If you’re on Medicare, you probably noticed your Social Security check looked a little different starting in January. It’s that yearly dance we do with the Centers for Medicare & Medicaid Services (CMS). Money goes in, money goes out. For this year, the numbers are officially set, and honestly, they’re a bit higher than last year.

Basically, the medicare part b premium 2025 has landed at $185.00 per month.

That is a $10.30 jump from the $174.70 people were paying in 2024. It might not sound like a fortune, but when you're on a fixed income, every ten-buck bill matters. It adds up to about $123 more over the course of the year.

Why did the medicare part b premium 2025 go up?

It’s never just one thing. CMS usually points to "projected price changes" and the fact that more people are using medical services. People are getting older, and medical tech is getting fancier (and pricier).

One big culprit? Physician-administered drugs. These aren't the pills you get at the pharmacy; these are the complex treatments you get at a doctor's office or a clinic. They cost a mint, and those costs get baked right into your monthly premium.

💡 You might also like: Banner McKee Medical Center Emergency Room: What to Expect When You Get There

There's also the "hold harmless" rule. This is a bit of a safety net. It’s designed to make sure your Social Security check doesn't actually shrink because of Medicare increases. If the cost-of-living adjustment (COLA) for Social Security is smaller than the Medicare hike, some people might pay a slightly lower premium to keep their check stable. But for 2025, the 2.5% COLA was generally enough to cover the $10.30 increase for most folks.

The deductible also took a hit

It wasn't just the monthly bill. The annual Part B deductible—the amount you pay out of pocket before Medicare starts chipping in—is now $257.

Compare that to $240 last year. It’s a $17 increase. If you have a Medigap plan (like Plan G), you’re likely used to paying this once a year, but it’s still a number that keeps creeping north.

