Honestly, if you spent the tail end of last year waiting for a massive "January sale" on interest rates, the reality of mortgage refinance rates January 2025 might feel a bit like a cold shower. Everyone hoped the new year would bring a clean slate and a rapid slide toward those 5% handles we’ve been dreaming about.

Instead? We got a bit of a mixed bag.

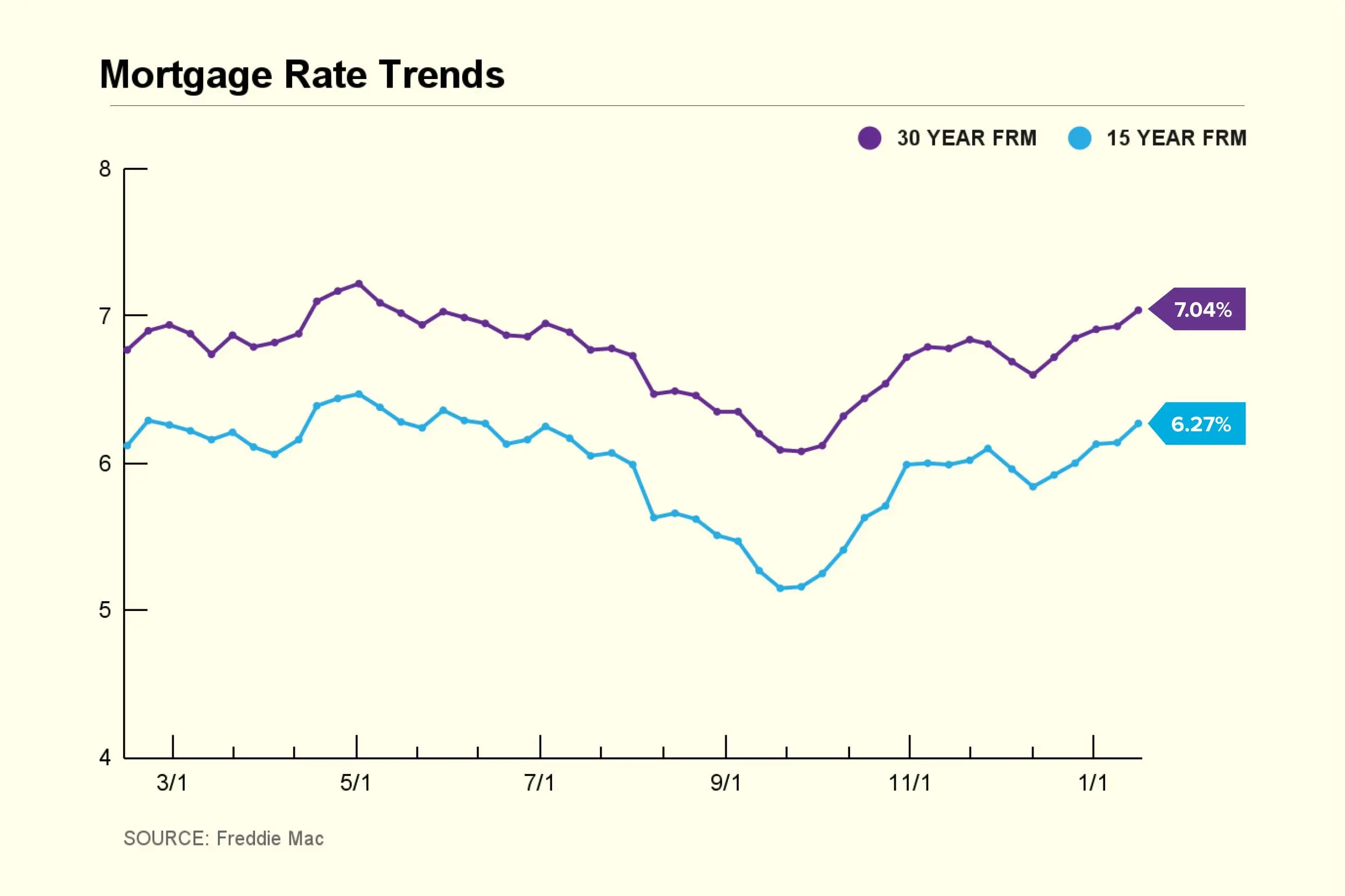

The 30-year fixed refinance rate kicked off the month averaging around 6.91%, according to Freddie Mac data. That’s a far cry from the sub-3% glory days of the pandemic, but it’s also not the 8% monster we saw lurking in late 2023. It’s this weird middle ground where "stable" feels like a victory even if it doesn't feel like a bargain.

The Reality of Mortgage Refinance Rates January 2025

Let’s look at the numbers. They aren't pretty, but they're honest.

By the time the calendar flipped, the Federal Reserve had already pulled the trigger on a few rate cuts in late 2024. You’d think that would send mortgage rates plummeting, right? Not exactly. The market is a fickle thing.

Mortgage rates actually "popped" back up at the very start of the year. On January 2, 2025, the 30-year fixed sat at 6.91%. If you were looking at a 15-year fixed—the darling of the "pay it off fast" crowd—you were looking at roughly 6.13%.

