If you were wearing a uniform back in 2015, you probably remember the collective groan when the budget dropped. It wasn't exactly a banner year for the bank account. For the second year in a row, the federal government capped the across-the-board pay increase at a mere 1%. People talk about military compensation like it’s this massive, ever-growing pile of gold, but the military pay scale 2015 tells a much more complicated story about post-war budgeting and the "Beltway" politics of the Obama administration.

It was a grind.

Basically, the 1% raise was actually a "pay cut" in terms of purchasing power if you looked at the Private Sector Wage growth, which was hovering closer to 2.4% at the time. The Department of Defense (DoD) was trying to figure out how to keep the lights on and the jets flying while facing sequestration cuts. You’ve got to understand the context here; we were coming off a decade of much higher raises—sometimes 3% or 4%—and suddenly the faucet just... tightened.

The Reality of the E-3 and O-3 Numbers

Let's get into the weeds of what people actually saw on their Leave and Earnings Statements (LES). An E-3 with over two years of service—think of your average Lance Corporal or Airman First Class—was pulling in a basic pay of roughly $1,979.70 a month. That’s not a lot when you’re stationed in a high-cost area, even with the housing allowance. If you were a Captain (O-3) with six years under your belt, your base pay sat at $5,469.60.

These numbers didn't exist in a vacuum.

While the military pay scale 2015 felt stagnant, the real money—or the real struggle—depended on the allowances. 2015 was the year the DoD started tinkering with Basic Allowance for Housing (BAH) in a way that really annoyed people. They decided that members should start paying a small percentage of their housing costs out of pocket, eventually aiming for a 5% cost-share. So, while your base pay went up 1%, your "out of pocket" expenses for a rental in San Diego or Norfolk started creeping up too.

👉 See also: Why the Recent Snowfall Western New York State Emergency Was Different

It was a wash. Honestly, for many families, it felt like losing ground.

Why the 1% Was Such a Big Deal

The Pentagon argued that if they didn't cap pay, they’d have to cut training or maintenance. They called it "rebalancing." But for a Sergeant (E-5) with a spouse and two kids, "rebalancing" meant choosing between a new set of tires and putting a little extra into the Thrift Savings Plan (TSP).

Critics of the 2015 plan, including groups like the Military Officers Association of America (MOAA), were vocal about the "pay gap." They argued that by law, military raises are supposed to track with the Employment Cost Index (ECI). When the 2015 raise was set at 1% instead of the 1.8% or 2% that the ECI suggested, it created a cumulative gap. You think a 0.8% difference is small? Over a twenty-year career, that's tens of thousands of dollars in lost lifetime earnings and retirement pension value.

It adds up. Fast.

The Breakdown of Basic Pay (The Monthly Grind)

