So, you’re looking at the housing market right now and probably feeling a bit of whiplash. One minute the news says things are cooling off, and the next, you're staring at a pre-approval letter that makes your stomach do a flip. If you were tracking mortgage rates March 12 2025, you saw a day that basically summed up the weird, "wait-and-see" Limbo we've all been living in lately.

The big headline from that Wednesday? Rates actually took a breather. After weeks of feeling like we were climbing a mountain with no summit, the Mortgage Bankers Association (MBA) dropped their weekly data showing the average 30-year fixed rate hit 6.67%.

That’s a drop. A real one. In fact, it was the sixth week in a row that rates drifted lower.

The Reality of Mortgage Rates March 12 2025

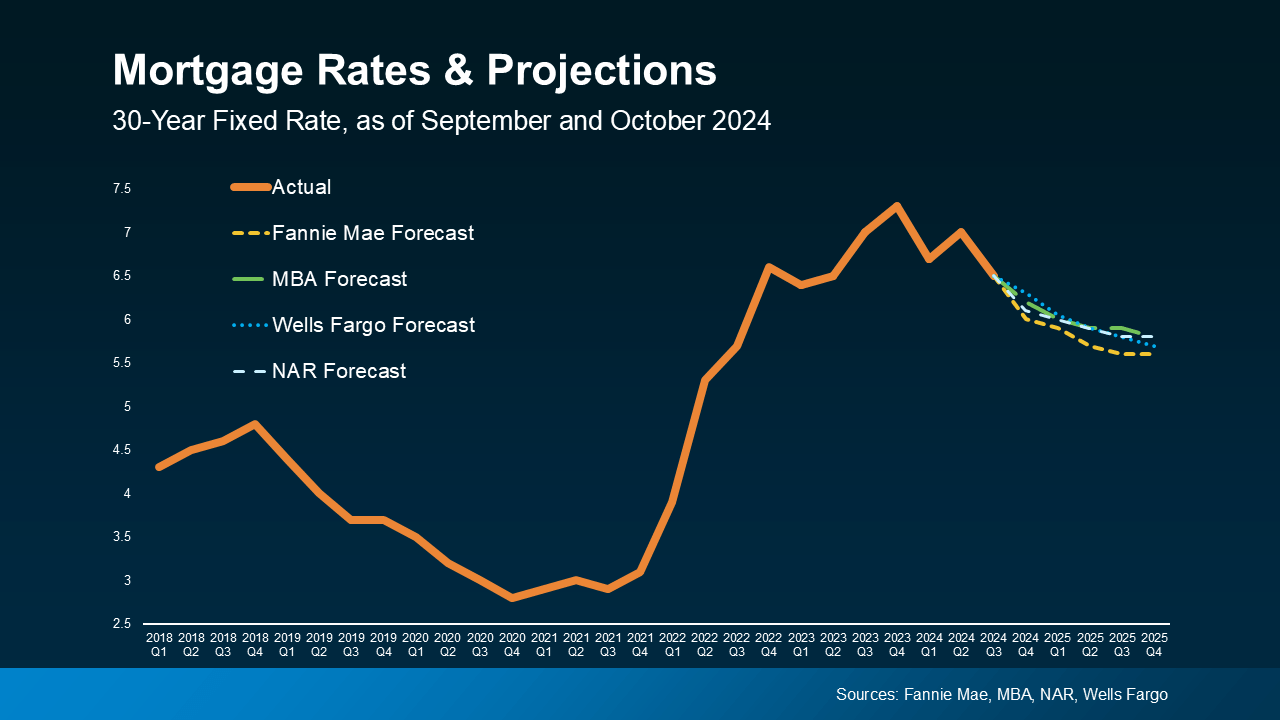

It's easy to look at a number like 6.67% and feel "meh" about it, especially if you still have that 3% rate from 2021 burned into your brain. But honestly, context is everything. At the start of 2025, we were flirting with 7% again.

On March 12, the vibe in the lending world was cautiously optimistic. Joel Kan over at the MBA pointed out that applications jumped over 11% that week. People aren't just watching from the sidelines anymore; they’re starting to jump in.

