Everything felt a bit heavy on Wall Street this Tuesday. The Dow shed 400 points. Big banks like JPMorgan Chase took a bruising after warning about credit card interest rate caps. Yet, if you looked at the right corners of the board, some people were making an absolute killing.

It’s one of those weird days where the "sea of red" headline doesn't tell the whole story. While the S&P 500 and Nasdaq ended slightly lower, a handful of names basically ignored the gravity of the broader market. We’re talking massive double-digit jumps. Honestly, if you’ve been tracking the most gainers stock today, you’ve noticed a very specific pattern: it’s all about specialized AI chips and biotech breakthroughs.

The Big Winners: Chips and Shots

You've probably heard the name Intel (INTC) mentioned a thousand times as a "legacy" company. Well, today it didn't act like one. Intel surged over 7%, closing around $47.29. Why? KeyBanc analysts basically handed them a golden ticket with an upgrade, citing a "sold out" status for their AI products. When a company the size of Intel moves 7% in a single session while the Dow is tanking, you know the big money is rotating.

Then you have Advanced Micro Devices (AMD). It followed the same script, jumping more than 6% to hit $220.97. It’s the same story—AI demand is just relentless. It doesn't seem to matter if the broader economy is worried about inflation or the Fed; if you make the silicon that runs the future, your stock is a magnet for cash right now.

Biotech's Wild Ride

If the chipmakers were the steady gainers, the biotech sector was the Wild West. Moderna (MRNA) was a standout, popping 17% to finish near $39.60. There’s been a lot of chatter about their pipeline lately, and today that speculative energy finally boiled over.

But for the real "moon mission" numbers, you have to look at the smaller players. Tryhard Holdings Limited (THH) went absolutely parabolic, up a staggering 138% to $55.05. It’s the kind of move that makes retail traders lose their minds. Is it sustainable? Probably not. Is it exciting? Definitely.

👉 See also: Finding the Right Help: State Farm Ocala FL Bart Blessing and What to Expect

Why the Market is Acting This Way

Basically, we’re in a "bifurcated" market. That’s a fancy way of saying it’s split in half. On one side, you have the old-school financials and consumer stocks getting hammered because of recession fears and regulatory jitters. On the other side, you have these pockets of extreme growth.

- Artificial Intelligence: This isn't just a buzzword anymore. The KeyBanc report on Intel and AMD proved that the "AI trade" has moved from promise to actual purchase orders.

- Analyst Upgrades: In a jittery market, a single "Overweight" rating from a major firm acts like a lighthouse.

- Short Squeezes: In cases like Roblox (RBLX), which climbed 10.5%, we're seeing high-growth tech stocks benefit from bears being forced to cover their positions.

It's kinda fascinating to see Roblox hitting $84.80. Most people written it off as a pandemic relic, but BMO Capital just reiterated an "Outperform" rating with a price target way higher than where we are now. It shows that "growth" isn't dead; it just moved houses.

The Risks Most People Ignore

Look, seeing a stock like Ambitions Enterprise Management (AHMA) jump 133% is intoxicating. You want a piece of that. But you've got to be careful. Many of the most gainers stock today are low-volume plays. When a stock like Erasca (ERAS) jumps 20%, it’s often on a specific piece of clinical trial news. If that news gets re-evaluated tomorrow, that 20% can vanish in twenty minutes.

