You’re sitting at the kitchen table with a stack of mail that feels more like a math exam than a Friday afternoon. One envelope says Medicare. The other says Medicaid. They sound the same. They’re both government programs. They both involve doctors. Honestly, it’s no wonder everyone mixes them up.

But here’s the thing: they are nothing alike.

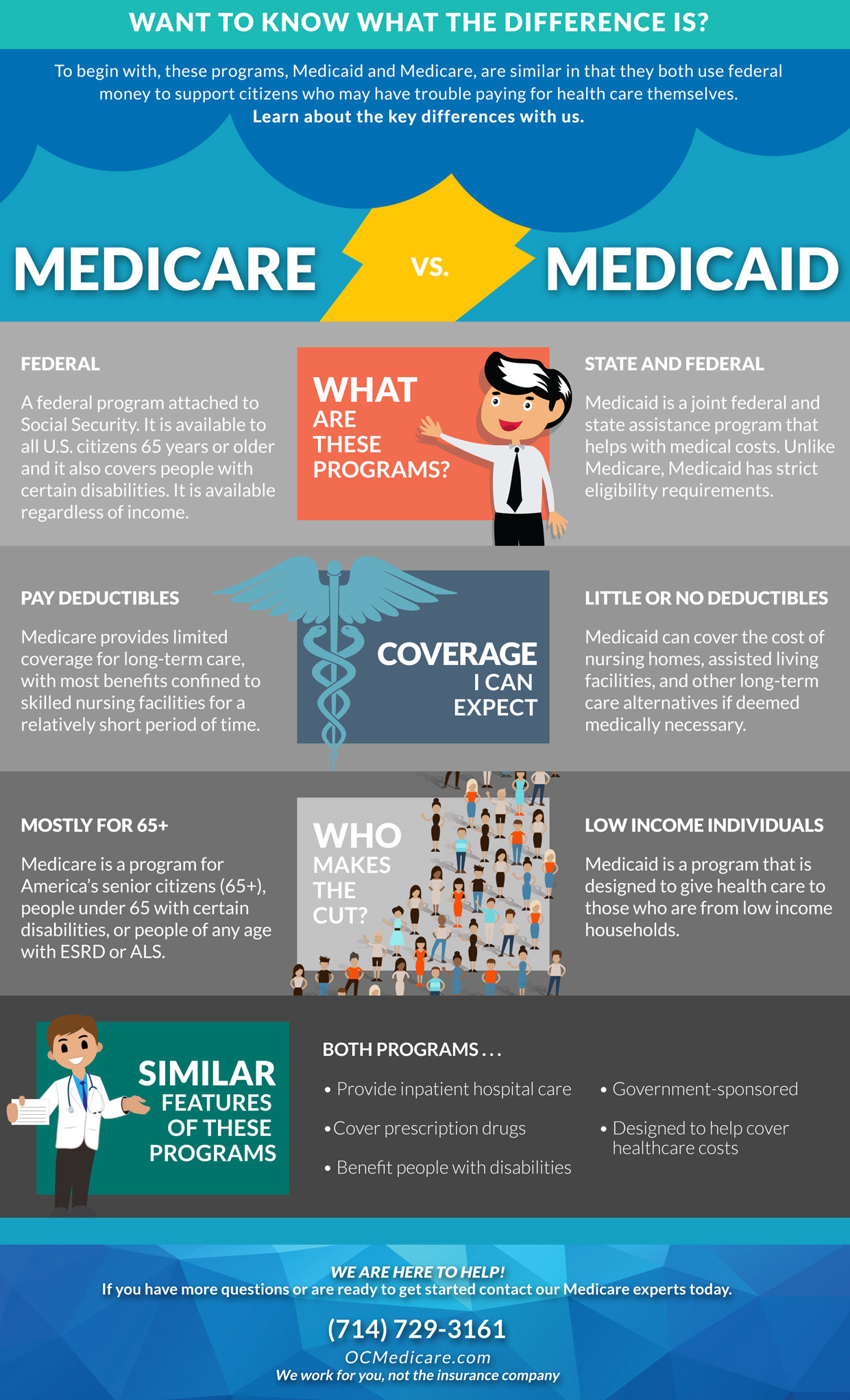

Think of Medicare as a club you pay into through your taxes while you're working. Once you hit 65, you’re in. Medicaid is more like a safety net. It’s there for people who don't have the financial resources to cover the skyrocketing costs of getting sick.

