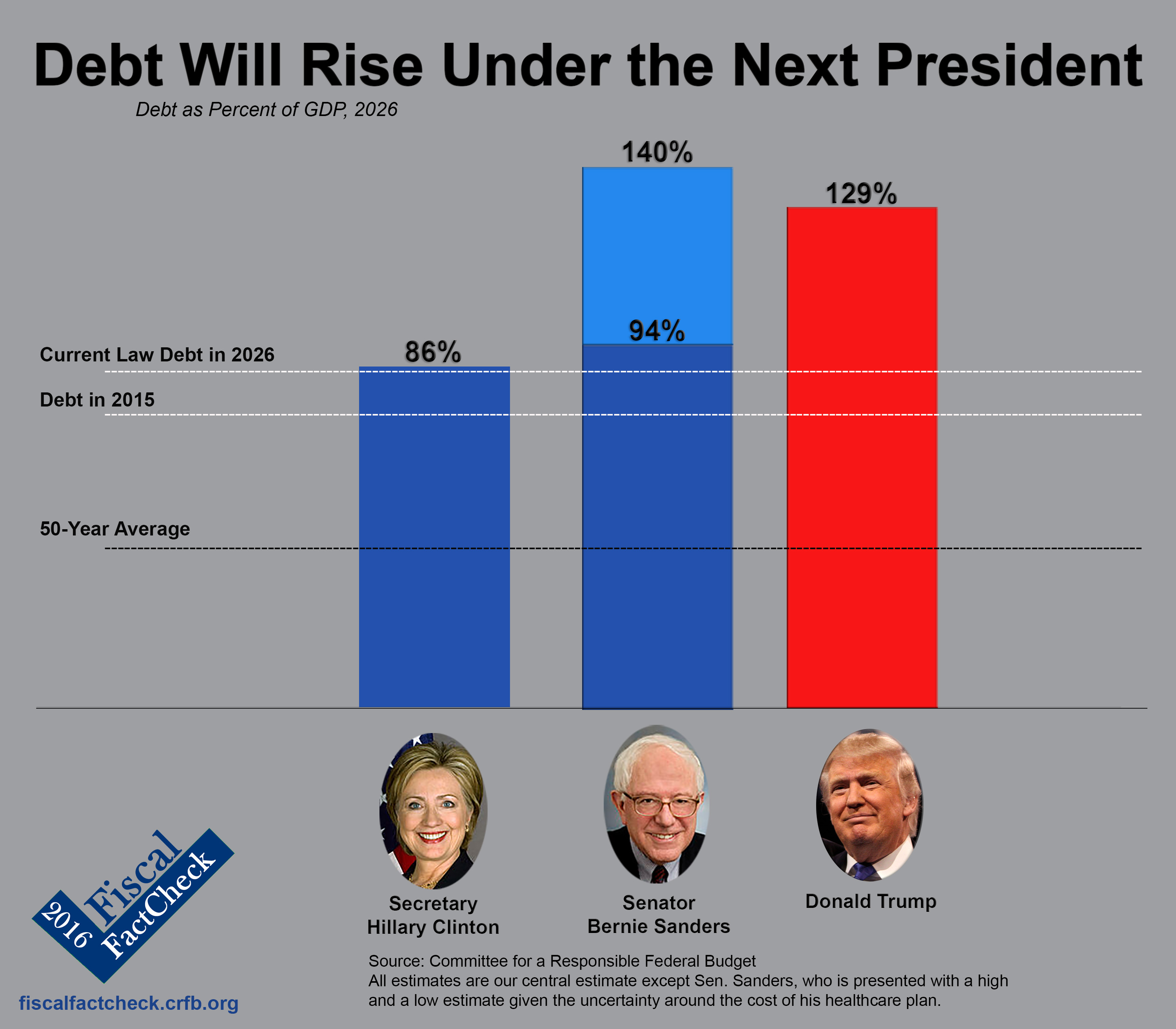

What's clear is that the current trajectory is steep. The CBO (Congressional Budget Office) projects that by 2035, we could hit a debt-to-GDP ratio of 118%.

How to Read a Debt Chart Like an Expert

Next time you see a national debt chart by president on your feed, ask yourself these three things:

- Is it adjusted for inflation? If not, it's just a chart showing that time passes.

- Is it shown as a % of GDP? This is the only way to see if the debt is actually outstripping our ability to pay it.

- What was the "inherited" deficit? A president's first year is almost entirely dictated by the budget passed by the previous administration.

The "Debt to the Penny" data from the Treasury Department is the gold standard if you want to track this yourself. They update it daily.

If you're looking to understand your own financial standing relative to the broader economy, start by checking the current Treasury Fiscal Data to see how interest rates are currently impacting federal outlays. You can also use a debt-to-income calculator for your personal finances to see if your own "household debt-to-GDP" is in a healthy range. Keeping an eye on the monthly Treasury statements will give you a much better "real-time" view than a static meme ever will.

Actionable Next Step: To get a truly accurate picture, visit the Congressional Budget Office (CBO) website and look for their "Budget and Economic Outlook" reports. These documents break down how much of the current debt is caused by new laws versus "automatic" spending, giving you a non-partisan view of which policies are actually driving the numbers.