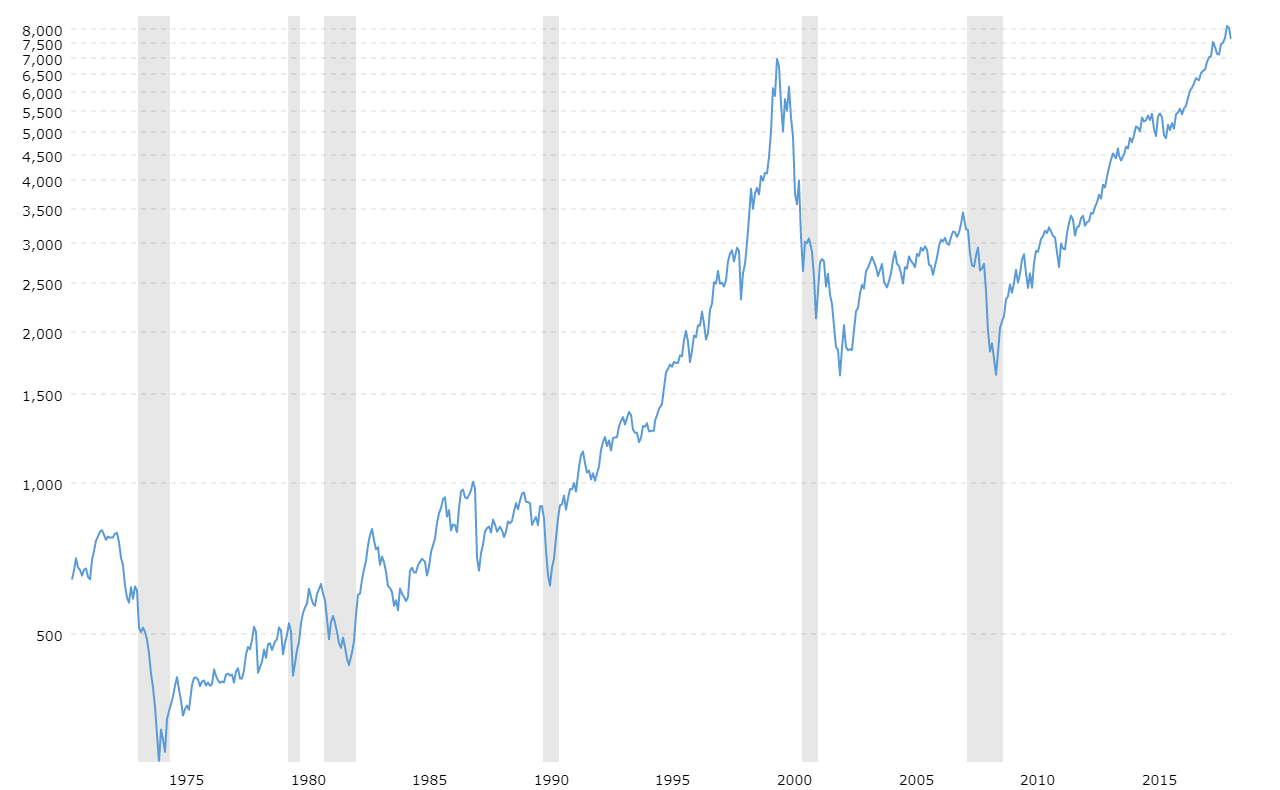

If you pull up a Nasdaq 10 year chart right now, you aren't just looking at a line moving from the bottom left to the top right. You’re looking at a decade-long psychological experiment. It’s a record of how we went from being cautious after the Great Recession to being completely obsessed with artificial intelligence and cloud computing. Honestly, the numbers are kind of staggering. If you’d dumped money into the Invesco QQQ Trust (which tracks the Nasdaq-100) back in early 2016, you’d be looking at a total return that makes traditional savings accounts look like a joke. But it wasn't a smooth ride. Not even close.

People love to talk about "the trend," but the trend has teeth.

The Nasdaq Composite and the Nasdaq-100 are heavy on tech, which means they are sensitive. Sensitive to interest rates, sensitive to what the Federal Reserve says, and sensitive to whether or not a handful of companies—the "Magnificent Seven"—had a good quarter. When you look at the chart over a ten-year horizon, you see the massive spike of the 2020-2021 pandemic era, the brutal "valuation reset" of 2022, and the AI-driven recovery that defined 2023 and 2024.

The Anatomy of the Nasdaq 10 Year Chart

Why does this specific timeframe matter? Ten years is usually the "sweet spot" for long-term investors to measure true growth versus market noise.

In 2014 and 2015, the Nasdaq was still finding its footing in a post-crisis world. We were worried about "taper tantrums" and whether the iPhone had peaked. Fast forward to today, and the index has essentially transformed. It's no longer just "internet stocks." It’s the backbone of global commerce.

Look at the slope. Between 2014 and early 2020, the growth was steady, almost predictable. Then, the COVID-19 crash happened in March 2020. It was a vertical drop. But look at what followed: an even sharper vertical climb. This "V-shape" recovery on the Nasdaq 10 year chart is perhaps the most famous part of the graph. It represents the moment the world realized that if we can't go outside, we have to live through our screens. Zoom, Amazon, and Microsoft became utilities, not just luxuries.

