If you look at a graph of national debt by president, you’ll probably feel a sudden urge to close your browser and go for a long walk. It’s a lot. As of early 2026, the total U.S. gross national debt has ballooned to roughly $38.43 trillion. That’s a number so large it basically loses all meaning to the human brain. To put it in perspective, that’s about $112,966 for every single person in the United States.

People love to point fingers. If you’re on Twitter (or X, whatever we’re calling it this week), you’ve seen the charts. One side blames the current guy. The other side posts a different chart blaming the last guy. Honestly, they’re both kinda right and kinda wrong.

The thing is, presidents don’t actually hold the checkbook. Congress does. But the president sets the agenda, signs the tax cuts, and leads us into (or out of) wars. So, if we’re going to look at how the debt stacks up by administration, we have to look at two things: the raw dollar amount and the percentage increase. They tell very different stories.

The Raw Dollar Climb: Why Recent Presidents Look "Worse"

If you just look at a raw dollar graph, the line looks like a terrifying roller coaster that only goes up. It starts as a gentle slope and then turns into a vertical wall around the year 2008.

Because of inflation and the sheer size of the modern economy, the most recent presidents will almost always "add the most" in terms of total dollars. It’s just math. A billion dollars in 1945 was a fortune; today, it’s what the government spends in a few hours.

As of January 2026, President Joe Biden holds the record for the largest dollar increase, adding approximately $8.5 trillion during his term. Right behind him is Donald Trump, who added about $7.8 trillion in his first four years. Barack Obama added $7.7 trillion over his eight-year tenure.

Wait. Why did the debt spike so hard recently?

Two words: The Pandemic.

When COVID-19 hit in 2020, the government essentially threw money at the economy to keep it from collapsing. We’re talking trillions in stimulus checks, PPP loans, and healthcare spending. That spending started under Trump and continued under Biden. It’s a huge reason why that graph of national debt by president looks so steep right now.

🔗 Read more: Another Name for Growth: Why the Word You Use Changes How You Lead

The Percentage Game: Who Actually Blew the Budget?

If you want to know who really shifted the needle, you have to look at the percentage increase. This is where the "Modern Greats" actually look a bit better, and some historical figures look like big spenders.

- Franklin D. Roosevelt (FDR): He’s the undisputed king of debt percentage. He took office during the Great Depression (The New Deal) and then had to fund World War II. The debt grew by over 1,000% during his time.

- Woodrow Wilson: Another war, another debt spike. Funding World War I caused a roughly 723% increase.

- Ronald Reagan: This is where the modern era of "peace-time" debt really started. Reagan’s mix of massive tax cuts and 35% increases in military spending saw the debt grow by about 186%.

- George W. Bush: Between two wars (Iraq and Afghanistan), the 2001 tax cuts, and the 2008 financial crisis, Bush II oversaw a 101% increase.

Compare that to Barack Obama, who saw a 70% increase, or Donald Trump’s first term at roughly 40%. When you look at it this way, the "scary" modern numbers are actually part of a trend that’s been decelerating in percentage terms, even if the dollar amounts are eye-watering.

Does the President Even Control This?

Kinda. Sorta. Not really.

There’s a massive lag in how this works. When a president takes office in January, they are actually operating under the previous guy’s budget for months. For instance, the fiscal year starts on October 1st.

So, when we look at the graph of national debt by president, the first year of any term is usually a carry-over. Plus, most of the spending is "automatic." Social Security, Medicare, and interest on the debt itself make up the vast majority of the budget. A president can’t just "stop" those without an act of Congress that would basically be political suicide.

Current data for 2026 shows that net interest on the debt is now the second-largest federal expense. We are literally paying over $1 trillion a year just in interest. That’s more than we spend on national defense. That is a massive, structural problem that no single president can fix with a pen stroke.

What Most People Miss: Debt-to-GDP

If you have a $10,000 credit card debt and you make $20,000 a year, you’re in trouble. If you make $200,000 a year, that debt is basically a rounding error.

