Honestly, if you've been waiting for the "perfect" time to buy a house, the latest data might feel like a cold shower. Or a warm hug. It kind of depends on whether you're still dreaming of those 2021 rates that basically didn't exist in the real world once you added the fees.

The big headline for mortgage rates today 2025 news is actually a 2026 reality: we are officially sitting at the lowest levels in over three years. As of mid-January 2026, the 30-year fixed-rate mortgage has dipped to a weekly average of 6.06%, according to Freddie Mac. Some lenders are even flirting with the high 5s.

It’s a massive shift from where we were exactly one year ago. Last January, you were looking at a painful 7.04% average.

But here is the kicker. While the numbers are technically "down," the vibe in the market is weirdly cautious. Why? Because the Fed is playing a very slow game of "will they or won't they" with rate cuts, and a new administration in Washington is throwing massive wildcards into the bond market.

The $200 Billion Wildcard in Mortgage Rates Today 2025 News

You can't talk about rates right now without mentioning the recent drama involving the Government-Sponsored Enterprises (GSEs), Fannie Mae and Freddie Mac.

Basically, the news cycle got rocked when President Trump directed representatives to purchase $200 billion in mortgage-backed securities (MBS). If you aren't a finance nerd, here is the short version: when someone buys a huge chunk of mortgage bonds, the price of those bonds goes up, and interest rates go down.

It worked. Sorta.

👉 See also: How Much Do Chick fil A Operators Make: What Most People Get Wrong

We saw a sharp tumble in rates immediately following that announcement. But the market is a fickle beast. While some lenders dropped their rates before the ink was even dry on the social media posts, others held back. By the time Friday morning rolled around, the bond market had already started to "correct" itself. It’s a tug-of-war between government intervention and the raw, unbridled fear of inflation.

The "Lock-In" Effect is Finally Cracking

For the last couple of years, everyone has been talking about the "Golden Handcuffs." People with 3% mortgages weren't moving because, well, why would you? You'd be trading a cheap payment for a house that costs twice as much to finance.

But we just hit a massive inflection point.

For the first time since the pandemic, the share of homeowners with a mortgage rate above 6% has officially surpassed the share of those with rates below 3%.

What does that actually mean for you? It means the market is becoming "normal" again. People are moving because of life—marriages, kids, new jobs—rather than just hoarding their low interest rates. The "lock-in" effect hasn't vanished, but the grip is loosening.

What the Experts are Actually Saying (No Fluff)

If you listen to the talking heads on TV, they make it sound like rates are either going to 0% or 10%. The reality is much more boring, which is usually a good thing for your wallet.

