Most people treat their monthly mortgage statement like a weather report. They look at the "Amount Due," groan a little bit, and send the check. But there is a massive difference between paying what you owe and actually winning the game. If you've ever played around with a mortgage payment calculator early payoff tool, you’ve seen those numbers move. It’s almost hypnotic. You click a button, add an extra $200 a month, and suddenly four years of your life—four years of working, stressing, and commuting—just vanish from the calendar.

It’s not magic. It’s just math.

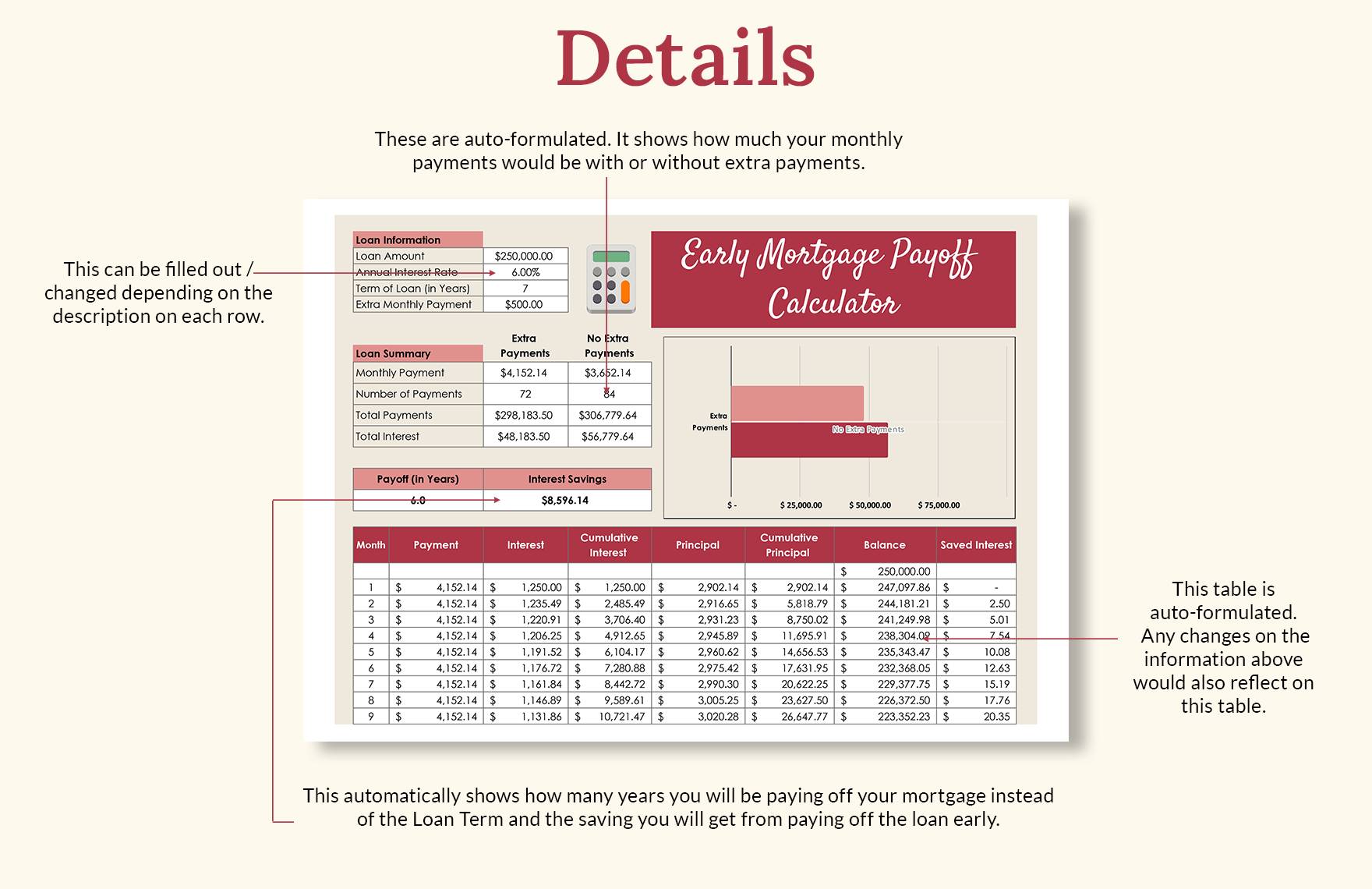

Honestly, the way we talk about debt in this country is backwards. We focus on interest rates, which matter, sure, but we ignore the "velocity" of the loan. Most 30-year fixed mortgages are front-loaded with interest. In those first few years, your money isn't even touching the principal. You’re just paying the bank for the privilege of sitting in your own living room. Using a calculator to visualize an early payoff strategy is basically like getting a cheat code for your own finances. It shows you exactly where the "tipping point" is—that moment where your principal starts dropping faster than the interest grows.

The Brutal Reality of Amortization

Amortization is a fancy word that basically means "killing the debt slowly." If you look at a standard $400,000 loan at a 6.5% interest rate, your first payment is roughly $2,528. Out of that, a staggering $2,166 goes straight to interest. Only about $362 actually pays for your house.

That is painful.

When you use a mortgage payment calculator early payoff feature, you start to see how the math shifts if you change the input. Even a tiny "rounding up" strategy—paying $2,600 instead of $2,528—can have an outsized impact because that extra $72 is "pure" principal. It doesn't get touched by the interest calculation. It just chops a chunk off the mountain.

