You're sitting there with a stack of mail that’s three inches thick. Most of it is from insurance companies. They’re all shouting about "Medicare Part G" and "Plan G," and honestly, it’s enough to make you want to throw the whole pile in the trash.

Here is the first thing you need to know: Medicare Part G does not actually exist.

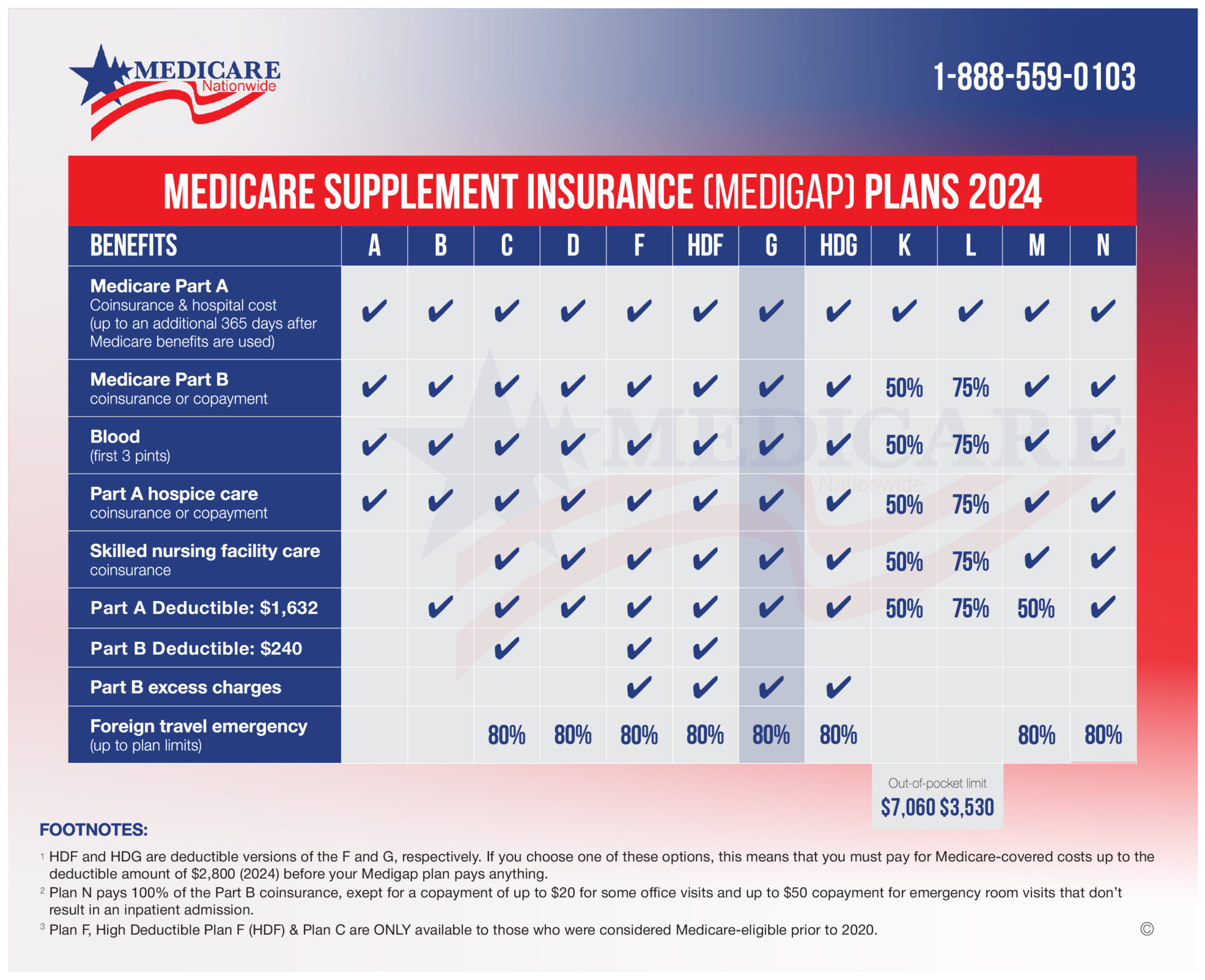

I know, I know. You've heard people talk about it. You might have even seen it written on a flyer. But in the world of Medicare, "Parts" (A, B, C, and D) are the government-run programs or the big Advantage plans. When people say Part G, they are almost always talking about Medicare Supplement Plan G.

It’s a tiny distinction that makes a massive difference in how your medical bills get paid.

The Plan G Reality Check

So, if it’s not a "Part," what is it? Think of Plan G as a piece of "financial gap insurance."

Original Medicare (that’s Part A and Part B) is great, but it has holes. It’s like a bucket with a few leaks. It covers most of your hospital and doctor bills, but it leaves you holding the bag for about 20% of the costs. There is no cap on that 20%. If you have a $100,000 surgery, you’re looking at a $20,000 bill.

Medicare Supplement Plan G is the most popular way to plug those leaks in 2026.