Why? Because $6.67%$ is the lowest we've seen since October of last year.

It’s not just the standard 30-year loans moving, either. If you were looking at FHA loans—which are huge for first-time buyers—those dipped down to 6.34%. That’s a massive deal for someone trying to keep their monthly payment under a certain threshold. Even jumbo loans, those big-ticket mortgages for high-priced markets, saw a slide down to 6.68%.

🔗 Read more: CCL Products India Ltd Share Price: Why Most Investors Get the Coffee Cycle Wrong

Why did the numbers move?

The market was basically front-running the Federal Reserve. Everyone knew the Fed meeting was coming up on March 18-19. The "smart money" was betting that the Fed wouldn't hike rates, and might even sound a little more relaxed about inflation.

But there’s a catch.

While the 10-year Treasury yield—which is the "north star" for mortgage rates—was hovering around 4.31%, there was this undercurrent of anxiety about new trade policies and tariffs. It’s a tug-of-war. On one side, you have slowing inflation making rates want to drop. On the other, you have the fear that new tariffs might make everything more expensive again, which pushes rates back up.

What the Experts are Actually Seeing

I talked to a few folks in the industry around this time, and the consensus was... complicated. Shmuel Shayowitz, a veteran in the lending space, was pretty blunt about it: don't expect a miracle.

The Fed didn't actually cut rates in March. They held steady at 4.5%.

This is the "higher for longer" reality. We’re not going back to 4% anytime soon. Lawrence Yun from the National Association of Realtors (NAR) has been saying this for a while. He’s forecasting that we might finish 2025 around 6.4%, maybe hitting 6.1% by the end of 2026.

The "Lock-In" Effect is Starting to Crack

For the last two years, nobody wanted to move because they didn't want to trade their 3% rate for a 7% rate. But by March 12, something changed.

The "average" home purchase loan amount hit $460,800. That’s a record high for the MBA survey. It tells us that higher-income buyers are losing patience. They've realized that waiting for a 4% rate is like waiting for a rotary phone to become trendy again—it’s probably not happening.

📖 Related: Miki Naftali Net Worth: What Most People Get Wrong About the Real Estate Titan

Also, inventory is finally creeping up. Not a flood, but a trickle. Builders are offering "rate buy-downs" where they basically pay to lower your interest rate for the first few years. If you’re seeing a "5.5% starting rate" on a new build, that’s how they’re doing it.

Actionable Steps for Today’s Market

If you’re looking at these mortgage rates March 12 2025 data points and wondering what to actually do, here is the breakdown:

- Get a "Motto" Pre-Approval: Don't just get a generic letter. Talk to a lender about "extended locks." Some lenders let you lock in a rate for 60 or 90 days while you shop, which protects you if the market gets spooked by the next inflation report.

- Watch the 10-Year Treasury, Not the Fed: The Fed doesn't set mortgage rates. The bond market does. If you see the 10-year Treasury yield (you can find this on any finance site) heading toward 4.0%, mortgage rates will follow. If it spikes toward 4.5%, expect your quote to go up.

- Run the "Marry the House, Date the Rate" Math: It's a cliché, but it works. If you find a house you love today, calculate the payment at 6.6%. If you can afford it now, buy it. If rates drop to 5.5% in two years, you refinance. If they go to 8%, you look like a genius for locking in 6.6%.

- Check FHA and VA Options: On March 12, the spread between conventional and government-backed loans was significant. FHA rates were nearly 0.35% lower than conventional ones. Even with the mortgage insurance (MIP), the math sometimes favors the FHA route in this specific environment.

The bottom line is that the mid-6% range is the new "good." It’s a far cry from the sub-3% era, but it's a hell of a lot better than the 8% scares we had. The stability we saw in mid-March is actually a gift for buyers because it means you can actually plan a budget without the goalposts moving every three hours.

Focus on the monthly payment you can live with long-term. If the market gives you a chance to refinance later, take it as a bonus, not a requirement for survival.