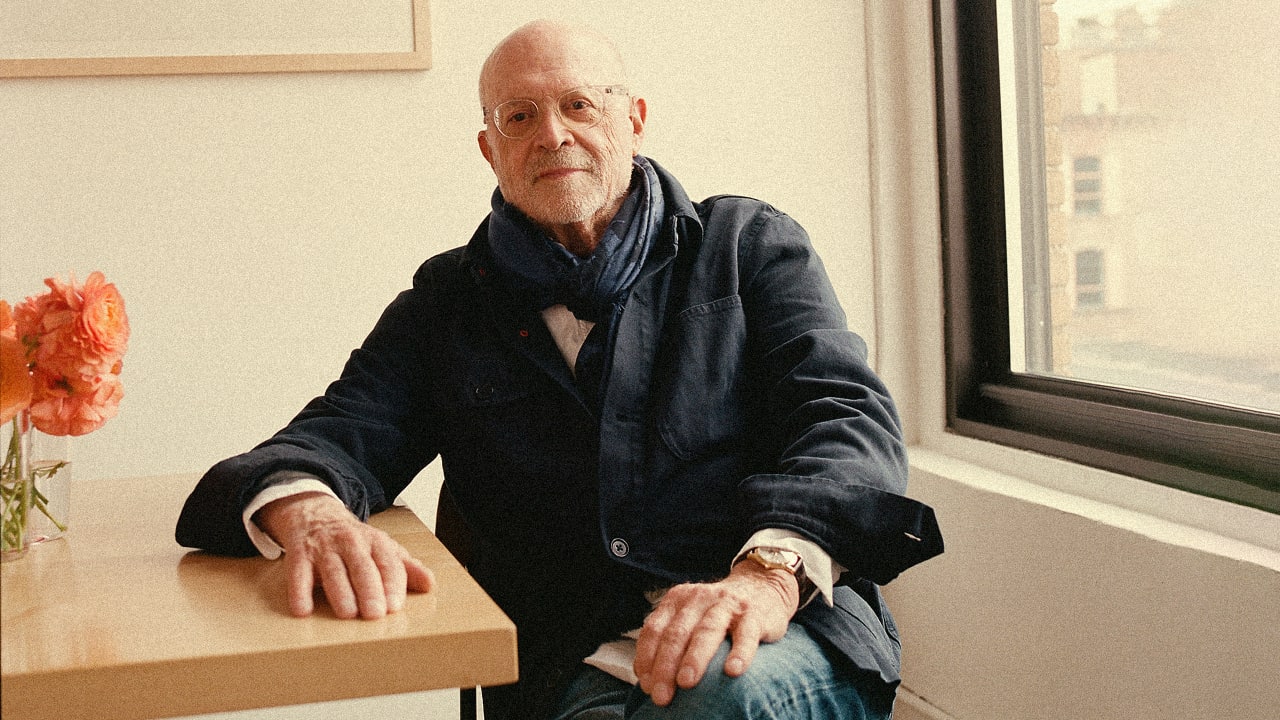

Millard "Mickey" Drexler. If you’ve ever stepped foot in a Gap, ordered a white button-down from J.Crew, or snagged a pair of khakis from Old Navy, you’ve basically been living in this guy's head for the last forty years. He’s the merchant prince of Manhattan, the man who taught America how to dress "casual" without looking like a total mess. But while his fashion legacy is everywhere, people always get tripped up on the numbers. What is Mickey Drexler net worth actually sitting at these days?

Honestly, calculating his wealth isn't as simple as looking at a single stock ticker. Unlike some tech billionaires who have 99% of their wealth tied up in one company, Drexler is a diversified animal. He’s got real estate, venture capital, legacy holdings from his Apple board days, and a flourishing late-career act with Alex Mill. Estimates generally place his net worth in the $150 million to $200 million range, though he’s famously private about the specific bottom line of his family office, Drexler Ventures.

The Gap Years and the $14 Billion Empire

To understand the money, you have to understand the hustle. Drexler didn't just manage Gap; he built it. When he showed up in the early 80s, Gap was just a place that sold other people's Levi's. He flipped the script. He started making private-label clothes and turned a $400 million business into a $14 billion behemoth.

