You’re standing in your shop at 6:00 AM. The smell of floor wax or maybe roasted coffee is still heavy in the air. You look at the books and realize the expansion you’ve been dreaming about—the one with the extra seating or the CNC machine that doubles your output—is just out of reach because your bank account doesn't have enough zeros. It’s frustrating. Honestly, it’s more than frustrating; it’s a specific kind of "small business owner" heartbreak where you have the vision but lack the fuel.

Finding mom and pop business funding isn't like the flashy Silicon Valley "pitch decks and Patagonia vests" world you see on TV. There are no venture capitalists coming to save your local bakery or the family-owned dry cleaners. Instead, you're navigating a maze of high-interest credit cards, confusing SBA requirements, and local bank managers who might know your name but still have to follow a rigid credit score algorithm. It’s a grind.

The Reality of the "Small" in Small Business Lending

Most people think that if they have a good business, the money will just follow. That’s a myth. Big banks have been steadily retreating from small-dollar loans for over a decade. Why? Because it costs them just as much to process a $50,000 loan for a neighborhood flower shop as it does to process a $5 million loan for a tech firm. They’d rather chase the $5 million.

If you've felt ignored by the big guys, you aren't crazy. Data from the Federal Reserve’s Small Business Credit Survey consistently shows that "microbusinesses"—those with less than $100,000 in annual revenue—have a much harder time securing traditional financing. You're fighting an uphill battle against an industry designed for scale, not for "mom and pop" charm.

But here’s the thing. You have options that actually fit your size. You just have to know where to look.

The SBA 7(a) and the "Microloan" Secret

The Small Business Administration (SBA) doesn't actually give you money. They just promise the bank that if you can't pay it back, the government will cover a huge chunk of the loss. This is the gold standard of mom and pop business funding because the interest rates are capped.

However, everyone talks about the 7(a) loan, but almost nobody mentions the SBA Microloan program. These are specifically for amounts up to $50,000. They are delivered through community-based nonprofit intermediaries. Because these organizations are nonprofits, they care more about your community impact than a Chase or Wells Fargo might. They offer technical assistance too. Basically, they teach you how to manage the money they just gave you.

✨ Don't miss: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

Why Your Local Credit Union is Your Best Friend

Forget the national banks. Seriously. If you want a lender who actually understands why a snowstorm in January matters to your revenue, you go to a credit union or a Community Development Financial Institution (CDFI).

CDFIs are the unsung heroes of the American economy. They are private financial institutions that are 100% dedicated to delivering responsible, affordable lending to help low-income, low-wealth, and other disadvantaged people and communities. They look at more than just a FICO score. They look at your character. They look at your years in business. They look at the fact that you’ve never missed a rent payment even when the world was falling apart.

