You're probably putting it off. Most of us do. Logging into a federal website sounds about as fun as a root canal, but here’s the thing: my social security gov online services are actually the only way to make sure the government isn't messing up your future paycheck.

It’s weirdly personal.

Think about it. Every single job you’ve ever had, every weird side hustle where you actually paid taxes, and every grueling double shift is recorded there. If the Social Security Administration (SSA) has a typo in your 2014 earnings, you lose money. It is that simple.

The Statement is a Living Document (Sorta)

Most people think the "Social Security Statement" is something that arrives in the mail once a year. Honestly? That stopped being the norm ages ago. Now, it just sits there in the cloud. You’ve got to go get it. When you log into your account, the first thing you see is your estimated monthly benefit. It’s a trip to see that number.

But don't just look at the big number and log out.

The real meat is in the earnings record. This is a year-by-year breakdown of your taxed earnings. If you see a zero for a year you know you worked your tail off, you have a problem. Fixing an earnings error ten years after the fact is a nightmare involving dusty W-2s and stubborn bureaucracy. Doing it now? Much easier.

Why You Need an Account Before Someone Else Grabs It

This is the part that actually matters for security. There’s this persistent problem where scammers use stolen data—from those massive corporate hacks we hear about every week—to open accounts in other people’s names.

💡 You might also like: Cooper City FL Zip Codes: What Moving Here Is Actually Like

If you haven't claimed your my social security gov online services portal, a fraudster potentially can.

By creating your account today, you basically "lock" your Social Security number to your specific email and identity. It’s a defensive move. The SSA recently migrated to using Login.gov and ID.me for authentication. It’s a bit of a hurdle to get through the identity verification—you might have to take a selfie with your driver's license—but it beats having someone else divert your future checks to a prepaid debit card in another state.

The Retirement Calculator is Brutally Honest

There’s a tool inside the portal that lets you toggle your retirement age.

It shows you the difference between taking benefits at 62 versus waiting until 70. The jump is massive. Usually, it’s about an 8% increase for every year you wait past your full retirement age. Seeing those bars move on a graph makes it feel way more real than reading a pamphlet in a doctor’s office. You can even input your expected future salary to see how a promotion might bump your check.

Medicare and the Paperwork You Didn’t Know You Needed

Once you hit 64 and nine months, this website becomes your best friend. Applying for Medicare Part A and Part B happens right here. No lines. No holding on the phone for 45 minutes listening to MIDI music.

You can also:

📖 Related: Why People That Died on Their Birthday Are More Common Than You Think

- Request a replacement Social Security card (in most states).

- Check the status of a pending application.

- Get an instant "Benefit Verification Letter" which you need for loans or housing.

- Change your direct deposit info without talking to a human.

It’s basically a self-service kiosk for your entire financial relationship with the U.S. government.

What Happens if You’re Already Getting Benefits?

If you're already retired or on disability (SSDI), the portal changes. It stops being about "what if" and starts being about management. You can get your 1099-Social Security form for tax season instantly. No waiting for the mailman.

If you move, you change your address in the portal and it updates across the system. It’s one of the few parts of the government that actually feels like it's caught up to the 21st century. Sorta. It still goes down for maintenance on Sunday nights, which is peak "government website" energy, but the core functionality is solid.

The Identity Theft Reality Check

If you’ve ever lost your wallet, you know that cold spike of adrenaline. The portal has a specific section for reporting if your number is being misused. While the SSA doesn't "fix" credit, they can put blocks on your electronic record so no one can change your info without a physical appearance at an office. That’s a massive peace of mind feature people ignore.