✨ Don't miss: ROST Stock Price History: What Most People Get Wrong

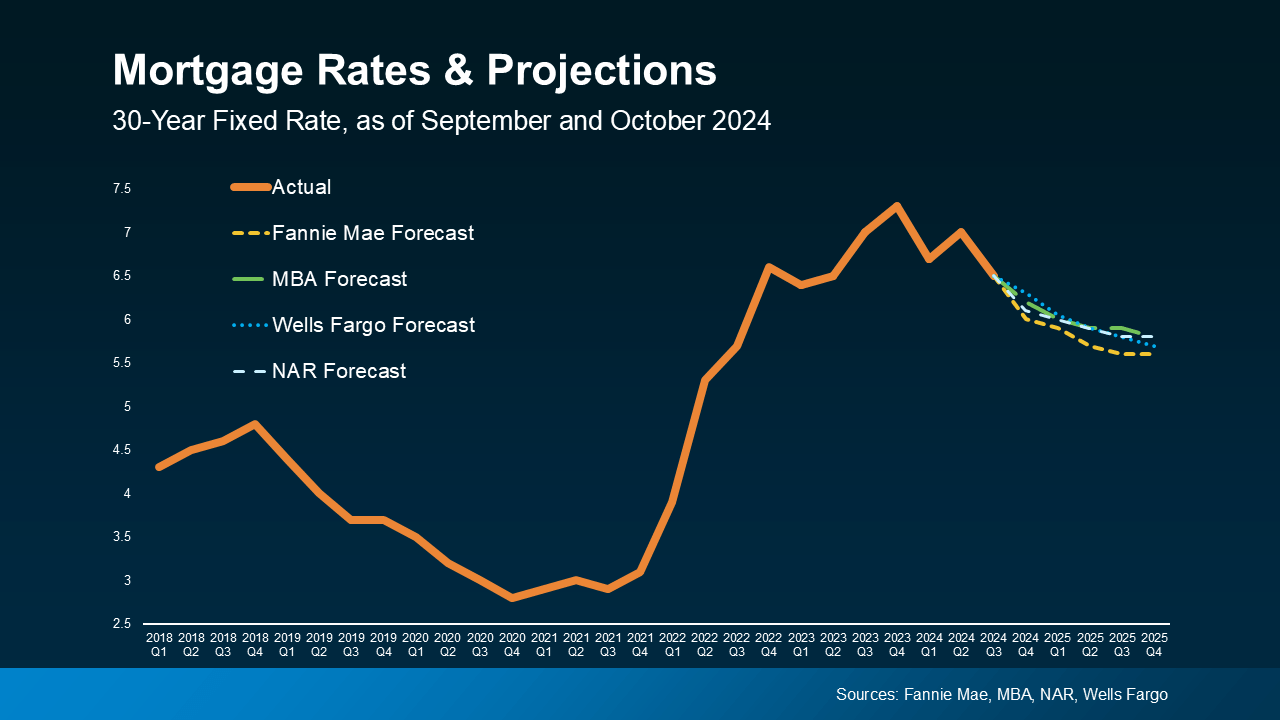

- Fannie Mae is predicting a "gentle downward trend," aiming for 5.9% by the end of 2026.

- The Mortgage Bankers Association (MBA) is the grumpy uncle in the room, holding steady at a forecast of 6.4%. They think the "new normal" is here to stay.

- Bankrate’s Ted Rossman thinks we might see 5.7% if the economy cools too fast.

Most of these forecasts have one thing in common: nobody sees 3% or 4% in the crystal ball. Not this year. Not next year.

The Federal Reserve cut rates three times in late 2025, bringing the funds rate to a range of 3.50% to 3.75%. However, there is a lot of dissent among the Fed governors. Some want to keep cutting to help the job market, while others are terrified that inflation is going to roar back like a 1970s disco trend.

Does the Fed Chair even matter?

Jerome Powell's term is up in May 2026. This creates a "lame duck" period where the market might get jittery. Historically, when a new Chair is about to take the seat, lenders get cautious. Cautious lenders don't give out cheap money.

If you are looking at mortgage rates today 2025 news to decide on a refi, you have to look at the "spread." Currently, the gap between the 10-year Treasury yield and mortgage rates is still wider than it used to be. Usually, that gap is about 1.7 percentage points. Right now, it’s closer to 2 or 2.5. If that gap shrinks, rates could fall even if the Fed does nothing.

The Real Cost of Waiting

Let's do some quick math, because "waiting for a better rate" can actually cost you more than just paying the interest.

If you're looking at a $400,000 home:

🔗 Read more: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

- At a 6.1% rate, your principal and interest is roughly $2,424.

- If you wait a year and rates drop to 5.5%, your payment drops to $2,271.

Sounds great, right? You save $153 a month.

But what if that $400,000 home is now $420,000 because everyone else who was "waiting" jumped back into the market at the same time? Now, even with a 5.5% rate, your payment is $2,385. You "saved" 0.6% on the rate but lost almost all of it to the price increase.

Plus, you spent a year paying rent instead of building equity.

Actionable Steps for Today's Market

Stop checking the national average every five minutes. It’s a "median" of a thousand different variables. Your rate depends on your life.

- Check your "Non-QM" options. If you’re self-employed or have a weird income stream, Non-QM (Non-Qualified Mortgage) rates are actually becoming more competitive with traditional bank loans.

- Look at the 15-year fixed. If you can stomach the higher monthly payment, the 15-year is averaging around 5.38%. You'll save literally hundreds of thousands in interest over the life of the loan.

- The "Float Down" is your friend. If you’re under contract, ask your lender about a float-down provision. It lets you lock in today’s rate but grab a lower one if the market dips before you close.

- Stop obsessing over the 30-year fixed refinance. Today's 30-year refi average is sitting around 6.58%. If you bought in 2023 or 2024 when rates were pushing 8%, this is a win. If you're at 5%, stop looking. You're fine.

The market in early 2026 is finally showing some teeth. We are seeing more inventory—up nearly 9% year over year—and a more balanced playing field. You might not get a 3% rate, but you might actually get a house without having to waive your inspection and promise the seller your firstborn child.

Your Next Move:

If your current rate is 7.5% or higher, call a broker this week. Even with closing costs, a drop to 6% is a massive win for your monthly cash flow. If you are a buyer, get your pre-approval updated. Most pre-approvals from three months ago are now based on higher rates, meaning you might actually be able to afford more house than you thought.