If you’ve been watching the housing market lately, you know it’s basically been a rollercoaster where the safety bar feels a little loose. Today is February 28, 2025, and honestly, the news is kind of a mixed bag. We’ve spent the last few weeks biting our nails, but the latest data shows that mortgage rates February 28 2025 have finally hit their lowest point of the year so far.

The average 30-year fixed mortgage rate is sitting right around 6.59%.

For context, just a few weeks ago in January, we were staring down rates north of 7.1%. It’s a breather. A small one, but a breather nonetheless. If you’re trying to buy a house, even a quarter-point drop feels like finding a twenty-dollar bill in your winter coat—except that twenty-dollar bill is actually thousands of dollars over the life of your loan.

Why Mortgage Rates February 28 2025 Are Moving This Way

So, why the sudden dip? It’s not just one thing. It’s a messy soup of bond market jitters, Federal Reserve posturing, and some surprisingly "sticky" inflation data that has everyone second-guessing their next move.

📖 Related: How the Breaking Into Wall Street 400 Questions Guide Actually Changed Finance Interviews

Basically, the 10-year Treasury yield—which is the secret sauce that actually dictates mortgage rates—has been cooling off. Investors are looking at the economy and seeing a bit of a slowdown. When the economy looks like it’s catching a cold, bond yields tend to drop, and mortgage rates usually follow them down the stairs.

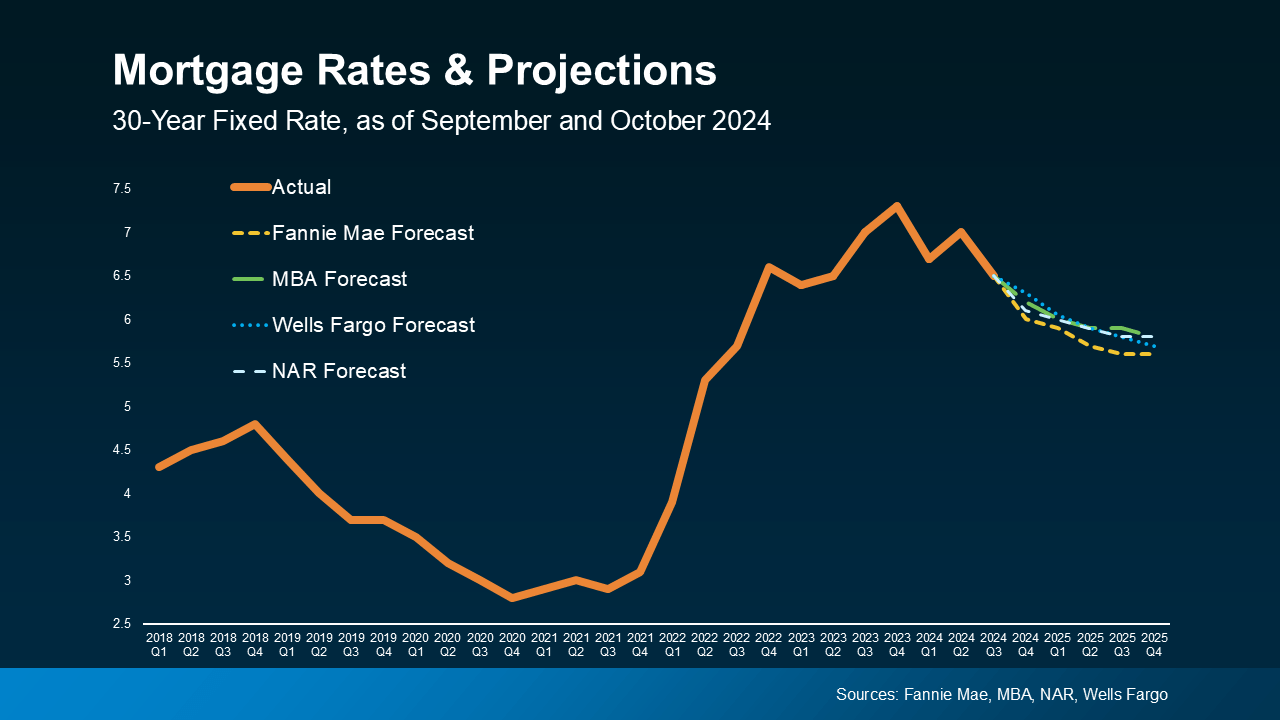

But don’t go pop the champagne just yet. While we’re at a 2025 low, we are still a far cry from those "fever dream" rates of 2.65% we saw back in 2021. Experts like Danielle Hale from Realtor.com have noted that while rates are easing, they’re still about half a percent higher than the brief dip we saw last September. It’s all about perspective.

The Federal Reserve’s "Wait-and-See" Game

The Fed has been acting like a cautious parent. They held rates steady at 4.5% during their recent meetings. They’re basically waiting to see if inflation is actually going to stay down or if it’s just playing tricks on them.

JPMorgan’s latest projections suggest the Fed might just sit on the sidelines for a while. They’ve even lowered their GDP growth forecast to 1.7%. What does that mean for you? It means mortgage rates probably won't plummet tomorrow, but they might not spike back to 8% either. We are in a "stagnation phase."

Breaking Down the Numbers: What Can You Actually Get?