🔗 Read more: Dumbbell Chest Press: Why Your Bench Press Might Be Killing Your Gains

Getting these two confused isn't just a minor "oops" moment. It can cost you thousands in out-of-pocket expenses or, worse, leave you without the home care you actually need. Let's break down the real-world differences between medicare vs medicaid so you can stop guessing and start planning.

Who Actually Gets In?

The biggest hurdle is understanding eligibility. Medicare is pretty straightforward. If you’re 65 or older, you’re generally in. It doesn't matter if you’re a billionaire or living on a modest pension. You can also qualify younger if you have a permanent disability or specific conditions like End-Stage Renal Disease (ESRD) or ALS.

Medicaid plays by different rules. It’s all about your wallet.

Each state sets its own income and asset limits. In many "expansion" states, you might qualify if your income is below 138% of the federal poverty level. But wait—there's a catch. If you’re looking for Medicaid to pay for a nursing home, they don't just look at your paycheck; they look at your bank accounts, your car, and even your house.

💡 You might also like: Dr. Casey Means Wikipedia Age: Why the Numbers Don't Tell the Whole Story

The 2026 Numbers You Need to Know

For 2026, the standard Medicare Part B premium is $202.90 per month. That's a jump from last year. If you make a lot of money—think over $109,000 as an individual—you’ll pay even more because of something called IRMAA (Income-Related Monthly Adjustment Amount).

Medicaid costs are usually near zero for those who qualify, but the paperwork is a nightmare. Some states are even re-introducing work requirements for certain adults in 2026, adding another layer of "fun" to the application process.

Medicare vs Medicaid: The Coverage Gap

Medicare is great for "acute" care. If you break your leg or need heart surgery, Medicare is your best friend. But it has a massive blind spot: Long-term care.

- Medicare will pay for a rehab center for a few weeks after a hospital stay. That’s it. After 100 days, you’re on your own.

- Medicaid is the primary payer for long-term nursing home care in the U.S. It also covers things like dental, vision, and transportation to the doctor—things Original Medicare (Parts A and B) famously ignores.

Most people don't realize that Original Medicare only covers 80% of your doctor visits. You’re responsible for the other 20%. Without a supplemental plan (Medigap) or moving to Medicare Advantage (Part C), a single bad health year could wipe out your savings.

💡 You might also like: Best Weight for 5 4 Woman: Why the Charts Are Kinda Lying to You

Can You Have Both? (The "Dual Eligible" Secret)

Yes. And it’s actually the "gold standard" of coverage. If you are dual eligible, you have Medicare as your primary insurance and Medicaid as your backup.

In this scenario, Medicare pays the doctor first. Then, Medicaid steps in to cover the deductibles, premiums, and the 20% co-insurance that Medicare leaves behind. It’s a lifesaver for low-income seniors. In 2026, we’re seeing more Dual-Eligible Special Needs Plans (D-SNPs) which try to coordinate these two programs so you don't have to carry two different cards and argue with two different billing departments.

The "Spend Down" Reality

What if you make too much for Medicaid but not enough to pay for a $10,000-a-month nursing home?

This is where things get gritty. Many people have to "spend down" their assets. You essentially pay for your own care until you’ve exhausted your savings down to the state-mandated limit (often as low as $2,000 in countable assets).

Be careful here. Medicaid has a 60-month "look-back" period. If you tried to give your house to your kids last month just to qualify for Medicaid today, the government will find out. They’ll penalize you, leaving you with a gap where nobody is paying the bills.

Actionable Next Steps

Don't wait until a health crisis to figure this out. The system is designed to be confusing, but you can navigate it if you take it step by step.

- Check your 2024 tax return. Since Medicare 2026 premiums are based on your income from two years ago, your 2024 filings will determine if you're hitting those high-income surcharges (IRMAA).

- Contact your local SHIP. The State Health Insurance Assistance Program (SHIP) offers free, unbiased counseling. They aren't trying to sell you a plan; they’re trying to help you understand the difference between the letters A, B, C, and D.

- Evaluate your "Long-Term" plan. If you’re worried about nursing home costs, talk to an elder law attorney about Medicaid planning at least five years before you think you’ll need it.

- Review your Advantage Plan. If you’re on Part C, check your "Evidence of Coverage" for 2026. Many plans are cutting back on "extra" benefits like over-the-counter allowances or dental caps this year to keep up with rising costs.

Understanding the maze of medicare vs medicaid is about more than just insurance—it's about protecting your autonomy as you age. Keep your records organized, watch the deadlines, and never assume that "the government will just take care of it."