It happened again. You woke up on January 1, maybe a little hungover, and realized the price of your morning latte went up by forty cents. Or, if you’re on the other side of the counter, your hourly rate finally hit a number that doesn't feel like it's stuck in 2009. We are officially in 2026 now, but looking back at the minimum wage by state 2025 map, it’s clear that last year was a massive turning point for American paychecks.

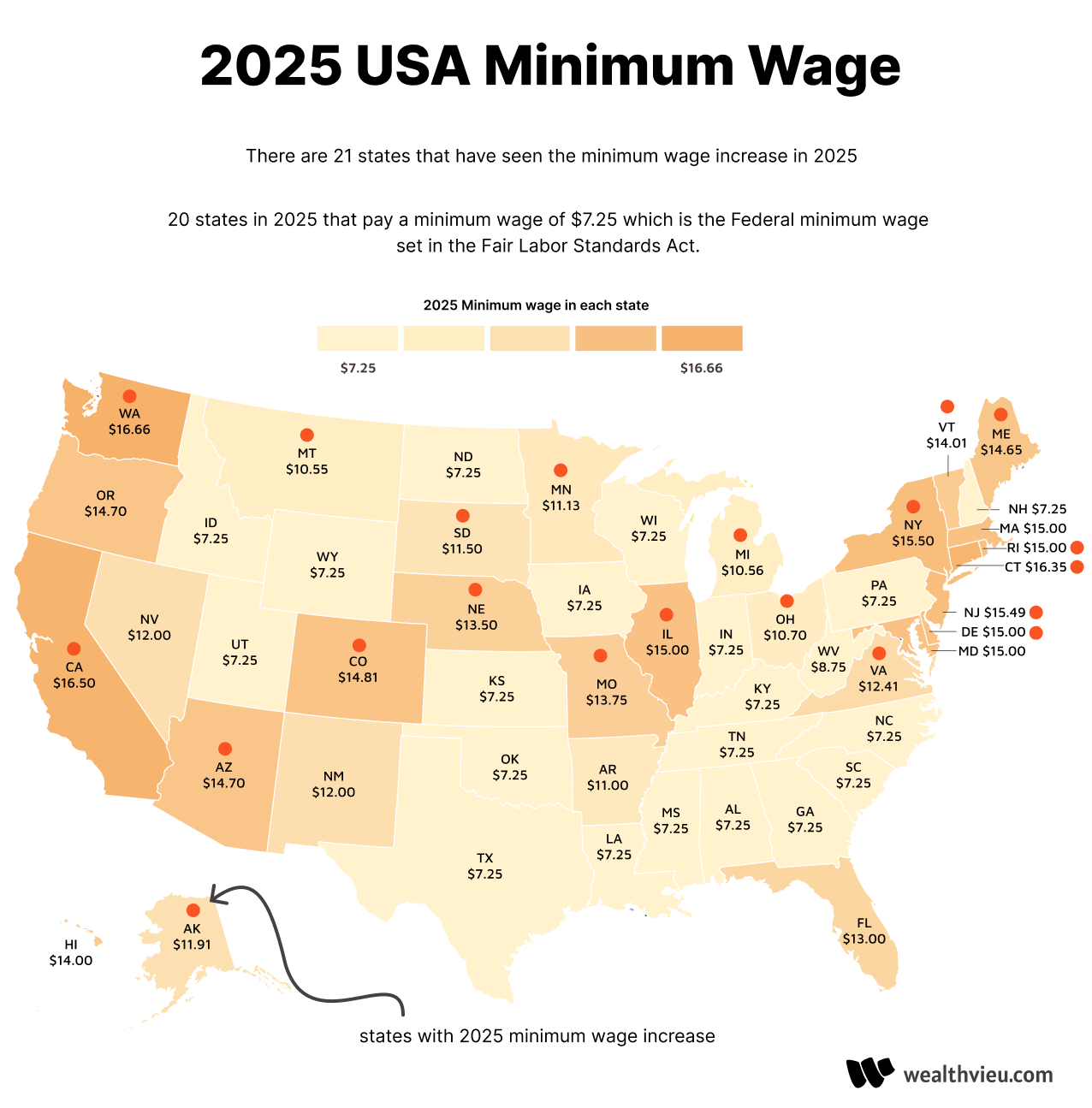

Honestly, the map looks like a patchwork quilt designed by someone who couldn't decide on a color scheme. You’ve got states like Washington and California pushing toward twenty bucks an hour, while a huge chunk of the South is still clinging to a federal rate that hasn't budged in seventeen years. It's weird. It’s messy. And if you’re a business owner with employees in multiple states, it’s a total headache.

The 2025 Shift: Where the Money Moved

Last year, more than 20 states kicked off the year with a raise. We aren't just talking about a few pennies for inflation, either. Some of these jumps were aggressive. For instance, Hawaii moved to $14.00 in 2025, but they’ve already signaled a jump to $16.00 here in 2026. They aren't playing around.