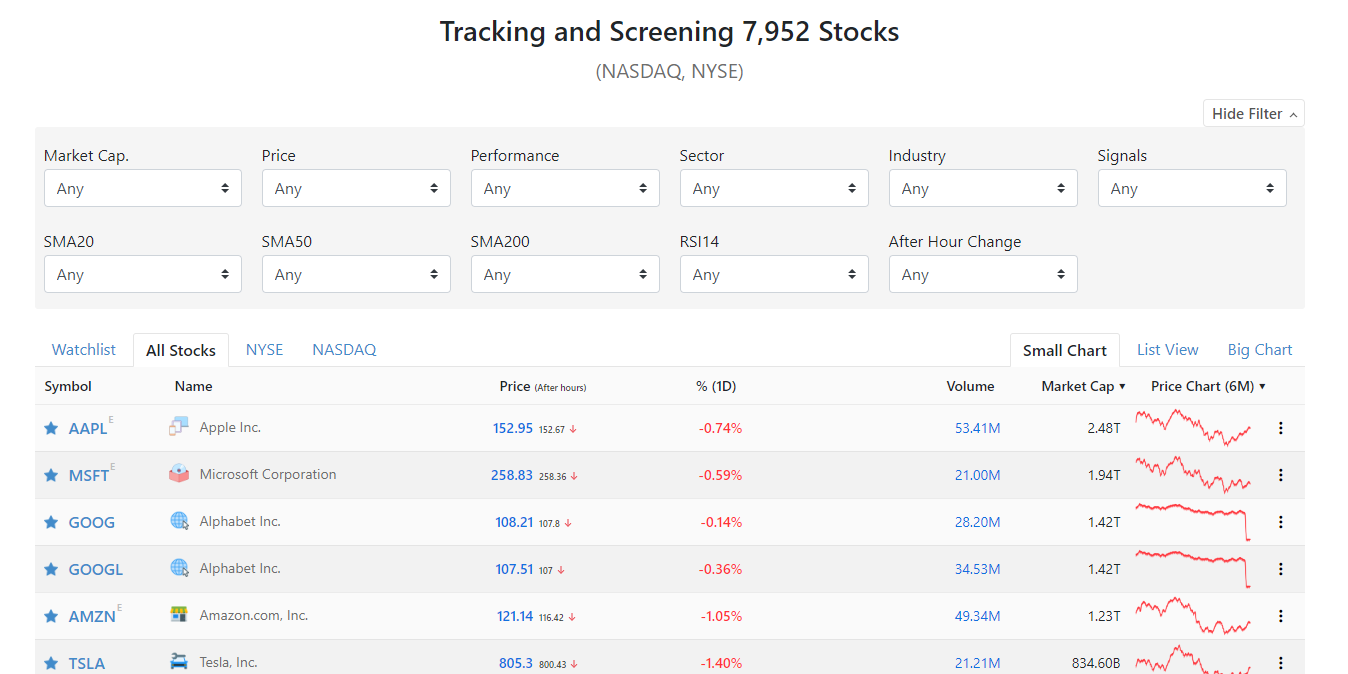

Also, the "Magnificent Seven" aren't the safe havens they used to be. Nvidia (NVDA) was basically flat today. Alphabet and Tesla were actually down. The "smart money" is shifting. They’re moving out of the overvalued giants and into "early-stage" AI and biotech where there's still room to run.

Sector Breakdown of Today’s Leaders

| Stock Ticker | Company Name | % Gain | Sector |

|---|---|---|---|

| THH | Tryhard Holdings | 138.3% | Diversified |

| AHMA | Ambitions Enterprise | 133.7% | Management |

| MRNA | Moderna | 17.0% | Biotech |

| TTMI | TTM Technologies | 19.7% | Tech/Manufacturing |

| INTC | Intel | 7.3% | Semiconductors |

What You Should Actually Do

Chasing the most gainers stock today is usually a recipe for getting "bagged"—meaning you buy at the top and hold while it drops. Instead of looking at what already happened, look at the why.

If you're looking for actionable steps, start by watching the semiconductor equipment providers. If Intel and AMD are "sold out," the companies that provide the tools to make those chips are likely next in line for a rally. Keep an eye on the "AI-adjacent" names that haven't popped yet.

👉 See also: RSI Indicator Explained: Why Most Traders Use It Wrong

Secondly, watch the volume. A 20% gain on low volume is a trap. A 7% gain on Intel with 169 million shares traded? That’s a trend. That’s institutional conviction.

Focus on the laggards in the winning sectors. If the chip sector is hot, but a high-quality supplier is still flat, that's where the opportunity usually hides. Diversify your entry points and don't let the "FOMO" (fear of missing out) drive your trades. The market is volatile right now, and while the gainers look pretty, the trap doors are everywhere.

Check the 52-week highs. Stocks like TTM Technologies (TTMI) are pushing near their peaks ($93.24), which suggests a breakout pattern rather than just a one-day fluke. Follow the momentum, but keep your stop-losses tight.