Ever looked at a stock chart and felt like you were reading a crime novel where the detective keeps missing the obvious clue? That’s basically the vibe with the Molina Healthcare share price lately. If you’ve been watching the ticker for MOH, you know the story isn't just about numbers on a screen; it’s about a massive, messy "reset" that has left a lot of people scratching their heads.

Honestly, it’s been a bit of a rollercoaster. Just look at the start of 2026. On January 2nd, the stock was hovering around the $173 to $176 mark. Fast forward a couple of weeks to mid-January, and we saw a weirdly specific jump. By January 15, it hit $193.74, only to dip back down to $191.40 the very next day.

Why the sudden mood swings?

Well, the market is trying to figure out if Molina has finally stopped the bleeding from the "acuity shift" disaster of 2025. For those who aren't deep in the weeds of health insurance jargon, the acuity shift is basically what happens when healthy people leave Medicaid and only the sick ones stay. It’s a nightmare for margins. Molina got hammered by this last year, with shares at one point down over 40% year-to-date in 2025.

The $14 Dollar Question and the 2026 Reset

When people talk about the Molina Healthcare share price, they’re usually obsessed with one thing: the Medical Care Ratio (MCR). This is the percentage of premiums the company actually spends on medical claims. In Q3 2025, Molina's MCR spiked to a painful 92.6%. For a company that likes to live in the 88% to 89% range, that’s basically the equivalent of a kitchen fire.

Management, led by CEO Joe Zubretsky—who, by the way, just got his contract extended through 2027—has been trying to put out that fire. They set the 2025 adjusted earnings guidance at about $14.00 per share. But here’s the kicker: they’re projecting 2026 to be another "reset" year where earnings might just flatline around that same $14.00 mark.

It’s a tough pill for investors to swallow.

📖 Related: Oil Market News Today: Why Prices Are Crashing Despite Middle East Chaos

You’ve got a company that was once a high-flying growth darling now telling the world, "Hey, we're just trying to get back to normal." Analysts are split. You have some folks like the team at Mizuho raising price targets to $220, while the bears at Goldman Sachs and UBS have been cutting their targets toward the $160-$170 range.

The disagreement mostly stems from whether you believe the government will play ball. Molina is almost entirely dependent on government contracts. If state governments don't raise the rates they pay Molina to cover these sicker patients, the share price is going to stay stuck in the mud.

Politics, Trump, and the "Policy Overhang"

You can’t talk about Molina without talking about Washington. It's just part of the deal. Back in late 2025, we saw a massive tumble in the Molina Healthcare share price when Donald Trump suggested redirecting federal healthcare funds directly to individuals instead of insurers.

That kind of talk sends shockwaves through the sector.

Even if those policies never actually happen, the threat of them creates what traders call a "policy overhang." It’s like a dark cloud that keeps the stock from reaching its full potential. Right now, as we head further into 2026, the market is pricing in a lot of "what if" scenarios.

- What if the ACA subsidies aren't extended?

- What if Medicaid funding gets slashed?

- What if the "unwinding" of Medicaid enrollment takes longer than expected?

These aren't just academic questions. They are the primary drivers of volatility for MOH. If you're holding these shares, you're essentially betting on the stability of the U.S. social safety net.

👉 See also: Cuanto son 100 dolares en quetzales: Why the Bank Rate Isn't What You Actually Get

Why the Smart Money is Watching the Q4 Earnings Report

Everyone is circling February 5, 2026, on their calendars. That’s the estimated date for the Q4 2025 earnings release. This isn't just another report; it’s the moment of truth for Zubretsky’s "reset" plan.

Investors are looking for three specific things:

- MCR Improvement: Did the medical cost trend finally stabilize in December?

- 2026 Formal Guidance: Will they stick to the $14.00 estimate, or is there a surprise "beat and raise" in the works?

