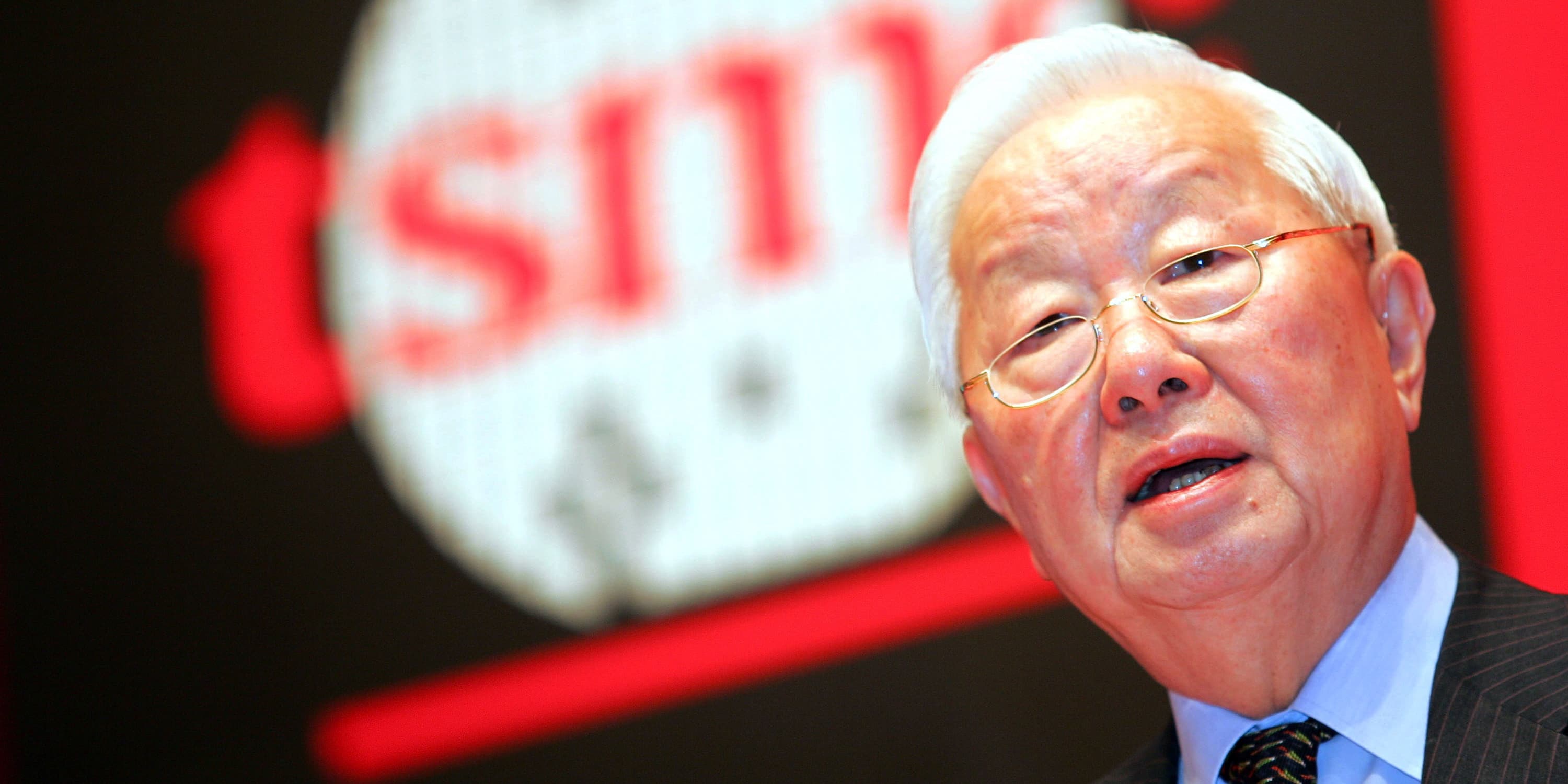

Morris Chang didn't start the world's most important company for the money. If he had, he probably would have stayed in the United States back in the eighties. Instead, the man basically invented the modern world at an age when most people are eyeing the golf course. As of early 2026, Morris Chang net worth sits at approximately $7.2 billion, a figure that has surged alongside the relentless explosion of Artificial Intelligence.

It’s a massive number, sure. But honestly, it’s almost tiny when you consider that his "baby," Taiwan Semiconductor Manufacturing Company (TSMC), is currently valued at roughly $1.77 trillion.

How does the guy who built the foundation of the entire digital economy—the man who makes the chips for your iPhone, your Tesla, and every Nvidia GPU on the planet—end up with a smaller fortune than some Silicon Valley app developers? The answer is kinda wild and tells you everything you need to know about the "Godfather" of chips.