Why the disconnect? Basically, the bond market had already "priced in" the Fed's moves months in advance. When the Fed finally acted, investors basically shrugged. Then, a new administration took office on January 20, adding a fresh layer of "what happens now?" to the economic stew.

Why the Fed "Pause" in January Matters

The big news of the month came on January 29, 2025. The Federal Open Market Committee (FOMC) met and decided to hold the benchmark interest rate steady at 4.25% to 4.5%.

They hit the brakes.

Fed Chair Jerome Powell and the crew basically said, "Look, inflation is still hovering near 3%, and we aren't convinced we're out of the woods yet." This pause sent a clear signal to anyone watching mortgage refinance rates January 2025: don't expect a free fall.

Lenders hate uncertainty. When the Fed stays still, lenders tend to keep their cushions thick. This is why refinance rates usually carry a "premium" over purchase rates—often 0.25% to 0.50% higher. If you're looking to swap out a 7.5% loan for something in the high 6s, the math starts to work, but it isn't a slam dunk for everyone.

Is Refinancing Actually Worth It Right Now?

I get this question a lot. Sorta.

The "rule of thumb" used to be that you should refinance if you can drop your rate by 1%. In January 2025, that rule felt a bit outdated. With home prices still stubbornly high—up about 4.7% year-over-year according to some NAR reports—your equity might be higher than you realize.

The Cash-Out Temptation

Because home values stayed up, even as rates stayed "meh," the cash-out refinance became a hot topic this January. If you’ve got $100k in equity and $30k in high-interest credit card debt, swapping that 25% APR plastic for a 6.9% mortgage starts to look like a genius move, even if your original mortgage rate was 4%.

It's a trade-off. You're trading a low-rate loan for a higher-rate one to kill off toxic debt.

✨ Don't miss: Banca Transilvania Share Price: What Most People Get Wrong

The 15-Year Pivot

Then there’s the crowd moving from a 30-year to a 15-year. In January, the gap between the two was significant. If you could snag a 15-year refi at 6.13%, you were looking at massive interest savings over the life of the loan. But man, those monthly payments? They're a gut punch. You’ve gotta have the cash flow to back it up.

What Most People Get Wrong About Rate Locks

Here’s the thing: people obsess over the "national average."

The national average is a ghost. It’s an aggregate. In the real world of mortgage refinance rates January 2025, your actual quote depends on your "stats."

- Credit Score: If you’re at a 740+, you’re seeing the "advertised" rates. If you’re at a 660? Add a point.

- Equity (LTV): Lenders love a 20% cushion. If you’re refinancing with only 5% equity, they’re going to charge you for the risk.

- Loan Type: VA and FHA loans actually saw some better movement this month. Some FHA refinance programs were hovering closer to the 5.75% mark, which is a huge deal for those in that ecosystem.

Real Examples from the Ground

I talked to a broker in Des Moines who told me about a couple—let's call them Sarah and Mike. They bought in late 2023 with an 8.1% rate. Brutal, I know.

In mid-January 2025, they locked in a refinance at 6.75%.

On a $400,000 loan, that’s a savings of roughly **$350 a month**. That’s a car payment. Or a lot of groceries. For them, waiting for 5% didn't make sense because they were "bleeding" $350 every single month they waited.

On the flip side, if you're sitting on a 5.5% rate from a few years ago, mortgage refinance rates January 2025 are basically irrelevant to you. You're staying put. This is what economists call the "lock-in effect," and it's why the housing market felt so frozen this month.

How to Handle These Rates

If you're staring at your monthly statement and wondering if you should jump, you need a plan that isn't just "watching the news."

- Check your "Breakeven": Refinancing isn't free. You’re looking at closing costs—usually 2% to 5% of the loan amount. If it costs you $6,000 to save $200 a month, you need to stay in that house for at least 30 months just to break even. If you're planning to move in two years? Don't do it.

- Shop the "Small" Guys: Interestingly, credit unions and local banks were often undercutting the big national lenders this January. Navy Federal, for instance, was frequently showing rates slightly more competitive than the big-box banks.

- The "No-Cost" Myth: Some lenders offer "no-cost" refinances. Just remember, there’s no such thing as a free lunch. They’re either rolling those costs into your loan balance or giving you a slightly higher interest rate to cover them.

- Watch the 10-Year Treasury: If you want to know where rates are going tomorrow, don't look at the Fed. Look at the 10-Year Treasury yield. In January, it was dancing around 4.17%. When that yield drops, mortgage rates usually follow a few days later.

Moving Forward With Your Refinance

The window for mortgage refinance rates January 2025 showed us that the era of "easy money" is gone, but the era of "insane rates" might be cooling off too. We’re in a period of normalization.

It’s boring. It’s frustrating. But it’s also manageable.

If you’re serious about moving forward, your next move is to get a formal Loan Estimate from at least three different lenders. Don't just look at the rate—look at the "Section A" fees on that estimate. That's where the real cost is hidden. Once you have those, you can actually do the math and see if the January "cool down" is enough to put some extra cash back in your pocket.