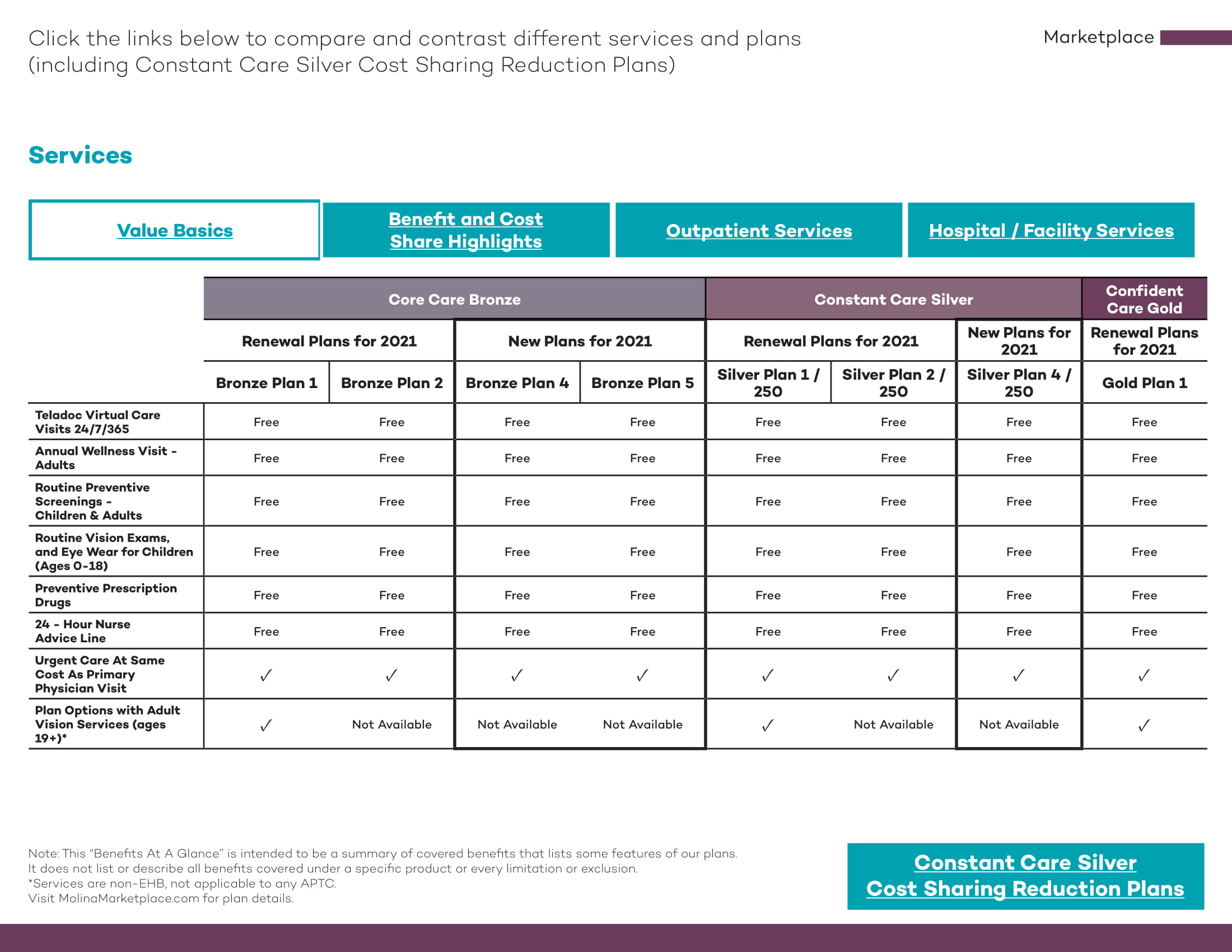

- Marketplace Exposure: Molina has been trying to pull back from the volatile "Marketplace" (ACA) segment where they lost a ton of money recently. Any news on that front will be huge.

Interestingly, institutional ownership is still incredibly high—around 98.5%. Big hedge funds and pension funds haven't abandoned ship yet. Many of them see Molina as a "fallen angel." They’re betting that once the 2025 mess is cleaned up, the company’s "new store" earnings (from recent acquisitions like ConnectiCare and various state contracts) will finally start to kick in.

Looking at the Technicals (If You're Into That)

If you're a chart person, the Molina Healthcare share price is currently in a weird spot. It’s been trading above its 50-day moving average (around $160) but well below its 52-week high of nearly $360.

Technically, it's in a "rising trend" in the short term, but it’s a fragile one. StockInvest.us recently labeled it a "Buy Candidate," noting that volume has been falling alongside price dips—which is usually a sign that the selling pressure is drying up. But let's be real: technicals don't mean much in this sector if a governor in a major state decides to cut Medicaid rates by 2%.

The Bottom Line for 2026

So, where does this leave you?

✨ Don't miss: Dealing With the IRS San Diego CA Office Without Losing Your Mind

Molina isn't a "get rich quick" play anymore. It’s a "wait for the dust to settle" play. The company is fundamentally a different beast than it was three years ago. It’s larger, but it’s also dealing with a much more complex patient base.

If you're looking for actionable steps, the first move is to watch the Medicaid "rate adequacy" updates coming out of states like Florida and California. Those updates are the lifeblood of the company. If the rates go up, the Molina Healthcare share price likely follows.

Second, keep an eye on the insider activity. We saw a director sell a small chunk of shares (357 shares) in early January. It wasn't a huge move, but in a period of uncertainty, you want to see the C-suite buying, not selling.

Finally, don't get distracted by the daily noise. The spread between the "Low" analyst target ($144) and the "High" target ($440) is absurdly wide. That tells you that even the experts don't have a consensus. The real story will be written in the margins—specifically, if Molina can get that MCR back under 90%.

Until then, expect the rollercoaster to continue. If the February earnings report shows that the "acuity shift" is finally in the rearview mirror, that $191 price point might look like a steal. But if costs are still rising, $170 could be the new ceiling.

Actionable Next Steps:

- Track the MCR: Download the Q3 2025 report and compare it specifically to the Medicaid segment performance in the upcoming Q4 release.

- Monitor State Rate Filings: Check for news on 2026 Medicaid reimbursement rates in Molina's core states.

- Set Price Alerts: Place alerts at $165 (strong support) and $205 (major resistance) to catch the next break in either direction.

- Evaluate Political Risk: Follow the 2026 midterm election rhetoric surrounding ACA subsidies, as this will likely dictate the stock's "ceiling" for the rest of the year.