📖 Related: Para qué sirve la hidroxizina: lo que tu médico quizá no te explicó con detalle

What it actually covers

Basically, once you pay one small deductible, Plan G picks up every single penny of your Medicare-approved medical expenses.

- Hospital Stays: It covers your Part A hospital deductible ($1,736 in 2026). If you’re in the hospital for 60 days, you pay $0.

- The 20% Gap: It covers the 20% coinsurance that Medicare usually leaves to you.

- Blood: It pays for the first three pints of blood you might need.

- Skilled Nursing: It covers the daily co-pays for days 21 through 100 in a nursing facility ($217 per day in 2026).

- Hospice: It covers the cost-sharing for hospice care.

The one thing it DOES NOT cover

There is a catch. Just one.

Plan G does not cover the Medicare Part B deductible. In 2026, that deductible is $283.

You pay that first $283 out of your own pocket at the beginning of the year. Once you’ve hit that amount, your Plan G kicks in and covers 100% of everything else for the rest of the year. You could go to the doctor fifty times or have five surgeries; you won’t see another bill.

Why Everyone is Obsessed with Plan G Right Now

A few years ago, there was a plan called Plan F. It was the "Cadillac" of Medicare because it even covered that Part B deductible. You never paid a dime.

But the government changed the rules. Anyone new to Medicare after January 1, 2020, can’t buy Plan F anymore.

This made Plan G the new "Gold Standard."

Honestly, Plan G is usually a better deal anyway. Why? Because the monthly premium for Plan F is often much higher than Plan G. You usually save way more than $283 in premiums by choosing Plan G, even though you have to pay that deductible yourself.

The "Excess Charges" Secret

There’s a weird little thing called Part B Excess Charges.

Most doctors accept "Medicare Assignment," which means they agree to be paid exactly what Medicare says. But some doctors don't. They are allowed to charge you up to 15% more than the Medicare-approved rate.

If you have Plan N (another popular choice), you have to pay those excess charges yourself.

Plan G covers them 100%. While these charges aren't super common, they can be a nasty surprise if you see a specialist who decides to bill more. With Plan G, you don't have to ask the doctor's office, "Hey, do you accept assignment?" You just show your card and walk out.

High-Deductible Plan G: The Budget Move

If you’re healthy and hate the idea of paying a high monthly premium, there is a "hidden" version of this plan.

It’s called High-Deductible Plan G (HDG).

It covers the exact same things as regular Plan G, but you have to pay a much larger deductible before the insurance company pays anything. In 2026, that deductible is $2,950.

The upside? The monthly premium is dirt cheap—sometimes as low as $30 or $40 a month depending on where you live. It’s basically "catastrophic" coverage for people who want the freedom to see any doctor but don't expect to go very often.

📖 Related: Lengua normal y anormal fotos: Lo que tu boca intenta decirte hoy mismo

Foreign Travel: A Nice Little Bonus

Most people don't realize that Original Medicare generally stops working the second you cross the U.S. border. If you get sick in Italy or trip on a sidewalk in Mexico, Medicare won't help you.

Plan G includes a foreign travel emergency benefit. It’s not unlimited—it usually pays 80% of the cost for emergency care during the first 60 days of a trip, after you pay a separate $250 deductible. There’s a lifetime limit of $50,000, but it’s a lot better than nothing.

What's Missing? (Don't Get Fooled)

Because people call it "Part G," they sometimes think it's an all-in-one plan like Medicare Advantage (Part C). It isn't.

Plan G does NOT cover:

- Prescription Drugs: You still need a separate Part D plan for your meds.

- Dental, Vision, or Hearing: It won't pay for your teeth cleaning, new glasses, or hearing aids.

- Long-Term Care: It doesn't pay for a permanent stay in a nursing home.

If you want those things, you usually have to buy separate "stand-alone" policies.

How to Get the Best Price

Since Plan G is "standardized," the benefits are identical regardless of which company you pick. A Plan G from UnitedHealthcare is exactly the same as a Plan G from Aetna or Mutual of Omaha.

They all have to cover the same stuff.

But they do not have to charge the same price. One company might charge $120 a month while another charges $190 for the exact same coverage.

🔗 Read more: The Truth About Calories and Carbs in Avocado: Why Most People Get It Wrong

The trick is to shop around. Also, pay attention to how they "rate" the plan.

- Community-rated: Everyone pays the same, regardless of age.

- Issue-age-rated: Your price is based on how old you were when you bought it.

- Attained-age-rated: The price goes up every year as you get older.

In the long run, attained-age plans can start cheap but get really expensive when you're 85 and need the coverage most.

Next Steps for You:

- Check your "Open Enrollment" date. The best time to buy Plan G is during the six months after you turn 65 and have Part B. During this window, insurance companies cannot look at your medical history or deny you coverage.

- Get three quotes. Since the benefits are the same, don't pay a "brand name" premium unless their customer service ratings are significantly better.

- Factor in the deductible. When looking at your budget for 2026, remember to set aside the $283 for that Part B deductible so it doesn't surprise you in January.