👉 See also: Getting a music business degree online: What most people get wrong about the industry

Why the Banks Want You to Stay on Schedule

Let’s be real: banks are businesses. They make their profit on the "spread" and the duration. If you take 30 years to pay back that $400,000, you aren't paying $400,000. You’re paying back nearly $910,000. That is half a million dollars in interest alone.

By utilizing an early payoff strategy, you are effectively "firing" the bank from a decade of your life. They don't want that. This is why some older loans used to have "prepayment penalties," though those are less common now on primary residences thanks to the Dodd-Frank Act. Still, you’ve gotta check your note. Always.

Three Ways to Use a Mortgage Payment Calculator Early Payoff Strategy

There isn't just one way to do this. Some people like the "set it and forget it" method, while others get aggressive when they get a bonus or a tax refund.

The Extra Monthly Payment Method

This is the most common. You find an extra $100 or $500 in your budget and you commit to it every single month. If you’re using a calculator, you’ll notice that the earlier you start this, the more powerful it is. An extra $200 a month starting in year one is worth way more than an extra $500 a month starting in year twenty. Why? Because compounding works both ways. By reducing the principal early, you reduce the base upon which the interest is calculated for the remaining 29 years.

The "13th Payment" Trick

Some folks just take their monthly principal and interest payment, divide it by 12, and add that amount to every check. By the end of the year, you’ve essentially made one full extra payment. On a 30-year loan, this usually shaves about 4 to 6 years off the total term. It’s a "painless" way to get ahead without feeling like you're starving your lifestyle.

✨ Don't miss: We Are Legal Revolution: Why the Status Quo is Finally Breaking

Lump Sum Injections

Did you get an inheritance? A big commission check? A settlement? If you drop $20,000 onto the principal of a loan early in the term, the "interest save" over the life of the loan is astronomical. Sometimes, a $20k payment can save you $60k or $80k in future interest. That's a 300% to 400% return on your money, tax-free. Show me a stock market index that guarantees that.

The Opportunity Cost Argument (The Other Side of the Coin)

Now, I’d be doing you a disservice if I didn't mention the "math nerds" who hate early payoffs. There is a very real argument against paying off a mortgage early, especially if your interest rate is low—think the 2.5% to 3.5% rates from 2020 and 2021.

If your mortgage rate is 3%, and a high-yield savings account or a treasury bond is paying 4.5% or 5%, you are technically "losing" money by paying down the mortgage. You’d be better off putting that extra cash in the bank, earning the higher interest, and keeping the liquidity.

Liquidity is key. Once you give that money to the mortgage company, you can't get it back without a refinance or a HELOC (Home Equity Line of Credit). You can't "eat" your kitchen cabinets if you lose your job.

However, there is a psychological component that a mortgage payment calculator early payoff tool doesn't show. It’s the feeling of total ownership. There is a "peace of mind" ROI that doesn't show up on an Excel spreadsheet. If you’re the type of person who stays up at night worrying about debt, the 2% difference in interest rates might not matter as much as the feeling of being debt-free.

🔗 Read more: Oil Market News Today: Why Prices Are Crashing Despite Middle East Chaos

Common Misconceptions About Paying Early

One thing people get wrong all the time is how they actually send the money. You can’t just write a check for more than the amount and hope for the best.

Most mortgage servicers—the people you send your money to—have a specific box to check or a line item for "Principal Only." If you don't specify that the extra money is for the principal, some companies will simply apply it to "next month's payment." That does nothing for you. It doesn't save you interest; it just makes you "paid ahead." You want to make sure every extra cent is attacking the principal balance.

Another weird one: "I'll just wait and pay it off in one big chunk at the end."

No. That’s the least efficient way to do it. Because interest is calculated on the remaining balance every single month, you want that balance to be as small as possible, as early as possible.

The Step-by-Step Action Plan

Don't just read about this. Do it. Or at least, see what it looks like for your specific situation.

- Find your latest statement. You need your current balance, your interest rate, and the number of months remaining.

- Run the numbers. Use a mortgage payment calculator early payoff tool. Plug in your current numbers first to establish a baseline. See how much total interest you’re scheduled to pay. It’ll probably make you a little sick. That’s good—use that as fuel.

- Test "What If" scenarios. What if you paid $150 extra? What if you did a $5,000 one-time payment next month? Look at the "years saved" column.

- Check your "Safety Net" first. Never, ever pay extra on a mortgage if you have high-interest credit card debt. If you’re paying 22% on a Visa card, and 6% on a house, pay the Visa first. It's basic math. Also, make sure you have 3-6 months of cash in an emergency fund.

- Automate it. Most online banking portals for mortgages allow you to set up a recurring "additional principal" payment. Set it to an amount that feels slightly uncomfortable but manageable. $100? $250? Just pick a number.

- Recast (Optional). If you make a massive lump sum payment (like $50k+), ask your lender about a "mortgage recast." They won't change your interest rate, but they will re-calculate your monthly payment based on the new, lower balance. This keeps your payoff date the same but lowers your monthly "overhead," giving you more breathing room.

Basically, the goal is to stop being a "renter" from the bank. Even if you "own" the home, the bank owns the title until that balance hits zero. Using a calculator to map out your exit strategy is the first step toward actually owning the dirt you stand on. It takes the mystery out of the process and turns a 30-year sentence into a 15 or 20-year project.

Start with the small wins. Round up your payment this month. See how it feels. Once you see that principal balance drop faster on your next statement, it becomes an addiction. A good one.