The high-income surcharge: IRMAA is back

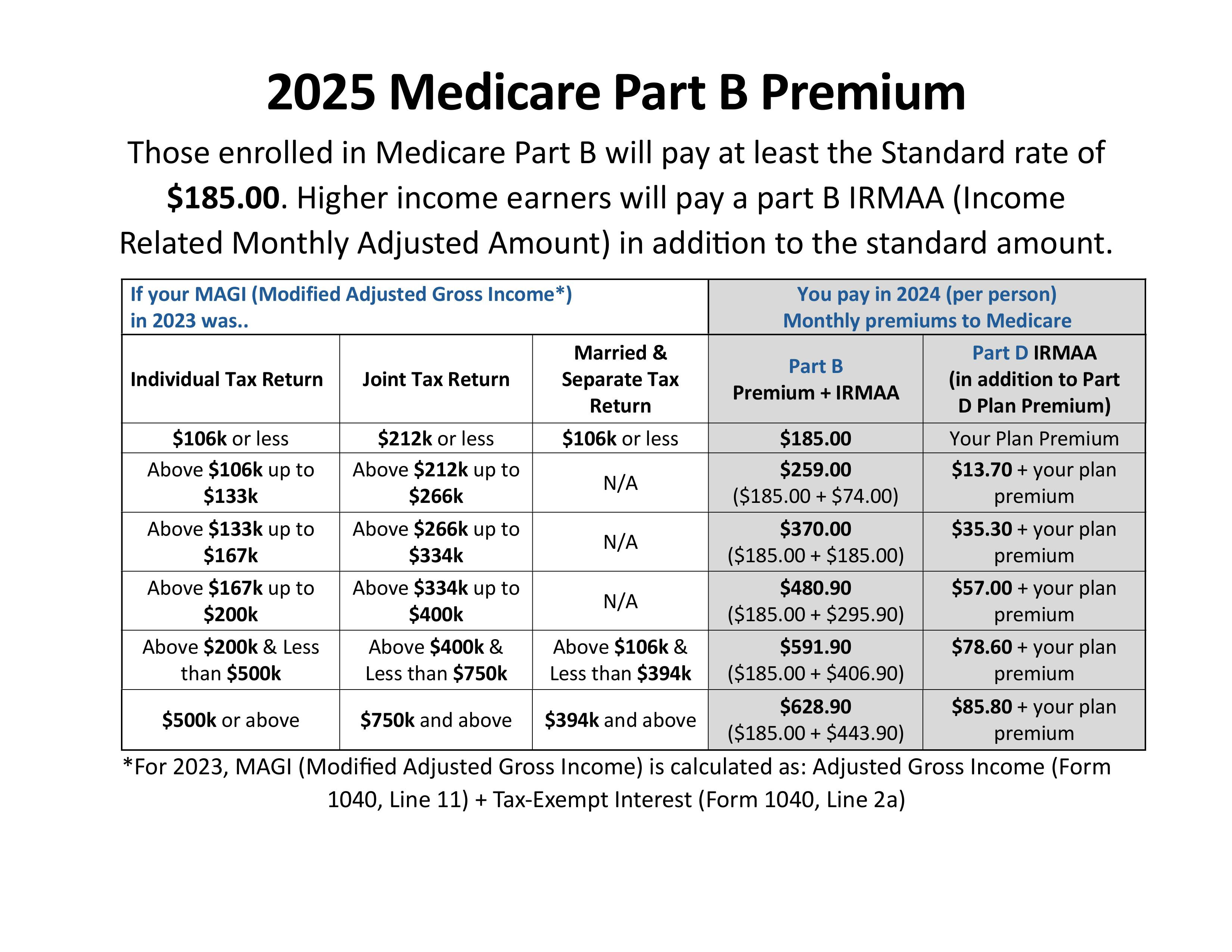

Most people—about 92% of Medicare beneficiaries—pay that standard $185.00. But if you made "good money" two years ago, the government wants a bigger slice. This is called the Income-Related Monthly Adjustment Amount, or IRMAA.

Medicare looks at your tax return from two years ago. So, for your 2025 premium, they are looking at your 2023 tax return. If your Modified Adjusted Gross Income (MAGI) was over a certain cliff, you’ll pay the standard $185 plus an extra surcharge.

How the 2025 IRMAA brackets shake out

Instead of a fancy table, let's just look at the raw numbers.

✨ Don't miss: Images of People Without Teeth: Why This Visual Trend Is Actually About Health Equity

If you filed an individual tax return for 2023 and your income was $106,000 or less, you’re in the clear. You pay $185. For couples filing jointly, that threshold is **$212,000**.

Once you cross $106,001 (for individuals), the price jumps to **$259.00** a month.

It keeps going up from there. If you’re an individual making between $133,001 and $167,000, your total monthly Part B bill is **$370.00**.

For the highest earners—those making $500,000 or more as an individual or $750,000 as a couple—the monthly premium hits a staggering **$628.90**. Per person. That is a lot of money for "basic" medical insurance.

Can you fight an IRMAA increase?

Actually, yes. Life happens. Maybe you retired in 2024, so your 2023 income (which Medicare is using) is way higher than what you’re making now.

The Social Security Administration calls these "Life-Changing Events." If you had one, you can file Form SSA-44 to ask them to lower your premium.

Common reasons they accept:

- You retired or reduced your work hours.

- You lost an income-producing property (like a rental) due to a disaster.

- Your spouse passed away.

- You got married or divorced.

- A pension plan failed or was terminated.

Don't just sit there and pay the higher rate if your income has dropped. It’s your money.

What about Medicare Advantage?

Some people think if they have a "Zero Premium" Medicare Advantage plan, they don't have to worry about the medicare part b premium 2025.

That's a myth.

Even if your Advantage plan costs $0, you still have to pay the Part B premium to the government. Usually, it’s just deducted from your Social Security check before you ever see it. A few Advantage plans offer a "Part B Buy-Back" or "Give-Back" where they pay a portion of that $185 for you, but those are specific to certain plans and regions.

Actionable steps for your 2025 budget

First off, check your Social Security "New Benefit Amount" statement. It’s the letter that usually arrives in December. It spells out exactly what is being taken out of your check.

🔗 Read more: Tretinoin Before and After Acne: Why Most People Quit Too Early

If you are paying more than $185 and your income has dropped since 2023, go get that Form SSA-44. Fill it out and get it to your local Social Security office.

If you are still working and planning to retire soon, keep an eye on your MAGI. Sometimes a poorly timed Roth conversion or selling a bunch of stock can accidentally trigger an IRMAA surcharge two years down the road. It’s what some people call the "Medicare Tax Trap."

Lastly, remember that while Part B covers your doctors, it doesn't cover everything. You still have that $257 deductible to meet. If you haven't seen a doctor yet this year, expect that first bill to be yours to handle.

Keep these records in a safe spot. You'll need them when 2026 rolls around and the cycle starts all over again.