The 2022 Reality Check

You can't talk about the decade without talking about the dip. 2022 was a disaster for tech. As the Fed started hiking interest rates to fight inflation, the Nasdaq took a massive hit, dropping roughly 33% from its peak. This is a crucial lesson for anyone looking at a Nasdaq 10 year chart: growth isn't guaranteed.

When rates go up, the "present value" of future earnings goes down. Tech companies, which often trade on the promise of what they will earn in five years, get crushed in that environment.

But then came ChatGPT.

By late 2022 and early 2023, the narrative shifted from "tech is dead" to "AI is the new industrial revolution." NVIDIA, which was once just a company making chips for gamers, suddenly became one of the most valuable entities on the planet. This single-handedly pulled the index out of the mud. If you look at the chart today, that 2022 dip looks like a minor speed bump, even though it felt like the end of the world at the time.

Breaking Down the Heavy Hitters

The Nasdaq is top-heavy. This is a fact that catches a lot of people off guard. You might think you're "diversified" by owning a Nasdaq index fund, but you're actually heavily concentrated in a few names.

- Apple and Microsoft: These two usually fight for the top spot. They are the "ballast" of the index.

- Alphabet (Google) and Meta (Facebook): The kings of digital advertising.

- Amazon: The retail and cloud giant.

- NVIDIA and Tesla: The high-beta "growth" engines that drive the most volatility.

When these companies move, the whole chart moves. If NVIDIA has a bad earnings report, the Nasdaq 10 year chart shows a visible dent. It’s a weird dynamic where the "average" stock in the index might be doing okay, but if the top five are hurting, the whole index looks like it's in a bear market.

What Most People Get Wrong About Tech Volatility

There's this idea that tech is "risky." Well, it is. But "risk" is often just the price you pay for outperformance.

Over the last ten years, the Nasdaq has significantly outperformed the S&P 500. However, the drawdowns (the drops from the highs) are much deeper. You have to have a stomach for it. Most retail investors see a 20% drop and panic-sell. The Nasdaq 10 year chart proves that, historically, those who stayed the course were rewarded.

Think about the "dot-com bubble" of 2000. It took years to recover. People were terrified that 2022 was a repeat of that. But the difference is earnings. In 2000, companies were worth billions with zero profit. Today, companies like Microsoft and Apple are printing cash. They are some of the most profitable enterprises in human history. That’s why the recovery on the chart was so much faster this time around.

The Role of the Federal Reserve

You honestly can't understand the Nasdaq without understanding the Fed. Tech stocks love "easy money."

When interest rates are near zero, investors are willing to pay a premium for growth. This is what fueled the massive run from 2016 to 2021. When money is cheap, venture capital flows, companies borrow to expand, and stock buybacks run rampant.

But when the Fed gets "hawkish" (raises rates), the air comes out of the balloon.

If you're looking at a Nasdaq 10 year chart for future guidance, you have to keep one eye on inflation data. If inflation stays sticky, the Nasdaq might struggle to maintain its trajectory. If rates come down, it’s usually fuel for the fire.

Valuation Concerns: Are We in a Bubble?

This is the million-dollar question. Some analysts look at the current levels and see 1999 all over again. They point to the Price-to-Earnings (P/E) ratios and say they are unsustainable.

Others argue that we are in a "New Era."

They say that AI will increase productivity so much that these high valuations are actually justified. It’s a classic tug-of-war. The Nasdaq 10 year chart shows that we are currently at the higher end of historical valuations. It’s not "cheap" by any stretch of the imagination. But "expensive" doesn't mean it can't get more expensive.

Actionable Insights for the Next Decade

If you’re staring at the chart trying to figure out your next move, don't just look at the line. Look at the context. Here is how to actually use this information:

🔗 Read more: Why 919 3rd Ave NYC Still Dominates the Midtown East Skyline

1. Don't time the top.

Many people saw the 2021 peak and thought, "This is it, it's over." They missed the 2023-2024 rally. Instead of trying to find the perfect exit, consider "rebalancing." If tech has become 80% of your portfolio because of the Nasdaq's growth, maybe trim it back to 60%.

2. Watch the 200-day moving average.

For a more technical view, overlay the 200-day moving average on your Nasdaq 10 year chart. Historically, when the index stays above this line, the "bull" case is intact. When it breaks below and stays there, things get ugly fast.

3. Pay attention to "Earnings Quality."

The next ten years won't be like the last ten. The "easy money" era might be over. Look for companies that have actual free cash flow, not just "user growth" or "hype." The winners on the chart going forward will be those that can turn AI into actual dollars, not just PowerPoint slides.

4. Diversify beyond the "Big Seven."

The concentration risk in the Nasdaq is real. If you're nervous about the chart looking "too vertical," look into equal-weighted ETFs. These give every company in the index the same "vote," which can protect you if the giants like Apple or NVIDIA hit a wall.

The Nasdaq 10 year chart is a story of resilience and innovation, but it's also a warning that the market can take away your gains just as fast as it gave them to you. It’s a wild ride. But for those who understand the underlying drivers—rates, earnings, and tech cycles—it remains the most important chart in the financial world.

If you're serious about your portfolio, start by auditing your current exposure to the top 10 holdings of the Nasdaq-100. Check how much of your net worth is tied to just three or four companies. Then, set a "buy-in" or "sell" price based on the historical support levels you see on the long-term chart to take the emotion out of your trading.