If you went to a lender today, you wouldn't just see one number. The market is fragmented. Depending on your credit score and how much "skin in the game" (down payment) you have, your quote might look wildly different from your neighbor's.

Here is the rough landscape of what’s available right now:

The 30-Year Fixed-Rate

This is the flagship. At 6.59%, a $400,000 loan will cost you roughly **$2,552 per month** in principal and interest. If you had locked this in back in October 2023 at 8%, you’d be paying nearly $400 more every single month. That’s a car payment.

✨ Don't miss: IRS Tax Deadline 2025: What You Actually Need to Know to Avoid Penalties

The 15-Year Fixed-Rate

For the "pay it off fast" crowd, the 15-year is hovering around 5.73%. It’s a great rate, but the monthly payment on that same $400,000 loan jumps to about **$3,318**. You save a fortune in interest, but you need a much bigger shovel to dig out that monthly payment.

FHA and VA Loans

Government-backed loans are often the heroes for first-time buyers. FHA 30-year rates are averaging 6.76%, while VA loans—for those who’ve served—are often the lowest in the market, sometimes dipping toward the 6.11% mark.

Jumbo Loans

If you're buying a "mansion" (or just a regular house in California or New York), you're looking at a Jumbo. These are for loans above the conforming limit of $806,500. Currently, Jumbo 30-year rates are around 6.67%. Surprisingly, they are very close to standard rates right now, which isn't always the case.

The "Lock-In" Effect: Why Nobody is Moving

There’s a weird phenomenon happening. About 60% of people with mortgages right now have a rate below 4%.

Imagine you’re sitting in a house with a 3% mortgage. If you move, you’re basically trading that 3% for a mortgage rate February 28 2025 of 6.6%. Your payment for the exact same priced house would almost double. So, people are staying put. They’re remodeling their kitchens instead of listing their homes.

This is creating a massive shortage of "existing homes" for sale. However, there’s a silver lining: new construction. Builders are stepping up because they have to. Many are even offering "rate buy-downs" where they pay to lower your interest rate to 5% or 5.5% for the first few years just to get you in the door. If you’re frustrated by the lack of old houses on the market, the "new build" route is honestly where a lot of the action is right now.

What Most People Get Wrong About 2025 Rates

You’ll hear people say, "Wait for 5%."

Here’s the reality: nobody knows when—or if—we’ll see 5% again soon. Fannie Mae and the Mortgage Bankers Association (MBA) are forecasting that rates might end 2025 around 6.2% to 6.5%. If you wait for 5%, you might be waiting years, and in the meantime, home prices might keep creeping up.

Redfin recently pointed out that while prices are growing slower, they are still growing—up about 3.5% year-over-year. If you wait for a 1% drop in rates but the house price goes up $20,000, you haven't actually won. You’ve just treaded water.

✨ Don't miss: Price for NVIDIA Stock: Why the $187 Level is Driving Everyone Crazy Right Now

Regional Differences Matter (A Lot)

Don't listen to national averages too closely. The market in Tampa is looking very different from Chicago right now. In some parts of the South, inventory is actually surging, and sellers are starting to get nervous. We saw a "seasonally unusual" uptick in price reductions this February. Nearly 18% of listings had a price cut.

If you're in a market like Seattle or Washington D.C., you're still in a dogfight. But in other areas, the power is slowly shifting back toward the buyer.

Strategy: How to Handle These Rates

If you're looking to buy or refinance right now, you can't just take the first offer. The gap between the "best" lender and the "average" lender is wider than usual.

- Shop at least three lenders. I’m serious. A 0.2% difference in rate might not sound like much, but over 30 years, it's enough to buy a nice boat.

- Check the APR, not just the rate. The "interest rate" is the flashy number. The APR includes the fees. A lender might offer a 6.4% rate but charge you $8,000 in "points" to get it. That’s often a bad deal unless you plan on living in that house for 20 years.

- Watch the 10-year Treasury. If you see news that the 10-year Treasury yield is tumbling, call your loan officer immediately. Mortgage rates usually react within hours or days.

- Consider an ARM (maybe). 5/6 Adjustable Rate Mortgages are sitting around 7.2% right now, which actually makes them more expensive than fixed rates. That’s inverted. Usually, ARMs are cheaper. In this weird market, the 30-year fixed is actually your best bet most of the time.

Where We Go From Here

The "Goldilocks" scenario for the rest of 2025 is that inflation continues to cool, the Fed finally starts a slow series of cuts, and mortgage rates settle into a comfortable low-6% range.

We aren't there yet. We’re in the "grind it out" phase. But seeing the mortgage rates February 28 2025 hit a new low for the year is a signal that the extreme volatility of the last two years might finally be behind us.

If you find a house you love and the payment fits your budget, don't let the "rate" scare you off. You can always refinance a rate, but you can't "refinance" the price you paid for the house.

Next Steps for Buyers:

Get a "pre-approval" that is actually verified. Many lenders are doing "soft pulls" now that won't hurt your credit score just to give you a ballpark. Once you have that, look into "Seller Concessions." With more price reductions happening this month, you have more leverage to ask the seller to pay for a "2-1 buy-down," which could effectively give you a 4.59% rate for the first year.

Check your local inventory levels on sites like Realtor.com or Zillow specifically for "Price Reduced" filters. This is where the motivated sellers are hiding. If a house has been sitting for 60 days (the current national average), they are likely ready to talk.