If you’re staring at a currency converter trying to figure out why the Namibian currency to USD rate looks exactly like the South African Rand, don't worry. You aren't seeing double. It’s actually one of the most stable, albeit misunderstood, financial setups in Southern Africa.

Honestly, Namibia is a bit of a hidden gem for travelers and investors, but the money side? That gets confusing. The Namibian Dollar (NAD) is currently trading at roughly 16.39 NAD to 1 USD as of mid-January 2026. But that number moves. It breathes. It fluctuates because of things happening in Pretoria just as much as what's happening in Windhoek.

Basically, the Namibian Dollar is "pegged" to the South African Rand (ZAR) at a 1:1 ratio. If the Rand trips and falls against the Greenback, the Namibian Dollar goes down with it. It’s a package deal.

The Weird Reality of Two Currencies in One Pocket

When you land at Hosea Kutako International Airport, you’ll notice something immediately. You can pay for your biltong or your taxi with Namibian Dollars, sure. But you can also hand over a stack of South African Rand. Both are legal tender.

You’ve got a situation where two different countries’ currencies are used interchangeably at the exact same value. It’s part of the Common Monetary Area (CMA). This agreement includes Namibia, South Africa, Lesotho, and Eswatini.

🔗 Read more: Shangri-La Asia Interim Report 2024 PDF: What Most People Get Wrong

Why does this matter for the Namibian currency to USD exchange?

Because it means Namibia doesn't really have its own independent monetary policy in the way the U.S. or the UK does. When the Bank of Namibia (BoN) meets—like they are scheduled to do on February 18, 2026—they usually follow the lead of the South African Reserve Bank. They have to. If Namibia’s interest rates got too far out of sync with South Africa’s, money would start flowing across the border in ways that would break that 1:1 peg.

Current Rates and What’s Driving the 2026 Forecast

Right now, the exchange rate is hovering around 0.061 USD per 1 NAD.

If you’re planning a trip or moving money, you need to look at the macro picture. The African Development Bank recently pointed out that Namibia’s GDP growth is expected to hit about 3.9% in 2026. That’s not bad. In fact, it's a decent recovery from the sluggishness seen in 2024 when diamond prices took a nose-dive.

💡 You might also like: Private Credit News Today: Why the Golden Age is Getting a Reality Check

- Uranium is the hero: With global demand for nuclear energy spiking, Namibia's uranium mines are working overtime. This brings in foreign currency, which helps stabilize the local economy.

- The Diamond Slump: On the flip side, lab-grown diamonds are still eating the lunch of natural diamond miners. Since diamonds are a huge export for Namibia, this puts downward pressure on the currency.

- The Fed Factor: Never forget that the "USD" half of the Namibian currency to USD equation is just as volatile. If the U.S. Federal Reserve keeps interest rates high to fight inflation, the USD stays strong, making the Namibian Dollar feel "weaker" by comparison.

A History of "The Kalahar" (The Currency That Almost Was)

Namibia didn't always have the "Dollar." After gaining independence from South Africa in 1990, the government spent a few years deciding what to call their new money.

Did you know it was almost called the "Kalahar"?

They even printed sample notes with the name "Kalahar" on them, referencing the Kalahari Desert. Eventually, they settled on the Namibian Dollar, which officially hit the streets in 1993. Even then, they kept the Rand as a backup. It was a smart move. It gave international investors confidence that the new country wouldn't just print money into oblivion.