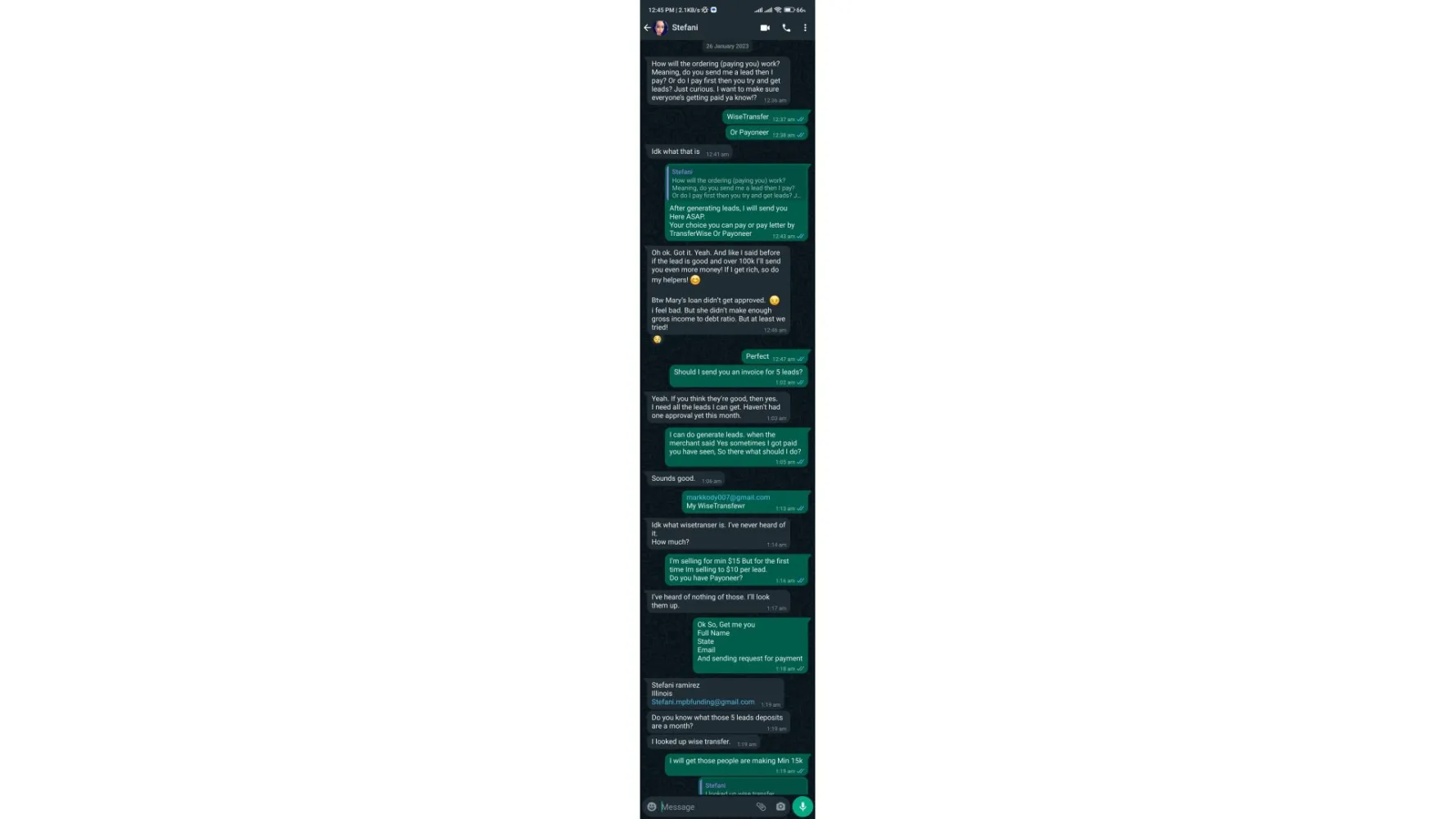

The Trap of Merchant Cash Advances (MCA)

Look, we've all seen the emails. "Get $20,000 in your account by tomorrow! No credit check!"

It sounds like a lifeline. In reality, it can be a noose. A Merchant Cash Advance isn't technically a loan; it’s a sale of your future credit card receipts. The "factor rate" might look low—maybe 1.2 or 1.4—but when you translate that into an Annual Percentage Rate (APR), you’re often looking at 60%, 80%, or even 150%.

I've seen business owners lose everything because the daily withdrawals from an MCA sucked their cash flow dry. They couldn't buy inventory because the lender took their cut every single morning before the shop even opened. Unless it is a literal life-or-death emergency for the business, stay away. There are better ways to get mom and pop business funding that won't bankrupt you in six months.

Community Development Financial Institutions (CDFIs) to Check Out:

- Accion Opportunity Fund: They focus heavily on underrepresented entrepreneurs and offer transparent rates.

- LISC (Local Initiatives Support Corporation): They work deeply in urban and rural revitalization.

- Kiva: This is technically "crowdfunded" micro-lending. It’s 0% interest. You get a loan by having your community (and then the world) chip in $25 at a time. It’s slow, but it’s the cheapest money you’ll ever find.

Getting Your "House in Order" Before You Ask

Lenders smell desperation. It’s an unfortunate truth. If you walk in with a shoebox of receipts and a "trust me" attitude, you’re going to get a "no" or a predatory rate.

🔗 Read more: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

You need a Profit and Loss (P&L) statement. Not one you scribbled on a napkin, but a clean one from QuickBooks or Xero. You need at least two years of tax returns. If you haven't filed your taxes, don't even bother applying for formal mom and pop business funding. You also need a "sources and uses" statement. This is just a fancy way of saying: "Here is exactly how much money I want, and here is exactly what I’m going to buy with it."

Banks hate vagueness. They don't want to hear that you need "working capital." They want to hear that you need $12,400 for a walk-in freezer and $3,000 for a three-month marketing push on Instagram. Specificity builds trust. Trust lowers interest rates.

The New Wave: Revenue-Based Financing

There is a middle ground emerging between the bank loan and the predatory MCA. It’s called revenue-based financing. Instead of a fixed monthly payment, you pay back a percentage of your monthly sales.

If you have a slow month—say, a rainy April for a landscaping business—your payment drops. If you have a huge June, you pay back more. It’s flexible. Companies like MainStreet or various Shopify-integrated lending platforms do this. It’s great for mom and pop business funding because it scales with your actual reality, not some rigid schedule set in a boardroom in New York.

Fact-Checking the "Grant" Myth

Let’s be real for a second. You probably see those TikToks or Facebook ads promising "Free Government Grants for Small Businesses."

Mostly? It's junk.

💡 You might also like: Why Toys R Us is Actually Making a Massive Comeback Right Now

The federal government rarely gives direct "free" money to a for-profit retail business. Most grants are for highly specific things: scientific research (SBIR grants), rural development, or very specific minority-owned business initiatives through organizations like the Amber Grant for Women. They are incredibly competitive and take months to apply for. Don't build your expansion plan on the hope of a "grant." Build it on the reality of a smart loan or organic growth.

Actionable Steps to Take Right Now

Stop scrolling and start doing. If you need capital, the clock is already ticking.

First, download your last 12 months of bank statements. Look for any "NSF" (Non-Sufficient Funds) fees. If you have those, wait three months to apply. Lenders see an NSF fee as a giant red flag that you can't manage cash. Clean that up first.

Second, check your personal credit score. Most mom and pop business funding is personally guaranteed. Your business and your life are intertwined in the eyes of a lender. If your score is under 640, focus on credit repair before you talk to a bank. Use a tool like Experian Boost or just pay down your smallest credit card balance to lower your utilization ratio.

Third, find your local SBDC. The Small Business Development Center is a national network of offices that provide free one-on-one consulting. They are funded by the SBA. They will help you write your business plan and even introduce you to local lenders who are actually "buying" (lending) right now. It’s free. Use it.

Lastly, calculate your Debt Service Coverage Ratio (DSCR). Banks use this to see if you can afford the loan. Take your annual net income, add back in your interest and depreciation, and divide it by your total annual debt payments. If the number is above 1.25, you’re in the "safe zone" for a traditional loan.

Funding isn't a gift; it’s a tool. Treat it like a new piece of equipment. It has a cost, a maintenance schedule, and a specific job to do. When you stop looking at it as a "save me" move and start looking at it as a strategic "grow me" move, the way you talk to lenders changes. And that’s when they start saying yes.