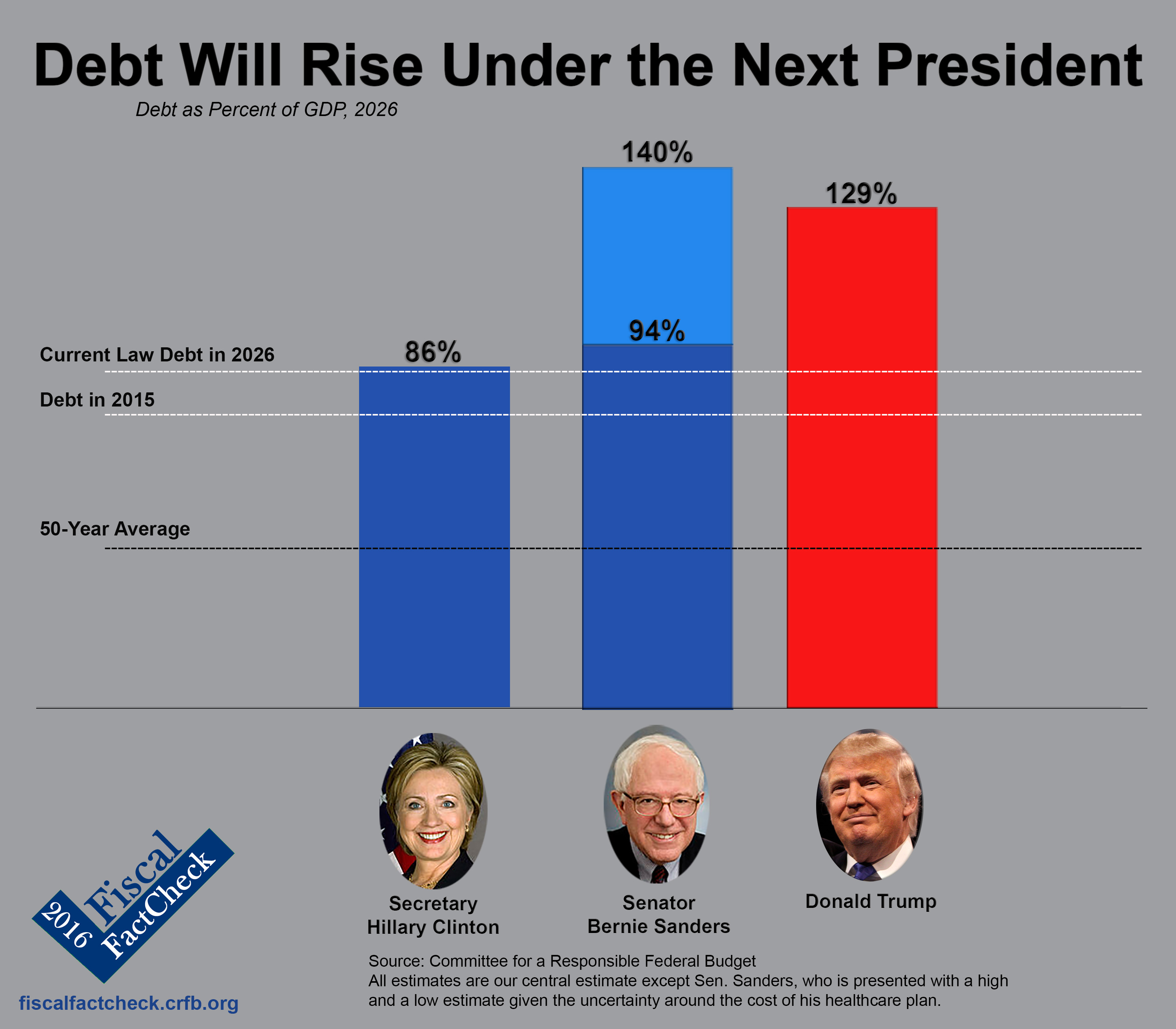

That’s why economists look at the Debt-to-GDP ratio. It measures the debt against the size of the whole economy.

- 1946: We hit 118% (Post-WWII).

- 1974: We hit a low of about 24%.

- 2020: We spiked to 132% because of the pandemic.

- 2025/2026: We are hovering around 124%.

When the ratio is over 100%, it means the country owes more than it produces in a year. Most experts agree this is the "danger zone" for long-term growth, but since the U.S. dollar is the world's reserve currency, we’ve been able to get away with it longer than most.

Actionable Insights: What This Means for You

Looking at a graph is fine for winning arguments at Thanksgiving, but it doesn't help your bank account. Here is the reality of the 2026 fiscal landscape:

✨ Don't miss: Pay TJX Bill Online: What Most People Get Wrong

- Expect "Sticky" Inflation: With the government printing/borrowing this much, the value of the dollar stays under pressure. Hard assets (real estate, certain stocks, or even gold) historically hold value better than cash in high-debt environments.

- Watch the Interest Rates: As the government competes to borrow money, it keeps a "floor" under interest rates. Don't expect the 3% mortgages of 2020 to come back anytime soon.

- Tax Volatility: Eventually, the bill comes due. Whether it's through direct tax hikes or "stealth" taxes (like letting credits expire), the government will need more revenue. Maximize your tax-advantaged accounts (401k, IRA, HSA) while current rates are still historically moderate.

- Diversify Nationally: If you’re worried about U.S. debt, look into international index funds. Spreading your risk across different economies is the only way to hedge against a potential U.S. credit downgrade.

The national debt isn't going to vanish. No matter who is in the Oval Office, the "graph of national debt by president" will likely continue its upward march. The best thing you can do is understand the "why" behind the numbers and position your own finances to be resilient regardless of who's signing the checks in D.C.