Think about that for a second.

He basically invented the "uniform" of the 90s. He launched Old Navy from scratch—naming it after a bar he saw in Paris—and it became a billion-dollar brand faster than almost any retail concept in history. By the time he left Gap in 2002 (after a pretty messy falling out with the Fisher family), he had already pocketed a fortune in salary and stock options.

📖 Related: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

The J.Crew Payday

Most people thought Drexler was done after Gap. They were wrong. He took over a struggling J.Crew in 2003 and invested $10 million of his own cash into the company. It was a massive gamble at the time. J.Crew was a catalog brand that had lost its way.

Then came 2010.

TPG Capital and Leonard Green & Partners took J.Crew private in a $3 billion deal. Because of that $10 million bet he made years earlier, Drexler reportedly walked away with a **$150 million payout**. That single transaction is the bedrock of his modern wealth. Even though J.Crew eventually struggled with debt and he stepped down in 2017, that 15x return on his initial investment is what professional investors call a "grand slam."

Real Estate: The Secret Wealth Driver

If you want to see where a guy like Mickey hides his money, look at his zip codes. He’s had a legendary run in the real estate market. He famously sold a Montauk compound (once owned by Andy Warhol) for $50 million back in 2015. He also unloaded a Hamptons estate for $15 million in 2018.

👉 See also: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

Currently, his portfolio includes:

- A massive Tribeca loft (because where else would a retail king live?).

- Luxury properties in Miami Beach.

- An Idaho mountain retreat in Ketchum that made headlines for looking like a "tram terminal" (it was listed for nearly $11 million).

Real estate isn't just a hobby for him; it's a massive store of value that has likely appreciated significantly while the retail sector was getting hammered by the "Amazon effect."

The Apple Connection and Modern Ventures

People often forget that Mickey Drexler sat on the board of Apple Inc. for 16 years. He was a close friend of Steve Jobs—Jobs actually helped him design the first J.Crew stores—and his tenure coincided with the greatest bull run in tech history. While his specific Apple holdings are mostly private now, filings from years ago showed him owning tens of thousands of shares. At today’s prices, even a "small" slice of Apple from the early 2000s would be worth a staggering amount.

These days, he’s focused on Alex Mill, the brand started by his son. He’s not just a "proud dad" investor; he’s the Chairman. He’s also put money into Warby Parker and Outdoor Voices through Drexler Ventures. He likes "direct-to-consumer" brands that have a soul.

✨ Don't miss: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

Why the Number Isn't Everything

When looking at Mickey Drexler net worth, it’s easy to focus on the flashy $200 million figures. But the nuance is in the influence. He’s a "kibitzer"—a guy who can’t stop giving advice. He’s known for calling store managers at 10 PM to complain about a mannequin’s scarf. That level of obsession is why he still gets invited to every major business forum in 2026.

He’s admitted that J.Crew stayed too expensive for too long. He’s been honest about the mistakes he made with pricing. That kind of self-awareness is rare in the CEO world, and it’s why his reputation (and his ability to raise capital) remains ironclad even as traditional malls die off.

Actionable Insights from the Drexler Playbook

If you’re trying to build your own "retail-scale" net worth, there are three big takeaways from Mickey's career:

- Skin in the Game: Don't just take a salary. Drexler made his real money by investing $10 million of his own cash into the J.Crew turnaround. If you don't believe in the project enough to risk your own capital, why should anyone else?

- Diversify into Hard Assets: High-end real estate in New York and Florida has acted as a hedge for Drexler whenever the retail market got volatile.

- Stay Curious: At 81, he’s still working on Alex Mill. The money is secondary to the "detective work" of finding out what people want to wear tomorrow.

The biggest misconception about Mickey is that he’s a "dinosaur" of old retail. In reality, he’s one of the few who actually understood that digital and physical stores have to tell the same story. That insight, more than his bank account, is his true net worth.

Monitor the quarterly filings of companies like Apple or Warby Parker to see if legacy directors are trimming their positions. This provides a clearer window into how the "old guard" of retail is reallocating their wealth into newer, leaner ventures like Alex Mill.