You just landed at Hartsfield-Jackson Atlanta International Airport (ATL). Maybe you've got a long layover, or maybe you're finally starting that dream trip to Europe or South America. Either way, you need cash. Specifically, the local kind. But here's the thing about money exchange in Atlanta airport: it’s convenient, sure, but convenience almost always comes with a tax you didn't see coming.

Most travelers walk straight to the first kiosk they see because, honestly, who wants to wander around a massive airport with luggage? It’s the world’s busiest airport for a reason. It's loud. It's chaotic. You just want your Euros or Pesos so you can get on with your life. But if you aren't careful, you might lose 10% to 15% of your value before you even leave the terminal.

Let's get real. Hartsfield-Jackson is a beast.

The Reality of Currency Exchange Kiosks at ATL

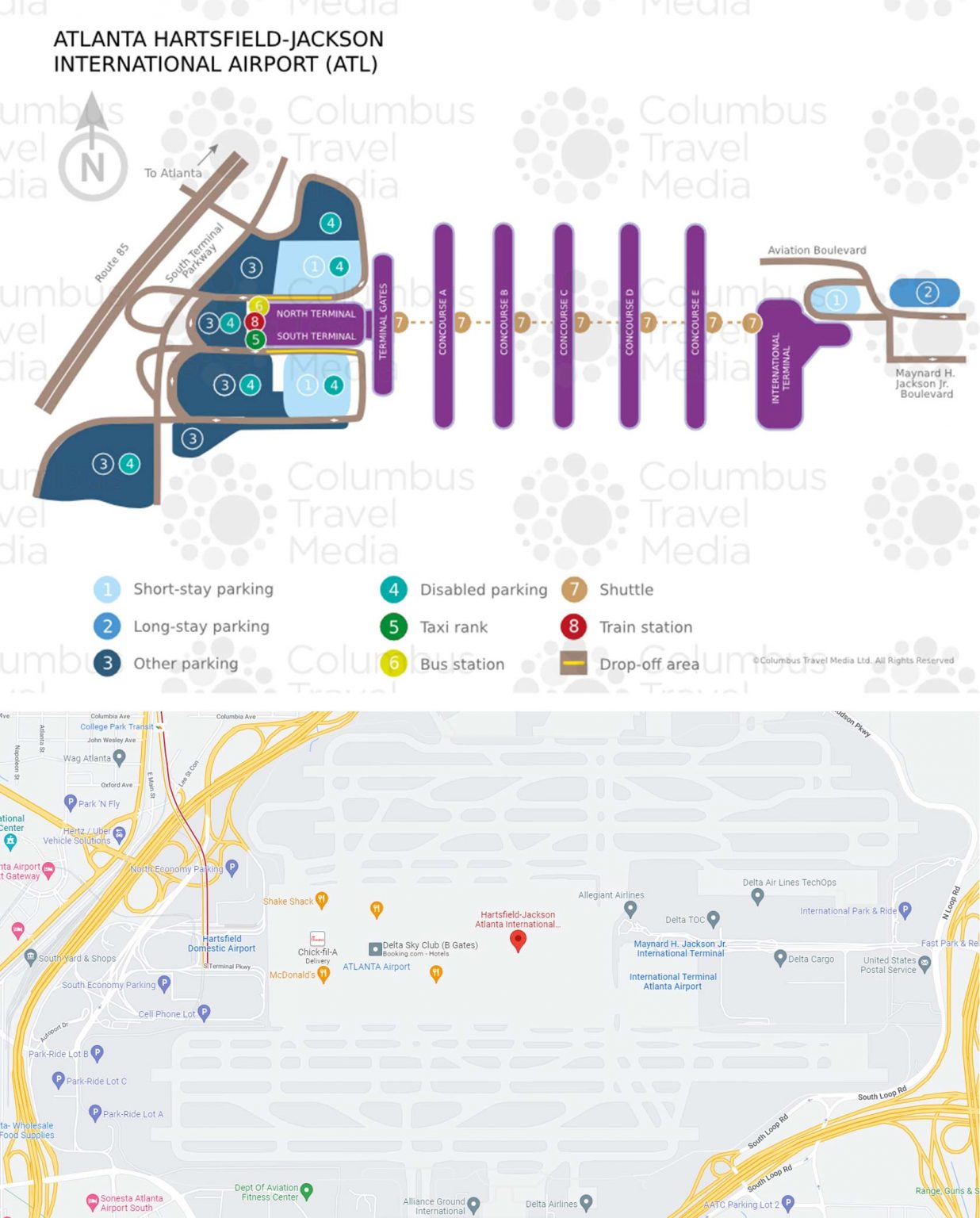

The primary player at ATL is ICE (International Currency Exchange). They are everywhere. You’ll find them in the International Terminal (Terminal F) and scattered throughout various concourses like E and T. They’ve basically got a monopoly on the physical "booth" experience at the airport.

Why does that matter? Well, competition keeps prices down. Without it, the rates get... adventurous.

