You’ve probably heard the horror stories. Someone gets a diagnosis, tries to switch insurance, and suddenly they're locked out or facing astronomical premiums because of a "pre-existing condition." In the private insurance world of twenty years ago, that was the grim reality. But when it comes to Medicare pre existing conditions, the rules are actually a lot more forgiving than most people realize. Honestly, the fear usually comes from a misunderstanding of how the different "parts" of Medicare interact with your medical history.

Medicare isn't a monolith.

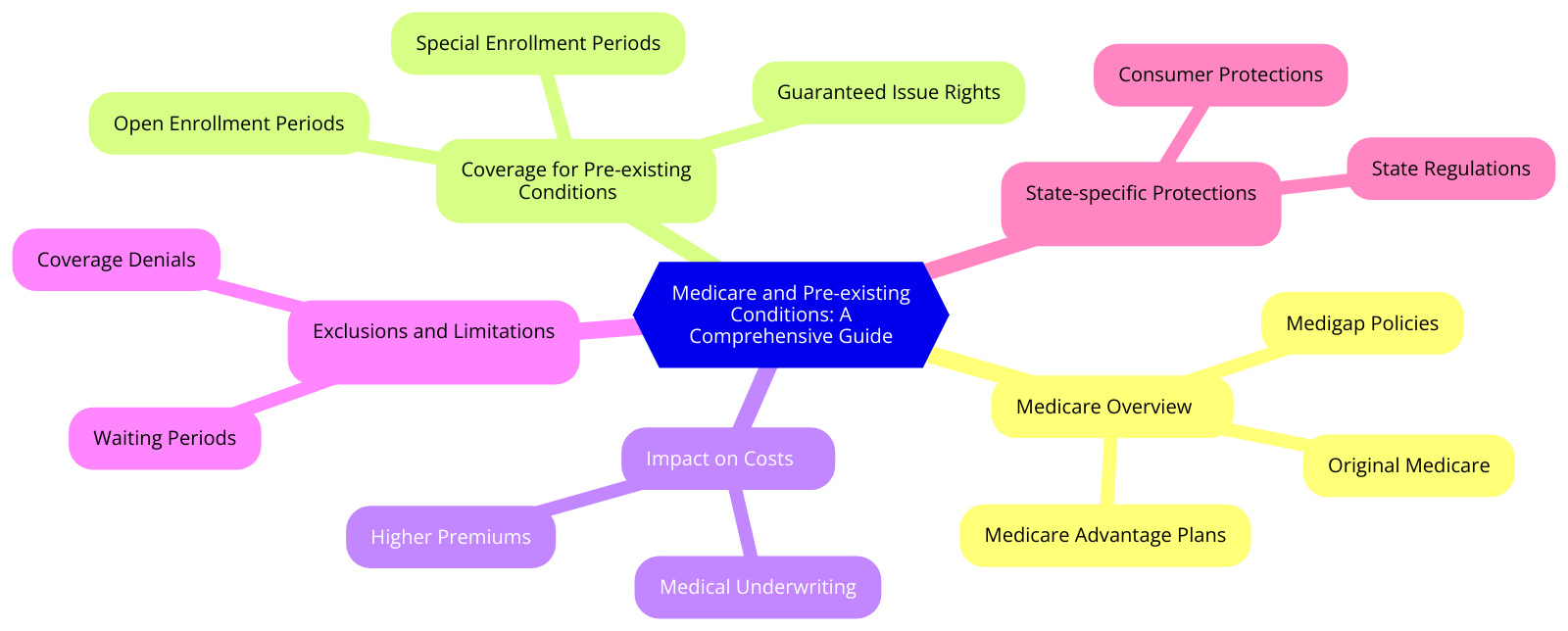

It’s a patchwork. Because of that, your health history matters a lot in some scenarios and not at all in others. If you are aging into Original Medicare (Part A and Part B), the government basically doesn't care if you've had cancer, diabetes, or a heart attack. You’re in. Period. The federal government prohibits Original Medicare from denying you coverage or charging you more based on your health status.

But—and this is a big "but"—the story changes the second you start looking at supplemental coverage.

🔗 Read more: Dr Peter McCullough Twitter: Why the Internet Can't Stop Talking About Him

The Medigap Trap and Why Timing is Everything

Medigap, or Medicare Supplement Insurance, is where the phrase Medicare pre existing conditions actually starts to carry some weight. These policies are sold by private companies to wrap around Original Medicare and pay for things like deductibles and co-insurance. Here’s the deal: there is a specific six-month window called the Medigap Open Enrollment Period. It starts the month you’re both 65 and signed up for Part B.

During these six months, you have "guaranteed issue rights."

The insurance company cannot look at your medical records. They cannot ask about your blood pressure. They can’t care about that surgery you had three years ago. They have to sell you a policy at the same price they’d give a marathon runner.

If you miss that window? You’re entering the world of medical underwriting.

I’ve seen people wait until they actually get sick to try and buy a Medigap plan, thinking they can just jump on board whenever. It doesn't work like that. If you apply outside of a protected period, the company can—and often will—deny you outright. Or they’ll look at your history of chronic pain or heart disease and stick you with a premium that's double the standard rate. It feels unfair, but it's how the private supplemental market stays profitable.

A Quick Note on the "Look-Back" Period

Even if you get a Medigap policy during your open enrollment, some companies use a "pre-existing condition waiting period." This is a sneaky bit of fine print. Under federal law, they can refuse to cover costs related to a condition you were treated for in the six months before the policy started. This wait can last up to six months.