Then you have the "inflation trackers." About 15 states now have laws where the wage just... goes up automatically. No voting, no debating in the statehouse, just a mathematical adjustment based on the Consumer Price Index (CPI). If eggs get more expensive, the wage goes up. It’s a simple feedback loop that keeps states like Arizona, Colorado, and Maine constantly shifting on the map.

The Heavy Hitters of 2025

- Washington State: Stayed at the top of the pack, hitting $16.66. It's a specific number, sure, but those sixes add up over a 40-hour week.

- California: $16.50 for everyone. But wait—there was a huge caveat for fast-food workers who saw $20.00 an hour thanks to sector-specific legislation.

- Connecticut: Hit $16.35, keeping the tri-state area competitive.

- New York: It depends on where you stand. If you were in NYC, Long Island, or Westchester, you were looking at $16.50. Anywhere else? $15.50.

The "Federal Floor" Holdouts

It is honestly wild that in 2026, the federal minimum wage is still $7.25. That hasn't changed since Obama’s first term. Because of that, the minimum wage by state 2025 map shows a massive "dead zone" across the Southeast and parts of the Midwest.

Alabama, Mississippi, Louisiana, South Carolina, and Tennessee. These five states have no state minimum wage law at all. None. They just default to the federal government. Then you have Georgia and Wyoming, which technically have a state minimum of $5.15, but since the federal law overrides them for most workers, everyone gets $7.25 anyway.

Is it livable? Most economists say no. A 2024 study from the Economic Policy Institute (EPI) pointed out that there isn't a single county in the U.S. where a $7.25 wage covers basic rent and groceries for a single adult. Yet, the political divide on the map remains as sharp as ever.

Why the Map Keeps Changing

You might wonder why we can't just have one number. The answer is basically "Home Rule."

📖 Related: Elon Musk 10 Years Ago: What Most People Get Wrong

States like Florida are on a "step schedule." They aren't waiting for inflation; they passed a constitutional amendment years ago to hit $15.00 by September 2026. In 2025, they were sitting at $13.00, and they just bumped to $14.00 last September. It's a slow climb.

And then there's the "City vs. State" drama.

Take Oregon. You can't just look at one number for the whole state. They have three tiers. You have the "Standard" rate, the "Portland Metro" rate (which is higher), and the "Non-urban" rate (which is lower). It's a way to acknowledge that living in a cabin in the woods costs less than a studio apartment in downtown Portland.

Business Reality: The Compliance Nightmare

If you’re running a remote company, the minimum wage by state 2025 map isn't just a fun graphic—it's a legal minefield.

You've got to track "nexus." If your graphic designer lives in Seattle but your office is in Austin, you're paying Seattle wages. Period.

Many small business owners are struggling with "wage compression." That's the fancy term for when the new guy's starting pay gets so close to the manager's pay that the manager starts asking for a raise, too. It’s a domino effect. If the floor rises, the ceiling has to move, or your best people will walk across the street to a competitor who adjusted their scales faster.

💡 You might also like: How Many Billionaires in New York: Why the Big Apple Still Owns the Top Spot

Surprising Details from 2025

- Michigan's Rollercoaster: They had massive legal battles over how fast their wage should rise, ultimately landing at $10.56 early in 2025 before more changes kicked in.

- Missouri and Nebraska: Often thought of as "low-cost" states, both have moved aggressively. Missouri hit $13.75 in 2025 and is on its way to $15.00.

- The Tipped Minimum: This is the next big battle. States like Alaska, California, and Washington have already eliminated the "tip credit," meaning servers get the full minimum wage plus tips. Other states still allow employers to pay as little as $2.13 an hour as long as tips make up the difference.

What You Should Do Now

Whether you’re a worker or a boss, you can't just look at a map once and forget it. These numbers are fluid.

If you’re an employee: Check your paystubs. Seriously. With all the incremental increases in states like Michigan or Florida that happen mid-year, it's easy for a payroll software glitch to keep you at the "old" rate for a month or two. You’re owed that money.

If you’re an employer: Audit your remote staff locations every quarter. Someone moves across a state line to a higher-wage area, and suddenly you’re in violation of labor laws without even knowing it.

Watch the ballot boxes: 2026 is an election year. Look for "Wage Hikes" on your local ballot. Historically, when voters get to decide directly—rather than waiting for politicians—minimum wage increases almost always pass, even in "red" states.

The trend is moving toward a $15.00 national "unofficial" floor, regardless of what the federal government does. By the time we look at the 2027 map, those $7.25 states are going to look more and more like outliers in a high-cost economy.

Key Takeaways for the 2025-2026 Cycle

- Check the Effective Date: Not all raises happen on January 1. Florida and Oregon, for example, usually see shifts in July or September.

- Verify Local Laws: Cities like West Hollywood, San Francisco, and Seattle often have rates $2-$3 higher than their state's minimum.

- Index for Inflation: If you live in an indexed state, expect a raise every single year based on the CPI.

To stay ahead of these changes, the best move is to bookmark the Department of Labor's state-by-state table. It’s the only way to stay sane in a country that currently has over 50 different "minimum" wages.