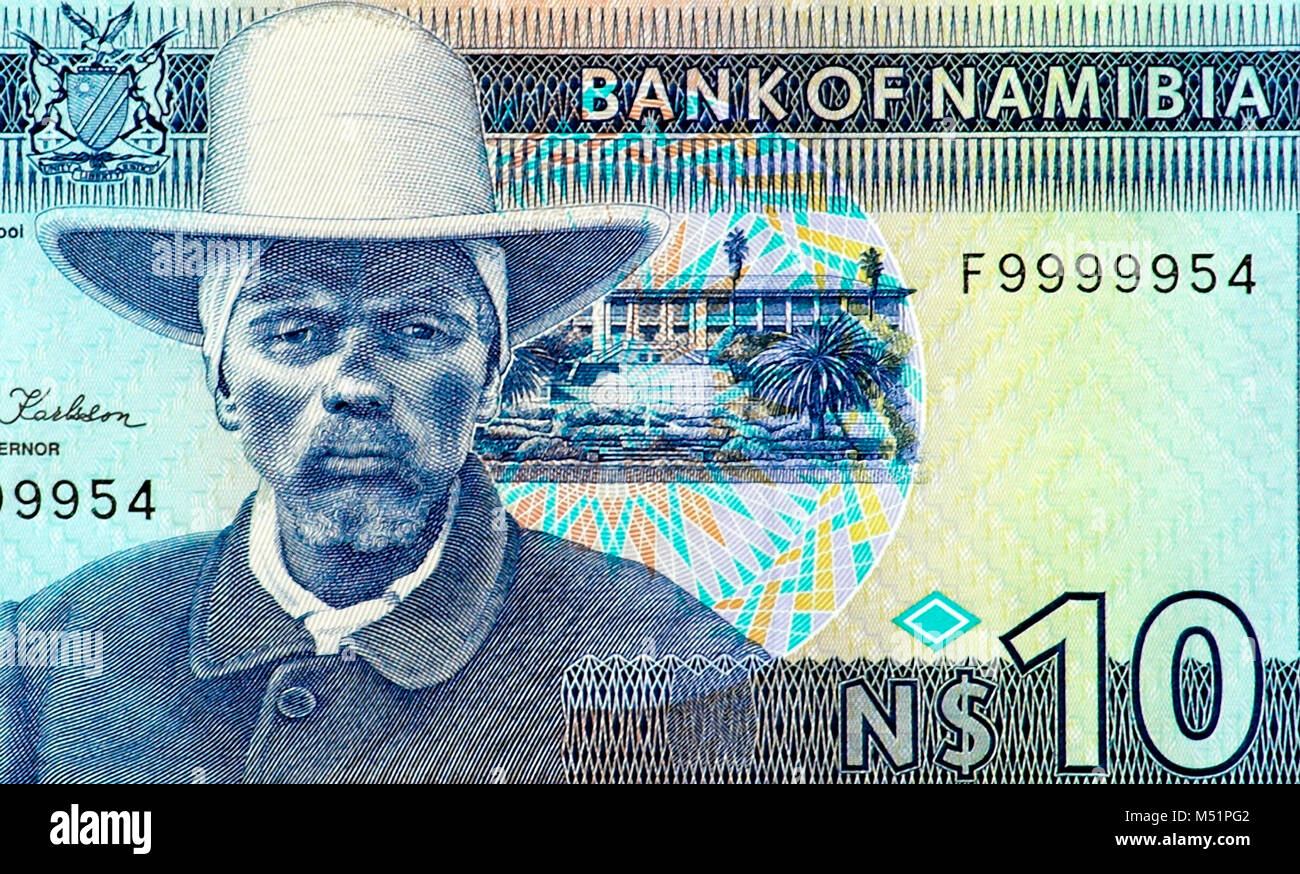

Today, the notes feature the face of Kaptein Hendrik Witbooi, a legendary Nama leader, and Sam Nujoma, the founding president. The 30-dollar polymer note issued a few years back is actually a bit of a collector's item now—it commemorates three decades of peace and the transition between three presidents.

📖 Related: Syrian Dinar to Dollar: Why Everyone Gets the Name (and the Rate) Wrong

What Most People Get Wrong About Converting NAD to USD

The biggest mistake travelers make is trying to trade Namibian Dollars outside of Southern Africa.

Listen: If you are at JFK airport in New York or Heathrow in London, many currency booths won't even touch the Namibian Dollar. Or, if they do, they’ll give you a predatory rate.

Pro tip: If you have leftover cash at the end of your trip, convert it to South African Rand before you leave Africa. The Rand is much easier to exchange globally. Since they are 1:1, you aren't losing any value in the swap.

Actionable Insights for 2026

If you're watching the Namibian currency to USD rate for business or travel, here’s what you actually need to do:

- Watch the SARB, not just the BoN: The South African Reserve Bank is the real tail wagging the Namibian dog. If South Africa’s inflation spikes, the Namibian Dollar will likely weaken against the USD.

- Use Credit Cards for the Mid-Market Rate: Don't bother with physical exchange bureaus in malls. Use a card with no foreign transaction fees (like a travel-specific Visa or Mastercard) to get as close to the interbank rate as possible.

- Hedge your Uranium bets: If you’re an investor, keep an eye on the Husab and Rössing uranium mines. Their output is one of the biggest "real" supports for the currency's value right now.

- Exchange at the Border: If you are driving from South Africa into Namibia, don't sweat the currency. Just use your Rand. But if you're going the other way, spend your Namibian Dollars first. You can't easily use them in Cape Town or Joburg.

The outlook for 2026 is one of "cautious optimism." Inflation in Namibia is expected to stay around 3.8%, which is relatively low for the region. This stability makes the Namibian Dollar a reliable currency within the CMA, even if it remains at the mercy of the mighty U.S. Dollar on the global stage.