You've probably felt it. That weird, sinking feeling when you look at your bank account after paying rent and realize you've basically just handed over your entire existence to a landlord in a zip code that doesn't even have decent parking. Living in the United States has never been exactly "cheap," but lately, the most expensive cost of living US has reached a level that feels almost like a satirical movie. If you’re currently residing in a coastal hub or a tech capital, you aren't imagining things. Your $100,000 salary is effectively acting like $45,000 in the Midwest.

Honestly, it’s a bit of a shell game. We see these massive salaries in places like San Francisco or Manhattan and think, "Wow, I’d be rich." Then you move there. You realize a mediocre sandwich costs $22, and the "charming" studio apartment you found for $3,800 a month is actually a converted closet with a view of a brick wall. The math just doesn't math for most people anymore.

The Cities Leading the Most Expensive Cost of Living US

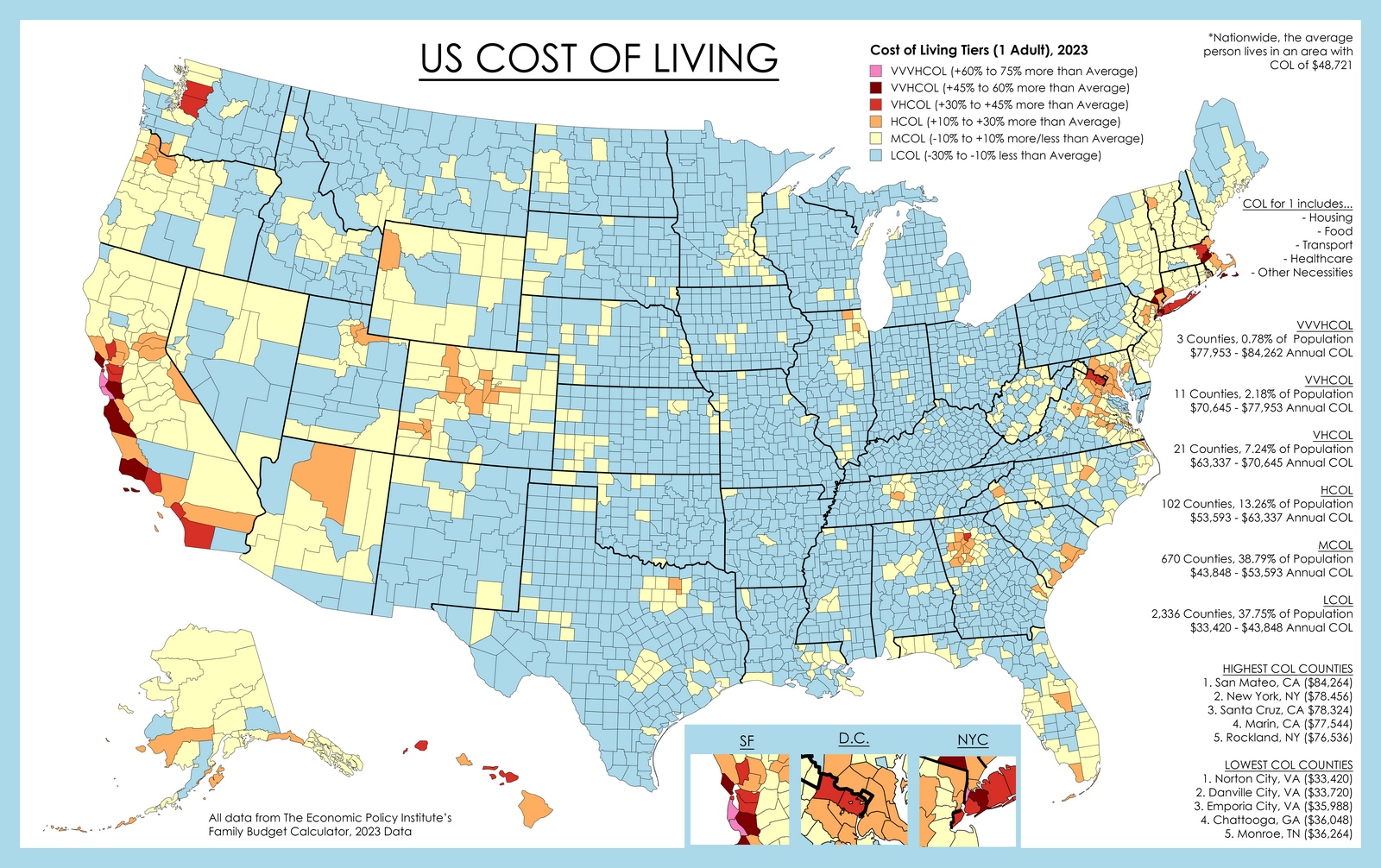

When we talk about where the money goes, we have to start with the usual suspects. In 2026, the rankings haven't shifted much at the top, but the gap between the "haves" and "have-nots" has widened. San Francisco remains the undisputed heavyweight champion of making people feel poor while earning six figures. The median home price there is still hovering around $1.4 million. Think about that. Even with a massive down payment, your monthly mortgage is likely more than some people earn in a season.