When you look at the board at an ICE booth, you’ll see the "Exchange Rate." It looks official. It’s glowing on a screen. But that number isn't the mid-market rate you see on Google. It’s the "retail rate." This rate includes a healthy margin for the company. On top of that, there’s often a flat transaction fee. If you’re only swapping $50, that $5 or $10 fee is a massive chunk of your money. It’s kinda brutal when you do the math.

Where to find them if you're in a rush

If you absolutely must use a kiosk, look for them here:

🔗 Read more: Finding Alta West Virginia: Why This Greenbrier County Spot Keeps People Coming Back

- International Terminal (Concourse F): There’s one right in the arrivals hall and another near the check-in counters.

- Concourse E: Since this handles a ton of international traffic, you’ll find booths near the center point.

- Atrium: There’s usually a location in the domestic terminal's main atrium, near the hidden entrance to the Plane Train.

Is it easy? Yes. Is it the smartest financial move? Probably not. You’re paying for the real estate that booth occupies.

The ATM Strategy: A Better Way to Handle Money Exchange in Atlanta Airport

Honestly, if you have a debit card from a major bank, stop looking for a currency booth. Use an ATM.

ATL has dozens of ATMs. Most are operated by Wells Fargo or Truist. If you are an American traveler heading out, you can’t exactly pull Euros from a domestic ATM. But if you are an international traveler arriving in Atlanta, the ATM is your best friend.

The machine will give you U.S. Dollars at the "network rate," which is almost always closer to the real exchange rate than what you’d get at a kiosk. Even with a $3 or $5 out-of-network fee, you’re usually coming out ahead if you’re withdrawing $200 or more.

Wait, there's a catch.

Dynamic Currency Conversion (DCC). This is a fancy term for a total rip-off. When the ATM asks, "Would you like to be charged in your home currency or the local currency?" always choose the local currency. If you let the ATM do the conversion for you, they apply their own terrible rate. Let your home bank handle the math. They’re usually much fairer.

💡 You might also like: The Gwen Luxury Hotel Chicago: What Most People Get Wrong About This Art Deco Icon

Why "No Fee" is a Total Myth

You’ll see signs everywhere for "No Commission" or "Zero Fees." It’s a classic marketing trick.

Think about it. These companies have employees to pay, rent to cover, and lights to keep on. They aren't doing this out of the goodness of their hearts. If they aren't charging a "fee," they are simply baking their profit into a worse exchange rate.

Suppose the real exchange rate is $1 to 0.92 Euro. A "no fee" kiosk might offer you 0.81 Euro. They didn't charge you a $7 fee, but they just took 11 cents for every dollar you traded. On a $500 exchange, you just handed them $55. That’s a fancy dinner in Paris you just threw away.

Better Alternatives Outside the Airport

If you’re still at home and haven't left for the airport yet, go to your local bank. Bank of America, Wells Fargo, and Chase usually allow their account holders to order foreign currency online or at a branch.

It takes a few days. You have to plan ahead. But the rates are significantly better than anything you’ll find near a runway.

Another pro tip: Get a Charles Schwab or Capital One debit card. Schwab, in particular, is the holy grail for travelers because they reimburse all ATM fees worldwide. You could use the most expensive ATM in the middle of the Atlanta airport, and Schwab will give you that $5 fee back at the end of the month.

📖 Related: What Time in South Korea: Why the Peninsula Stays Nine Hours Ahead

What About Leftover Cash?

Coming back home with a pocket full of colorful paper? Selling your currency back to the airport kiosks is the worst possible move. They buy it back at a "bid" price that is significantly lower than what they sold it to you for.

Basically, you get hit twice.

If you have leftovers, keep them for your next trip. Or, use them to pay the final portion of your hotel bill in cash and put the rest on your credit card. Anything is better than selling it back at the airport.

Actionable Steps for Your Arrival or Departure

Don't let the stress of travel make you make a $100 mistake. Here is exactly what you should do instead of panic-buying currency.

- Check your credit card's foreign transaction fees. If your card has 0% fees, use it for everything. You rarely need cash in 2026 unless you’re visiting very rural areas or specific street markets.

- Download an offline currency converter app. Apps like XE or even just typing "USD to EUR" into Google will give you the baseline. If the booth at ATL is offering you something wildly different, walk away.

- Use the ATM in the Arrivals hall. If you’re an international visitor, skip the ICE booth. Find a Truist or Wells Fargo ATM, decline the "conversion," and take out the maximum amount you think you'll need to minimize fees.

- Notify your bank. Before you touch an ATM at the airport, make sure your bank knows you're traveling. Nothing ruins a trip faster than a frozen card in Concourse F.

- Use Apple Pay or Google Pay. Most vendors in and around Atlanta (and most major global cities) take contactless payments. This uses the mid-market rate provided by your card issuer, which is almost always the best deal you can get.

The convenience of money exchange in Atlanta airport is a luxury. If you have the money to burn and you just want the peace of mind of having physical bills in your pocket, go for it. But if you’d rather spend that money on your actual vacation, stick to ATMs and travel-friendly debit cards. The kiosks are there for the unprepared; now that you know how the system works, you don't have to be one of them.