📖 Related: Why Fox Business Network Live Stream is the Only Way Some Traders Keep Their Sanity

The $7.2 Billion "Anomalous" Fortune

You've probably heard of the "founder's stake." Usually, when someone starts a company like Amazon or Facebook, they keep a massive chunk of equity. Jeff Bezos and Mark Zuckerberg became centi-billionaires because they owned the joint.

Morris Chang did it differently.

When he founded TSMC in 1987, he wasn't a scrappy 20-something in a garage. He was a 56-year-old industry titan recruited by the Taiwanese government. He didn't actually receive a massive "founder's grant" of stock at the start. He was essentially a high-level government employee and professional manager.

Most of his wealth comes from the 125 million shares he held when he finally retired as Chairman in 2018. Back then, TSMC was a big deal, but it wasn't the trillion-dollar behemoth it is today.

Why the sudden jump in 2025-2026?

If you looked at his net worth a couple of years ago, it was hovering around $2.3 to $2.8 billion. What changed?

- The AI Supercycle: Every single AI chip—literally all of them—is made by TSMC. As companies like Nvidia and Apple scrambled for 3nm and 2nm capacity in 2025, TSMC's stock price went vertical.

- Dividends: Chang is a big fan of cash flow. In mid-2024, it was estimated he pocketed nearly $14 million (NT$437 million) in a single quarterly dividend payout. By 2026, with TSMC raising dividends to roughly $3.87 per share annually, his passive income is staggering.

- Compound Growth: He didn't panic-sell. While other tech founders diversify into space rockets or social media platforms, Chang’s wealth is almost entirely tied to the company he built.

From Ningbo to the Ivy League

To understand the money, you have to understand the man's grit. Born in Ningbo, China, in 1931, Chang’s early life was defined by war and flight. He lived through the Japanese occupation and the Chinese Civil War. He eventually made it to Harvard, then MIT.

He spent 25 years at Texas Instruments (TI). He was the guy who figured out that if you lower prices early, you gain market share and "learn" how to make chips cheaper than anyone else. It's called the "Experience Curve," and he used it to crush the competition.

But TI passed him over for the top job. They wanted to focus on consumer electronics (calculators and watches). Chang knew the real future was in the chips themselves.

He left. He went to General Instrument. Then, the call from Taiwan came.

👉 See also: Chase New Debit Card Request: How to Get Your Plastic Faster

The Business Model That Changed Everything

Before TSMC, if you wanted to design a chip, you had to own a factory (a "fab"). Fabs cost billions. This meant only the giants could innovate.

Chang's idea was simple but revolutionary: "We will only make chips. We won't design them. We will never compete with our customers."

This created the "fabless" industry. It allowed companies like Nvidia, Qualcomm, and Broadcom to exist. Without Morris Chang, your smartphone would probably be the size of a brick and cost as much as a car.

What People Get Wrong About His Wealth

There is a common misconception that Morris Chang is a "typical" billionaire. He isn't. He doesn't flaunt it. You won't see him on a 500-foot yacht in the Mediterranean.

In Taiwan, he’s treated like a national hero—the "Godfather." His wealth is seen more as a byproduct of national success than individual greed. People often ask: "Why isn't he worth $100 billion?"

Honestly, it's because he wasn't looking to own the world; he was looking to build a system that worked. He took a salary and earned his shares through decades of performance. He didn't use venture capital tricks to inflate his valuation. It was all "learning by doing," as he often tells students at MIT and Stanford.

How to Think Like Morris Chang (Actionable Insights)

If you’re looking at Morris Chang’s $7.2 billion and wondering what the takeaway is for your own financial life, it isn't "go start a semiconductor fab." That ship has sailed (and it costs $20 billion to build a new one).

Instead, look at his principles:

- Play the Long Game: Chang stayed at Texas Instruments for 25 years before even starting his "main" career. Wealth often comes from the second or third act of life.

- The Power of Dividends: He doesn't need to sell his shares to live well. By focusing on a company with high margins (TSMC’s net margin is often over 40%), he created a personal "cash machine."

- Identify the Bottleneck: He realized that manufacturing was the bottleneck for the tech industry. He solved the hardest problem, which made him indispensable.

- Trust is a Currency: TSMC’s motto is "Integrity." By promising never to compete with customers, he won the trust of Apple and Nvidia. That trust is why he is a multi-billionaire today.

If you want to track the movement of his net worth, keep a close eye on TSMC's (TSM) quarterly earnings and their capital expenditure (CapEx) guidance. As of January 2026, the company is planning to spend upwards of $54 billion on new tech. When the company spends that much on its own future, it's a safe bet the founder’s net worth isn't going down anytime soon.

Next Steps for You:

Check the current trading price of TSM on the NYSE. If the stock is trading above $340, Chang's net worth is likely pushing even higher than the $7.2 billion estimate. Look into "Dividend Growth Investing" if you want to emulate his strategy of building wealth through high-quality, high-margin companies that pay you to stay invested.