New York City—specifically Manhattan—is right on its heels. While the outer boroughs like Queens or parts of the Bronx used to be the "affordable" fallback, even those are getting squeezed. A monthly MetroCard now sets you back $127, and if you want a two-bedroom apartment in a decent area, you're looking at a median rent of about $5,800. It's wild. You’re paying a premium just for the right to stand on a crowded subway platform.

💡 You might also like: Human DNA Found in Hot Dogs: What Really Happened and Why You Shouldn’t Panic

A Breakdown of the Numbers

- San Francisco, CA: Cost of Living Index (COLI) of 195.7. Median income is high at $104,000, but it barely covers a $3,500 one-bedroom rent.

- New York City, NY: COLI 187.2. The tax burden here is what really kills you—the highest individual tax burden in the country at nearly 5.8%.

- San Jose, CA: The heart of Silicon Valley. You’ve got tech workers competing for a tiny supply of homes, driving median prices to $1.3 million.

- Boston, MA: It’s not just the rent; it’s the utilities and healthcare. Massachusetts has some of the highest healthcare costs in the nation, roughly 18% above the average.

Why Does It Cost This Much?

It’s easy to blame "corporate greed" or "inflation" and call it a day, but the reality is more nuanced and, frankly, more annoying. In California, for example, the most expensive cost of living US is driven by a toxic cocktail of limited housing supply and strict zoning laws. For decades, these cities underbuilt. Now, you have a massive influx of high-earning tech workers (especially with the AI boom of 2025 and 2026) all fighting over the same 1920s bungalows.

Geography plays a role too. You can't just "build more" in Honolulu or San Francisco. You're trapped by the ocean and mountains. In Hawaii, almost everything has to be shipped in. That gallon of milk isn't $5 because the cows are fancy; it's $5 because it had to take a long boat ride to get to your cereal bowl.

Then there’s the "Lifestyle Tax." People pay these prices because they want the amenities. They want the Michelin-star restaurants, the career networking, and the cultural vibe. But at some point, the "vibe" starts to cost 60% of your take-home pay, and that’s when the "Great Housing Reset" we're seeing in 2026 starts to make sense. People are finally looking at the Midwest and thinking, "Is a 30-minute commute in Ohio really worse than a $4,000 rent in San Jose?"

📖 Related: The Gospel of Matthew: What Most People Get Wrong About the First Book of the New Testament

The "Hidden" Costs You Forget to Budget For

Most people focus on rent, but it’s the smaller stuff that bleeds you dry in high-cost areas.

- Utilities: In Connecticut and Rhode Island, utility bills are nearly 30% higher than the national average.

- Transportation: It’s not just gas (which is consistently near $5 in California). It’s insurance, tolls, and the cost of parking, which can be $400 a month in NYC just for a spot.

- Taxes: States like New York and California have progressive income taxes that eat a massive chunk of those "high" salaries before you even see the money.

- Groceries: In Alaska and Hawaii, food costs are roughly 30% to 50% higher than in the lower 48 states.

Is It Ever Going to Get Better?

Economists from firms like Zillow and Redfin are pointing toward a "normalization" in late 2026. Mortgage rates are expected to hover around 6.3%, which is better than the peaks of previous years but still high enough to keep prices from skyrocketing further. We’re seeing a "Lifestyle Renter" emerge—people who choose to rent not because they can't buy, but because they value the mobility and lack of maintenance in an uncertain economy.

If you’re looking for relief, you might have to look away from the coasts. Cities like Columbus, OH, Syracuse, NY, and St. Louis, MO are becoming the new hotspots for people fleeing the most expensive cost of living US. These places offer a "bang for your buck" that the big coastal hubs simply can't match right now.

👉 See also: God Willing and the Creek Don't Rise: The True Story Behind the Phrase Most People Get Wrong

Real Steps to Manage the High Cost of Living

If you are stuck in a high-cost area or planning to move to one, stop guessing and start calculating. Use a COLI calculator to see the "real" value of your salary. If you're moving from Dallas to San Francisco, a $100k salary is actually a pay cut.

Look into "house hacking" or co-living spaces if you're single; shared housing is the only way many people in their 20s and 30s are surviving in Brooklyn or Oakland right now. Also, audit your "lifestyle creep." In expensive cities, it’s easy to spend $50 a day on "small" things like lattes, Uber rides, and quick lunches. That's $1,500 a month—basically another rent payment.

Move your "fun" budget to free amenities. Every major expensive city has incredible parks, free museum days, and community events. If you’re paying the premium to live there, you might as well use the stuff that doesn't cost extra.

Next Steps for You

- Audit your current spending against the national average for your city using the 2026 COLI data.

- Research "Tier 2" cities in the Midwest or South if your job allows for remote or hybrid work.

- Calculate the tax implications of your next move using a state-specific income tax calculator, especially if you're eyeing New York or California.