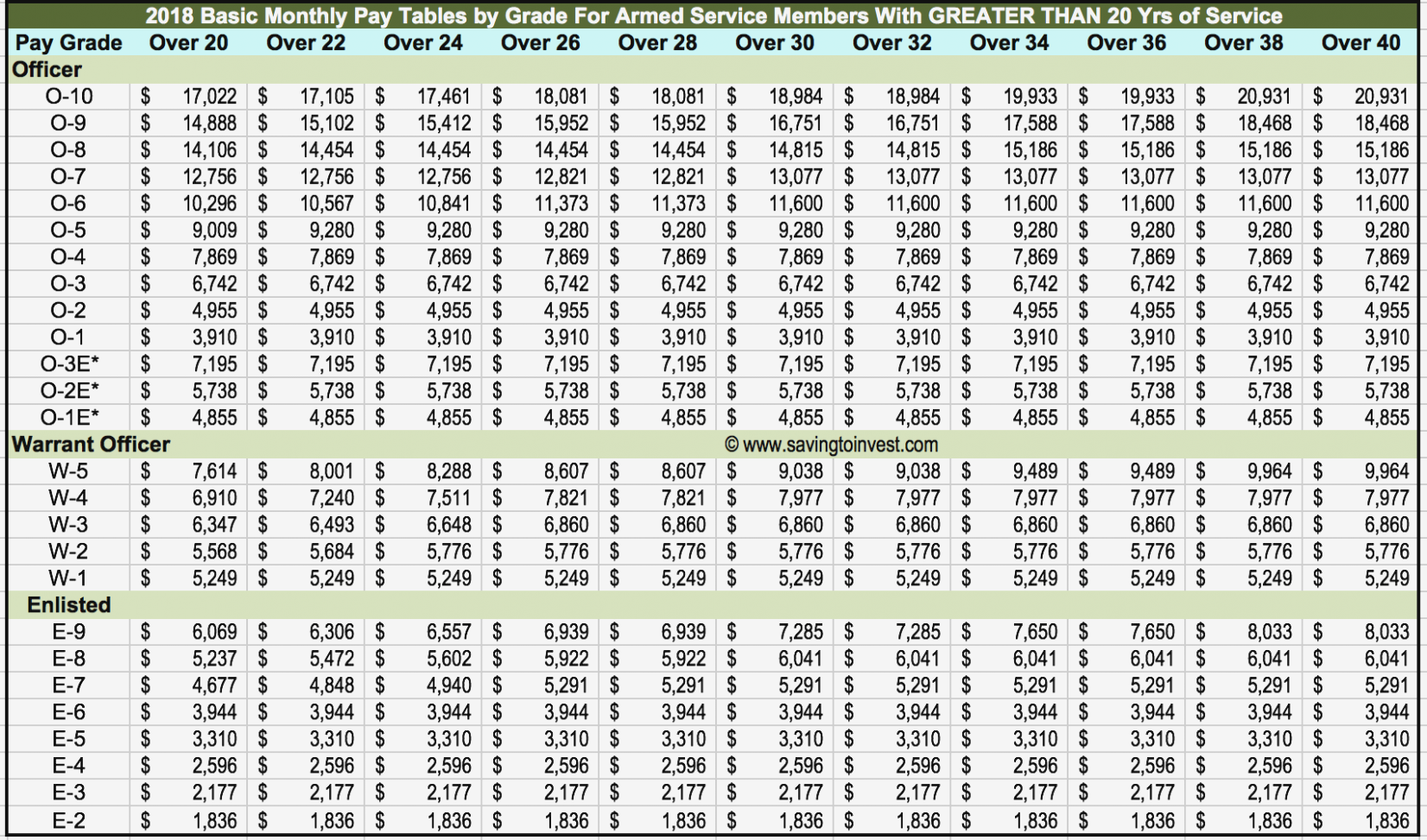

To give you a clearer picture of how the military pay scale 2015 shook out across different ranks, look at these monthly base pay figures for common "sweet spots" in a career:

✨ Don't miss: Nate Silver Trump Approval Rating: Why the 2026 Numbers Look So Different

- E-1 (Private/Seaman Recruit): Under 4 months of service started at $1,430.40. Imagine trying to start a life on that. It's tough.

- E-4 (Corporal/Specialist): With 4 years of service, they were looking at $2,343.60. This is the backbone of the military, the NCOs doing the heavy lifting.

- E-7 (Sgt 1st Class/Chief Petty Officer): At 10 years, the pay jumped to $3,923.40.

- O-1 (Second Lieutenant/Ensign): Fresh out of the Academy or ROTC, they started at $2,934.30.

- O-5 (Lt. Colonel/Commander): With 16 years of service, the pay was $8,231.70.

Keep in mind, this is just basic pay. It’s taxable. It’s what your social security and retirement are calculated from. It doesn't include the "invisible" parts of the paycheck like the Basic Allowance for Subsistence (BAS), which for enlisted members in 2015 was $367.92 a month.

The 2015 Retirement Commission Bombshell

You can't talk about 2015 pay without mentioning the Military Compensation and Retirement Modernization Commission (MCRMC). This was the year they dropped their massive report recommending the biggest shift in military pay in seventy years.

They wanted to kill the "all or nothing" 20-year retirement cliff.

The commission proposed what eventually became the Blended Retirement System (BRS). In 2015, this was just a scary proposal on paper. Service members were worried that the government was trying to claw back their benefits. The proposal suggested a 401(k)-style match in exchange for a smaller monthly pension later. While the 2015 pay scale remained under the "Old High-3" system, the shadows of these changes were everywhere. It created a weird vibe of uncertainty.

Special Pays: The "Band-Aids" of 2015

Since the base pay was so low, special pays became the lifeblood of certain communities. If you were a nuke in the Navy or a flight medic in the Army, those bonuses were the only thing keeping you competitive with the civilian sector.

🔗 Read more: Weather Forecast Lockport NY: Why Today’s Snow Isn’t Just Hype

Hardship Duty Pay, Sea Pay, and Flight Pay didn't see the same stagnation as the base scale. In 2015, the DoD used these targeted bonuses as "retention magnets." They knew they couldn't give everyone a 3% raise, so they sprinkled extra cash on the people they absolutely could not afford to lose. It’s a "robbing Peter to pay Paul" strategy that’s still used today, but in 2015, it was particularly obvious because the base pay raise was so measly.

The Cost of Living Reality Check

If you were stationed at Fort Hood (now Fort Cavazos), 2015 wasn't so bad. Your dollar went pretty far in Killeen, Texas. But if you were at Fort Belvoir or JBLM? You were feeling the squeeze.

The military pay scale 2015 failed to account for the skyrocketing rental markets in coastal cities. Even with BAH, many service members found themselves commuting an hour or more just to find a neighborhood they could afford. This is where the "hidden" costs of military life start to eat that 1% raise for breakfast. Gas, childcare, and groceries were all trending up faster than that $20-a-month increase the E-4s got.

How to Use This Data Today

Looking back at these numbers isn't just a nostalgia trip. It’s a tool for financial planning, especially if you’re looking at VA loan eligibility or calculating back-pay issues.

Verify your old LES: If you're doing a VA claim or correcting a record from that era, ensure your "High-3" calculations for retirement reflect the 2015 rates accurately.

Compare the Trend: Compare the 1% raise of 2015 to the 5.2% raise of 2024. It shows how much political willpower affects your wallet.

Evaluate the BRS vs. High-3: If you entered around 2015, you were likely at the crossroads of the retirement change. Use the 2015 base pay as your baseline for calculating what your "Legacy" pension would have looked like versus your current TSP growth.

The 2015 pay scale was a reflection of a military in transition—trying to be "lean" while still asking for "heavy" sacrifices. It remains a case study in how small percentage shifts in Washington D.C. have massive ripples in living rooms across the country.

Actionable Next Steps:

- Download the 2015 PDF: If you are auditing your own records, the DFAS website still maintains archives of the 2015 pay tables. Keep a digital copy for your personal records.

- Calculate Inflation Impact: Use a standard CPI calculator to see what $2,343.60 (2015 E-4 pay) is worth in today's dollars. It's an eye-opening exercise for budgeting.

- Review Your TSP: If you were serving in 2015 and didn't maximize your contributions because of the low raise, look at your current contribution "catch-up" options to make up for those lean years.