However, you can often avoid this if you had "creditable coverage" (like insurance through an employer) right before joining Medicare. If you had at least six months of prior coverage without a significant break, the Medigap company usually has to waive that waiting period.

Medicare Advantage: The Rules are Different Here

If you’re leaning toward Medicare Advantage (Part C) instead of the Original Medicare + Medigap route, the conversation about Medicare pre existing conditions is much simpler.

✨ Don't miss: Is Heparin a Blood Thinner? What Your Doctor Might Not Have Time to Explain

Basically, they can’t reject you.

Ever since the 21st Century Cures Act fully kicked in, even people with End-Stage Renal Disease (ESRD)—who were previously the only group excluded—can now join Medicare Advantage plans. These plans are required to take everyone during the Annual Enrollment Period (October 15 to December 7) regardless of health.

You won’t pay more for your monthly premium because you have a chronic illness. The trade-off, of course, is that you have to stay within a specific network of doctors and often need prior authorizations for specialists. It’s a "give and take." You get guaranteed entry despite your health, but you lose some of the freedom that Original Medicare offers.

Real-World Examples: When Health History Bites

Let's look at a hypothetical—but very common—situation.

Meet Sarah. Sarah is 68. She’s been on Original Medicare with no supplement for three years because she was healthy and wanted to save money. Last month, she was diagnosed with rheumatoid arthritis. Now, realizing her out-of-pocket costs are about to skyrocket, she tries to buy a Medigap Plan G.

Because Sarah is well past her initial enrollment window and doesn't have a "guaranteed issue" trigger (like moving or losing employer coverage), the Medigap company puts her through underwriting. They see the RA diagnosis and the expensive infusions she needs. They deny her application.

Sarah is now stuck.

She can stay on Original Medicare and pay 20% of every bill, or she can wait until the next fall to switch to a Medicare Advantage plan. This is why the advice is almost always: buy the best coverage you can afford when you are first eligible, even if you’re healthy. You aren't buying it for who you are today; you're buying it for the person you might be in five years.

The Exceptions to the Underwriting Rules

There are moments when the "health doesn't matter" rule comes back into play, even for Medigap. These are called Guaranteed Issue Rights. You get these if:

- Your employer group health plan is ending.

- You’re in a Medicare Advantage plan and the plan is leaving the area or stopping service.

- You moved out of your Medicare Advantage plan's service area.

- Your Medigap company went bankrupt or misled you.

In these cases, the insurance company must sell you a supplement plan regardless of Medicare pre existing conditions. You usually have 63 days from the time your other coverage ends to act on this. If you wait 64 days? You’re back to medical underwriting. The system is incredibly rigid about these timelines.

State-Specific Perks

Some states are just better to live in if you have a chronic illness. New York, Connecticut, Massachusetts, and Maine have "continuous" or "annual" open enrollment for Medigap. In New York, for instance, Medigap providers have to accept you year-round regardless of your health. They are prohibited from using medical underwriting at any time. If you live in a state like that, the stress over your health history is basically non-existent. But for the rest of the country? You have to be strategic.

Part D and Prescriptions

Don't worry about your meds. Medicare Part D (prescription drug coverage) follows the same non-discrimination rules as Part B. They cannot deny you a drug plan because you take expensive medications.

What they can do, however, is change their formulary.

Every year, these private drug plans re-evaluate which medications they cover and which "tier" those drugs fall into. So while they can’t reject you for having a condition that requires a $5,000-a-month biological drug, they can certainly make you jump through hoops like "step therapy" or high co-insurance. This is why checking your Part D plan every single October is non-negotiable.

What You Should Actually Do Now

If you are approaching 65 or looking to change your coverage, stop worrying about being "denied" by Medicare itself. That won't happen. Instead, focus on the "Supplement vs. Advantage" crossroads.

First, audit your current health. If you have a laundry list of specialists and a history of chronic issues, the Original Medicare + Medigap route is often superior because once you are "in," you are in for life, and you don't have to deal with network restrictions. But you have to get that Medigap plan during your first six months of Part B.

Second, check your state laws. If you live in a state with community rating (like New York or Vermont), you have much more flexibility to switch plans later in life. If you live in a state like Texas or Florida, you are likely "married" to the Medigap plan you choose at 65. Changing later will be nearly impossible if your health declines.

Third, don't lie on applications. If you do find yourself undergoing medical underwriting for a supplement, be honest. Private insurers have access to "prescription drug caches"—databases that show every med you've filled in the last several years. If you claim you don't have heart disease but you've been filling a prescription for Nitroglycerin, they will catch it, and they will deny you for "material misrepresentation."

The reality of Medicare pre existing conditions is that the system is designed to protect you when you first join, but it rewards those who plan ahead. If you treat your initial enrollment like a one-time-only opportunity to lock in your future health security, you'll be fine. If you try to game the system and wait until you're sick to get the "good" coverage, you're going to find the doors are much harder to open.

Understand your window. Watch the calendar. Once that six-month Medigap clock starts ticking, it doesn't stop for anyone. Ensure you have your "creditable coverage" letters ready from your previous employer to prove you've been insured; this simple piece of paper can save you from a six-month waiting period for pre-existing treatment.

Check your "Summary of Benefits" if you are currently in a Medicare Advantage plan. If you're thinking of switching back to Original Medicare and wanting a Medigap plan, do the math on the underwriting risk before you drop your current coverage. Sometimes, staying in a "good enough" Advantage plan is safer than being rejected by every Medigap insurer and ending up with no supplemental coverage at all.