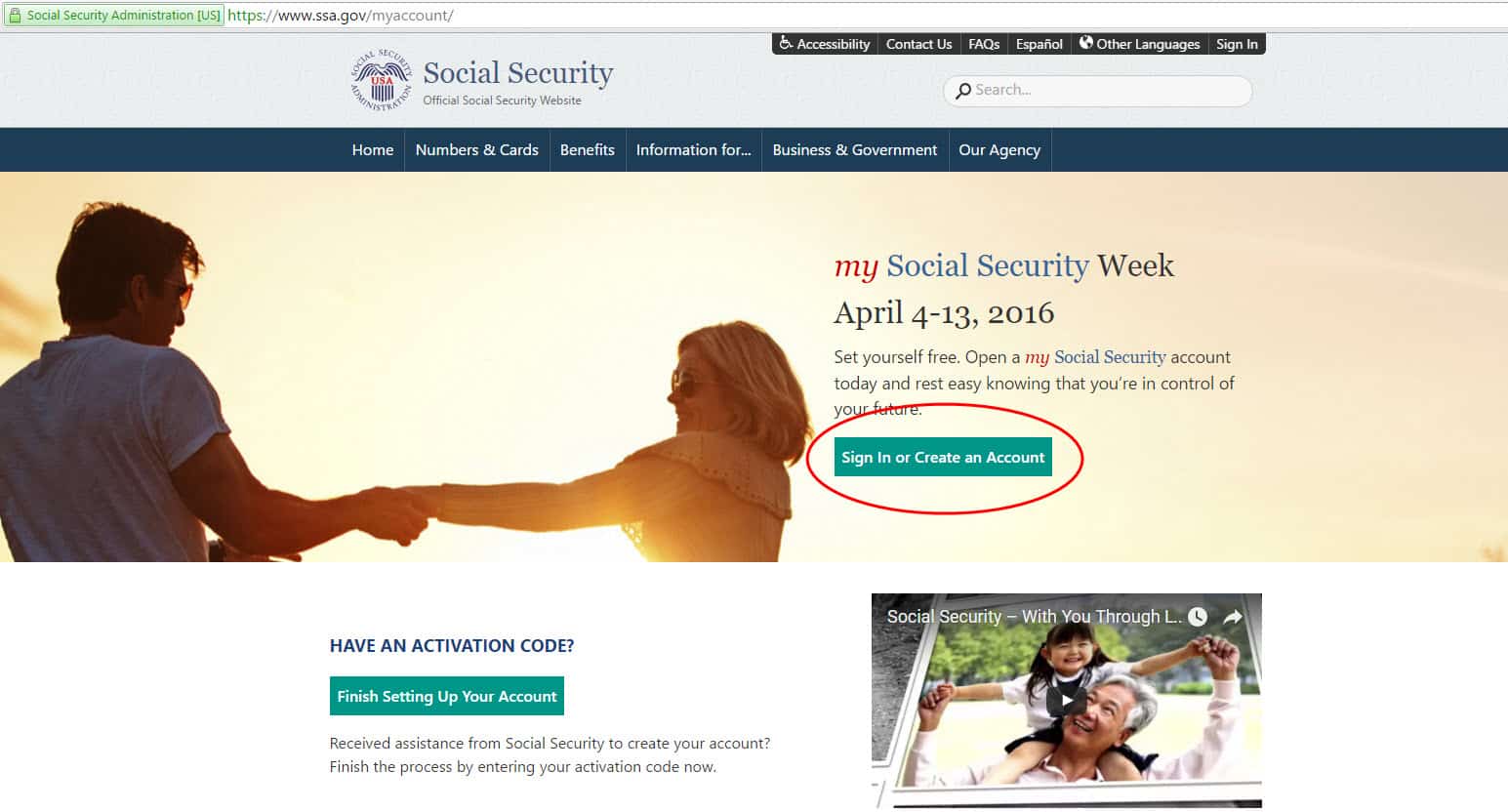

How to Actually Get In Without Losing Your Mind

Don't try to do this on a spotty cell connection at a coffee shop.

- Gather your ID. You'll likely need a State ID or Passport.

- Use Login.gov if you already have it for TSA PreCheck or Global Entry. It’s the same system.

- Have your phone handy for two-factor authentication.

- Check your "Earnings Record" first. It's the most important tab.

If you find a mistake, you'll need Form SSA-7008. It’s the "Request for Correction of Earnings Record." You’ll need to prove you earned the money, so keep those old tax returns in a safe spot.

👉 See also: Marie Kondo The Life Changing Magic of Tidying Up: What Most People Get Wrong

Practical Steps to Secure Your Future Today

The smartest thing you can do right now is spend twenty minutes doing a digital audit.

First, log in and verify your "Full Retirement Age." It isn't 65 for most people anymore; for anyone born in 1960 or later, it's 67. Knowing that date changes your entire savings strategy.

Second, download your current Statement as a PDF. Save it in a secure folder. If the site goes down or the rules change, you have a timestamped record of what the government promised you on this date.

Third, set a calendar reminder to check the portal every January. It’s the easiest way to ensure your employer reported your previous year’s wages correctly. If you're self-employed, this is even more critical because 1099 reporting can get messy.

Finally, if you're over 60, use the "Benefit Estimate" tool to run a "what-if" scenario for a spouse. Social Security isn't just about you—it’s about survivor benefits too. Understanding how your filing age affects a surviving spouse is a nuance that many people miss until it's too late to change course. Take the time to look at the "Survivors" tab in the estimates; it's a sobering but necessary part of planning.